Union Bank of India Shows Resilience Amid Mixed Market Signals

2025-04-03 13:50:25Union Bank of India has exhibited strong performance, gaining 3.3% on April 3, 2025, and outperforming its sector. The stock has recorded consecutive gains, reaching an intraday high of Rs 131.6. Over the past month, it has significantly outperformed the broader market, showcasing resilience and positive momentum.

Read MoreUnion Bank of India Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-04-01 08:03:08Union Bank of India, a prominent player in the public banking sector, has recently undergone an evaluation revision reflecting its current market dynamics. The bank's stock is currently priced at 126.20, showing a notable increase from the previous close of 124.15. Over the past week, Union Bank has demonstrated a stock return of 3.06%, significantly outperforming the Sensex, which returned 0.66% in the same period. In terms of technical indicators, the bank's weekly MACD suggests a mildly bullish sentiment, while the monthly outlook presents a mildly bearish trend. The Bollinger Bands indicate bullish conditions on both weekly and monthly charts, suggesting potential volatility. The daily moving averages, however, reflect a mildly bearish stance, indicating mixed signals in the short term. Looking at the broader performance, Union Bank's returns over various periods highlight its resilience. Over the las...

Read More

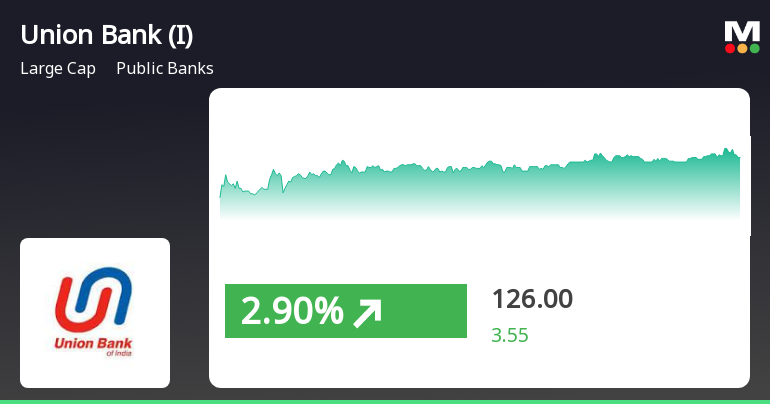

Union Bank of India Shows Strong Market Position Amid Broader Sensex Recovery

2025-03-27 10:05:27Union Bank of India has experienced a notable performance today, reversing a two-day decline with a significant intraday high. The stock is trading above multiple moving averages and has outperformed its sector. In the broader market, the Sensex has rebounded sharply, reflecting overall market resilience.

Read MoreUnion Bank of India Sees Surge in Open Interest Amid Trading Activity Shift

2025-03-26 15:00:40Union Bank of India has experienced a notable increase in open interest today, reflecting heightened activity in its trading. The latest open interest stands at 24,069 contracts, up from the previous figure of 21,721, marking a change of 2,348 contracts or a 10.81% increase. The trading volume for the day reached 17,882 contracts, contributing to a total futures value of approximately Rs 43,678.56 lakhs and an options value of around Rs 5,418.30 crores, culminating in a total value of Rs 44,228.93 lakhs. In terms of price performance, Union Bank of India has underperformed its sector by 1.37%, with the stock recording a 1D return of -2.46%. Over the past two days, the stock has seen a consecutive decline, resulting in a total drop of 5.54%. The intraday low was noted at Rs 120, reflecting a decrease of 2.72%. While the stock is currently trading above its 20-day, 50-day, and 100-day moving averages, it rem...

Read MoreUnion Bank of India Shows Mixed Technical Trends Amid Market Volatility

2025-03-26 08:04:12Union Bank of India, a prominent player in the public banking sector, has recently undergone an evaluation revision reflecting its current market dynamics. The bank's stock is currently priced at 123.30, down from a previous close of 127.35, with a 52-week high of 172.45 and a low of 100.75. Today's trading saw a high of 128.65 and a low of 122.45, indicating some volatility. In terms of technical indicators, the bank's weekly MACD shows a mildly bullish trend, while the monthly perspective leans towards a mildly bearish outlook. The Relative Strength Index (RSI) remains neutral for both weekly and monthly assessments. Bollinger Bands indicate a bullish stance on a weekly basis, contrasting with a mildly bearish monthly view. Moving averages reflect a mildly bearish trend on a daily basis, while the KST shows a mixed picture with weekly mildly bullish and monthly mildly bearish signals. When comparing the...

