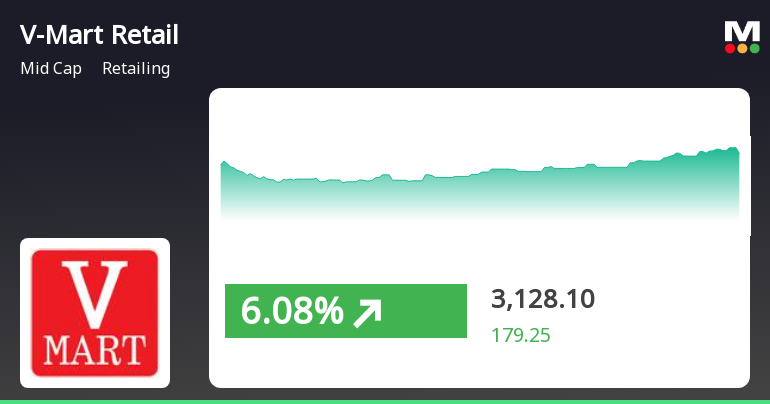

V-Mart Retail Shows Strong Short-Term Gains Amid Broader Market Uptrend

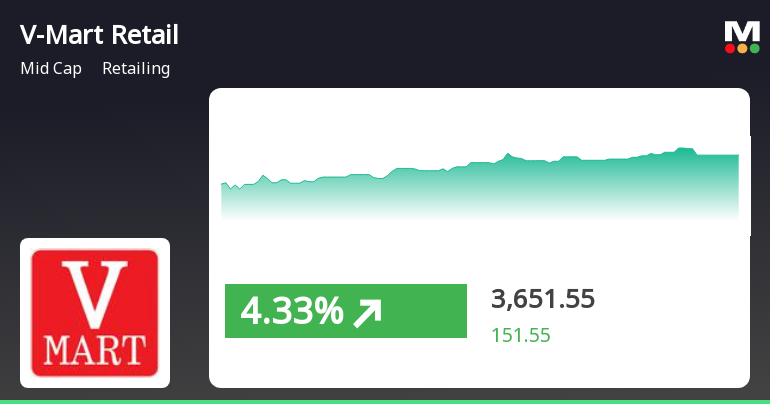

2025-04-02 11:50:19V-Mart Retail Ltd. has experienced notable stock activity, outperforming its sector and achieving significant weekly returns. The stock opened higher and reached an intraday peak, while its performance against various moving averages presents a mixed picture. The broader market is also showing positive trends, particularly among mid-cap stocks.

Read More

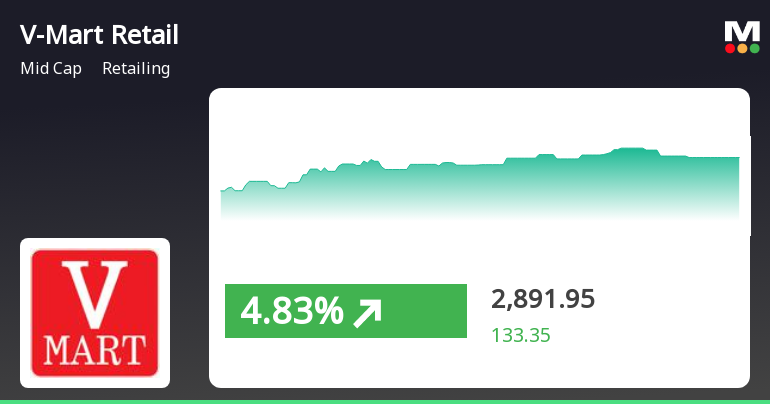

V-Mart Retail Shows Signs of Recovery Amid Broader Market Trends

2025-03-18 11:05:20V-Mart Retail experienced a significant uptick in its stock performance, reversing a three-day decline and outperforming its sector. Despite mixed moving averages, the stock has shown strong annual growth compared to the broader market. Meanwhile, the Sensex also rose, though it remains below key moving averages.

Read MoreV-Mart Retail Faces Mixed Technical Signals Amid Market Volatility

2025-03-18 08:03:15V-Mart Retail, a midcap player in the retailing industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 2,758.60, slightly down from the previous close of 2,771.60. Over the past year, V-Mart has shown a notable return of 47.46%, significantly outperforming the Sensex, which recorded a return of 2.10% in the same period. However, the stock has faced challenges in the shorter term, with a year-to-date return of -29.90%, compared to the Sensex's -5.08%. The technical summary indicates mixed signals, with the MACD showing bearish momentum on a weekly basis while remaining bullish monthly. The Bollinger Bands reflect a bearish trend weekly, but a sideways movement monthly. Additionally, the moving averages and KST are bearish on a weekly basis, while the monthly outlook shows some bullish tendencies. In terms of price performance, V-Mart...

Read MoreV-Mart Retail Faces Technical Trend Shifts Amid Market Volatility and Fluctuating Performance

2025-03-17 08:01:03V-Mart Retail, a midcap player in the retailing industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 2,771.60, down from the previous close of 2,820.00. Over the past year, V-Mart has experienced significant fluctuations, with a 52-week high of 4,517.30 and a low of 1,814.30. The technical summary indicates a bearish sentiment in various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly perspective is mildly bearish. The Bollinger Bands also reflect a bearish outlook weekly, contrasting with a mildly bullish stance monthly. Moving averages and KST further support the bearish sentiment on a weekly basis, although KST shows bullishness monthly. In terms of performance, V-Mart's stock return has been notably underwhelming in the short to medium term, with a year-to-date decline of 29.57%, compared to a 5...

