Timex Group India Shows Mixed Technical Signals Amid Strong Long-Term Performance

2025-04-03 08:02:21Timex Group India, a small-cap player in the lifestyle industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 169.30, showing a slight increase from the previous close of 167.85. Over the past year, Timex has demonstrated a notable return of 19.90%, significantly outperforming the Sensex, which recorded a return of 3.67% in the same period. In terms of technical indicators, the stock's moving averages signal a bullish trend on a daily basis, while the monthly Bollinger Bands indicate a bullish stance as well. However, the MACD and KST metrics present a mixed picture, with bearish signals on a weekly basis. The overall technical summary suggests a complex landscape for Timex, with varying signals across different time frames. The company's performance over longer periods is particularly impressive, with a staggering 815.14% return ov...

Read MoreTimex Group India Shows Mixed Technical Trends Amid Strong Long-Term Performance

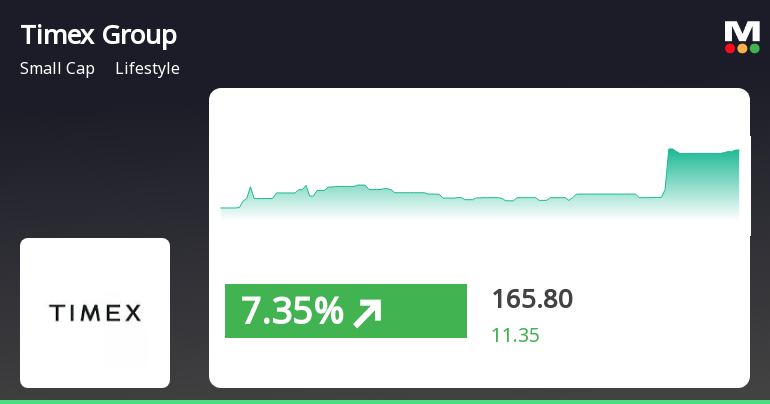

2025-04-02 08:03:43Timex Group India, a small-cap player in the lifestyle industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 167.85, showing a notable increase from the previous close of 154.45. Over the past year, Timex has demonstrated a robust performance with a return of 20.80%, significantly outperforming the Sensex, which recorded a return of 2.72% in the same period. The technical summary indicates a mixed outlook, with various indicators reflecting different trends. The MACD shows bearish tendencies on a weekly basis, while the monthly perspective leans mildly bearish. The Bollinger Bands present a contrasting view, indicating a bullish trend on a monthly basis. Daily moving averages suggest a mildly bullish sentiment, while the KST and Dow Theory metrics reflect a more cautious stance. In terms of stock performance, Timex has shown resili...

Read More

Timex Group India Shows Resilience Amid Market Volatility and Mixed Trends

2025-04-01 14:30:21Timex Group India experienced notable activity on April 1, 2025, with significant intraday volatility and a peak intraday high. While the stock has shown mixed trends in moving averages, it has performed well over the past year, contrasting with a decline in the broader market.

Read More

Timex Group India Reports Strong Quarterly Growth Amid Long-Term Concerns

2025-03-12 08:04:32Timex Group India has recently adjusted its evaluation, reflecting a reassessment of its financial metrics. The company reported strong quarterly growth in net sales, profit before tax, and profit after tax. However, its long-term growth trajectory appears less favorable, with minimal domestic mutual fund investment and a high price-to-book ratio.

Read MoreTimex Group India Faces Mixed Technical Trends Amid Market Volatility

2025-03-12 08:01:00Timex Group India, a small-cap player in the lifestyle industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 160.00, down from a previous close of 167.00, with a 52-week high of 238.00 and a low of 113.45. Today's trading saw a high of 168.75 and a low of 158.70, indicating some volatility. The technical summary reveals a mixed picture. The MACD indicates bearish trends on both weekly and monthly scales, while the Bollinger Bands also reflect bearish conditions. Moving averages present a mildly bullish outlook on a daily basis, contrasting with the mildly bearish signals from the KST and Dow Theory metrics. The RSI shows no significant signals for both weekly and monthly assessments. In terms of performance, Timex Group's returns have varied significantly over different periods. Over the past week, the stock has declined by 3.32%, ...

