Triveni Engineering Shows Resilience Amid Mixed Market Performance and Recovery Trends

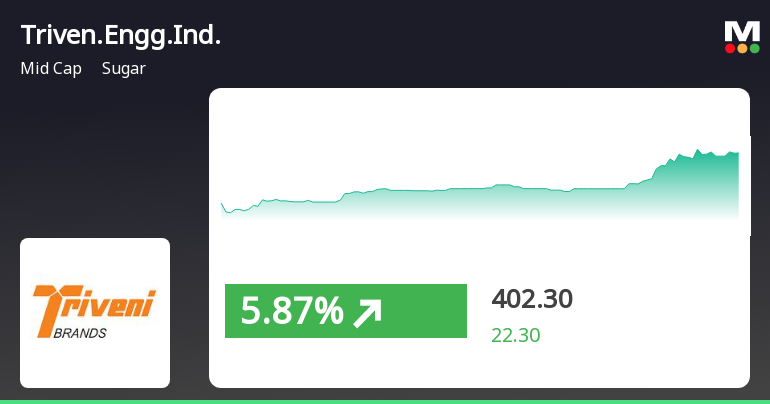

2025-03-21 11:05:22Triveni Engineering and Industries, a midcap sugar company, experienced significant stock activity, outperforming its sector. The stock is above several short-term moving averages but below longer-term ones. Over the past year, it has shown strong performance compared to the Sensex, despite a decline year-to-date.

Read MoreTriveni Engineering Shows Mixed Technical Trends Amid Strong Long-Term Performance

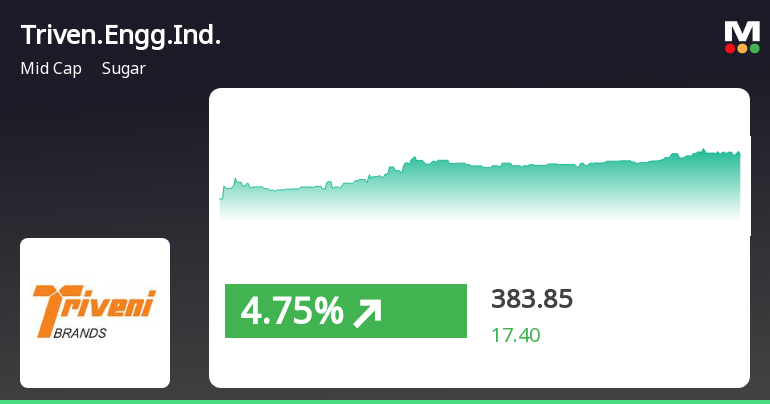

2025-03-19 08:03:29Triveni Engineering and Industries, a midcap player in the sugar industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 384.50, showing a notable increase from the previous close of 366.45. Over the past year, Triveni has demonstrated a solid performance with an 18.82% return, significantly outperforming the Sensex, which recorded a 3.51% return in the same period. The technical summary indicates a mixed outlook, with various indicators reflecting different trends. The MACD shows a bearish stance on a weekly basis while leaning mildly bearish on a monthly scale. The Bollinger Bands present a mildly bearish trend weekly, contrasting with a bullish monthly perspective. Moving averages also suggest a mildly bearish trend, while the Dow Theory indicates a mildly bullish position on a weekly basis. In terms of returns, Triveni has shown ...

Read More

Triveni Engineering Shows Resilience Amidst Sugar Sector Trends and Market Challenges

2025-03-18 15:15:59Triveni Engineering and Industries, a midcap sugar company, experienced notable trading activity on March 18, 2025, with a significant intraday high. The stock has shown resilience over the past year, outperforming the broader sugar sector and the Sensex, despite facing short-term challenges.

Read More

Triveni Engineering Faces Continued Stock Decline Amid Market Challenges

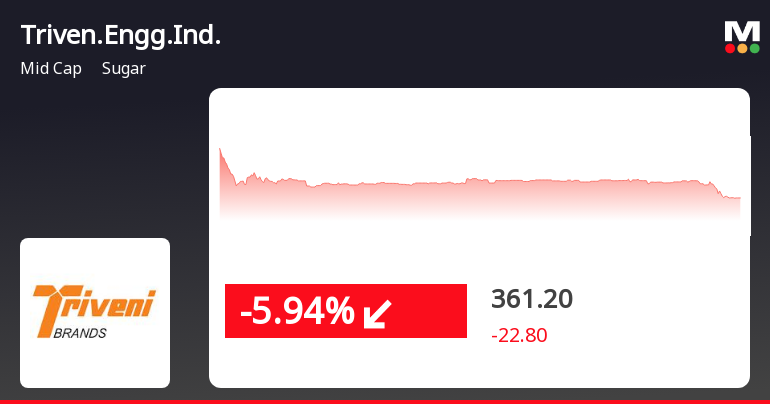

2025-02-27 09:50:18Triveni Engineering and Industries, a midcap sugar company, has faced notable stock volatility, declining for two consecutive days and underperforming its sector. The stock is trading below key moving averages and has seen a significant drop over the past month, highlighting ongoing market challenges.