Read More

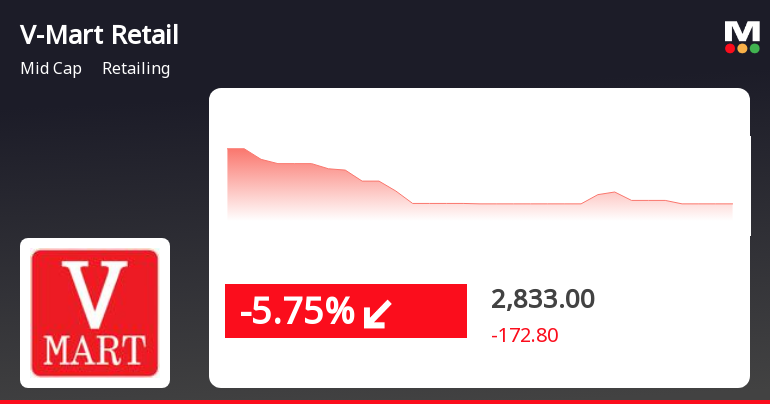

V-Mart Retail Faces Significant Stock Decline Amid Market Challenges and Bearish Trends

2025-03-03 09:35:21V-Mart Retail Ltd. has faced a notable decline in stock performance, dropping significantly today and underperforming compared to its sector. The stock is trading below all key moving averages, and its monthly decline contrasts sharply with the broader market, indicating ongoing challenges for the company.

Read More

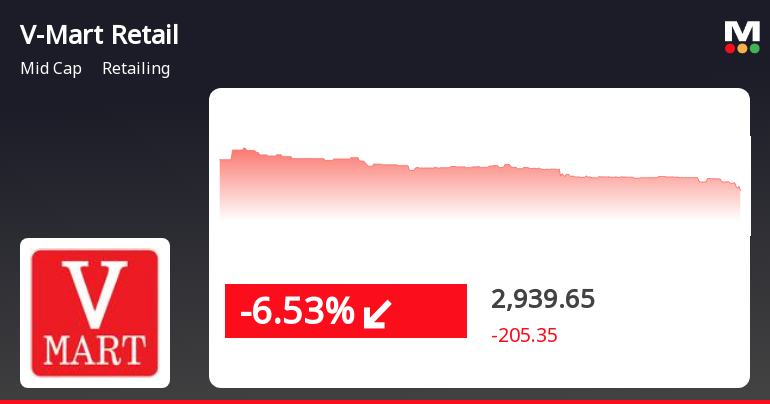

V-Mart Retail Faces Significant Stock Decline Amid Broader Retail Sector Challenges

2025-02-20 15:20:20V-Mart Retail Ltd. has faced notable stock declines, dropping 5.53% today and 6.19% over two days. The stock is trading below multiple moving averages and has underperformed its sector, reflecting ongoing challenges in the retail industry amid broader market trends.

Read MoreV-Mart Retail Faces Stock Volatility Amidst Strong Yearly Performance and Market Challenges

2025-02-20 11:57:29V-Mart Retail Ltd., a mid-cap player in the retailing industry, has experienced significant fluctuations in its stock performance recently. With a market capitalization of Rs 6,137.00 crore, the company has shown a one-year performance increase of 51.57%, notably outperforming the Sensex, which recorded a gain of just 3.64% over the same period. However, today's trading session has seen V-Mart's stock decline by 3.28%, contrasting with the Sensex's minor drop of 0.29%. Over the past week, V-Mart's stock has decreased by 6.00%, while the Sensex fell by 0.55%. In the broader context, the stock has faced challenges, with a year-to-date decline of 22.71% compared to the Sensex's 3.10% drop. Financial metrics indicate a P/E ratio of -533.98, significantly lower than the industry average of 1268.57. Technical indicators present a mixed picture, with weekly metrics showing bearish trends in MACD and Bollinger Ba...

Read More

V-Mart Retail Reports Strong Profit Growth Amid Financial Leverage Concerns

2025-02-19 19:02:41V-Mart Retail has recently adjusted its evaluation following a strong financial performance for the quarter ending December 2024, marked by a significant net profit increase and record net sales. However, challenges persist, including declining long-term operating profits and a high debt to EBITDA ratio, despite strong institutional investor confidence.

Read More

V-Mart Retail Shows Resilience Amid Broader Market Fluctuations and Sector Gains

2025-02-05 11:05:22V-Mart Retail Ltd. experienced notable stock activity on February 5, 2025, with a significant increase and consecutive gains over two days, totaling 9.32%. The stock outperformed its sector and showed resilience against broader market trends, despite a slight decline over the past month.

Read MoreBusiness Update At The End Of Quarter 4 Of Financial Year 2024-25

01-Apr-2025 | Source : BSEBusiness Update at the end of Quarter 4 of Financial Year 2024-25

Intimation Under Regulation 30 Of The SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015

31-Mar-2025 | Source : BSEDetails of order received under Income Tax Act 1961

Closure of Trading Window

24-Mar-2025 | Source : BSEIntimation of Trading Window Closure

Corporate Actions

No Upcoming Board Meetings

V-Mart Retail Ltd. has declared 7% dividend, ex-date: 18 Aug 22

No Splits history available

No Bonus history available

No Rights history available