Read MoreTimex Group India Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-02-28 08:01:33Timex Group India, a small-cap player in the lifestyle industry, has recently undergone an evaluation revision reflecting shifts in its technical indicators. The company's current price stands at 163.55, slightly down from the previous close of 165.65. Over the past year, Timex has shown a notable return of 15.50%, significantly outperforming the Sensex, which recorded a return of 2.08% in the same period. In terms of technical metrics, the MACD indicates a mildly bearish trend on a weekly basis, while the monthly outlook remains bullish. The Relative Strength Index (RSI) shows no signals for both weekly and monthly periods, suggesting a neutral momentum. Bollinger Bands reflect a mildly bearish trend weekly, with a sideways movement monthly. Daily moving averages indicate a mildly bullish sentiment, while the KST and Dow Theory both lean towards a mildly bearish stance on a weekly and monthly basis. Time...

Read MoreTimex Group India Shows Mixed Technical Signals Amid Strong Long-Term Performance

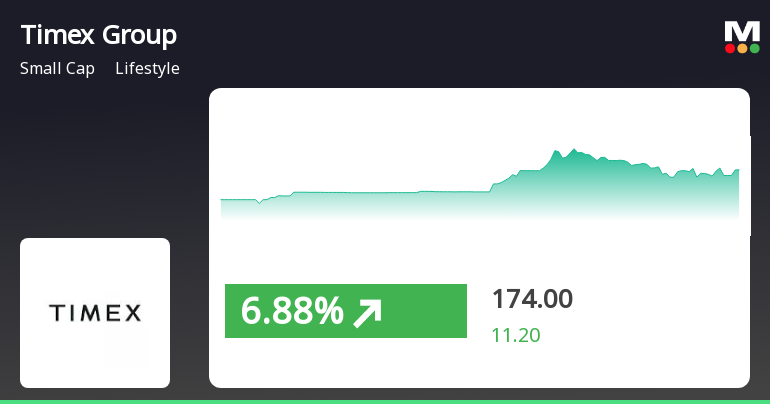

2025-02-25 10:30:00Timex Group India, a small-cap player in the lifestyle industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 174.90, showing a notable increase from the previous close of 169.65. Over the past year, Timex has demonstrated a robust performance with a return of 22.52%, significantly outperforming the Sensex, which recorded a return of just 2.08% in the same period. The technical summary indicates mixed signals across various indicators. While the MACD shows a mildly bearish trend on a weekly basis, it is bullish on a monthly scale. The Bollinger Bands reflect a similar divergence, with a mildly bearish stance weekly and bullish monthly. Moving averages indicate a mildly bullish trend on a daily basis, suggesting some positive momentum. In terms of stock performance, Timex has shown resilience over longer periods, with a remarkable 38...

Read More

Timex Group India Reports Strong Quarterly Growth Amid Slower Long-Term Trajectory

2025-02-24 18:29:03Timex Group India has recently adjusted its evaluation, reflecting its financial performance and market conditions. The company reported a 27.32% increase in net sales for the quarter ending December 2024, alongside substantial growth in profits. However, long-term growth remains slower, with a strong debt servicing capability and notable market outperformance.

Read More

Timex Group India Shows Notable Stock Activity Amid High Volatility and Sector Outperformance

2025-02-24 11:00:20Timex Group India has shown notable trading activity, with a significant rise in stock performance today. The stock reached an intraday high of Rs 184 and demonstrated high volatility. Despite a recent decline over the past month, it has outperformed its sector and exhibited strong gains in the last two days.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

04-Apr-2025 | Source : BSEPursuant to Regulation 74(5) of SEBI(Depositories and Participants) Regulations 2018 please find enclosed herewith a confirmation certificate received from Alankit Assignments Limited the Registrar and Share Transfer Agent(RTA) of the Company quarter ended March 31 2025.

Announcement under Regulation 30 (LODR)-Change in Management

01-Apr-2025 | Source : BSEWe wish to inform you that based on the recommendation of the Nomination and Remuneration Committee the Board of Directors of the Company has appointed Mr. Sanjeev Kumar Swain as Vice President - Sales Offline Channels and Senior Management Personnel. Mr. Sanjeev Swain has joined the Company today i.e April 1 2025. The details of the same is in the attached letter.

Closure of Trading Window

27-Mar-2025 | Source : BSEPursuant to the provision of SEBI (Prohibition of Insider Trading ) Regulations 2015 and Timex Group India Limited- Code of Internal Procedures and Conduct of Regulating Monitoring and Reporting of Trading by Insiders the Trading Window for dealing in the shares of the Company shall remain closed from April 1 2025 till May 8 2025 (both days inclusive) on account of disclosure of Audited Financial Results of the Company for the financial year ending on March 31 2005 and the Financial Results for the quarter ending on March 31 2025.

Corporate Actions

06 May 2025

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available