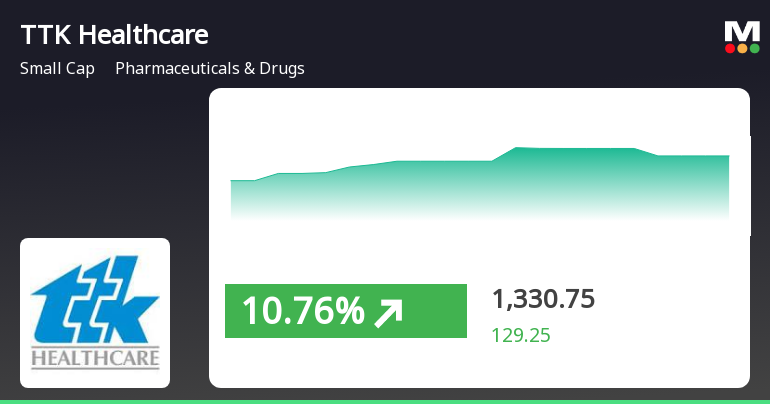

TTK Healthcare Surges Amid Broader Market Volatility and Small-Cap Gains

2025-04-03 14:50:16TTK Healthcare has seen a notable increase today, significantly outperforming the broader pharmaceuticals sector. The stock has shown a consistent upward trend over the past four days, while the overall market remains volatile. Despite recent gains, TTK Healthcare's long-term performance has experienced declines.

Read MoreTTK Healthcare Adjusts Valuation Grade Amid Competitive Industry Landscape

2025-03-25 08:00:31TTK Healthcare, a small-cap player in the Pharmaceuticals & Drugs sector, has recently undergone a valuation adjustment. The company's current price stands at 1,230.00, reflecting a slight increase from the previous close of 1,196.60. Over the past week, TTK Healthcare has shown a stock return of 11.59%, outperforming the Sensex, which returned 5.14% in the same period. Key financial metrics reveal a PE ratio of 25.38 and a price-to-book value of 1.67. The company's EV to EBIT is recorded at 37.90, while the EV to EBITDA stands at 27.71. TTK Healthcare's return on capital employed (ROCE) is 8.02%, and its return on equity (ROE) is 6.59%. The dividend yield is noted at 0.81%. In comparison to its peers, TTK Healthcare's valuation metrics indicate a competitive position within the industry. For instance, Orchid Pharma and RPG LifeScience are positioned at higher valuation levels, while companies like Sequen...

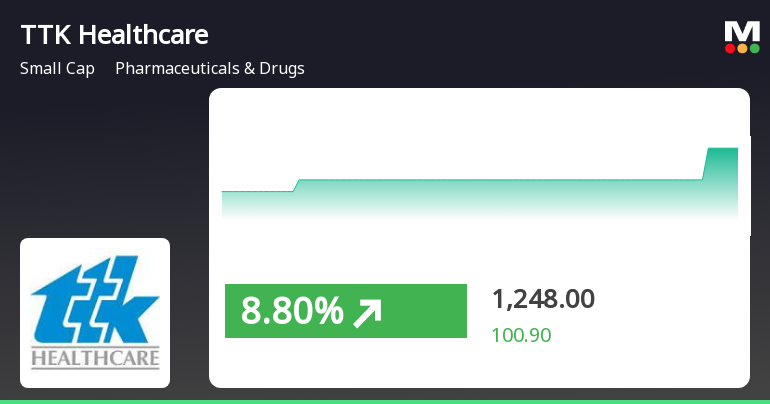

Read MoreTTK Healthcare Opens Strong with 9.26% Gain, Outperforming Sector Trends

2025-03-20 09:35:10TTK Healthcare Ltd., a small-cap player in the Pharmaceuticals & Drugs industry, has shown significant activity today, opening with a notable gain of 9.26%. This surge has allowed the stock to outperform its sector by 5.2%. Over the past four days, TTK Healthcare has consistently gained, accumulating a total return of 7.63% during this period. The stock reached an intraday high of Rs 1224, reflecting strong market momentum. In terms of performance metrics, TTK Healthcare's one-day performance stands at 5.78%, significantly surpassing the Sensex's 0.71% gain. However, its one-month performance shows a slight decline of 0.42%, contrasting with the Sensex's modest increase of 0.33%. From a technical perspective, TTK Healthcare's moving averages indicate a mixed outlook, being higher than the 5-day and 20-day averages but lower than the 50-day, 100-day, and 200-day averages. The stock is classified as high be...

