TTK Prestige Opens Strong with 4.39% Gain Amid Mixed Technical Indicators

2025-04-02 14:25:10TTK Prestige, a midcap player in the domestic appliances industry, has shown notable activity in today's trading session. The stock opened with a gain of 4.39%, reaching an intraday high of Rs 638. Over the past two days, TTK Prestige has demonstrated a positive trend, accumulating a total return of 5.22%. In terms of performance metrics, TTK Prestige outperformed its sector by 0.72% today, with a one-day performance of 1.77% compared to the Sensex's 0.60%. However, the stock's one-month performance reflects a decline of 0.66, contrasting with the Sensex's gain of 4.48%. Technical indicators present a mixed picture. While the stock is currently above its 5-day and 20-day moving averages, it remains below the 50-day, 100-day, and 200-day moving averages. The MACD indicates a bearish trend on both weekly and monthly scales, while the RSI shows a bullish signal on a weekly basis. TTK Prestige is classified...

Read MoreTTK Prestige Adjusts Valuation Amidst Competitive Domestic Appliances Landscape

2025-04-02 08:02:01TTK Prestige, a midcap player in the domestic appliances sector, has recently undergone a valuation adjustment. The company's current price stands at 611.15, reflecting a slight increase from the previous close of 593.70. Over the past year, TTK Prestige has experienced a stock return of -11.63%, contrasting with a positive return of 2.72% for the Sensex during the same period. Key financial metrics for TTK Prestige include a PE ratio of 40.00 and an EV to EBITDA ratio of 27.62. The company's return on capital employed (ROCE) is reported at 18.05%, while the return on equity (ROE) is at 11.57%. The dividend yield is relatively modest at 0.98%. In comparison to its peers, TTK Prestige's valuation metrics reveal a competitive landscape. Whirlpool India has a PE ratio of 40.49 and an EV to EBITDA of 21.51, while Eureka Forbes shows a significantly higher PE ratio of 68.50 and an EV to EBITDA of 41.22. IFB In...

Read MoreTTK Prestige Adjusts Valuation Grade Amid Competitive Domestic Appliances Landscape

2025-03-27 08:00:43TTK Prestige, a midcap player in the domestic appliances sector, has recently undergone a valuation adjustment, reflecting its current financial standing. The company's price-to-earnings ratio stands at 39.60, while its price-to-book value is recorded at 4.49. Key performance indicators include an EV to EBITDA ratio of 27.32 and an EV to EBIT ratio of 36.05, which provide insights into its operational efficiency. TTK Prestige's return on capital employed (ROCE) is noted at 18.05%, and its return on equity (ROE) is at 11.57%. The company also offers a dividend yield of 0.99%. In comparison to its peers, TTK Prestige's valuation metrics indicate a competitive position, particularly when juxtaposed with Whirlpool India, which has a lower PE ratio of 37.28, and Eureka Forbes, which shows a significantly higher PE ratio of 69.42. Despite recent fluctuations in stock performance, including a year-to-date return...

Read MoreTTK Prestige Experiences Valuation Adjustment Amidst Competitive Market Landscape

2025-03-19 08:00:45TTK Prestige, a midcap player in the domestic appliances sector, has recently undergone a valuation adjustment, reflecting a shift in its financial standing. The company's current price stands at 589.25, slightly above the previous close of 586.45. Over the past year, TTK Prestige has faced challenges, with a stock return of -15.75%, contrasting with a positive return of 3.51% for the Sensex during the same period. Key financial metrics for TTK Prestige include a PE ratio of 38.57 and an EV to EBITDA ratio of 26.55, indicating its market positioning relative to its peers. The company's return on capital employed (ROCE) is reported at 18.05%, while the return on equity (ROE) is at 11.57%. In comparison, Whirlpool India also holds an attractive valuation with a lower PE ratio of 36.56 and an EV to EBITDA of 18.97. Meanwhile, Eureka Forbes and Symphony are positioned differently within the market, with higher...

Read More

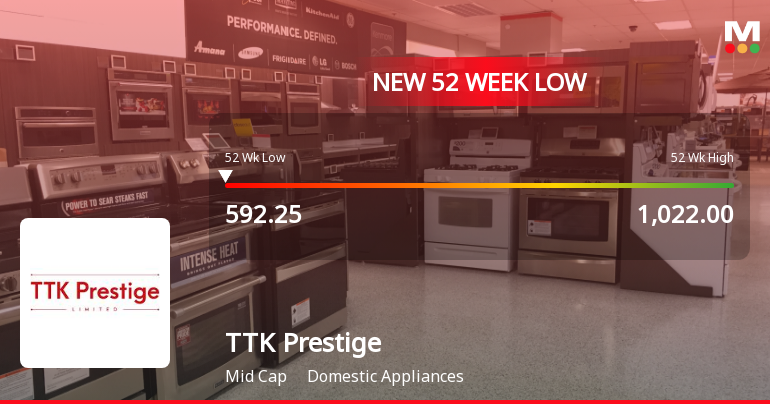

TTK Prestige Hits 52-Week Low Amidst Ongoing Underperformance and Declining Profits

2025-03-17 09:49:15TTK Prestige, a midcap player in the domestic appliances sector, reached a new 52-week low today, underperforming its sector. Over the past year, the stock has declined significantly, contrasting with the Sensex's positive performance. Financial metrics indicate low profit growth and a bearish trend in trading averages.

