Tulsyan NEC Ltd Sees Increased Buying Activity Amid Market Challenges and New 52-Week Low

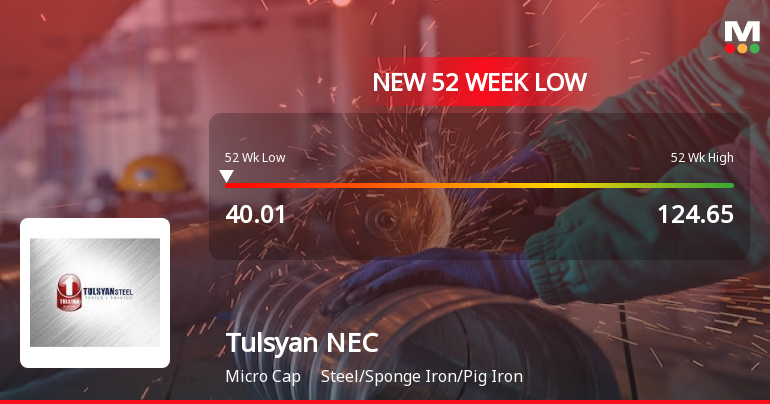

2025-04-03 14:25:13Tulsyan NEC Ltd, a microcap player in the Steel/Sponge Iron/Pig Iron industry, is witnessing notable buying activity today, despite a challenging overall market environment. The stock has shown a performance of 0.24% increase, contrasting with the Sensex, which declined by 0.38%. This marks a significant outperformance against the broader market on this trading day. However, the stock's recent trajectory reveals a more complex picture. Over the past week, Tulsyan NEC has decreased by 3.99%, while the Sensex fell by 1.65%. In the longer term, the stock has faced substantial declines, with a 52.97% drop over the past year compared to the Sensex's 3.32% gain. Today's trading session opened with a gap down of 4.74%, hitting a new 52-week low of Rs. 40.01 before reaching an intraday high of Rs. 44, reflecting a 4.76% increase from the day's low. The stock is currently trading below its 5-day, 20-day, 50-day, 1...

Read More

Tulsyan NEC Faces Financial Struggles Amid Significant Stock Volatility and Debt Concerns

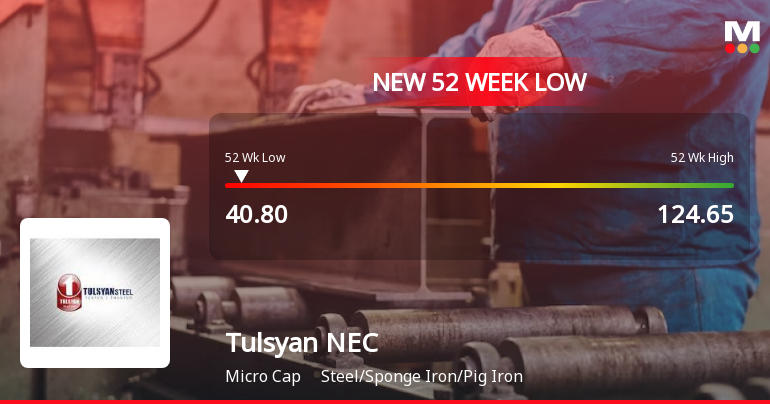

2025-04-03 09:38:44Tulsyan NEC, a microcap in the Steel/Sponge Iron/Pig Iron sector, has hit a new 52-week low amid significant volatility. The company faces financial challenges, including an operating loss and a high Debt to EBITDA ratio. Its net sales have declined, and a large percentage of promoter shares are pledged.