Read More

TTK Healthcare Faces Challenges Amidst Recent Stock Activity and Declining Performance Metrics

2025-03-12 11:10:32TTK Healthcare, a small-cap pharmaceutical company, has reached a 52-week low while showing some signs of recovery after recent declines. Over the past year, it has faced a significant drop, with limited growth in net sales and operating profit, and a low inventory turnover ratio. Its valuation remains high compared to peers.

Read More

TTK Healthcare Hits 52-Week Low Amid Broader Market Decline and Operational Concerns

2025-03-11 11:15:18TTK Healthcare has reached a 52-week low amid broader market declines, underperforming the sector. Over the past year, the company's stock has dropped significantly, despite modest growth in net sales and operating profit. Technical indicators show a bearish trend, raising concerns about operational efficiency and long-term growth prospects.

Read MoreTTK Healthcare Adjusts Valuation Amidst Competitive Market Landscape Challenges

2025-03-06 08:00:48TTK Healthcare, a small-cap player in the Pharmaceuticals & Drugs sector, has recently undergone a valuation adjustment. The company's current price stands at 1,175.50, reflecting a notable shift from its previous close of 1,147.10. Over the past year, TTK Healthcare has experienced a decline of 22.90%, contrasting with a slight increase of 0.07% in the Sensex. Key financial metrics for TTK Healthcare include a price-to-earnings (PE) ratio of 24.26 and an EV to EBITDA ratio of 25.52. The company's return on capital employed (ROCE) is reported at 8.02%, while the return on equity (ROE) stands at 6.59%. The dividend yield is relatively modest at 0.85%. In comparison to its peers, TTK Healthcare's valuation metrics indicate a more favorable position relative to companies like Supriya Lifesciences and Orchid Pharma, which are categorized at higher valuation levels. However, TTK's performance has lagged behind...

Read More

TTK Healthcare's Recent Gains Highlight Diverging Trends in Market Performance

2025-03-05 14:20:15TTK Healthcare has experienced notable trading activity, achieving consecutive gains over two days and outperforming the broader sector. The stock's current price is above its short-term moving averages but below longer-term ones. In the broader market, small-cap stocks are leading, while the Sensex shows minimal change year-over-year.

Read More

TTK Healthcare Hits 52-Week Low Amid Broader Market Decline and Weak Growth Prospects

2025-03-04 10:08:25TTK Healthcare has faced notable volatility, hitting a new 52-week low and underperforming its sector. The stock has declined significantly over the past three days and is trading below key moving averages. In contrast, small-cap stocks show some resilience amid a broader market downturn, with the Sensex also nearing its 52-week low.

Read More

TTK Healthcare Hits 52-Week Low Amid Broader Sector Trends and Market Challenges

2025-03-03 09:36:35TTK Healthcare has reached a new 52-week low, reflecting a year-to-date decline of 21.48%, contrasting with the Sensex's minor dip. The stock is trading below key moving averages, indicating a sustained downward trend, and highlighting challenges in the competitive pharmaceuticals market. Monitoring these developments is essential for understanding the company's financial health.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

04-Apr-2025 | Source : BSECertificate under Reg. 74(5) of SEBI (DP) Regulations 2018 for the Quarter ended March 31 2025

Shareholder Meeting / Postal Ballot-Notice of Postal Ballot

27-Mar-2025 | Source : BSENotice of Postal Ballot dated March 21 2025

Announcement under Regulation 30 (LODR)-Change in Directorate

26-Mar-2025 | Source : BSEAnnouncement under Regulation 30 (LODR) Regulations 2015

Corporate Actions

No Upcoming Board Meetings

TTK Healthcare Ltd. has declared 100% dividend, ex-date: 16 Jul 24

No Splits history available

No Bonus history available

No Rights history available