V-Guard Industries Shows Mixed Technical Trends Amidst Market Dynamics

2025-04-01 08:00:34V-Guard Industries, a midcap player in the consumer durables sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 358.00, showing a notable increase from the previous close of 349.50. Over the past week, V-Guard has demonstrated a stock return of 2.29%, outperforming the Sensex, which returned 0.66% in the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) indicates a bullish trend on a weekly basis, but shows no signal for the monthly period. Bollinger Bands and KST metrics also reflect a mildly bearish stance on both weekly and monthly evaluations. The Dow Theory presents a mildly bullish trend weekly, contrasting with the monthly mildly bearish outlook. V-Guard's performance over various time frames reveals a 14.54% return ...

Read MoreV-Guard Industries Faces Mixed Technical Trends Amidst Market Evaluation Revision

2025-03-27 08:00:30V-Guard Industries, a midcap player in the consumer durables sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 352.70, slightly down from its previous close of 355.75. Over the past year, V-Guard has shown a return of 10.25%, outperforming the Sensex, which recorded a return of 6.65% in the same period. In terms of technical indicators, the weekly MACD is bearish, while the monthly reading is mildly bearish. The Relative Strength Index (RSI) indicates a bullish trend on a weekly basis, but shows no signal for the monthly timeframe. Bollinger Bands and KST metrics also reflect a mildly bearish stance on both weekly and monthly charts. Daily moving averages are bearish, suggesting a cautious outlook. When comparing the stock's performance to the Sensex, V-Guard has demonstrated notable resilience over longer periods, with a three-y...

Read MoreV-Guard Industries Faces Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-26 08:00:44V-Guard Industries, a midcap player in the consumer durables sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 355.75, showing a slight increase from the previous close of 355.00. Over the past year, V-Guard has demonstrated a return of 10.38%, outperforming the Sensex, which recorded a return of 7.12% in the same period. The technical summary indicates a mixed performance across various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly perspective leans mildly bearish. The Relative Strength Index (RSI) is bullish on a weekly scale but shows no signal monthly. Bollinger Bands and moving averages also reflect a mildly bearish stance, suggesting a cautious outlook in the near term. In terms of stock performance, V-Guard has experienced notable fluctuations, with a 52-week high of 577.35 and a low of 30...

Read More

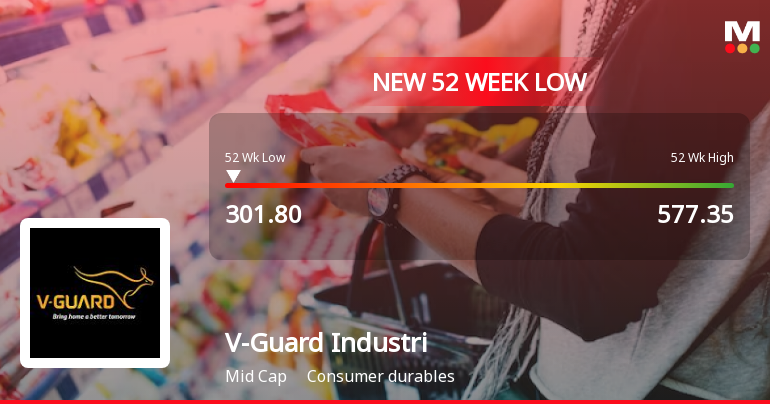

V-Guard Industries Hits 52-Week Low Amidst Mixed Financial Performance and Investor Confidence

2025-03-04 09:52:01V-Guard Industries has reached a new 52-week low, following five consecutive days of losses. Despite this, the stock has outperformed its sector today. While the company shows strong management efficiency and high institutional holdings, it has experienced a decline in profit after tax and is trading below key moving averages.

Read More

V-Guard Industries Faces Significant Volatility Amid Broader Consumer Durables Sector Challenges

2025-03-03 10:35:41V-Guard Industries has faced notable volatility, hitting a 52-week low of Rs. 301.8 and underperforming against its sector. The stock has declined 11.04% over the past five days and consistently remains below key moving averages, reflecting ongoing challenges in the consumer durables market.

