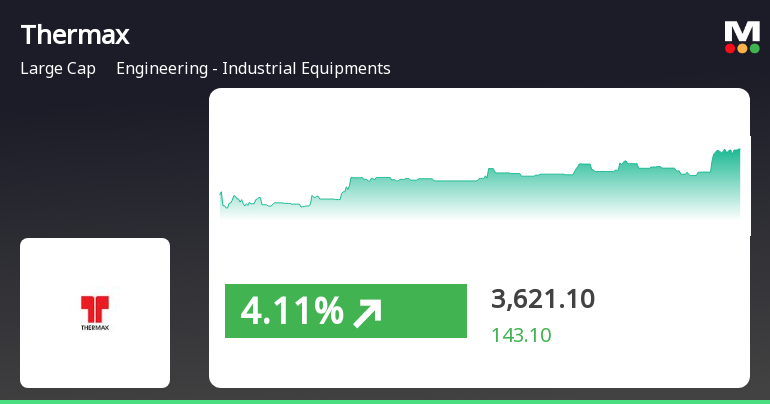

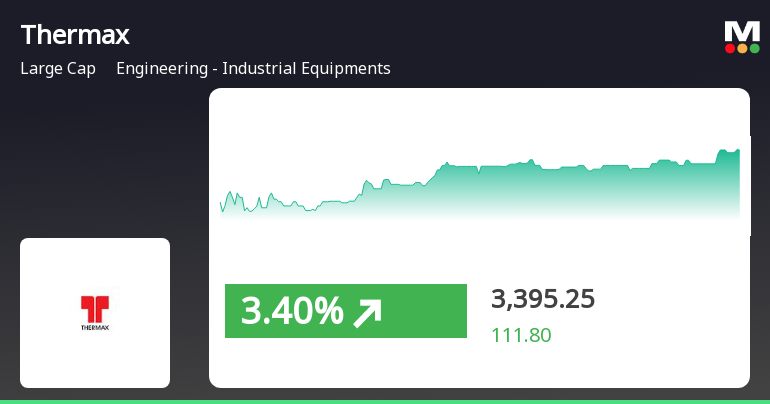

Thermax Ltd. Shows Strong Performance Amid Broader Market Rebound and Sector Gains

2025-03-27 14:45:26Thermax Ltd. has demonstrated strong performance in the engineering sector, with its stock rising significantly today. The company has outperformed its sector and reached an intraday high. Despite mixed trends in moving averages, Thermax's long-term growth remains impressive, significantly exceeding broader market gains over the past five years.

Read More

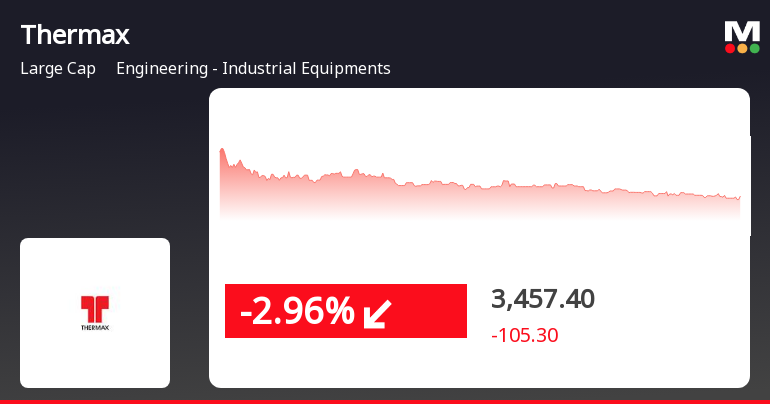

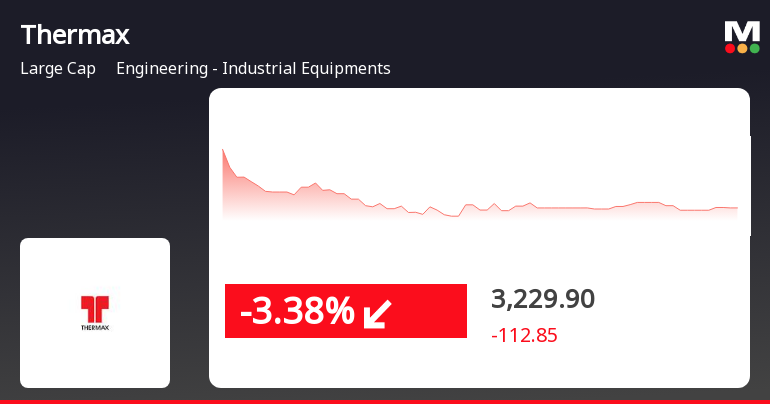

Thermax Ltd. Faces Mixed Performance Amid Broader Market Decline and Long-Term Growth

