Utique Enterprises Adjusts Valuation Amidst Competitive Market Landscape and Low Profitability Concerns

2025-04-02 08:00:27Utique Enterprises, a microcap player in the finance and non-banking financial company (NBFC) sector, has recently undergone a valuation adjustment. The company's current price stands at 4.33, reflecting a modest increase from the previous close of 4.05. Over the past year, Utique has faced challenges, with a stock return of -44.91%, contrasting sharply with a 2.72% return from the Sensex during the same period. Key financial metrics for Utique reveal a PE ratio of 17.34 and an EV to EBITDA ratio of 6.34, indicating a competitive position within its industry. The company's PEG ratio is notably low at 0.16, suggesting potential for growth relative to its earnings. However, the return on equity (ROE) is at 1.99%, which may raise questions about profitability. In comparison to its peers, Utique's valuation metrics appear more favorable, particularly when contrasted with companies like Colab Platforms and Osw...

Read More

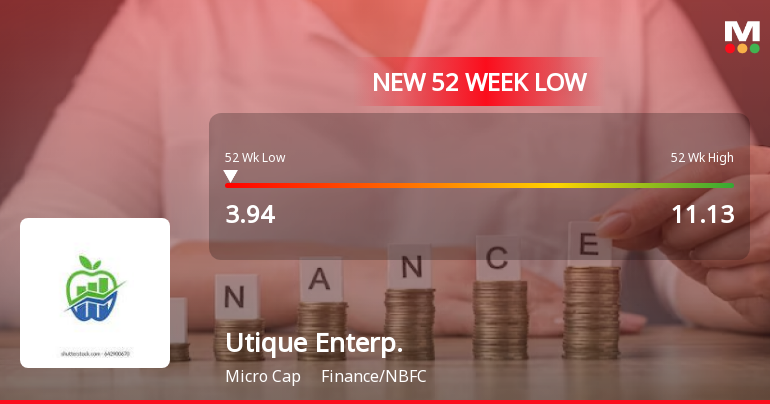

Utique Enterprises Faces Significant Volatility Amid Broader Sector Challenges

2025-03-21 09:35:33Utique Enterprises, a microcap in the finance and NBFC sector, has reached a new 52-week low, reflecting significant volatility and a 43.59% decline over the past year. Despite recent positive financial results, the company's technical indicators and declining operating profits suggest ongoing challenges in the market.

Read More

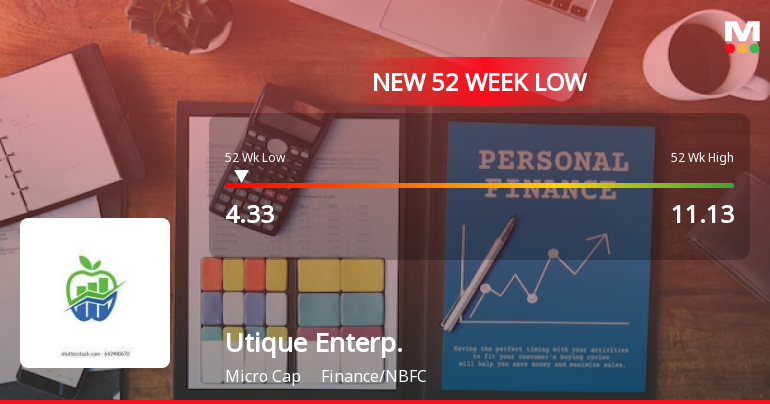

Utique Enterprises Faces Ongoing Challenges Amidst Significant Stock Volatility

2025-03-19 13:35:15Utique Enterprises, a microcap in the finance/NBFC sector, has hit a new 52-week low, continuing a downward trend with significant underperformance compared to its sector. Despite increased net sales and profit, the company faces challenges with operating losses and weak long-term growth, reflecting a bearish market outlook.

Read MoreUtique Enterprises Experiences Valuation Grade Change Amidst Market Challenges and Operational Concerns

2025-03-17 08:00:08Utique Enterprises, a microcap player in the finance and non-banking financial company (NBFC) sector, has recently undergone a valuation adjustment. The company's current price stands at 4.26, reflecting a decline from its previous close of 4.45. Over the past year, Utique has faced significant challenges, with a stock return of -40.00%, contrasting sharply with a modest gain of 1.47% in the Sensex. Key financial metrics reveal a PE ratio of 17.06 and an EV to EBITDA ratio of 6.65, indicating a competitive position within its industry. However, the company also reports a negative capital employed, which raises concerns about its operational efficiency. In comparison to its peers, Utique's valuation metrics show a relatively favorable position, particularly when contrasted with companies like Centrum Capital and Oswal Green Tech, which are facing more severe valuation challenges. Despite the recent valuati...

