United Breweries Faces Technical Trend Adjustments Amid Mixed Market Signals

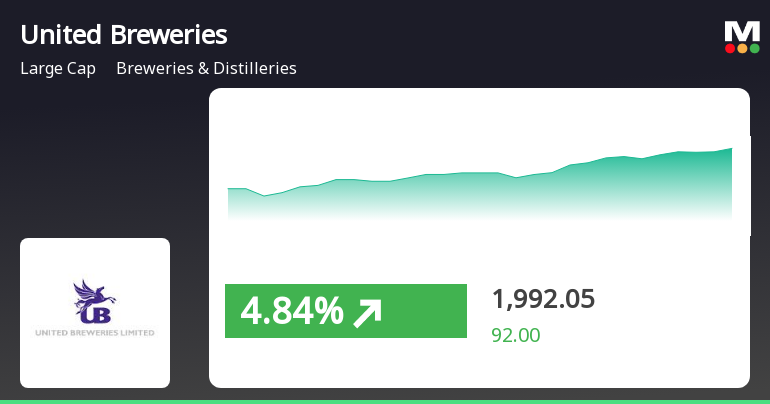

2025-04-02 08:04:04United Breweries, a prominent player in the Breweries & Distilleries sector, has recently undergone a technical trend adjustment. The company's current stock price stands at 1953.90, reflecting a decline from the previous close of 1999.20. Over the past year, United Breweries has shown a stock return of 9.42%, outperforming the Sensex, which recorded a return of 2.72% during the same period. In terms of technical indicators, the MACD signals a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. The Bollinger Bands indicate a bearish stance weekly, contrasting with a mildly bullish monthly perspective. Moving averages also reflect a bearish trend, suggesting a cautious market sentiment. Despite the recent challenges, United Breweries has demonstrated resilience over longer periods, with a notable 30.23% return over three years, compared to the Sensex's 28.25%. However, the five-ye...

Read MoreUnited Breweries Faces Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-28 08:01:24United Breweries, a prominent player in the Breweries & Distilleries sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1978.85, showing a notable increase from the previous close of 1929.05. Over the past year, United Breweries has demonstrated a return of 16.69%, significantly outperforming the Sensex, which recorded a return of 6.32% in the same period. In terms of technical indicators, the MACD shows a bearish trend on a weekly basis while indicating a mildly bearish stance monthly. The Relative Strength Index (RSI) remains neutral, with no signals detected on both weekly and monthly charts. Bollinger Bands reflect a mildly bearish trend weekly, contrasting with a bullish outlook monthly. Moving averages indicate a bearish trend on a daily basis, while the KST shows a mildly bearish trend weekly and bullish monthly. When compa...

Read MoreUnited Breweries Faces Technical Trend Shifts Amid Mixed Market Performance

2025-03-26 08:01:51United Breweries, a prominent player in the Breweries & Distilleries sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1915.05, down from a previous close of 1967.95, with a 52-week high of 2,299.40 and a low of 1,687.15. Today's trading saw a high of 1983.95 and a low of 1907.35. The technical summary indicates a bearish sentiment in the weekly MACD and moving averages, while the monthly indicators show a mildly bearish trend. The Bollinger Bands present a mixed picture, with a bearish outlook on the weekly chart and a mildly bullish stance on the monthly chart. The KST reflects a mildly bearish trend for both weekly and monthly evaluations, while the On-Balance Volume (OBV) shows a mildly bullish weekly trend but no clear direction monthly. In terms of performance, United Breweries has experienced varied returns compared to the...

Read MoreUnited Breweries Faces Mixed Technical Trends Amidst Market Evaluation Revision

2025-03-25 08:02:11United Breweries, a prominent player in the Breweries & Distilleries sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1967.95, showing a notable increase from the previous close of 1933.60. Over the past year, United Breweries has demonstrated a return of 13.81%, outperforming the Sensex, which recorded a return of 7.07% in the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no signal for both weekly and monthly assessments. Bollinger Bands indicate a mildly bearish trend on a weekly basis, contrasting with a bullish monthly perspective. Moving averages reflect a bearish sentiment on a daily basis, while the KST shows a mildly bearish trend weekly and bullish monthly. When comparing the stock's performance to the ...

