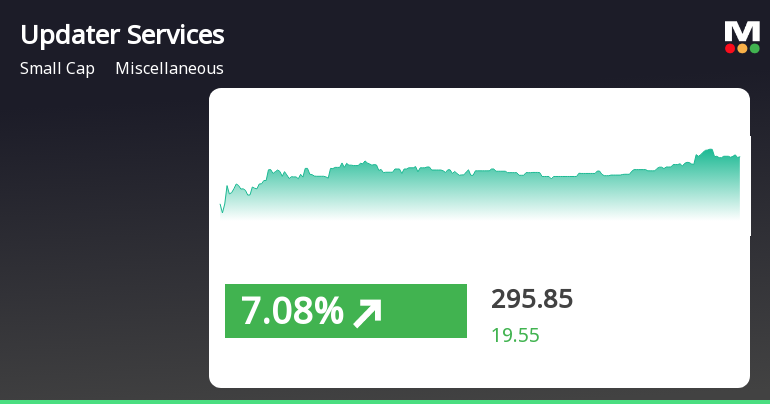

Updater Services Outperforms Sector Amid Broader Market Decline and Small-Cap Gains

2025-04-01 14:20:29Updater Services has experienced significant gains, outperforming its sector amid a broader market decline. The stock has shown consecutive increases over the past two days and is currently above its short-term moving averages. However, its longer-term performance indicates a decline over the past three months and year.

Read MoreUpdater Services Faces Mixed Technical Trends Amid Market Volatility and Evaluation Revision

2025-03-20 08:04:21Updater Services, a small-cap player in the miscellaneous industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 289.95, showing a notable increase from the previous close of 279.45. Over the past year, Updater Services has faced challenges, with a return of -7.7%, contrasting with a positive return of 4.77% for the Sensex during the same period. The technical summary indicates a mixed performance across various indicators. The MACD shows a bearish trend on a weekly basis, while the moving averages also reflect a bearish stance. However, the On-Balance Volume (OBV) presents a mildly bearish outlook on a weekly basis, suggesting some underlying strength. The Dow Theory aligns with this sentiment, indicating a mildly bearish trend as well. In terms of price performance, Updater Services reached a 52-week high of 437.95 and a low of 24...

Read MoreUpdater Services Faces Technical Trend Shift Amid Ongoing Market Challenges

2025-03-19 08:05:16Updater Services, a small-cap player in the miscellaneous industry, has recently undergone a technical trend adjustment. The company's current price stands at 279.45, reflecting a slight increase from the previous close of 270.45. Over the past year, Updater Services has faced challenges, with a stock return of -12.51%, contrasting sharply with a 3.51% gain in the Sensex during the same period. The technical summary indicates a bearish sentiment across various indicators. The MACD and Bollinger Bands on a weekly basis are both bearish, while the daily moving averages also reflect a bearish trend. The KST and Dow Theory metrics further support this sentiment, with weekly readings showing a bearish outlook. Interestingly, the On-Balance Volume (OBV) presents a mildly bearish trend on a weekly basis, while monthly data indicates a bullish stance. In terms of performance, Updater Services has struggled signif...

Read MoreUpdater Services Faces Technical Trend Shifts Amid Market Volatility and Underperformance

2025-03-18 08:04:50Updater Services, a small-cap player in the miscellaneous industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 270.45, down from a previous close of 282.25, with a notable 52-week high of 437.95 and a low of 242.60. Today's trading saw a high of 284.20 and a low of 268.00, indicating some volatility. The technical summary reveals a bearish stance in several indicators, including the MACD and Bollinger Bands on a weekly basis, while the Dow Theory suggests a mildly bearish outlook. The On-Balance Volume (OBV) shows no trend on a weekly basis but indicates bullish momentum on a monthly scale. The Relative Strength Index (RSI) remains neutral, signaling no immediate directional bias. In terms of performance, Updater Services has faced challenges compared to the Sensex. Over the past week, the stock returned -2.51%, while the Sensex s...

Read MoreUpdater Services Faces Bearish Technical Trends Amid Market Volatility Challenges

2025-03-12 08:03:33Updater Services, a small-cap player in the miscellaneous industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 283.95, showing a notable shift from its previous close of 277.40. Over the past year, Updater Services has faced challenges, with a return of -15.8%, contrasting with a slight gain of 0.82% in the Sensex during the same period. The technical summary indicates a bearish sentiment across various indicators. The MACD and Bollinger Bands on a weekly basis are both aligned with this bearish outlook, while the daily moving averages also reflect a similar trend. The Dow Theory shows a mildly bearish stance on a weekly basis, suggesting a cautious market sentiment. In terms of performance, the stock has experienced a significant decline year-to-date, with a return of -25.12%, compared to a -5.17% return for the Sensex. This unde...

