TVS Supply Chain Solutions Faces Bearish Technical Trends Amid Market Challenges

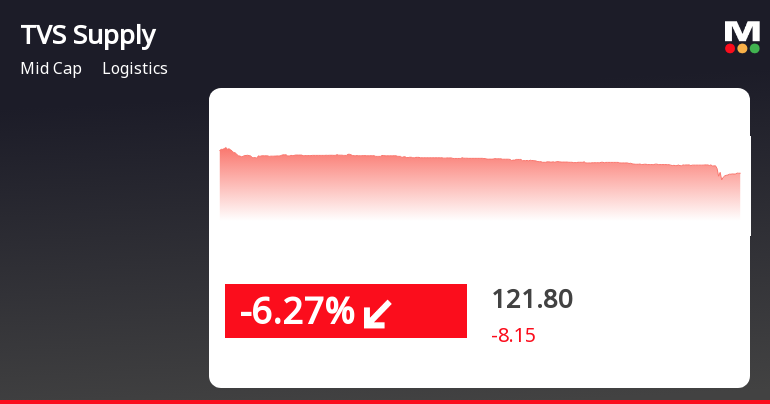

2025-04-01 08:03:41TVS Supply Chain Solutions, a midcap player in the logistics industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 120.90, down from a previous close of 129.95, with a notable 52-week high of 217.35 and a low of 118.50. Today's trading saw fluctuations, reaching a high of 133.55 and a low matching its 52-week low. The technical summary indicates a bearish sentiment across various indicators. The MACD and Dow Theory both reflect bearish trends on a weekly basis, while the Bollinger Bands show a bearish outlook in the short term. The moving averages also align with this sentiment, indicating a bearish trend. The On-Balance Volume (OBV) presents a mildly bearish stance on a weekly basis, contrasting with a bullish monthly outlook. In terms of performance, TVS Supply Chain Solutions has faced challenges compared to the Sensex. Over the...

Read MoreTVS Supply Chain Solutions Adjusts Valuation Amidst Competitive Logistics Landscape

2025-04-01 08:00:54TVS Supply Chain Solutions has recently undergone a valuation adjustment, reflecting a shift in its financial assessment within the logistics industry. The company currently presents a PE ratio of -1182.65, indicating significant challenges in profitability. In contrast, its price-to-book value stands at 2.94, suggesting a moderate valuation relative to its assets. Key performance indicators reveal an EV to EBITDA ratio of 10.54 and an EV to sales ratio of 0.70, which may indicate operational efficiency in generating revenue. However, the return on capital employed (ROCE) is at 3.93%, and return on equity (ROE) is at 1.64%, both of which highlight areas for improvement in generating returns for shareholders. When compared to its peers, TVS Supply Chain Solutions shows a stark contrast in valuation metrics. For instance, Delhivery has a significantly higher PE ratio of 464.28, while Blue Dart Express and T...

Read More

TVS Supply Chain Solutions Faces Significant Stock Volatility Amid Broader Market Trends

2025-03-28 14:50:27TVS Supply Chain Solutions has faced notable stock volatility, hitting a 52-week low of Rs. 118.5 and experiencing a cumulative decline of 14.38% over five days. The stock is trading below all key moving averages, while the broader market shows a slight increase. Year-to-date, the stock is down 31.93%.

Read More

TVS Supply Chain Solutions Faces Continued Decline Amid Broader Logistics Sector Challenges

2025-03-28 14:38:17TVS Supply Chain Solutions has faced notable volatility, hitting a 52-week low and declining over 11% in the past five days. The stock's performance over the last year has been disappointing, with weak long-term fundamentals and a recent drop in quarterly profits, contrasting sharply with broader market trends.

Read More

TVS Supply Chain Solutions Hits All-Time Low Amid Sector Volatility and Weak Fundamentals

2025-03-28 14:12:11TVS Supply Chain Solutions has faced significant volatility, reaching an all-time low and underperforming the logistics sector. The stock has declined notably over the past week and year-to-date. Key financial metrics reveal weak long-term fundamentals, raising concerns about debt servicing, despite increased institutional investment.

Read More

TVS Supply Chain Solutions Shows Strong Short-Term Gains Amid Mixed Long-Term Trends

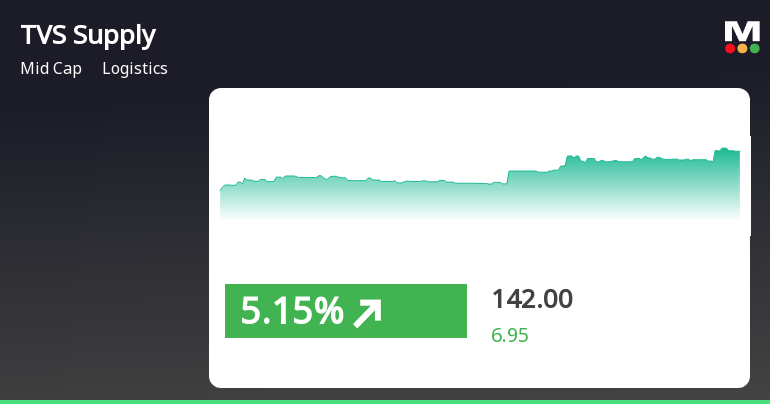

2025-03-21 13:05:30TVS Supply Chain Solutions has experienced notable gains, marking its fourth consecutive day of increases and outperforming its sector. The stock is currently above its short-term moving averages but below longer-term ones. In the broader market, the Sensex has rebounded significantly, with small-cap stocks leading the way.

