Tube Investments Adjusts Valuation Amidst Challenging Market Conditions and Strong Long-Term Performance

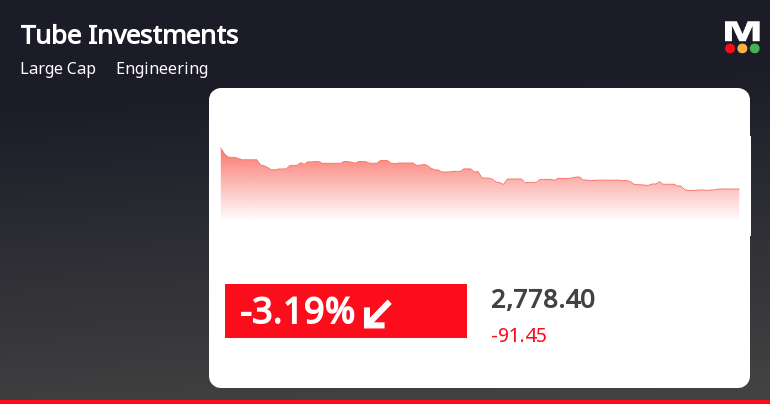

2025-04-02 08:02:51Tube Investments of India, a prominent player in the engineering sector, has recently undergone a valuation adjustment. The company's current price stands at 2,690.50, reflecting a notable shift from its previous close of 2,759.40. Over the past year, Tube Investments has faced challenges, with a return of -27.74%, contrasting sharply with the Sensex's gain of 2.72% during the same period. Key financial metrics reveal a PE ratio of 63.42 and an EV to EBITDA ratio of 25.31, indicating a premium valuation relative to its peers. For instance, Rail Vikas, another player in the industry, has a PE ratio of 56.09, while AIA Engineering's valuation metrics suggest a higher premium overall. Tube Investments also reports a robust return on capital employed (ROCE) of 50.58%, which highlights its operational efficiency. Despite the recent valuation adjustment, the company's long-term performance remains noteworthy, p...

Read MoreSurge in Open Interest Signals Shift in Market Dynamics for Tube Investments

2025-03-26 15:00:44Tube Investments of India Ltd (TIINDIA), a prominent player in the engineering sector, has experienced a significant increase in open interest today. The latest open interest stands at 20,959 contracts, reflecting a notable rise of 5,017 contracts or 31.47% from the previous open interest of 15,942. This surge in open interest comes alongside a trading volume of 19,555 contracts, indicating heightened activity in the derivatives market. In terms of price performance, Tube Investments has faced challenges recently, with the stock declining for four consecutive days, resulting in a total drop of 5.65%. Today, the stock reached an intraday low of Rs 2,692.3, marking a decrease of 2.89%. The weighted average price suggests that more volume was traded closer to this low price point. Additionally, the stock is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a b...

Read MoreSurge in Open Interest for Tube Investments Signals Shift in Market Dynamics

2025-03-26 14:00:31Tube Investments of India Ltd (TIINDIA), a prominent player in the engineering sector, has experienced a significant increase in open interest today. The latest open interest stands at 20,666 contracts, marking a notable rise of 4,724 contracts or 29.63% from the previous open interest of 15,942. The trading volume for the day reached 18,093 contracts, contributing to a futures value of approximately Rs 33,128.52 lakhs and an options value of around Rs 4,166.74 crores, culminating in a total value of Rs 33,704.06 lakhs. In terms of price performance, Tube Investments has underperformed its sector by 0.6%, with the stock declining for four consecutive days, resulting in a total drop of 6.01%. The stock touched an intraday low of Rs 2,692.30, reflecting a decrease of 2.89%. Additionally, it is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a bearish trend....

Read MoreSurge in Open Interest for Tube Investments Signals Increased Trading Activity Amid Price Decline

2025-03-26 13:00:23Tube Investments of India Ltd (TIINDIA), a prominent player in the engineering sector, has experienced a significant increase in open interest today, reflecting heightened trading activity. The latest open interest stands at 19,506 contracts, up from the previous 15,942 contracts, marking a change of 3,564 contracts or 22.36%. The trading volume for the day reached 11,658 contracts, contributing to a futures value of approximately Rs 24,281.39 lakhs. Despite this surge in open interest, the stock has underperformed relative to its sector, declining by 2.03% today, while the sector itself saw a decrease of 0.91%. Over the past four days, Tube Investments has faced consecutive losses, totaling a decline of 5.96%. The stock touched an intraday low of Rs 2,692.30, reflecting a drop of 2.89% from the previous close. Additionally, the stock is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-...