2025-03-26 14:45:25Thermax Ltd. experienced a decline on March 26, 2025, underperforming its sector. The stock's moving averages indicate mixed trends, with short-term performance better than long-term averages. While the broader market saw a decline, Thermax has shown varied performance over different time frames, including significant growth over five years.

Read More

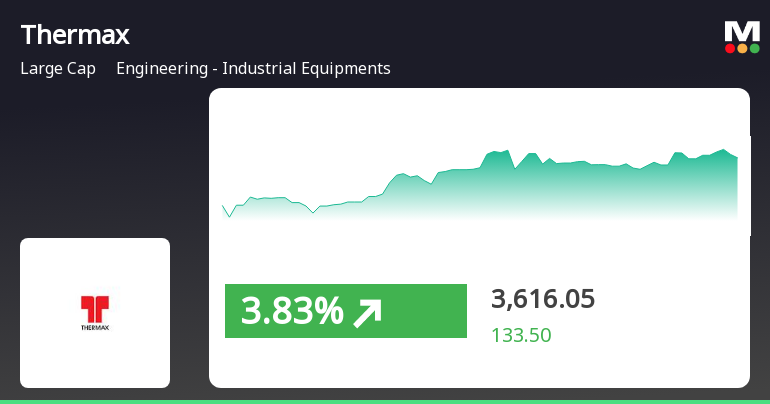

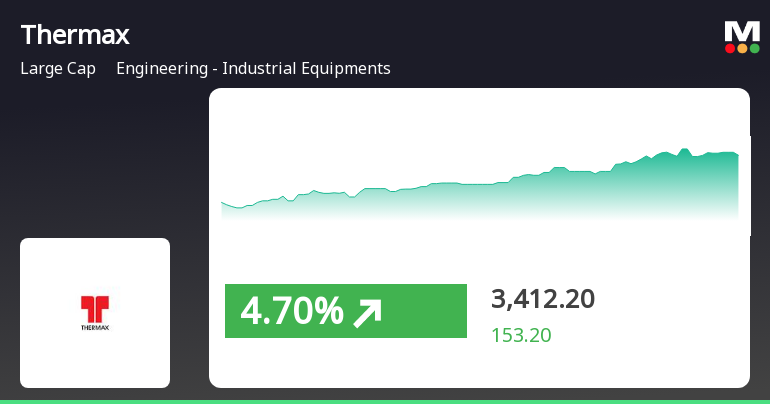

Thermax Ltd. Shows Signs of Recovery Amid Broader Market Gains

2025-03-25 10:05:25Thermax Ltd. has experienced a notable uptick in stock performance, reversing a two-day decline with a significant intraday high. The company has outperformed its sector today and over the past week, although it has faced a decline over the last three months, contrasting with broader market trends.

Read MoreThermax Experiences Technical Trend Shifts Amid Market Volatility and Resilience

2025-03-21 08:01:56Thermax, a prominent player in the engineering and industrial equipment sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 3,513.70, showing a notable increase from the previous close of 3,376.80. Over the past week, the stock has reached a high of 3,615.85 and a low of 3,407.00, indicating some volatility in its trading activity. In terms of technical indicators, the MACD shows a bearish trend on a weekly basis, while the monthly perspective is mildly bearish. The Bollinger Bands also reflect a mildly bearish stance for both weekly and monthly evaluations. Moving averages indicate a mildly bearish trend on a daily basis, while the KST presents a bearish outlook weekly and mildly bearish monthly. The Dow Theory suggests a mildly bullish trend on a weekly basis, contrasting with the monthly no trend signal. When comparing the compa...

