Trent Ltd. Shows Mixed Performance Amidst Strong Short-Term Gains and Premium Valuation

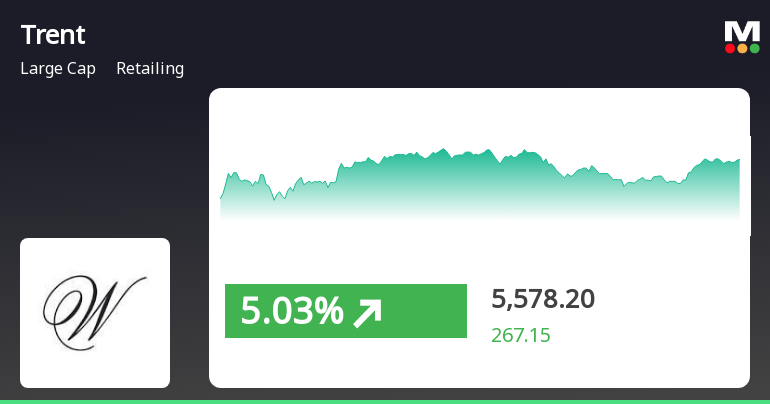

2025-04-03 12:35:12Trent Ltd., a prominent player in the retailing sector, has shown notable activity today, underperforming its sector by 1.02%. Despite this, the stock has demonstrated a positive trend over the past three days, accumulating a total return of 7.37%. Currently, Trent's market capitalization stands at Rs 2,03,100.65 crore, categorizing it as a large-cap company. The stock's price-to-earnings (P/E) ratio is 135.85, significantly higher than the industry average of 99.56, indicating a premium valuation relative to its peers. In terms of performance metrics, Trent has outperformed the Sensex over various time frames. Over the past year, the stock has gained 45.50%, while the Sensex has only increased by 3.33%. In the last month, Trent's performance has been particularly strong, with a 15.40% rise compared to the Sensex's 4.45%. However, it is worth noting that the stock has faced challenges in the longer term,...

Read More

Trent Reports Strong Financial Growth and Maintains Leading Market Position

2025-04-02 08:03:10Trent, a key player in retail, recently adjusted its evaluation based on strong financial performance, including a significant annual growth in net sales and operating profit. The company has shown consistent positive results over 14 quarters, with impressive metrics in return on capital and market position.

Read More

Trent Ltd. Outperforms Market Amid Broader Decline, Showcases Long-Term Growth Potential

2025-04-01 11:40:13Trent Ltd., a key player in retail, demonstrated strong performance on April 1, 2025, outperforming the broader market despite a general decline. The stock reached an intraday high and has shown significant growth over the past year and decade, highlighting its resilience and positive trajectory.

Read MoreTrent Ltd. Shows Resilience Amid Mixed Market Trends and Strong Yearly Performance

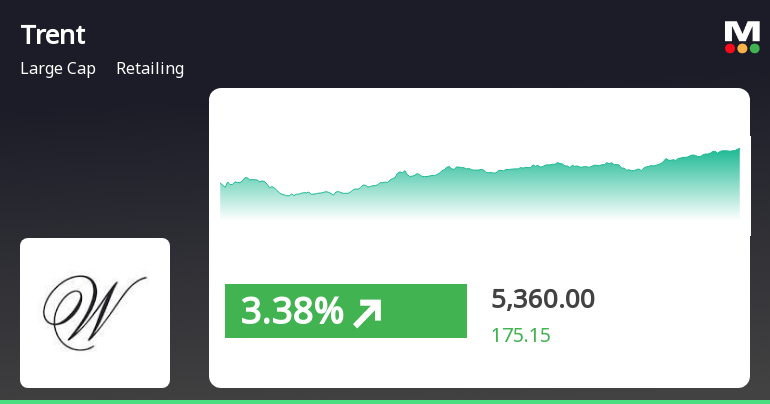

2025-03-28 09:20:08Trent Ltd., a prominent player in the retailing sector, has shown notable activity today, aligning its performance with the broader market trends. The stock has experienced a consecutive gain over the last four days, accumulating a total return of 7.16% during this period. Today, it opened at Rs 5,416.75 and has maintained this trading price throughout the session. In terms of moving averages, Trent's stock is currently above its 5-day, 20-day, and 50-day averages, although it remains below the 100-day and 200-day moving averages. This positioning indicates a mixed trend in the short to medium term. With a market capitalization of Rs 1,93,674.90 crore, Trent operates within a large-cap segment, boasting a price-to-earnings (P/E) ratio of 129.44, significantly lower than the industry average of 1170.04. Over the past year, Trent has outperformed the Sensex, delivering a return of 37.98% compared to the Sen...