Read MoreUnion Bank of India Sees Surge in Open Interest Amid Increased Trading Activity

2025-03-25 15:01:02Union Bank of India has experienced a notable increase in open interest today, reflecting heightened trading activity. The latest open interest stands at 23,250 contracts, up from the previous 21,134 contracts, marking a change of 2,116 contracts or a 10.01% increase. The trading volume for the day reached 23,258 contracts, indicating robust participation in the market. In terms of price performance, Union Bank of India has underperformed its sector by 1.33%, with the stock falling 2.82% today. It touched an intraday low of Rs 122.34, representing a decline of 4.02%. Despite this, the stock is currently trading above its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, suggesting a longer-term positive trend. The delivery volume has also seen a significant rise, with 59.92 lakh shares delivered on March 24, an increase of 59.28% compared to the 5-day average. With a market capitalization of Rs...

Read More

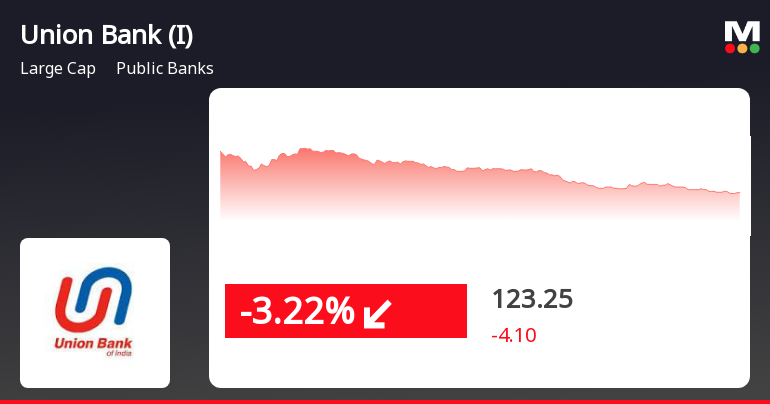

Union Bank of India Faces Short-Term Decline Amid Strong Long-Term Performance Trends

2025-03-25 12:35:28Union Bank of India saw a decline on March 25, 2025, after two days of gains, reaching an intraday low. Despite this downturn, the bank's stock remains above key moving averages and has shown positive performance over the past week and month, outperforming the Sensex in both periods.

Read MoreUnion Bank of India Shows Mixed Technical Trends Amid Strong Performance Gains

2025-03-25 08:05:21Union Bank of India, a prominent player in the public banking sector, has recently undergone an evaluation revision reflecting its current market dynamics. The bank's stock price is currently at 127.35, showing a notable increase from the previous close of 122.45. Over the past week, Union Bank has demonstrated a robust performance, with a stock return of 13.20%, significantly outpacing the Sensex return of 5.14%. In terms of technical indicators, the bank's weekly MACD is mildly bullish, while the monthly outlook presents a mildly bearish scenario. The Bollinger Bands indicate a bullish trend on both weekly and monthly bases, suggesting potential volatility in the stock's price movement. Additionally, the daily moving averages reflect a mildly bearish sentiment, contrasting with the overall bullish signals from the weekly indicators. Looking at the bank's performance over various time frames, Union Bank ...

Read More

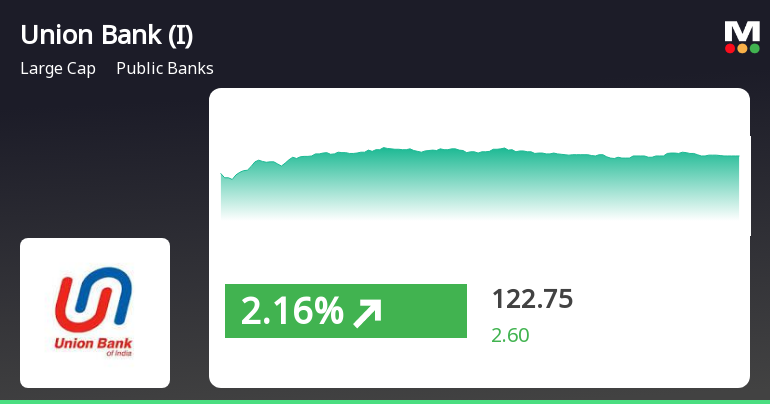

Union Bank of India Shows Strong Performance Amid Positive Market Trends

2025-03-24 13:45:28Union Bank of India has experienced notable gains, outperforming its sector and achieving a significant return over the past week. The stock is currently trading above all key moving averages, reflecting a positive trend. Despite a challenging year-to-date performance, it has shown remarkable growth over the past three to five years.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSECertificate under Regulation 74 (5) of the SEBI (Depository and participants) Regular 2018 for the quarter ended March 31st 2025.

Intimation Under Regulation 30 Of SEBI (LODR) Regulation 2015

09-Apr-2025 | Source : BSEUnion Bank of India informed the Exchange about Amalgamation of Regional Rural Bank w.e.f. 1st May 2025

Centralized Database For Corporate Bonds Debentures

08-Apr-2025 | Source : BSEUnion Bank of India Annual disclosure of Outstanding Bonds as on 31.03.2025

Corporate Actions

No Upcoming Board Meetings

Union Bank of India has declared 36% dividend, ex-date: 19 Jul 24

No Splits history available

No Bonus history available

No Rights history available