TVS Electronics Faces Technical Trend Shifts Amid Market Evaluation Revision

2025-04-02 08:05:57TVS Electronics, a microcap player in the IT hardware sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 329.25, showing a notable shift from its previous close of 318.00. Over the past year, TVS Electronics has demonstrated a return of 14.54%, outperforming the Sensex, which recorded a return of 2.72% in the same period. In terms of technical indicators, the weekly MACD and KST are both signaling bearish trends, while the monthly indicators show a mildly bearish stance. The Bollinger Bands also reflect a mildly bearish outlook on a weekly basis. Notably, the daily moving averages indicate a bearish trend, suggesting a cautious market sentiment. When examining the company's performance over various time frames, TVS Electronics has shown resilience, particularly over the last five years, with an impressive return of 499.73%, signif...

Read More

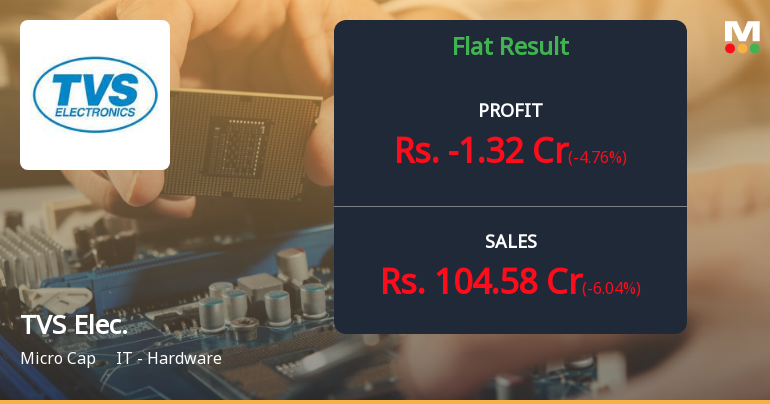

TVS Electronics Faces Growth Concerns Amid Flat Financial Performance and Market Dynamics

2025-03-19 08:08:09TVS Electronics has recently experienced a change in its evaluation, reflecting complex financial metrics and market dynamics. The company reported flat financial performance for the quarter ending December 2024, raising concerns about its long-term growth. Despite challenges, it generated an 18.18% return over the past year, outperforming the broader market.

Read MoreTVS Electronics Faces Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-19 08:02:54TVS Electronics, a microcap player in the IT hardware industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 314.00, showing a notable increase from the previous close of 279.65. Over the past year, TVS Electronics has demonstrated a return of 18.18%, significantly outperforming the Sensex, which recorded a return of 3.51% during the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no signals on both weekly and monthly charts, indicating a neutral momentum. Bollinger Bands also reflect a mildly bearish trend on both timeframes. Daily moving averages are bearish, while the KST presents a mixed picture with a bearish weekly and bullish monthly stance. The On-Balance Volume (OBV) indicates a mildly bearish trend weekly but...

Read MoreTVS Electronics Faces Market Challenges Despite Recent Stock Price Increase

2025-03-04 11:07:59TVS Electronics, a microcap player in the IT hardware industry, has shown notable activity today, with its stock price increasing by 2.52%. This uptick comes amidst a challenging performance landscape, as the company has experienced a year-to-date decline of 36.22%, significantly underperforming the Sensex, which has decreased by 6.57% during the same period. Over the past year, TVS Electronics has recorded a decline of 10.83%, contrasting with the Sensex's modest drop of 1.18%. In the short term, the stock has faced headwinds, with a weekly performance down by 11.24% and a monthly decline of 22.90%. However, the company has demonstrated resilience over longer time frames, boasting a three-year performance of 35.77% and an impressive five-year increase of 223.98%. Financial metrics indicate a P/E ratio of -192.22, starkly contrasting with the industry average of 20.41. Technical indicators suggest a beari...

Read More

TVS Electronics Faces Challenges Amid Declining Profitability and Market Sentiment

2025-03-03 18:49:28TVS Electronics has recently experienced a change in its evaluation, reflecting ongoing trends and performance indicators. The company's Q3 FY24-25 results showed flat financial performance, raising concerns about its growth trajectory, while a significant decline in operating profit over five years highlights challenges in maintaining profitability.

Read MoreTVS Electronics Faces Mixed Technical Trends Amid Market Evaluation Revision

2025-02-25 10:31:52TVS Electronics, a microcap player in the IT hardware sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's technical indicators present a mixed picture, with the MACD showing bearish trends on both weekly and monthly scales, while moving averages indicate a mildly bullish stance on a daily basis. The Bollinger Bands and KST metrics also suggest bearish tendencies, particularly on the weekly timeframe. In terms of performance, TVS Electronics has faced challenges in the short to medium term. Over the past month, the stock has returned -17.11%, significantly underperforming the Sensex, which returned -2.01% during the same period. Year-to-date, the stock has seen a decline of 26.90%, while the Sensex has only dipped by 4.45%. However, the company has shown resilience over longer periods, with a remarkable 215.48% return over the past five years, compared...

Read More

TVS Electronics Reports Stable Financial Performance and Highest Operating Profit Margin in December 2024

2025-02-13 22:04:39TVS Electronics has reported stable financial results for the quarter ending December 2024, with its highest operating profit margin in five quarters at 3.04%. The company's evaluation score has also been adjusted, reflecting its efforts to optimize operations in the competitive IT hardware sector.

Read More

TVS Electronics Faces Operational Challenges Amid Flat Q2 FY24 Performance and Market Evaluation Adjustments

2025-01-27 18:55:10TVS Electronics, a microcap in the IT-Hardware sector, has recently adjusted its evaluation amid flat financial performance for Q2 FY24. While net sales have grown annually, operating profit has declined. The company shows a low debt-to-equity ratio, but its stock is viewed as risky compared to historical valuations.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSECertificate under Reg 74(5) of SEBI (DP) Regulation

Change In The Building Name Of The Registered Office Of The Company

07-Apr-2025 | Source : BSEIntimation of change in the Building Name of the Registered Office of the Company. No change in the address.

Shareholder Meeting / Postal Ballot-Outcome of Court Convened Meeting

04-Apr-2025 | Source : BSETVS Electronics Limited has informed the Exchanges regarding proceedings of NCLT Convened Meeting of Equity Shareholders held on April 4 2025. Further the Company has submitted the Exchange a copy of Scrutinizers Report Proceedings and Voting Results.

Corporate Actions

No Upcoming Board Meetings

TVS Electronics Ltd has declared 10% dividend, ex-date: 02 Aug 24

No Splits history available

No Bonus history available

No Rights history available