Read More

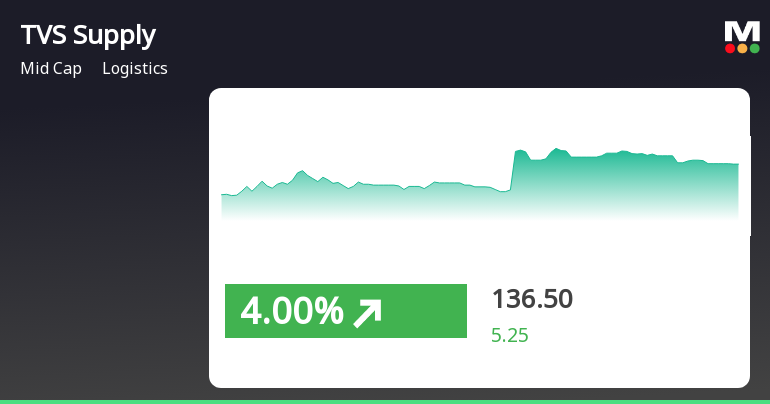

TVS Supply Chain Solutions Shows Positive Short-Term Gains Amid Broader Market Trends

2025-03-19 10:20:31TVS Supply Chain Solutions has experienced significant activity, with consecutive gains over the past two days and an overall increase during this period. The stock is currently above its short-term moving averages but below longer-term ones. In the broader market, small-cap stocks are leading, while the Sensex shows a bearish trend.

Read More

TVS Supply Chain Solutions Faces Decline Amid Broader Logistics Sector Challenges

2025-03-10 14:35:38TVS Supply Chain Solutions has faced a notable decline on March 10, 2025, following three days of gains, highlighting potential trend shifts. The stock is trading below key moving averages, reflecting a bearish outlook. Year-to-date, it has decreased significantly compared to the broader market's performance.

Read MoreTVS Supply Chain Solutions Adjusts Valuation Amidst Competitive Logistics Landscape

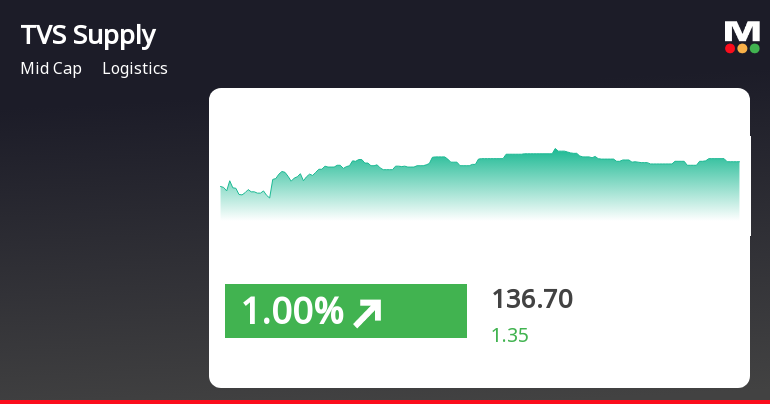

2025-03-01 08:00:20TVS Supply Chain Solutions has recently undergone a valuation adjustment, reflecting a shift in its financial standing within the logistics industry. The company's current price stands at 139.95, slightly above its previous close of 137.50. Over the past year, TVS has experienced a decline of 22.51%, contrasting with a modest gain of 1.24% in the Sensex. Key financial metrics for TVS reveal a PE ratio of -1368.97, indicating significant challenges in profitability. The company's EV to EBITDA ratio is reported at 11.82, while the EV to Sales ratio stands at 0.78. Return on Capital Employed (ROCE) is at 3.93%, and Return on Equity (ROE) is notably low at 1.64%. In comparison to its peers, TVS Supply Chain Solutions presents a unique position. Delhivery is categorized as risky with a PE ratio of 455.35, while Blue Dart Express is marked as expensive with a PE of 51.37. Transport Corporation is noted as very...

Read MoreAnnouncement under Regulation 30 (LODR)-Award_of_Order_Receipt_of_Order

08-Apr-2025 | Source : BSETVS SCS Global Freight Solutions Limited a wholly owned subsidiary of TVS Supply Chain Solutions Limited has received an order under Central Goods and Service Tax Act 2017 (CGST Act).

Announcement Regarding The Name Change Of The Material Subsidiary

07-Apr-2025 | Source : BSEIntimation of Change of Name of the Material Subsidiary of the Company under Regulation 30 of the SEBI (Listing Obligations and Disclosure Requirements)Regulations 2015.

Announcement under Regulation 30 (LODR)-Resignation of Statutory Auditors

05-Apr-2025 | Source : BSEThe Company wishes to inform Stock Exchange regarding resignation of Ernst & Young LLP UK Statutory Auditors of TVS Logistics Investment UK Limited Rico Logistics Limited UK and TVS Supply Chain Solutions Limited UK Material Subsidiaries of the Company with effect from April 04 2025.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available