Read More

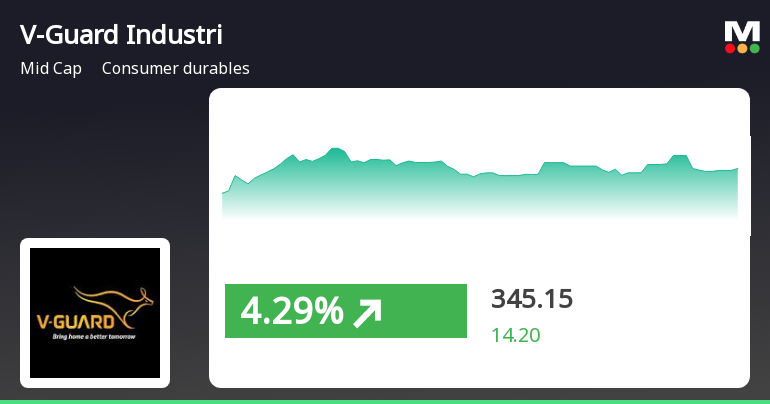

V-Guard Industries Shows Short-Term Strength Amid Mixed Long-Term Outlook

2025-02-21 10:30:15V-Guard Industries experienced significant trading activity, gaining 5.42% on February 21, 2025, and outperforming its sector. The stock's intraday high reached Rs 354. While it shows short-term strength above its 5-day moving average, it remains below longer-term averages, indicating mixed performance trends.

Read More

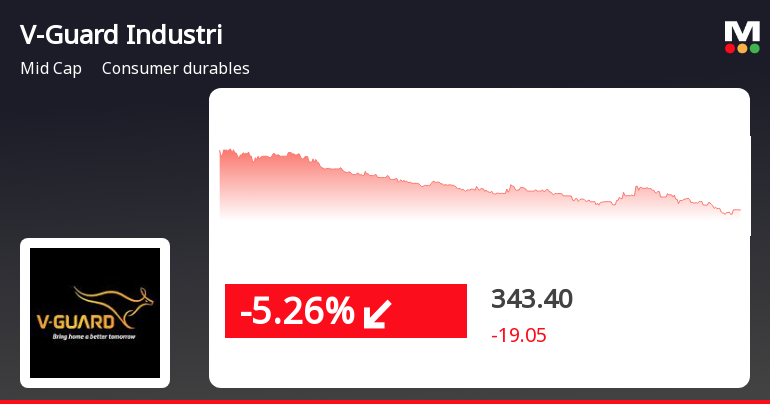

V-Guard Industries Faces Continued Stock Decline Amid High Volatility in February 2025

2025-02-13 15:30:16V-Guard Industries has faced a notable decline in its stock price, dropping for six consecutive days and experiencing high volatility. The stock is trading below multiple moving averages, indicating a bearish trend, and has underperformed compared to the broader market, reflecting ongoing challenges in the consumer durables sector.

Read More

V-Guard Industries Faces Continued Stock Decline Amid Broader Consumer Durables Challenges

2025-02-11 14:30:16V-Guard Industries has faced a notable decline in stock performance, marking its fourth consecutive day of losses. The company has underperformed compared to the broader market and the consumer durables sector, reflecting ongoing challenges within a difficult market environment. The stock is trading below key moving averages.

Read More

V-Guard Industries Reports Flat Q3 FY24-25 Results Amid Mixed Financial Indicators

2025-01-28 17:33:13V-Guard Industries has reported its financial results for Q3 FY24-25, showing a flat performance. The company achieved a notable Debtors Turnover Ratio of 11.45 times, the highest in five half-yearly periods. However, Profit After Tax declined by 18.8% compared to the previous four quarters.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSECertificate under Regulation 74(5) of the SEBI (Depositories and Participants) Regulations 2018 for the quarter ended March 31 2025

Closure of Trading Window

27-Mar-2025 | Source : BSEIntimation of Closure of trading window

Announcement under Regulation 30 (LODR)-Allotment of ESOP / ESPS

17-Mar-2025 | Source : BSEIssue and Allotment of shares under ESOP Scheme of the Company.

Corporate Actions

No Upcoming Board Meetings

V-Guard Industries Ltd has declared 140% dividend, ex-date: 25 Jul 24

V-Guard Industries Ltd has announced 1:10 stock split, ex-date: 30 Aug 16

V-Guard Industries Ltd has announced 2:5 bonus issue, ex-date: 15 Mar 17

No Rights history available