TFCI Shows Mixed Technical Trends Amidst Long-Term Resilience in Finance Sector

2025-04-03 08:04:47Tourism Finance Corporation of India (TFCI), a small-cap player in the finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 175.05, showing a slight increase from the previous close of 173.30. Over the past year, TFCI has experienced a 3.87% decline, contrasting with a 3.67% gain in the Sensex, indicating a challenging performance relative to the broader market. In terms of technical indicators, the weekly MACD suggests a mildly bullish sentiment, while the monthly perspective leans towards a mildly bearish outlook. The Bollinger Bands are bullish on both weekly and monthly charts, suggesting potential volatility. However, moving averages indicate a mildly bearish trend on a daily basis, reflecting mixed signals in the short term. Notably, TFCI has shown impressive returns over longer periods, with a remarkable 411.09% ...

Read MoreTourism Finance Corporation of India Shows Mixed Technical Trends Amid Strong Performance

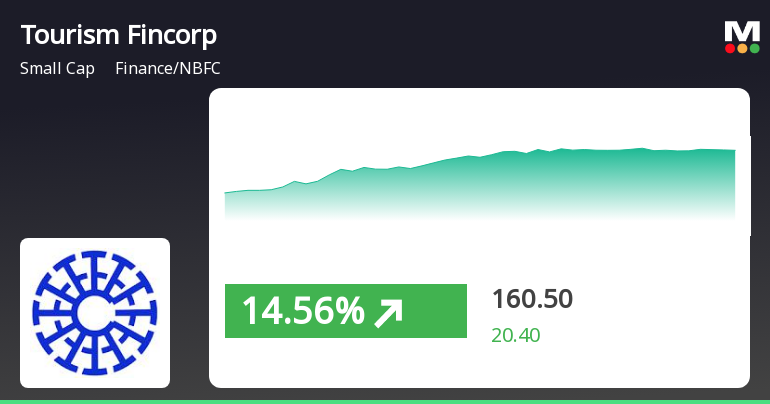

2025-04-02 08:07:02Tourism Finance Corporation of India, a small-cap player in the finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 173.30, showing a notable shift from its previous close of 169.50. Over the past week, the stock has demonstrated a strong performance, achieving a return of 23.70%, significantly outperforming the Sensex, which recorded a decline of 2.55%. In terms of technical indicators, the weekly MACD suggests a mildly bullish sentiment, while the monthly perspective leans towards a mildly bearish outlook. The Bollinger Bands indicate bullish trends on both weekly and monthly scales, suggesting some volatility in price movements. However, moving averages on a daily basis reflect a mildly bearish trend, indicating mixed signals in the short term. The company's performance over various time frames shows resilience, par...

Read MoreTourism Finance Corporation Sees Surge in Trading Activity Amid Market Dynamics

2025-03-27 10:00:13Tourism Finance Corporation of India Ltd, a small-cap player in the Finance/NBFC sector, has experienced significant activity today, hitting its upper circuit limit with a high price of Rs 167.82. The stock recorded a notable change of Rs 26.64, reflecting a percentage increase of 19.05%. Throughout the trading session, the stock fluctuated between an intraday low of Rs 139.4 and the aforementioned high, showcasing a price band of 20%. The total traded volume reached approximately 118.35 lakh shares, contributing to a turnover of Rs 190.96 crore. Despite this positive movement, the stock underperformed its sector by 2.09% and recorded a 1D return of -2.64%. However, it remains above its 5-day, 20-day, 50-day, and 100-day moving averages, although it is lower than the 200-day moving average. Investor participation has notably increased, with delivery volume rising by 231.85% compared to the 5-day avera...

Read MoreTFCI Shows Mixed Technical Trends Amidst Significant Market Volatility and Growth Potential

2025-03-27 08:02:46Tourism Finance Corporation of India (TFCI), a small-cap player in the finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 167.20, showing a notable increase from the previous close of 140.10. Over the past year, TFCI has experienced a 52-week high of 219.40 and a low of 122.15, indicating significant volatility. In terms of technical indicators, the weekly MACD suggests a mildly bullish sentiment, while the monthly perspective leans towards a mildly bearish outlook. The Bollinger Bands indicate bullish trends on both weekly and monthly charts, suggesting potential upward momentum. However, the daily moving averages reflect a mildly bearish stance, indicating mixed signals in the short term. When comparing TFCI's performance to the Sensex, the company has shown impressive returns over various periods. Over the past thr...

Read More

TFCI Shows Short-Term Gains Amid Mixed Long-Term Performance in Financial Sector

2025-03-26 09:35:21Tourism Finance Corporation of India (TFCI) experienced notable trading activity, gaining 7.82% on March 26, 2025, and reaching an intraday high of Rs 152. While TFCI's short-term performance shows mixed results, its long-term growth over three, five, and ten years remains impressive despite a decline over the past year.