Read More

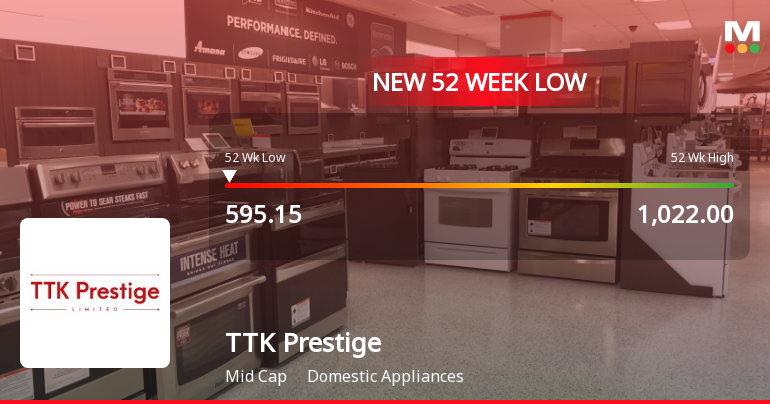

TTK Prestige Hits 52-Week Low Amid Broader Market Gains and Mixed Sentiment

2025-03-17 09:49:15TTK Prestige, a midcap player in the domestic appliances sector, reached a new 52-week low amid mixed market sentiment. Despite a year of declining performance and concerns over growth prospects, the company maintains a low debt-to-equity ratio and fair valuation metrics, though it has underperformed compared to benchmark indices.

Read More

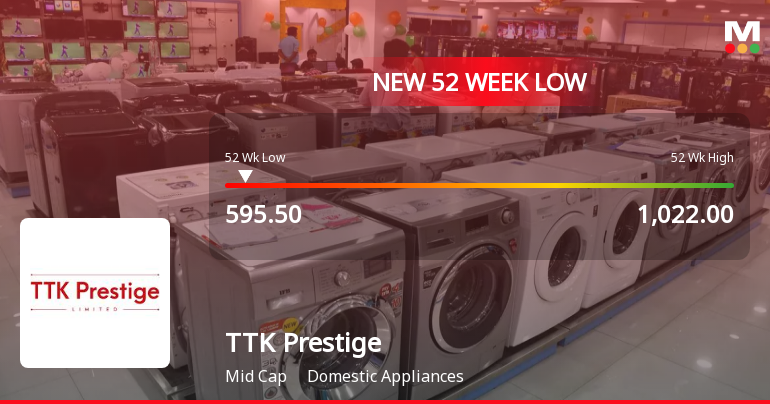

TTK Prestige Faces Continued Volatility Amid Declining Stock Performance and Profit Concerns

2025-03-13 11:36:15TTK Prestige has faced notable volatility, reaching a new 52-week low amid a four-day decline. The stock has underperformed its sector, with a significant drop over the past year. Despite some sales growth, profit challenges and a bearish technical trend raise concerns about the company's market position.

Read More

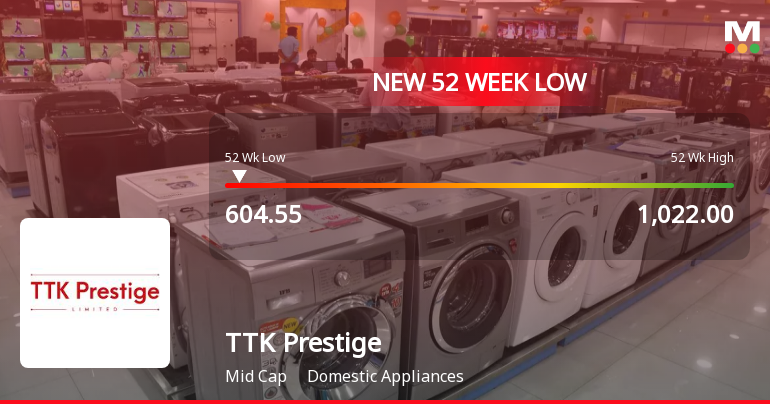

TTK Prestige Faces Continued Volatility Amid Declining Profitability and Technical Weakness

2025-03-11 09:45:50TTK Prestige, a midcap in the domestic appliances sector, has hit a new 52-week low, continuing a downward trend with a notable decline over the past two days. The stock has underperformed its sector and recorded a negative one-year return, raising concerns about its long-term growth potential.

Read More

TTK Prestige Hits 52-Week Low Amidst Ongoing Market Challenges and Concerns

2025-03-04 10:14:22TTK Prestige, a midcap player in the domestic appliances sector, reached a new 52-week low amid a five-day price decline. Despite a slight recovery, the stock remains below key moving averages and has underperformed over the past year, raising concerns about its long-term growth potential and valuation.

Read MoreDisclosure Under Regulation 30(13) Of The SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015 Order From Office Of The Commissioner Of Customs Centralized Adjudication Cell Jawaharlal Nehru Customs House Nhava Sheva.

08-Apr-2025 | Source : BSEOrder received from the Office of the Commissioner of Customs Centralized Adjudication Cell Jawaharlal Nehru Customs House Nhava Sheva

Shareholder Meeting / Postal Ballot-Outcome of Postal_Ballot

03-Apr-2025 | Source : BSEMinutes of the Postal Ballot

Dissemination Of Cautionary Letters Dated March 28 2025 Received From National Stock Exchange Of India Limited And BSE Limited

28-Mar-2025 | Source : BSEDissemination of cautionary letters dated March 28 2025 received from National Stock Exchange of India Limited and BSE Limited

Corporate Actions

27 May 2025

TTK Prestige Ltd has declared 600% dividend, ex-date: 14 Aug 24

TTK Prestige Ltd has announced 1:10 stock split, ex-date: 14 Dec 21

TTK Prestige Ltd has announced 1:5 bonus issue, ex-date: 15 May 19

No Rights history available