Read MoreTrent Ltd. Shows Strong Performance Amid Mixed Retail Sector Results

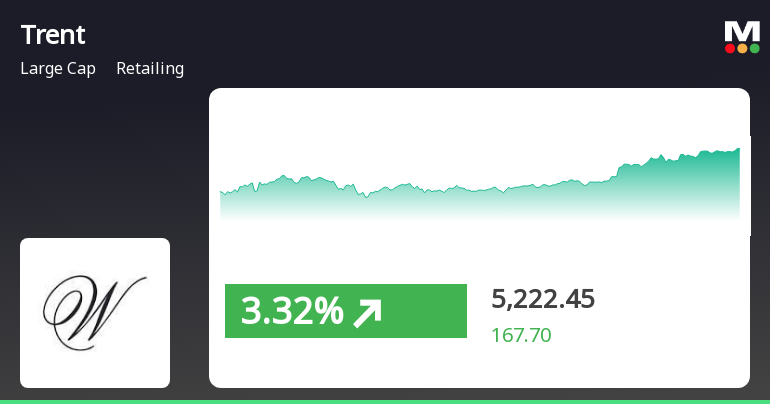

2025-03-27 09:25:08Trent Ltd., a prominent player in the retailing sector, has shown significant activity today, outperforming its sector by 1.12%. The stock has experienced a positive trend over the past three days, accumulating a total return of 6.32%. Today, it reached an intraday high of Rs 5440, marking a 2.28% increase. However, the stock has also exhibited high volatility, with an intraday volatility rate of 30.26%. In terms of moving averages, Trent's stock price is currently above its 5-day, 20-day, and 50-day moving averages, yet remains below the 100-day and 200-day averages. The company holds a market capitalization of Rs 1,90,800.78 crore and has a price-to-earnings (P/E) ratio of 127.20, which is notably lower than the industry average of 1319.78. Over the past year, Trent Ltd. has delivered a remarkable performance of 38.57%, significantly outpacing the Sensex's 6.14% return. In the broader context, the retai...

Read More

Trent Ltd. Shows Resilience Amid Broader Market Decline with Strong Recent Gains

2025-03-26 12:45:14Trent Ltd., a key player in retail, has demonstrated strong performance, gaining 3.15% on March 26, 2025, and outperforming its sector. The stock has seen a total return of 5.57% over two days and a notable 7.90% increase over the past month, despite a year-to-date decline.

Read MoreTrent's Technical Indicators Show Mixed Signals Amid Strong Long-Term Performance

2025-03-26 08:00:41Trent, a prominent player in the retailing industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 5,184.85, showing a notable increase from the previous close of 5,054.75. Over the past year, Trent has demonstrated a robust performance with a return of 31.31%, significantly outperforming the Sensex, which recorded a return of 7.12% in the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook shows a mildly bearish trend. The Relative Strength Index (RSI) indicates bullish momentum on a weekly basis, yet presents no signal on a monthly scale. Bollinger Bands reflect a mildly bearish trend weekly, contrasting with a bullish monthly perspective. Moving averages indicate a bearish stance on a daily basis, while the KST shows a bearish trend weekly and mildly bearish monthly. Trent's pe...

Read More

Trent Ltd. Shows Signs of Trend Reversal Amid Broader Market Gains

2025-03-25 12:45:17Trent Ltd., a key player in retail, experienced a notable increase in stock price after a series of declines. The stock outperformed its sector today and has shown strong annual returns compared to the broader market. Meanwhile, the Sensex continues its upward trend, reflecting overall market strength.

Read More

Trent's Stock Faces Technical Shift Amid Strong Financial Performance and Market Position

2025-03-25 08:02:08Trent, a key player in retail, has experienced a recent evaluation adjustment reflecting changes in technical indicators, signaling a shift in market sentiment. Despite this, the company reported strong quarterly results, with significant growth in net sales and operating profit, maintaining a solid operational efficiency and market position.

Read MoreUpdate For Q4 And Financial Year 2024-25

05-Apr-2025 | Source : BSEUpdate for Q4 and Financial Year 2024-25

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

04-Apr-2025 | Source : BSECertificate under Regulation 74(5) of the Securities Exchange Board of India (Depositories and Participants) Regulations 2018 for the quarter ended 31st March 2025.

Portfolio Of Over 1000 Fashion Stores

31-Mar-2025 | Source : BSEPursuant to Regulation 30 of the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations 2015 we wish to inform that the Company has now crossed an operating portfolio of over 1000 large-box fashion stores.

Corporate Actions

No Upcoming Board Meetings

Trent Ltd. has declared 320% dividend, ex-date: 22 May 24

Trent Ltd. has announced 1:10 stock split, ex-date: 12 Sep 16

No Bonus history available

Trent Ltd. has announced 1:5 rights issue, ex-date: 08 May 07