Thyrocare Technologies Faces Mixed Performance Amid Technical Outlook Shift

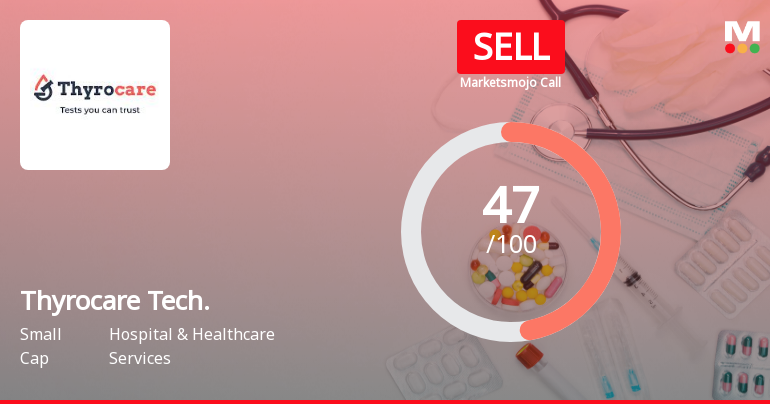

2025-04-03 08:10:00Thyrocare Technologies has recently experienced a change in evaluation, reflecting a shift in its technical outlook amid mixed market conditions. The company boasts strong financial metrics, including a high return on equity and consistent net sales growth, despite facing challenges in long-term profitability and stock stability.

Read MoreThyrocare Technologies Faces Mixed Technical Trends Amid Market Evaluation Revision

2025-04-01 08:03:17Thyrocare Technologies, a small-cap player in the Hospital & Healthcare Services sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 683.40, down from a previous close of 701.40, with a notable 52-week high of 1,053.05 and a low of 555.85. Today's trading saw a high of 709.90 and a low of 672.45. The technical summary indicates a mixed performance across various indicators. The MACD shows bearish trends on a weekly basis, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) presents a bullish signal weekly, but no signal is noted for the monthly period. Bollinger Bands and moving averages also reflect bearish tendencies, particularly on a daily basis. In terms of performance, Thyrocare's stock return over the past week has been negative at -5.95%, contrasting with a slight gain of 0.66% in the Sensex. Ove...

Read More

Thyrocare Technologies Shows Strong Financial Metrics Amid Long-Term Growth Challenges

2025-03-18 08:17:05Thyrocare Technologies has recently adjusted its evaluation, reflecting strong financial performance in Q3 FY24-25. The company reported a return on equity of 22.47% and a low debt-to-equity ratio. Despite consistent quarterly growth, challenges remain in long-term growth, with operating profit declining over five years.

Read MoreThyrocare Technologies Shows Mixed Technical Trends Amid Market Evaluation Revision

2025-03-18 08:03:46Thyrocare Technologies, a small-cap player in the Hospital & Healthcare Services sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 723.80, showing a notable increase from the previous close of 699.05. Over the past week, the stock has demonstrated a return of 5.72%, significantly outperforming the Sensex, which recorded a mere 0.07% return. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook shows bullish tendencies. The Relative Strength Index (RSI) indicates a bullish trend on a weekly basis, although there is no signal for the monthly timeframe. The Bollinger Bands suggest a mildly bearish trend weekly, contrasting with a bullish monthly perspective. Moving averages indicate a bearish trend on a daily basis, while the KST shows a bearish weekly trend but a bullish monthly outlook. When ...

Read MoreThyrocare Technologies Navigates Mixed Market Trends Amid Stock Fluctuations

2025-03-04 11:08:11Thyrocare Technologies, a small-cap player in the Hospital & Healthcare Services industry, has shown notable activity today, with its stock rising by 3.08%. This uptick contrasts with the broader market, as the Sensex experienced a slight decline of 0.11%. Over the past year, Thyrocare's performance has been relatively stable, with a gain of 2.19%, while the Sensex has decreased by 1.18%. Despite today's positive movement, Thyrocare has faced challenges in the short term, with a 6.36% decline over the past week and a significant drop of 33.34% over the last three months. Year-to-date, the stock is down 25.23%, underperforming the Sensex, which has seen a decline of 6.57%. In terms of valuation, Thyrocare Technologies has a price-to-earnings (P/E) ratio of 39.99, which is lower than the industry average of 49.69. Technical indicators suggest a mixed outlook, with weekly metrics showing bearish trends, whi...