Read More

Tulsyan NEC Faces Financial Struggles Amid Significant Stock Volatility and Pledged Shares

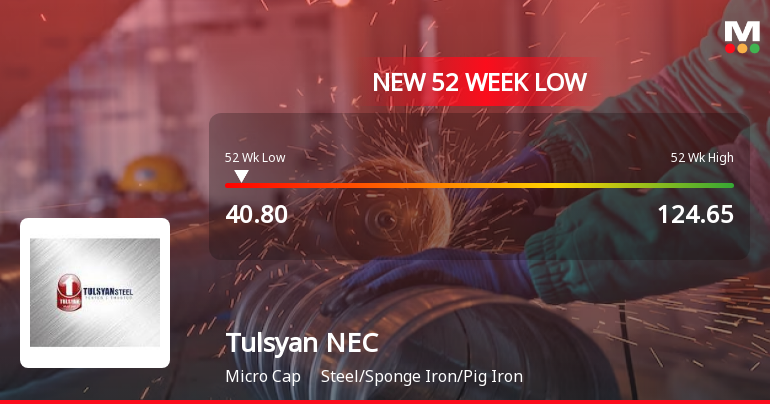

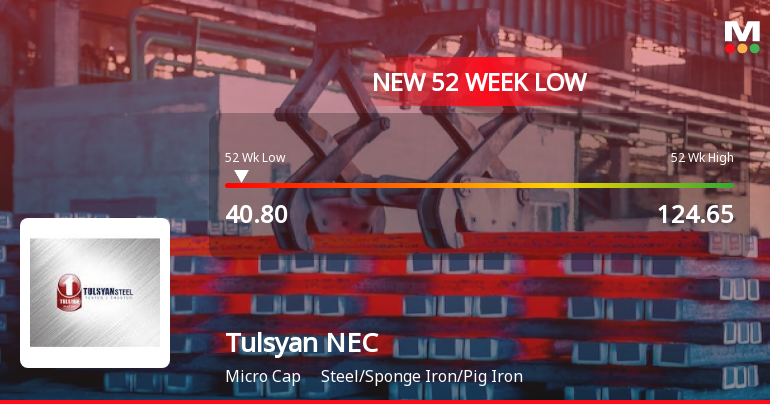

2025-04-01 11:54:28Tulsyan NEC, a microcap in the Steel/Sponge Iron/Pig Iron sector, hit a new 52-week low amid significant volatility, following four days of losses. The company faces financial challenges, including operating losses and a high Debt to EBITDA ratio, with recent results showing a substantial drop in profit and net sales.

Read More

Tulsyan NEC Faces Financial Struggles Amid Significant Stock Volatility and Debt Concerns

2025-04-01 11:54:27Tulsyan NEC, a microcap in the Steel/Sponge Iron/Pig Iron sector, has hit a new 52-week low amid significant volatility. The stock has underperformed the market over the past year, facing challenges such as operating losses, a high Debt to EBITDA ratio, and a substantial percentage of pledged promoter shares.

Read More

Tulsyan NEC Faces Financial Struggles Amid Significant Market Volatility and Declining Sales

2025-04-01 11:54:27Tulsyan NEC, a microcap in the Steel/Sponge Iron/Pig Iron sector, has hit a new 52-week low, reflecting significant volatility and underperformance compared to the broader market. The company faces operating losses, declining net sales, a high debt-to-EBITDA ratio, and a majority of promoter shares pledged, indicating financial challenges.

Read MoreTulsyan NEC Faces Intense Selling Pressure Amid Significant Stock Price Declines

2025-03-28 10:25:11Tulsyan NEC Ltd is currently facing significant selling pressure, with the stock showing only sellers today. The company, operating in the Steel/Sponge Iron/Pig Iron industry, has experienced a notable decline, with its stock price falling by 4.99% in a single day. This marks the fourth consecutive day of losses, totaling a steep 17.99% drop over this period. In comparison to the broader market, Tulsyan NEC's performance has been starkly negative. Over the past week, the stock has declined by 14.21%, while the Sensex has gained 0.63%. The one-month performance shows a decrease of 9.06% for Tulsyan NEC, contrasting with a 5.72% increase in the Sensex. Year-to-date, the stock is down 40.82%, while the Sensex has only dipped by 0.96%. Currently, Tulsyan NEC is trading close to its 52-week low, just 0.26% away from Rs 41.55. The stock is underperforming its sector by 5.2% and is trading below all key moving a...