Read More

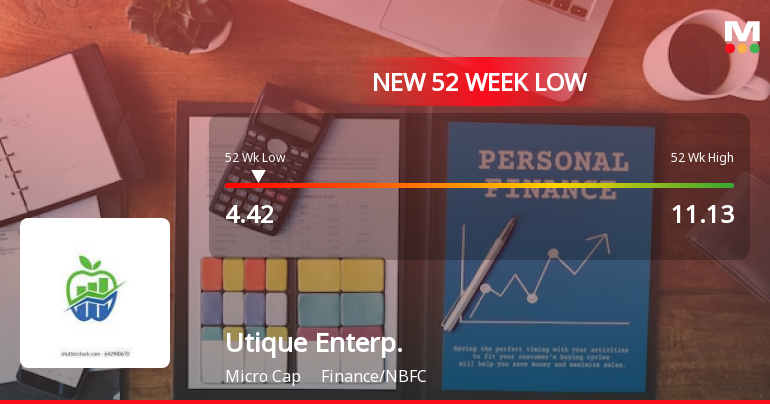

Utique Enterprises Faces Financial Struggles Amid Broader Market Gains and Volatility

2025-03-13 11:35:33Utique Enterprises, a microcap in the finance/NBFC sector, has hit a new 52-week low and is underperforming its sector. The company faces scrutiny due to operating losses and a weak growth outlook, with a significant one-year decline in stock value contrasting with broader market gains.

Read More

Utique Enterprises Faces Challenges Amid Broader Market Decline and Poor Performance

2025-03-11 10:05:43Utique Enterprises, a microcap in the finance and NBFC sector, has reached a new 52-week low amid broader market declines. The company has struggled over the past year, with a significant drop in stock value despite recent increases in net sales and profit, facing ongoing operational challenges.

Read More

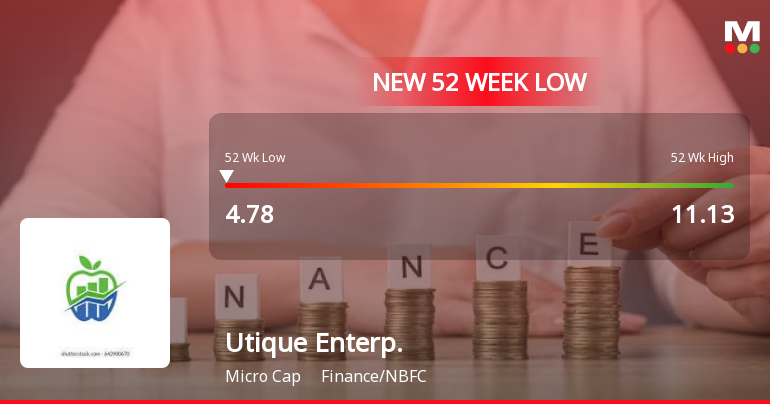

Utique Enterprises Hits 52-Week Low Amid Broader Market Decline and Weak Growth Prospects

2025-03-04 09:42:17Utique Enterprises, a microcap in the finance and NBFC sector, reached a new 52-week low amid significant underperformance, with a 43.03% decline over the past year. Despite reporting higher profits and net sales, the company faces ongoing operating losses and bearish technical indicators, reflecting persistent market challenges.

Read More

Utique Enterprises Hits 52-Week Low Amid Broader Finance Sector Challenges

2025-02-28 09:35:33Utique Enterprises, a microcap in the finance sector, has reached a new 52-week low, continuing a six-day decline totaling 14.01%. Over the past year, the stock has dropped 37.16%, underperforming compared to the Sensex. Its trading metrics indicate a sustained bearish trend amid broader market challenges.

Read MoreUtique Enterprises Adjusts Valuation Amidst Operational Challenges and Market Competition

2025-02-25 10:22:43Utique Enterprises, a microcap player in the finance and non-banking financial company (NBFC) sector, has recently undergone a valuation adjustment. The company's current price stands at 5.17, reflecting a slight increase from the previous close of 5.05. Over the past year, Utique has faced significant challenges, with a stock return of -42.23%, contrasting sharply with a modest gain of 2.07% in the Sensex. Key financial metrics reveal a PE ratio of 20.23 and an EV to EBITDA ratio of 3.19, indicating a complex market position. The company's price to book value is notably low at 0.40, which may suggest undervaluation relative to its assets. However, the return on equity (ROE) is at 1.99%, and the latest return on capital employed (ROCE) is negative, highlighting operational challenges. In comparison to its peers, Utique's valuation metrics present a mixed picture. While some competitors exhibit significant...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Apr-2025 | Source : BSEPlease find attached Certificate dated April 4 2025 received from our Registrar & Transfer Agent Bigshare Services Private Limited.

Closure of Trading Window

31-Mar-2025 | Source : BSEPlease find attached our letter dated March 31 2025 for Closure of Trading Window.

Integrated Filing (Financial)

17-Feb-2025 | Source : BSEIn continuation letter dated February 14 2025 we are once again filing herewith the Unaudited Financial Results of the Company for the quarter and nine months ended December 31 2024. The aforesaid Unaudited Financial Results were earlier filed with you on Friday February 14 2025 vide Acknowledgement No.9041373 at 5:07:01 p.m.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available