Read More

Thyrocare Technologies Reports Growth Amidst Long-Term Challenges and Market Pressures

2025-03-03 18:53:47Thyrocare Technologies has recently experienced an evaluation adjustment following its Q3 FY24-25 performance, which showed a 23.14% increase in net sales to Rs 165.92 crore. The company maintains strong management efficiency with a 22.47% return on equity, though long-term growth prospects appear challenging due to declining operating profits.

Read MoreThyrocare Technologies Faces Mixed Technical Signals Amidst Market Volatility

2025-03-03 08:01:07Thyrocare Technologies, a small-cap player in the Hospital & Healthcare Services sector, has recently undergone an evaluation revision reflecting shifts in its technical indicators. The company's current stock price stands at 680.75, down from a previous close of 722.65. Over the past year, Thyrocare has experienced a 52-week high of 1,053.05 and a low of 555.85, indicating significant volatility. The technical summary reveals mixed signals across various indicators. The MACD shows a bearish trend on a weekly basis while remaining bullish monthly. Similarly, the Bollinger Bands and KST indicate bearish conditions weekly, with the moving averages suggesting a mildly bullish stance on a daily basis. The Dow Theory and On-Balance Volume (OBV) both reflect a mildly bearish outlook on a weekly and monthly basis. In terms of performance, Thyrocare's returns have lagged behind the Sensex across multiple time fra...

Read MoreThyrocare Technologies Faces Mixed Technical Signals Amidst Declining Stock Performance

2025-03-02 08:01:06Thyrocare Technologies, a small-cap player in the Hospital & Healthcare Services sector, has recently undergone an evaluation revision reflecting shifts in its technical indicators. The current price stands at 680.75, down from the previous close of 722.65, with a notable 52-week high of 1,053.05 and a low of 555.85. Today's trading saw a high of 738.95 and a low of 675.05. The technical summary indicates mixed signals across various metrics. The MACD shows a bearish trend on a weekly basis while remaining bullish monthly. The Bollinger Bands and KST both reflect bearish tendencies on a weekly scale, with the moving averages indicating a mildly bullish stance daily. The On-Balance Volume (OBV) and Dow Theory metrics also suggest a mildly bearish outlook on a weekly basis. In terms of performance, Thyrocare's stock return has lagged behind the Sensex across multiple time frames. Over the past week, the sto...

Read MoreThyrocare Technologies Faces Mixed Technical Trends Amid Market Challenges

2025-03-01 08:01:05Thyrocare Technologies, a small-cap player in the Hospital & Healthcare Services sector, has recently undergone an evaluation revision reflecting shifts in its technical indicators. The company's current stock price stands at 680.75, down from a previous close of 722.65, with a 52-week high of 1,053.05 and a low of 555.85. The technical summary indicates a mixed performance across various metrics. The MACD shows a bearish trend on a weekly basis while remaining bullish monthly. Bollinger Bands and KST also reflect bearish signals on a weekly basis, suggesting some volatility in the short term. Meanwhile, moving averages indicate a mildly bullish stance daily, contrasting with the overall bearish sentiment observed in the weekly indicators. In terms of performance, Thyrocare's stock has faced challenges compared to the Sensex. Over the past week, the stock returned -6.33%, while the Sensex returned -2.81%...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Apr-2025 | Source : BSEPlease find attached Certificate pursuant to Regulation 74(5) of the SEBI (Depositories and Participants) Regulations 2018 for the Quarter ended March 31 2025.

Closure of Trading Window

27-Mar-2025 | Source : BSEIntimation for Closure of Trading Window.

Announcement under Regulation 30 (LODR)-Acquisition

03-Mar-2025 | Source : BSEPlease find attached herewith Disclosure under Regulation 30 for Additional Equity infusion in Thyrocare Laboratories (Tanzania) Limited - Joint Venture.

Corporate Actions

No Upcoming Board Meetings

Thyrocare Technologies Ltd has declared 180% dividend, ex-date: 16 Aug 24

No Splits history available

No Bonus history available

No Rights history available