Read MoreUpdater Services Faces Mixed Technical Trends Amidst Market Volatility and Underperformance

2025-03-05 08:03:49Updater Services, a small-cap player in the miscellaneous industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 286.95, slightly down from its previous close of 289.90. Over the past year, the stock has experienced a high of 437.95 and a low of 242.60, indicating significant volatility. The technical summary reveals a mixed picture. The MACD indicates bearish momentum on a weekly basis, while the daily moving averages also reflect bearish tendencies. However, the weekly Relative Strength Index (RSI) shows bullish signals, suggesting some positive momentum in the short term. The On-Balance Volume (OBV) presents a mildly bearish outlook weekly, contrasting with a bullish monthly perspective. In terms of performance, Updater Services has faced challenges compared to the Sensex. Over the past week, the stock has returned -8.43%, while ...

Read More

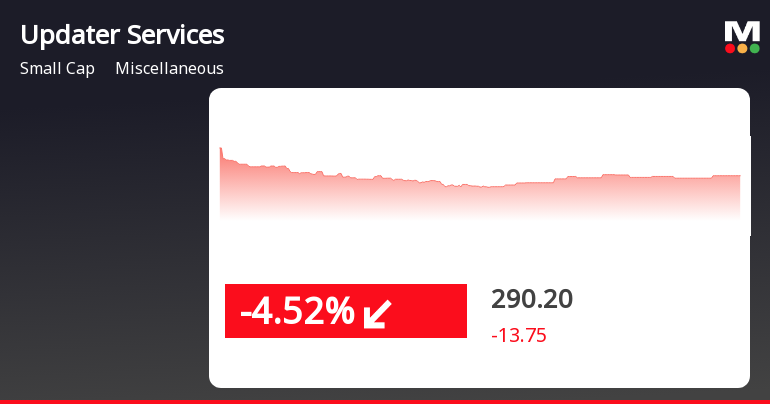

Updater Services Faces Ongoing Volatility Amidst Broader Market Declines

2025-03-03 11:50:39Updater Services has faced notable volatility, with its stock declining for six consecutive days and underperforming its sector. The stock has dropped significantly over the past month and is currently trading below key moving averages, indicating a challenging market position as it navigates these conditions.

Read MoreUpdater Services Ltd Faces Market Challenges Amid Stock Performance Fluctuations

2025-02-28 10:25:21Updater Services Ltd, operating within the miscellaneous industry, has experienced notable fluctuations in its stock performance today. The company, classified as a small-cap entity with a market capitalization of Rs 2,053.79 crore, currently holds a price-to-earnings (P/E) ratio of 18.75, significantly lower than the industry average of 35.85. Over the past year, Updater Services has seen a decline of 12.12%, contrasting with the Sensex's positive performance of 2.03%. In the short term, the stock has decreased by 0.62% today, while the Sensex fell by 1.13%. Weekly and monthly performance metrics also reflect a downward trend, with declines of 2.65% and 9.10%, respectively, compared to the Sensex's losses of 2.04% and 2.81%. Technical indicators present a mixed picture; the MACD shows a bearish trend on a weekly basis, while the Relative Strength Index (RSI) indicates bullish momentum in the short term. ...

Read MoreUpdater Services Faces Mixed Technical Indicators Amid Market Volatility

2025-02-28 08:01:29Updater Services, a small-cap player in the miscellaneous industry, has recently undergone an evaluation revision reflecting shifts in its technical indicators. The stock is currently priced at 308.65, down from a previous close of 313.35. Over the past year, it has experienced a high of 437.95 and a low of 242.60, indicating significant volatility. The technical summary reveals a mixed performance across various indicators. The MACD and Bollinger Bands are showing bearish signals on a weekly basis, while the Relative Strength Index (RSI) indicates bullish momentum in the short term. However, moving averages and the KST also reflect bearish trends, suggesting caution in the current market environment. The On-Balance Volume (OBV) shows a mildly bullish trend on a weekly basis, contrasting with the overall bearish sentiment. In terms of performance, Updater Services has faced challenges compared to the Sens...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSEUpdater Services Limited has informed the exchange about Compliance Certificate and Regulation 74(5) of SEBI (Depository and Participants) Regulations 2018 for the quarter ended 31.03.2025.

Intimation Under Regulation 30 Of SEBI (Listing Obligations And Disclosure Requirements) Regulation 2015

29-Mar-2025 | Source : BSEIntimation under Regulation 30 of SEBI (Listing Obligations and Disclosure Requirements) Regulation 2015

Closure of Trading Window

26-Mar-2025 | Source : BSEUpdater Services Limited has informed exchange regarding closure of trading window for the quarter and financial year ending March 31 2025

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available