Read More

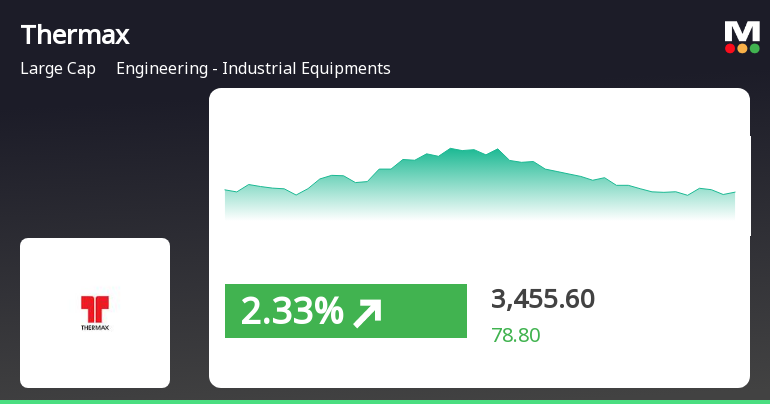

Thermax Ltd. Shows Positive Momentum Amid Broader Market Gains and Small-Cap Strength

2025-03-20 09:35:27Thermax Ltd. has experienced a positive trading session, gaining 3.65% and outperforming its sector. The stock has shown consecutive gains over three days, totaling 7.96%. Despite a decline over the past three months, it has achieved substantial growth over the last five years. The broader market also opened positively.

Read More

Thermax Ltd. Shows Short-Term Gains Amid Mixed Long-Term Performance Signals

2025-03-19 12:45:27Thermax Ltd. has experienced a notable increase in stock performance, outperforming its sector recently. The stock reached an intraday high and is currently above its short-term moving averages, though it lags behind in the longer term. The broader market also opened positively, reflecting mixed trends in the engineering sector.

Read More

Thermax Ltd. Faces Short-Term Volatility Amidst Long-Term Growth Trends

2025-03-17 09:45:25Thermax Ltd. experienced significant intraday volatility on March 17, 2025, with a notable decline despite an initial gain. The stock has underperformed in the short term compared to the broader market but has shown strong growth over three years, outpacing the Sensex significantly.

Read MoreThermax Adjusts Valuation Grade Amid Strong Market Performance and Premium Positioning

2025-03-17 08:00:32Thermax, a prominent player in the engineering and industrial equipment sector, has recently undergone a valuation adjustment reflecting its financial metrics and market position. The company's price-to-earnings ratio stands at 64.34, while its price-to-book value is noted at 8.62. Additionally, the enterprise value to EBITDA ratio is recorded at 44.14, indicating a robust valuation relative to its earnings before interest, taxes, depreciation, and amortization. In terms of performance, Thermax has demonstrated a return on capital employed (ROCE) of 19.40% and a return on equity (ROE) of 13.96%, showcasing its efficiency in generating profits from its capital and equity. The company's dividend yield is relatively modest at 0.36%. When compared to its peers, Thermax's valuation metrics suggest a premium positioning within the industry. Over the past three years, the company has achieved a return of 76.04%,...

Read More

Thermax Ltd. Shows Signs of Trend Reversal Amid Broader Market Fluctuations

2025-03-13 10:35:21Thermax Ltd. experienced a notable performance on March 13, 2025, gaining 3.1% after three days of decline. The stock outperformed the broader market, with a daily performance of 3.80%. However, its three-month performance shows a significant decline compared to the Sensex. Moving averages indicate mixed trends.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

04-Apr-2025 | Source : BSEThermax Limited has submitted the certificate under Regulation 74(5) of SEBI (Depositories and Participants) Regulations 2018 for the quarter ended March 31 2025.

Announcement under Regulation 30 (LODR)-Restructuring

03-Apr-2025 | Source : BSEThermax Limited has informed the exchanges about sale of stake in associate company

Closure of Trading Window

27-Mar-2025 | Source : BSEThermax Limited has informed the exchanges about closure of trading window for the quarter and year ended March 31 2025.

Corporate Actions

No Upcoming Board Meetings

Thermax Ltd. has declared 600% dividend, ex-date: 05 Jul 24

Thermax Ltd. has announced 2:10 stock split, ex-date: 31 Mar 06

No Bonus history available

No Rights history available