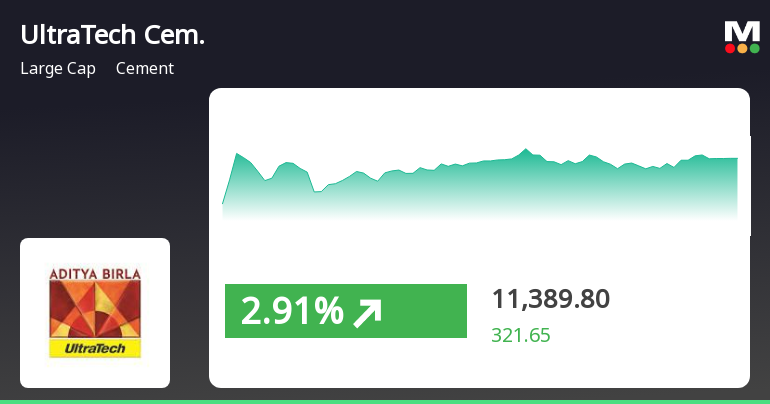

UltraTech Cement Shows Resilience with Strong Market Performance and Premium Valuation

2025-04-03 12:35:21UltraTech Cement has shown notable activity today, outperforming its sector by 0.59%. After experiencing three consecutive days of decline, the stock has reversed its trend, gaining 1.98% on the day. It reached an intraday high of Rs 11,511.9, reflecting a 2.09% increase. As a large-cap player in the cement industry, UltraTech Cement boasts a market capitalization of Rs 3,38,859.87 crore. The company's price-to-earnings (P/E) ratio stands at 52.99, significantly higher than the industry average of 44.26, indicating a premium valuation relative to its peers. In terms of performance metrics, UltraTech Cement has delivered a 15.00% return over the past year, substantially outperforming the Sensex, which recorded a 3.33% gain. Over the last month, the stock has risen by 11.24%, while its year-to-date performance shows a modest increase of 0.69%. The stock is currently trading above its 5-day, 20-day, 50-day, ...

Read MoreUltraTech Cement Approaches 52-Week High Amid Strong Market Performance

2025-03-28 09:20:30UltraTech Cement, a prominent player in the cement industry, has shown significant activity today, trading close to its 52-week high, just 4.79% away from Rs 12,143.9. The stock opened at Rs 11,588.5 and has maintained this price throughout the trading session. Over the past two days, UltraTech Cement has recorded a gain of 1.66%, aligning its performance with sector trends. With a market capitalization of Rs 3,43,533.45 crore, UltraTech Cement boasts a P/E ratio of 54.32, slightly above the industry average of 50.94. The stock is currently trading above its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a strong upward trend. In terms of performance metrics, UltraTech Cement has outperformed the Sensex across various time frames. Over the past year, the stock has risen by 19.63%, compared to the Sensex's 5.31%. Additionally, it has shown a 15.27% increase over the past month, whi...

Read MoreUltraTech Cement Shows Resilience Amid Recent Stock Decline and Sector Challenges

2025-03-27 09:20:07UltraTech Cement, a prominent player in the cement industry with a market capitalization of Rs 3,36,005.92 crore, has experienced notable activity today. The stock has underperformed the sector by 0.76%, marking a consecutive decline over the past two days, with a total return of -0.25% during this period. Despite this recent downturn, UltraTech Cement is currently trading above its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a longer-term upward trend. In terms of financial metrics, UltraTech Cement has a price-to-earnings (P/E) ratio of 52.48, which is higher than the industry average of 49.89. Over the past year, the stock has delivered an impressive return of 18.46%, significantly outperforming the Sensex, which has gained only 5.71%. Additionally, UltraTech Cement has shown resilience over longer periods, with a remarkable 306.47% increase over the last decade compared to t...

Read MoreUltraTech Cement has emerged as one of the most active stock calls today amid heightened trading volumes.

2025-03-26 10:00:06UltraTech Cement Ltd, a prominent player in the cement industry, has emerged as one of the most active stocks today, particularly in the options market. The company’s underlying stock, ULTRACEMCO, has seen significant trading activity with 57,756 call contracts exchanged, resulting in a turnover of approximately Rs 2,768.53 lakhs. The options have a strike price of Rs 11,500 and are set to expire on March 27, 2025, with an open interest of 2,103 contracts. In terms of performance metrics, UltraTech Cement has underperformed its sector by 0.58% today, marking a trend reversal after seven consecutive days of gains. The stock is currently valued at Rs 11,406, trading above its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a generally positive long-term trend. Additionally, the stock has experienced a notable increase in delivery volume, with 370,000 shares delivered on March 25, refl...

