Titan Company Navigates Mixed Market Signals Amidst Long-Term Performance Challenges

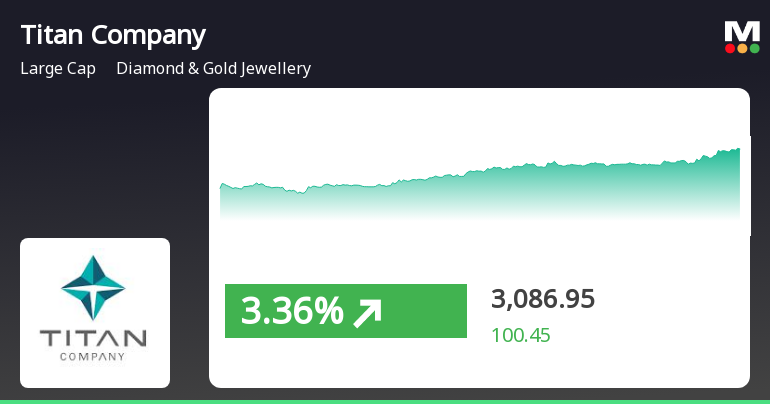

2025-04-03 12:35:15Titan Company, a prominent player in the diamond and gold jewellery industry, has shown notable activity in the stock market today. The stock has underperformed its sector by 0.34%, despite a positive trend over the last two days, where it has gained 4.95%. Currently, Titan's stock price is above its 5-day and 20-day moving averages but remains below the 50-day, 100-day, and 200-day moving averages, indicating mixed short to medium-term performance. With a market capitalization of Rs 2,77,748.34 crore, Titan Company operates within the large-cap segment. The company's price-to-earnings (P/E) ratio stands at 85.00, significantly higher than the industry average of 69.39. Over the past year, Titan's performance has declined by 15.74%, contrasting with the Sensex's increase of 3.33%. However, in the short term, Titan has outperformed the Sensex on a daily and weekly basis, with respective gains of 0.95% and 1...

Read More

Titan Company Shows Signs of Trend Reversal Amid Mixed Market Performance

2025-04-02 13:15:18Titan Company, a key player in the diamond and gold jewellery sector, experienced a rise on April 2, 2025, following two days of decline. Despite this short-term gain, the stock remains below several moving averages and has seen a year-to-date decline, contrasting with the broader market's positive performance.

Read More

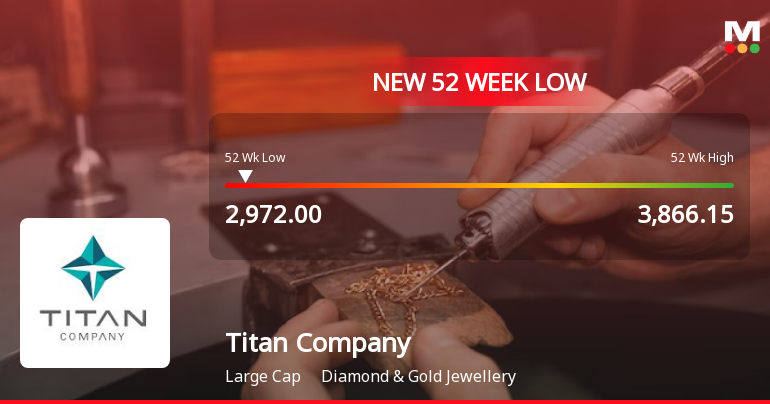

Titan Company Hits 52-Week Low Amid Broader Market Resilience and Profit Decline

2025-04-02 10:05:14Titan Company, a leading player in the diamond and gold jewellery sector, has reached a new 52-week low, continuing a downward trend. Despite a strong market presence and high management efficiency, the company faces challenges, including a high debt-equity ratio and declining profits, while underperforming compared to broader market indices.

Read More

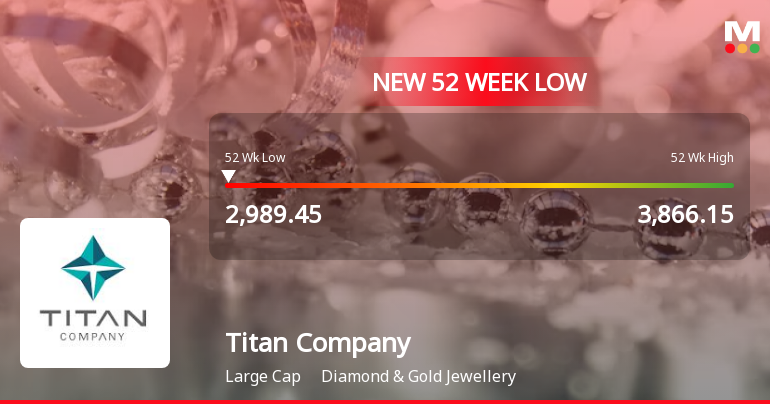

Titan Company Approaches 52-Week Low Amidst Sector Underperformance and High Leverage Concerns

2025-04-01 12:05:14Titan Company, a major player in the diamond and gold jewellery market, is nearing its 52-week low amid a recent decline. The company has underperformed its sector, trading below key moving averages. Despite challenges, it holds a significant market capitalization and demonstrates strong management efficiency, though concerns about its debt-equity ratio persist.

