Triveni Turbine Faces Technical Challenges Amidst Long-Term Resilience in Market Dynamics

2025-03-28 08:02:42Triveni Turbine, a midcap player in the engineering sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 562.55, slightly down from the previous close of 563.90. Over the past year, Triveni Turbine has experienced a stock return of 3.18%, which is notably lower than the Sensex return of 6.32% during the same period. In terms of technical indicators, the weekly MACD and KST are both signaling bearish trends, while the monthly indicators show a mildly bearish outlook. The Bollinger Bands indicate a bearish trend on a weekly basis, contrasting with a bullish stance on a monthly basis. The daily moving averages also reflect a bearish sentiment. Despite these technical challenges, Triveni Turbine has shown resilience over longer periods, with a remarkable 922.82% return over the last five years, significantly outperforming the Sensex's...

Read More

Triveni Turbine Shows Mixed Performance Amid Broader Market Resilience and Small-Cap Gains

2025-03-27 15:20:19Triveni Turbine, a midcap engineering firm, saw a 9.22% increase on March 27, 2025, despite underperforming its sector. The stock's mixed performance is reflected in its moving averages. Meanwhile, the Sensex has shown resilience, recovering from a negative opening and gaining over the past three weeks.

Read MoreTriveni Turbine Shows Mixed Technical Trends Amidst Strong Long-Term Performance

2025-03-27 08:02:35Triveni Turbine, a midcap player in the engineering sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 563.90, showing a slight increase from the previous close of 557.00. Over the past year, Triveni Turbine has experienced a 4.78% return, which is modest compared to the Sensex's 6.65% return during the same period. In terms of technical indicators, the MACD shows a bearish trend on a weekly basis, while the monthly perspective indicates a mildly bearish stance. The Relative Strength Index (RSI) remains neutral, with no significant signals detected in both weekly and monthly assessments. Bollinger Bands present a mixed picture, with a bearish outlook weekly and a bullish trend monthly. Moving averages indicate a bearish trend on a daily basis, while the KST reflects a mildly bearish sentiment monthly. Notably, Triveni Turbine has ...

Read MoreTriveni Turbine Faces Bearish Technical Trends Amid Market Volatility and Historical Growth

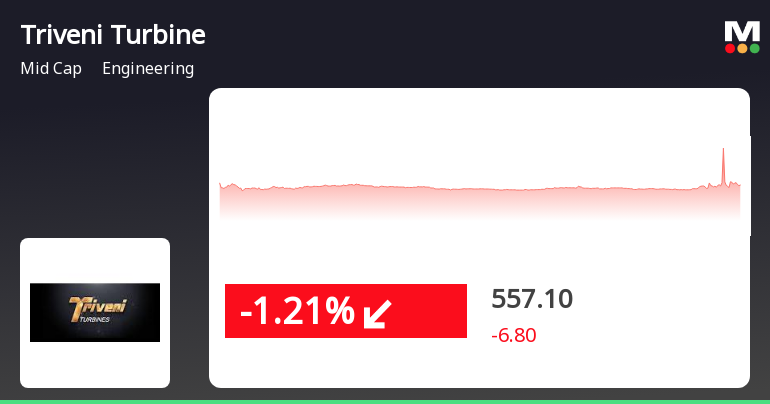

2025-03-26 08:03:10Triveni Turbine, a midcap player in the engineering sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 557.00, down from a previous close of 576.00, with a notable 52-week high of 885.00 and a low of 460.40. Today's trading saw a high of 591.70 and a low of 550.45, indicating some volatility. The technical summary reveals a bearish sentiment in various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. The Bollinger Bands also indicate a bearish trend weekly, with a sideways movement monthly. Moving averages reflect a bearish stance on a daily basis, and the KST aligns with this bearish sentiment on a weekly level, though it is mildly bearish monthly. In terms of performance, Triveni Turbine's stock return over the past year stands at 10.91%, outperforming the Sensex, which ...

Read MoreTriveni Turbine Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-19 08:03:08Triveni Turbine, a midcap player in the engineering sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 575.75, showing a notable increase from the previous close of 510.00. Over the past year, Triveni Turbine has demonstrated a robust performance with a return of 24.78%, significantly outperforming the Sensex, which recorded a return of 3.51% in the same period. The technical summary indicates a mixed outlook, with various indicators suggesting different trends. The MACD shows a bearish stance on a weekly basis, while the monthly perspective leans mildly bearish. The Bollinger Bands present a mildly bearish signal weekly but indicate bullish momentum on a monthly scale. Additionally, the On-Balance Volume (OBV) reflects a mildly bullish trend monthly, suggesting some positive investor sentiment. In terms of stock performance, Triv...