Read MoreUltraTech Cement Faces Volatility Amid Strong Long-Term Performance Trends

2025-03-26 09:25:35UltraTech Cement, a prominent player in the cement industry with a market capitalization of Rs 3,29,800.00 Cr, has experienced notable activity today. The stock has underperformed the sector by 0.33%, marking a trend reversal after seven consecutive days of gains. Today's trading has been characterized by high volatility, with an intraday volatility rate of 130.94%, indicating significant price fluctuations. In terms of performance metrics, UltraTech Cement is currently trading above its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, suggesting a strong short to long-term trend. The company's price-to-earnings (P/E) ratio stands at 52.57, which is higher than the industry average of 49.72. Over the past year, UltraTech Cement has delivered a return of 18.99%, significantly outperforming the Sensex, which has risen by 7.78%. In the short term, the stock has shown a weekly gain of 4.66%, while...

Read More

UltraTech Cement Shows Strong Performance Amidst Broader Market Uptrend

2025-03-25 10:05:15UltraTech Cement has demonstrated strong performance, achieving its seventh consecutive day of gains and significantly outperforming its sector. The stock is trading above key moving averages, indicating positive trends. In the broader market, the Sensex has also shown upward momentum, with mega-cap stocks contributing to its rise.

Read MoreUltraTech Cement has emerged as one of the most active stock calls today amid heightened options trading.

2025-03-25 10:00:07UltraTech Cement Ltd, a prominent player in the cement industry, has emerged as one of the most active stocks today, reflecting significant trading activity in its options market. The company’s underlying stock, ULTRACEMCO, is currently valued at Rs 11,365. Notably, two call options with expiry dates set for March 27, 2025, have garnered attention. The first option, with a strike price of Rs 11,400, saw 10,144 contracts traded, resulting in a turnover of approximately Rs 678.19 lakhs and an open interest of 1,944 contracts. The second option, with a strike price of Rs 11,500, recorded 13,517 contracts traded, leading to a turnover of around Rs 644.42 lakhs and an open interest of 3,311 contracts. In terms of performance, UltraTech Cement has outperformed its sector by 0.44% today, marking a consecutive gain over the past seven days with an impressive return of 8.21%. The stock reached an intraday high of...

Read MoreUltraTech Cement has emerged as one of the most active stock puts today amid notable market dynamics.

2025-03-25 10:00:06UltraTech Cement Ltd, a prominent player in the cement industry, has emerged as one of the most active stocks in the options market today, particularly in the put options segment. The underlying stock, ULTRACEMCO, has seen significant activity with 5,845 contracts traded, reflecting a turnover of approximately Rs 73.00 lakhs. The put options have a strike price of Rs 11,000 and are set to expire on March 27, 2025, with an open interest of 1,885 contracts. In terms of price performance, UltraTech Cement has outperformed its sector by 0.44%, marking a notable trend with consecutive gains over the past seven days, resulting in an 8.21% increase during this period. The stock reached an intraday high of Rs 11,420, representing a 3.34% rise for the day. Currently, UltraTech Cement is trading above its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a strong upward trend. Despite this pos...

Read MoreUltraTech Cement Shows Strong Performance Amidst Sector Challenges and Market Trends

2025-03-25 09:20:30UltraTech Cement, a prominent player in the cement industry with a market capitalization of Rs 3,28,456.08 crore, has shown significant activity today, aligning with sector performance. The stock has experienced a notable upward trend, gaining 6.22% over the past week, marking seven consecutive days of increases. Today, UltraTech Cement opened at Rs 11,100.05 and has maintained this price throughout the trading session. In terms of financial metrics, UltraTech Cement's price-to-earnings (P/E) ratio stands at 50.96, slightly above the industry average of 48.97. The stock is currently trading above its 5-day, 20-day, and 50-day moving averages, although it remains below the 100-day and 200-day moving averages. Over the past year, UltraTech Cement has delivered a return of 17.45%, significantly outperforming the Sensex, which has returned 7.54% in the same period. The stock's performance over various time fr...

Read MoreDisclosure W.R.T. Order Passed By GST Authority

09-Apr-2025 | Source : BSEDisclosure w.r.t. order passed by GST Authority

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

09-Apr-2025 | Source : BSEIntimation regarding Earning Calls of UltraTech Cement Limited

Board Meeting Outcome for Investment In Equity Share Capital

03-Apr-2025 | Source : BSEInvestment in equity share capital

Corporate Actions

28 Apr 2025

UltraTech Cement Ltd has declared 700% dividend, ex-date: 30 Jul 24

No Splits history available

No Bonus history available

No Rights history available