Read MoreTitan Company Faces Mixed Market Signals Amidst Industry Variability

2025-03-28 09:20:18Titan Company, a prominent player in the Diamond and Gold Jewellery industry, has shown notable activity in the stock market today. The stock is currently trading close to its 52-week low, just 3.36% away from Rs 2993.85. It opened at Rs 3097.95 and has maintained this price throughout the trading session. Over the past three days, Titan Company has experienced a consecutive gain, reflecting a modest increase of 1.4% during this period. In terms of moving averages, the stock is positioned higher than its 20-day moving average but remains below the 5-day, 50-day, 100-day, and 200-day moving averages, indicating mixed short-term performance. With a market capitalization of Rs 2,74,237.14 crore, Titan Company has a P/E ratio of 84.63, significantly higher than the industry average of 68.70. The company's one-year performance stands at -18.81%, contrasting with the Sensex's positive return of 5.31%. Despite ...

Read MoreTitan Company Faces Market Challenges Amid High Volatility and Declining Performance

2025-03-27 09:25:16Titan Company, a prominent player in the Diamond and Gold Jewellery industry, has shown notable activity in the stock market today. The stock is currently trading close to its 52-week low, just 2.28% away from Rs 2993.85. Over the past two days, Titan Company has experienced a slight increase of 0.28%, aligning its performance with sector trends. Today’s trading has been characterized by high volatility, with an intraday fluctuation of 30.55%. The stock has remained within a narrow range of Rs 28.2, indicating a cautious trading environment. Despite these short-term gains, Titan Company is trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, suggesting a challenging market position. In terms of broader performance metrics, Titan Company has faced a decline of 18.30% over the past year, contrasting with the Sensex's positive return of 6.14%. Year-to-date, the stock has decreased b...

Read MoreTitan Company Faces Market Challenges Amid High Volatility and Declining Stock Performance

2025-03-26 09:25:20Titan Company, a prominent player in the Diamond and Gold Jewellery industry, is currently experiencing notable market activity. The stock is trading close to its 52-week low, just 1.62% away from Rs 2,993.85. Today, it has underperformed its sector by 0.83%, marking a continuation of a downward trend with a decline of 4.69% over the past four days. The stock has exhibited high volatility today, with an intraday volatility rate of 190.89%. Additionally, Titan Company is trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a challenging market position. In terms of financial metrics, Titan Company has a market capitalization of Rs 2,70,157.77 crore and a price-to-earnings (P/E) ratio of 83.79, which is significantly higher than the industry average of 69.23. Over the past year, the stock has seen a decline of 17.76%, contrasting sharply with the Sensex's performance of ...

Read MoreTitan Company Shows Slight Recovery Amidst Broader Sector Challenges and Declining Trends

2025-03-25 09:20:19Titan Company, a prominent player in the Diamond and Gold Jewellery industry, has shown notable activity today, trading inline with sector performance. The stock opened at Rs 3,096.95 and has maintained this price throughout the trading session. After experiencing two consecutive days of decline, Titan Company has registered a slight gain of 0.55% today. Despite this uptick, the stock remains close to its 52-week low, currently just 3.33% above Rs 2,993.85. In terms of moving averages, Titan Company is trading below its 5-day, 20-day, 50-day, 100-day, and 200-day averages, indicating a challenging short-term trend. The company’s market capitalization stands at Rs 2,74,840.84 crore, categorizing it as a large-cap stock. With a price-to-earnings (P/E) ratio of 84.44, it is notably higher than the industry average of 70.41. Over the past year, Titan Company has seen a decline of 16.54%, contrasting with the ...

Read MoreTitan Company Faces Volatility Amid Mixed Performance and Long-Term Resilience

2025-03-24 09:30:26Titan Company, a prominent player in the Diamond and Gold Jewellery industry, has experienced notable activity today, underperforming its sector by 0.6%. The stock has faced consecutive declines over the past two days, resulting in a total drop of 1.26%. Today's trading session has been characterized by high volatility, with an intraday volatility rate of 59.71%, indicating significant price fluctuations. In terms of moving averages, Titan Company’s stock is currently above its 5-day and 20-day moving averages but below the 50-day, 100-day, and 200-day moving averages, suggesting mixed short-term performance relative to longer-term trends. The company holds a market capitalization of Rs 2,77,166.84 crore and a price-to-earnings (P/E) ratio of 86.77, which is notably higher than the industry average of 51.78. Over the past year, Titan Company has seen a decline of 15.83%, contrasting sharply with the Sense...

Read MoreQuarterly Update - Q4 FY 2024-25

07-Apr-2025 | Source : BSEQuarterly update - Q4 FY 2024-25.

Reporting Of Debt Securities Issued Through Private Placement

04-Apr-2025 | Source : BSEReporting of Debt Securities issued through Private Placement

Noting By The Board Of Directors On Delayed Submission Of Record Date

28-Mar-2025 | Source : BSENoting by the Board of Directors on delayed submission of record date.

Corporate Actions

No Upcoming Board Meetings

Titan Company Ltd has declared 1100% dividend, ex-date: 27 Jun 24

Titan Company Ltd has announced 1:10 stock split, ex-date: 23 Jun 11

Titan Company Ltd has announced 1:1 bonus issue, ex-date: 23 Jun 11

No Rights history available