Read MoreTriveni Engineering Faces Bearish Technical Trends Amid Market Volatility

2025-02-27 08:01:29Triveni Engineering and Industries, a midcap player in the sugar industry, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock price is currently at 365.05, down from a previous close of 384.00, with a 52-week high of 536.00 and a low of 266.15. Today's trading saw a high of 389.45 and a low of 360.30, indicating some volatility in the market. The technical summary for Triveni Engineering reveals a predominantly bearish outlook across various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly perspective is mildly bearish. Bollinger Bands and moving averages also reflect bearish signals, suggesting a cautious market sentiment. The KST indicator aligns with this trend, indicating bearish conditions on a weekly basis and mildly bearish on a monthly basis. In terms of performance, Triveni Engineering's returns have varied over...

Read More

Triveni Engineering Faces Significant Stock Decline Amid Broader Market Stability

2025-02-25 15:35:20Triveni Engineering and Industries, a midcap sugar company, saw its shares decline significantly today, underperforming its sector. The stock has experienced notable volatility and is trading below key moving averages, reflecting a bearish trend. Over the past month, it has also faced challenges compared to broader market indices.

Read MoreTriveni Engineering Outperforms Sensex Amid Broader Market Decline, Highlights Industry Resilience

2025-02-24 10:44:28Triveni Engineering and Industries Ltd, a mid-cap player in the sugar industry, has shown significant activity in today's trading session, with a notable increase of 3.83%. This performance stands in contrast to the broader market, as the Sensex experienced a decline of 1.02% on the same day. Over the past week, Triveni Engineering has outperformed the Sensex, gaining 6.17% compared to the index's drop of 1.91%. In terms of annual performance, Triveni Engineering has achieved a return of 13.21% over the past year, significantly surpassing the Sensex's modest gain of 1.92%. However, year-to-date figures reveal a decline of 13.35% for the company, while the Sensex has decreased by 4.60%. The company's market capitalization stands at Rs 8,593.93 crore, with a price-to-earnings ratio of 37.41, which is above the industry average of 33.29. Over the longer term, Triveni Engineering has demonstrated robust grow...

Read More

Triveni Engineering Reports Continued Financial Challenges in Q3 FY24-25 Amid Valuation Concerns

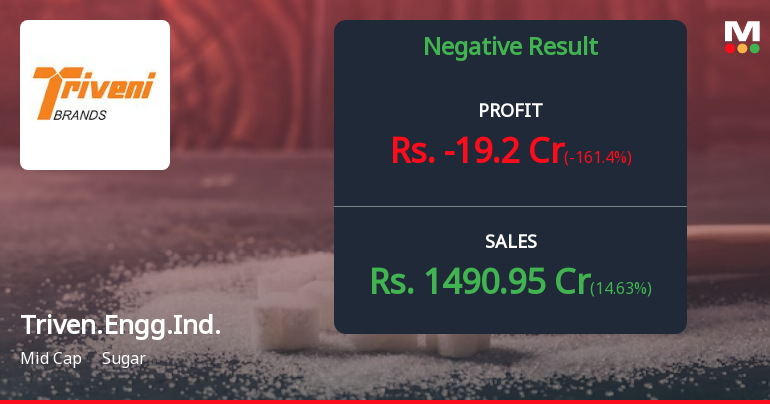

2025-02-10 18:54:21Triveni Engineering and Industries has recently adjusted its evaluation amid ongoing financial challenges, reporting negative performance for the third quarter of FY24-25. Despite maintaining a healthy return on capital employed, the company faces perceptions of expensive valuation and a lack of clear price momentum in the market.

Read More

Triveni Engineering Reports Q3 FY24-25 Results Amidst Sugar Industry Challenges

2025-02-05 10:02:58Triveni Engineering and Industries has reported its financial results for the quarter ending February 2025, showing negative performance for Q3 FY24-25. Despite this, an adjustment in evaluation reflects a slight improvement in the company's financial health assessment, highlighting the challenges faced by midcap players in the sugar industry.

Read MoreAnnouncement under Regulation 30 (LODR)-Credit Rating

04-Apr-2025 | Source : BSERevision in Credit Rating

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

04-Apr-2025 | Source : BSEWe enclose herewith a Certificate under Regulation 74(5) of SEBI (DP) Regulation 2018 for the quater ended 31st March. 2025 recived from rta of the Company

Shareholder Meeting / Postal Ballot-Scrutinizers Report

29-Mar-2025 | Source : BSEDisclosure under Regulation 44(3) of the SEBI (LODR) Regulations 2015 - Voting Result of Postal Ballot along with Scrutinizers Report

Corporate Actions

No Upcoming Board Meetings

Triveni Engineering and Industries Ltd has declared 125% dividend, ex-date: 06 Sep 24

No Splits history available

No Bonus history available

No Rights history available