Read MoreTulsyan NEC Ltd Faces Intense Selling Pressure Amid Significant Stock Price Decline

2025-03-27 09:45:09Tulsyan NEC Ltd is currently facing significant selling pressure, with the stock showing only sellers today. The company, operating in the Steel/Sponge Iron/Pig Iron industry, has experienced a notable decline, with a 4.96% drop in its stock price compared to a modest 0.20% gain in the Sensex. Over the past week, Tulsyan NEC has lost 5.31%, while the Sensex has risen by 1.43%. The stock has been on a downward trend for three consecutive days, accumulating a total loss of 13.68% during this period. Today, it opened with a gap down of 4.98%, reaching an intraday low of Rs 43.85. This performance is indicative of a broader struggle, as the stock has underperformed its sector by 5.28%. In terms of longer-term performance, Tulsyan NEC has seen a staggering 48.06% decline over the past year, contrasting sharply with the Sensex's 6.09% increase. The stock is currently trading below its 5-day, 20-day, 50-day, 1...

Read MoreTulsyan NEC Faces Intense Selling Pressure Amid Consecutive Losses and Market Underperformance

2025-03-26 10:40:09Tulsyan NEC Ltd is currently facing significant selling pressure, with the stock showing only sellers today. The company has experienced consecutive losses over the past two days, resulting in a total decline of 9.15%. Today, the stock opened with a gap down of 3.79% and reached an intraday low of Rs 46.15, reflecting a decrease of 4.85% from the previous close. In terms of performance relative to the Sensex, Tulsyan NEC has underperformed significantly. Over the past day, the stock fell by 4.72%, while the Sensex saw a marginal increase of 0.04%. Over the past month, Tulsyan NEC has declined by 10.93%, contrasting sharply with the Sensex's gain of 4.62%. Year-to-date, the stock is down 34.36%, while the Sensex has remained relatively stable with a decline of just 0.12%. Several factors may be contributing to this selling pressure, including broader market trends and potential sector-specific challenges w...

Read MoreTulsyan NEC Ltd Experiences Significant Buying Surge Amidst Short-Term Recovery Trend

2025-03-24 10:35:27Tulsyan NEC Ltd is currently witnessing significant buying activity, with the stock gaining 4.65% today, outperforming the Sensex, which rose by 0.93%. Over the past week, Tulsyan NEC has shown a robust performance, increasing by 12.43%, while the Sensex recorded a gain of 4.65%. Notably, the stock has been on a consecutive upward trend for the last three days, accumulating a total return of 14.85% during this period. Despite a challenging year-to-date performance, where Tulsyan NEC is down 27.81% compared to the Sensex's slight decline of 0.67%, the recent buying pressure may be attributed to various factors, including market sentiment and sector-specific developments. The stock reached an intraday high of Rs 50.82 today, indicating strong buyer interest. In terms of moving averages, Tulsyan NEC is currently above its 5-day and 20-day moving averages but remains below the 50-day, 100-day, and 200-day mov...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSECompliance Certificate under Reg. 74(5) of SEBI (DP) Regulations 2018 for the quarter ended March 31 2025

Announcement under Regulation 30 (LODR)-Newspaper Publication

03-Apr-2025 | Source : BSENewspaper Advertisement - Notice of Forfeiture to Party Paid-up Equity Shareholders

Intimation On Notice Of Forfeiture Sent To Partly Paid-Up Equity Shareholders

01-Apr-2025 | Source : BSEIntimation on Notice of Forfeiture sent to partly paid-up equity shareholders

Corporate Actions

No Upcoming Board Meetings

Tulsyan NEC Ltd has declared 15% dividend, ex-date: 20 Sep 12

No Splits history available

No Bonus history available

Tulsyan NEC Ltd has announced 2:1 rights issue, ex-date: 10 Mar 11