Read MoreSurge in Open Interest for Tube Investments Signals Increased Investor Participation Amid Price Decline

2025-03-26 12:00:20Tube Investments of India Ltd (TIINDIA), a prominent player in the engineering sector, has experienced a significant increase in open interest (OI) today. The latest OI stands at 18,423 contracts, marking a rise of 2,481 contracts or 15.56% from the previous OI of 15,942. The trading volume for the day reached 7,975 contracts, contributing to a total futures value of approximately Rs 16,891.85 lakhs. Despite this uptick in open interest, the stock has underperformed relative to its sector, declining by 2.07% today. Over the past four days, Tube Investments has seen a cumulative drop of 6.61%. The stock hit an intraday low of Rs 2,692.30, reflecting a decrease of 2.89% from the previous close. Additionally, the weighted average price indicates that more volume was traded closer to this low price. Currently, Tube Investments is trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages. N...

Read MoreSurge in Open Interest Signals Shift in Market Dynamics for Tube Investments

2025-03-25 15:01:09Tube Investments of India Ltd (TIINDIA) has experienced a notable increase in open interest today, reflecting heightened activity in the derivatives market. The latest open interest stands at 17,792 contracts, up from the previous figure of 16,170, marking a change of 1,622 contracts or a percentage increase of 10.03%. The trading volume for the day reached 11,703 contracts, contributing to a futures value of approximately Rs 24,224.58 lakhs. In terms of price performance, Tube Investments has underperformed its sector by 2.47%, with the stock declining for three consecutive days, resulting in a total return of -3.69% during this period. The stock hit an intraday low of Rs 2,763.80, reflecting a decrease of 3.18%. The weighted average price indicates that more volume was traded closer to this low price point. While the stock remains above its 20-day moving averages, it is currently below the 5-day, 50-day,...

Read More

Tube Investments of India Faces Continued Stock Decline Amid Broader Market Gains

2025-03-25 11:35:24Tube Investments of India has faced a decline in stock performance, marking three consecutive days of losses. The stock has underperformed against the broader market, with significant declines over various time frames. Despite recent struggles, it remains above its 20-day moving average while trading below other key averages.

Read MoreSurge in Open Interest for Tube Investments Signals Shift in Market Dynamics

2025-03-24 15:00:54Tube Investments of India Ltd (TIINDIA), a prominent player in the engineering sector, has experienced a notable increase in open interest (OI) today. The latest OI stands at 17,152 contracts, reflecting a rise of 1,883 contracts or 12.33% from the previous OI of 15,269. This surge in OI comes alongside a trading volume of 7,061 contracts, indicating active participation in the derivatives market. In terms of financial performance, Tube Investments has underperformed its sector, with a decline of 0.11% today, while the sector itself gained 1.34%. The stock has been on a downward trend, recording losses for the past two days, amounting to a total decline of 0.74% during this period. Despite these challenges, the stock remains above its 20-day moving averages but is trading below its 5-day, 50-day, 100-day, and 200-day moving averages. Additionally, the liquidity remains adequate, with a delivery volume of...

Read MoreTube Investments of India Sees Surge in Open Interest Amid Increased Trading Activity

2025-03-20 15:00:08Tube Investments of India Ltd (TIINDIA) has experienced a significant increase in open interest today, reflecting heightened trading activity in the engineering sector. The latest open interest stands at 15,223 contracts, up from the previous 13,639 contracts, marking a change of 1,584 contracts or an 11.61% increase. The trading volume for the day reached 14,682 contracts, contributing to a total futures value of approximately Rs 21,904.82 lakhs. In terms of price performance, Tube Investments of India outperformed its sector with a 1.33% return, compared to the sector's 0.35%. The stock reached an intraday high of Rs 2,967.50, reflecting a 3.78% increase. Notably, the stock is currently trading above its 5-day and 20-day moving averages, although it remains below the 50-day, 100-day, and 200-day moving averages. Additionally, the stock has seen a rise in delivery volume, with 346,000 shares delivered on...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Apr-2025 | Source : BSECompliance Certificate under Regulation 74(5) of SEBI (Depository Participants) Regulations 2018

Closure of Trading Window

31-Mar-2025 | Source : BSEClosure of Trading Window

Amendment To The Code Of Practices And Procedures For Fair Disclosure Of Unpublished Price Sensitive Information

25-Mar-2025 | Source : BSEAmendment to the Code of Practices and Procedures for Fair Disclosure of Unpublished Price Sensitive Information

Corporate Actions

No Upcoming Board Meetings

Tube Investments of India Ltd has declared 200% dividend, ex-date: 07 Feb 25

No Splits history available

No Bonus history available

No Rights history available