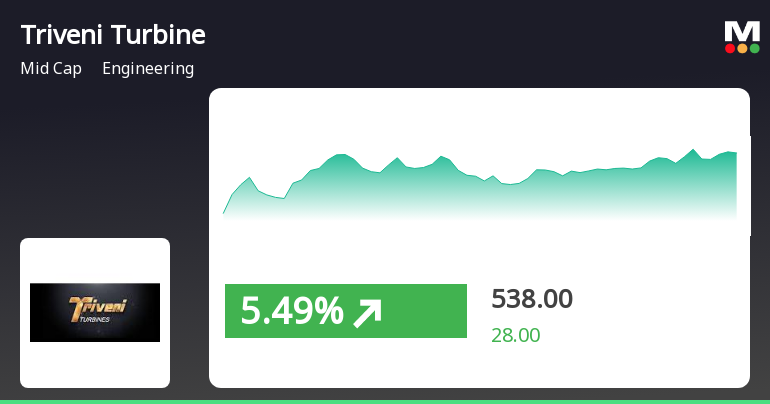

Read MoreTriveni Turbine Experiences Significant Trading Surge Amidst Sector Activity Shift

2025-03-18 14:00:04Triveni Turbine Ltd. (symbol: TRITURBINE) has emerged as one of the most active stocks today, reflecting significant trading activity in the engineering sector. The company reported a total traded volume of 9,756,808 shares, with a total traded value of approximately Rs 535.54 crore. The stock opened at Rs 515.0 and reached an intraday high of Rs 564.9, marking a notable gain of 10.98% from its previous close of Rs 509.0. Today’s performance indicates a trend reversal for Triveni Turbine, as it has gained after five consecutive days of decline. The stock has outperformed its sector by 6.78%, while the engineering sector itself has seen a gain of 2.9%. However, it is worth noting that the delivery volume has decreased significantly, falling by 60.6% compared to the five-day average, with a delivery volume of 329,000 shares recorded on March 17. In terms of moving averages, Triveni Turbine's current price ...

Read More

Triveni Turbine Shows Signs of Trend Reversal Amid Broader Market Challenges

2025-03-18 09:35:17Triveni Turbine has experienced a notable increase in stock price after a series of declines, suggesting a potential trend reversal. Despite this uptick, the company is trading below key moving averages, indicating ongoing challenges. In contrast, the broader market shows a positive opening, though it remains in a bearish trend overall.

Read MoreTriveni Turbine Faces Technical Trend Shift Amid Mixed Market Signals

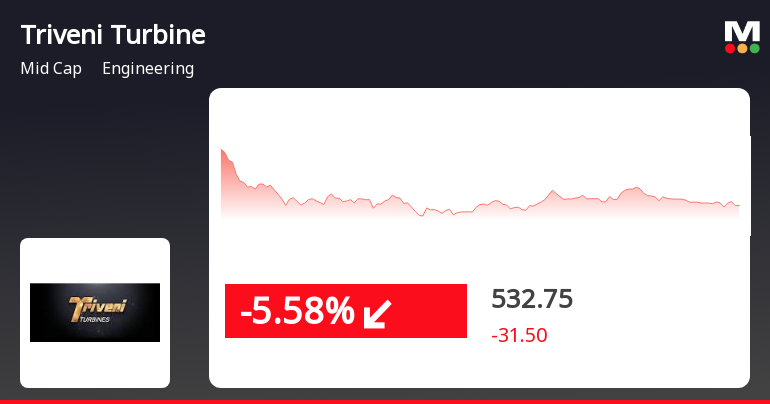

2025-03-12 08:01:58Triveni Turbine, a midcap player in the engineering sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 530.55, a notable shift from its previous close of 564.25. Over the past year, Triveni Turbine has demonstrated a return of 10.44%, outperforming the Sensex, which recorded a return of 0.82% in the same period. However, year-to-date performance shows a decline of 28.22%, compared to the Sensex's drop of 5.17%. The technical summary indicates a bearish sentiment in various indicators, including MACD and Bollinger Bands, both on weekly and monthly bases. The daily moving averages also reflect a bearish trend, while the On-Balance Volume (OBV) shows a bullish stance on a monthly scale. In terms of price movement, Triveni Turbine has experienced fluctuations, with a 52-week high of 885.00 and a low of 444.40. The stock's performance...

Read More

Triveni Turbine Faces Consecutive Declines Amid Broader Engineering Sector Challenges

2025-03-11 10:05:16Triveni Turbine, a midcap engineering firm, saw a significant decline on March 11, 2025, continuing a downward trend over two days. The stock's performance has lagged behind its sector, while the broader engineering industry also faced challenges. Despite recent struggles, Triveni Turbine has outperformed the Sensex over the past year.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSECertificate under regulation 74(5) of SEBI (Depository & Participants) Regulations 2018 for the quarter ended March 31 2025

Disclosures under Reg. 10(5) in respect of acquisition under Reg. 10(1)(a) of SEBI (SAST) Regulations 2011

02-Apr-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 10(5) in respect of acquisition under Regulation 10(1)(a) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Zahan Nikhil Sawhney

Closure of Trading Window

26-Mar-2025 | Source : BSEClosure of Trading window

Corporate Actions

No Upcoming Board Meetings

Triveni Turbine Ltd. has declared 200% dividend, ex-date: 06 Feb 25

No Splits history available

No Bonus history available

No Rights history available