Read MoreTourism Finance Corporation Faces Bearish Technical Trends Amid Market Evaluation Revision

2025-03-26 08:03:35Tourism Finance Corporation of India, a small-cap player in the finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 140.10, down from a previous close of 143.70, with a 52-week high of 219.40 and a low of 122.15. Today's trading saw a high of 145.40 and a low of 138.50. The technical summary indicates a bearish sentiment across various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. Bollinger Bands and moving averages also reflect bearish conditions, suggesting a cautious market environment. The KST aligns with this sentiment, indicating bearish trends weekly and mildly bearish monthly. However, the On-Balance Volume (OBV) remains bullish on both weekly and monthly scales, hinting at some underlying strength. In terms of performance, the company has faced chall...

Read MoreTourism Finance Corporation Adjusts Valuation Amidst Competitive NBFC Landscape

2025-03-26 08:00:33Tourism Finance Corporation of India has recently undergone a valuation adjustment, reflecting a shift in its financial standing within the finance and non-banking financial company (NBFC) sector. The company's current price stands at 140.10, with a previous close of 143.70. Over the past year, the stock has experienced a decline of 18.99%, contrasting with a 7.12% gain in the Sensex. Key financial metrics for Tourism Finance Corporation include a price-to-earnings (PE) ratio of 13.80 and a price-to-book value of 1.11. The company also reports an EV to EBITDA ratio of 10.72 and a dividend yield of 1.78%. Return on capital employed (ROCE) is noted at 10.55%, while return on equity (ROE) is at 8.06%. When compared to its peers, Tourism Finance Corporation's valuation appears more favorable, particularly against companies like Indus Inf. Trust and Indostar Capital, which are positioned at significantly highe...

Read MoreTechnical Trends Indicate Mixed Outlook for Tourism Finance Corporation Amid Market Dynamics

2025-03-19 08:03:25Tourism Finance Corporation of India, a small-cap player in the finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 140.15, showing a slight increase from the previous close of 139.35. Over the past year, the stock has experienced a decline of 20.71%, contrasting with a 3.51% gain in the Sensex during the same period. The technical summary indicates a mixed outlook, with various indicators suggesting a bearish sentiment in the short term. The MACD and Bollinger Bands reflect a bearish trend on both weekly and monthly scales, while the moving averages indicate a bearish position on a daily basis. However, the On-Balance Volume (OBV) shows bullish momentum on both weekly and monthly charts, suggesting some underlying strength. In terms of returns, the company has faced challenges, particularly in the year-to-date perform...

Read MoreTourism Finance Corporation of India Faces Bearish Technical Trends Amid Market Volatility

2025-03-11 08:03:34Tourism Finance Corporation of India, a small-cap player in the finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 145.35, down from a previous close of 149.05, with a 52-week high of 219.40 and a low of 122.15. Today's trading saw a high of 150.90 and a low of 143.15, indicating some volatility. The technical summary reveals a bearish sentiment across various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. Bollinger Bands and moving averages also reflect bearish conditions, suggesting a cautious market environment. Notably, the KST indicates a bearish trend weekly, with a mildly bearish stance monthly. In terms of performance, the company has shown mixed results compared to the Sensex. Over the past week, the stock returned 3.42%, outperforming the Sensex's 1...

Read MoreCompliances-Half Yearly Report (SEBI Circular No. CIR/IMD/DF-1/67/2017)

08-Apr-2025 | Source : BSETFCI ISIN details

Format of the Initial Disclosure to be made by an entity identified as a Large Corporate : Annexure A

08-Apr-2025 | Source : BSEFormat of Initial Disclosure to be made by an entity identified as a Large Corporate.

| Sr. No. | Particulars | Details |

| 1 | Name of Company | Tourism Finance Corporation of India Ltd |

| 2 | CIN NO. | L65910DL1989PLC034812 |

| 3 | Outstanding borrowing of company as on 31st March / 31st December as applicable (in Rs cr) | 866.15 |

| 4 | Highest Credit Rating during the previous FY | A+ |

| 4a | Name of the Credit Rating Agency issuing the Credit Rating mentioned in (4) | BRICKWORK RATINGS INDIA PRIVATE LIMITED |

| 5 | Name of Stock Exchange# in which the fine shall be paid in case of shortfall in the required borrowing under the framework | BSE |

Designation: Company Secretary and Compliance Officer

EmailId: sanjayahuja@tfciltd.com

Designation: Managing Director and CFO

EmailId: anoop.bali@tfciltd.com

Date: 08/04/2025

Note: In terms para of 3.2(ii) of the circular beginning F.Y 2022 in the event of shortfall in the mandatory borrowing through debt securities a fine of 0.2% of the shortfall shall be levied by Stock Exchanges at the end of the two-year block period. Therefore an entity identified as LC shall provide in its initial disclosure for a financial year the name of Stock Exchange to which it would pay the fine in case of shortfall in the mandatory borrowing through debt markets.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

02-Apr-2025 | Source : BSECertificate under Reg. 74(5) of SEBI (DP) Regulations 2018

Corporate Actions

No Upcoming Board Meetings

Tourism Finance Corporation of India Ltd has declared 25% dividend, ex-date: 07 Aug 24

No Splits history available

No Bonus history available

No Rights history available