Read More

United Breweries Stock Outperforms Sector Amid Mixed Long-Term Performance Trends

2025-03-20 09:35:13United Breweries experienced significant stock activity, with a notable intraday high and a weekly increase. The stock is currently positioned above its short-term moving averages but below longer-term ones. Over the past year, it has outperformed the Sensex, despite a year-to-date decline.

Read More

United Breweries Faces Financial Challenges Amid Declining Sales and Profitability Trends

2025-03-18 08:01:53United Breweries has recently experienced a change in its evaluation, reflecting its financial performance and market position following Q3 FY24-25 results. The company reported a decline in net sales and profit after tax, alongside concerns regarding liquidity, despite a positive return over the past year.

Read MoreUnited Breweries Faces Bearish Technical Trends Amid Market Evaluation Revision

2025-03-18 08:01:41United Breweries, a prominent player in the Breweries & Distilleries sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1886.05, down from a previous close of 1917.25. Over the past year, the stock has seen a high of 2,299.40 and a low of 1,667.85, indicating a significant range in its performance. The technical summary reveals a bearish sentiment in various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly perspective is mildly bearish. Similarly, the Bollinger Bands indicate a bearish outlook weekly, contrasting with a mildly bullish stance monthly. Moving averages also reflect a bearish trend, suggesting a cautious market environment. In terms of returns, United Breweries has faced challenges compared to the Sensex. Over the past week, the stock returned -0.48%, while the Sensex saw a slight gain o...

Read MoreUnited Breweries Adjusts Valuation Amid Strong Performance and Competitive Metrics

2025-03-18 08:00:29United Breweries, a prominent player in the Breweries & Distilleries sector, has recently undergone a valuation adjustment. The company's current price stands at 1886.05, reflecting a slight decline from the previous close of 1917.25. Over the past year, United Breweries has shown a return of 8.47%, outperforming the Sensex, which recorded a return of 2.10% in the same period. Key financial metrics for United Breweries include a PE ratio of 112.95 and an EV to EBITDA ratio of 62.54, indicating a premium valuation relative to its peers. In comparison, Varun Beverages and United Spirits have PE ratios of 66.13 and 66.87, respectively, while Radico Khaitan stands at 96.1. The PEG ratio for United Breweries is 3.72, which is higher than that of Varun Beverages at 3.12, suggesting a different growth outlook among these companies. Despite the recent valuation adjustment, United Breweries maintains a competitive...

Read MoreUnited Breweries Faces Stock Volatility Amidst Strong Long-Term Growth Trends

2025-03-17 18:00:18United Breweries, a prominent player in the Breweries & Distilleries industry, has seen notable stock activity today. The company, with a market capitalization of Rs 50,080.00 crore, operates within a sector characterized by a current industry P/E of 67.96, while United Breweries itself reports a significantly higher P/E of 112.95. In terms of performance, United Breweries has recorded a one-year growth of 8.47%, outperforming the Sensex, which has seen a rise of only 2.10% during the same period. However, the stock has faced challenges recently, with a decline of 1.63% today, contrasting with the Sensex's modest gain of 0.46%. Over the past month, the stock has decreased by 6.76%, while the Sensex has fallen by 2.40%. Longer-term performance metrics show that United Breweries has achieved a 27.16% increase over three years and an impressive 97.14% rise over five years, although these figures lag behind...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSECertificate in terms of Regulation 74(5) of the SEBI Listing Regulations for the quarter ended March 31 2025.

Board Meeting Intimation for Intimation Of Meeting Of The Board Of Directors Of United Breweries Limited

08-Apr-2025 | Source : BSEUnited Breweries Ltd-has informed BSE that the meeting of the Board of Directors of the Company is scheduled on 07/05/2025 inter alia to consider and approve Intimation of meeting of the Board of Directors of United Breweries Limited and Closure of Trading Window to consider and approve the Audited Standalone and Consolidated Financial Results for the financial year ended March 31 2025 and recommend dividend on the equity shares of the company if any for the financial year ended March 31 2025

Announcement Under Regulation 30 Of SEBI LODR- Updates

03-Apr-2025 | Source : BSEAnnouncement under Regulation 30 of SEBI LODR - New Product Launch

Corporate Actions

07 May 2025

United Breweries Ltd. has declared 1000% dividend, ex-date: 25 Jul 24

United Breweries Ltd. has announced 1:10 stock split, ex-date: 09 Jun 06

No Bonus history available

United Breweries Ltd. has announced 1:9 rights issue, ex-date: 10 Apr 08