V2 Retail Shows Strong Momentum Amid Mixed Signals in Broader Market

2025-04-03 10:20:20V2 Retail has demonstrated strong performance, gaining 5.0% on April 3, 2025, and achieving a total return of 13.29% over four consecutive days. The stock is trading above all key moving averages and has impressive long-term returns, significantly surpassing the broader market's performance.

Read MoreV2 Retail Stock Surges, Indicating Strong Investor Confidence and Market Position

2025-04-03 10:01:02V2 Retail Ltd, a mid-cap player in the retailing industry, has made headlines today as its stock hit the upper circuit limit, closing at an impressive high price of Rs 1,809.90. The stock experienced a notable change of Rs 86.15, reflecting a 5% increase, and has shown strong performance by outperforming its sector by 3.83%. Throughout the trading session, V2 Retail reached an intraday high of Rs 1,876, marking a 3.65% increase from the previous close, while the intraday low was recorded at Rs 1,750. The total traded volume for the day was approximately 2.92 lakh shares, resulting in a turnover of Rs 52.54 crore. The stock has been on a positive trajectory, gaining for four consecutive days and accumulating a total return of 10.71% during this period. Additionally, V2 Retail is currently trading above its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a robust upward trend. In...

Read MoreV2 Retail Ltd Achieves Milestone with 289% Annual Growth Amid Strong Buying Activity

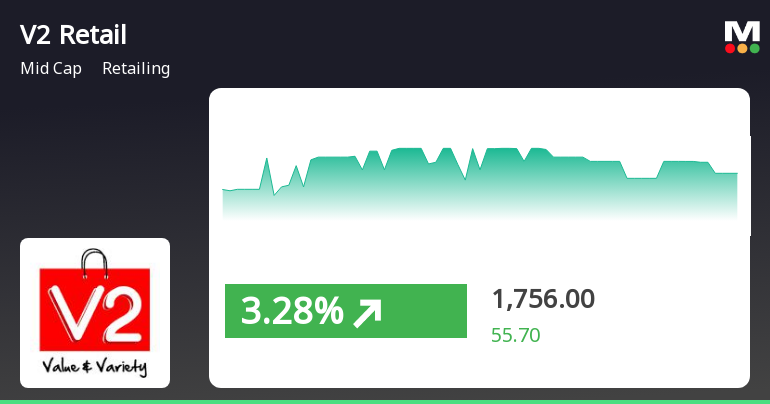

2025-04-02 15:15:09V2 Retail Ltd is currently witnessing significant buying activity, with the stock gaining 3.99% today, outperforming the Sensex, which rose by only 0.80%. Over the past week, V2 Retail has shown a robust performance with a 6.69% increase, while the Sensex declined by 0.84%. The stock has been on a positive trajectory, marking consecutive gains for the last three days, accumulating a total return of 7.9% during this period. In terms of longer-term performance, V2 Retail has demonstrated remarkable growth, with a staggering 289.39% increase over the past year, compared to the Sensex's modest 3.70% rise. The stock's performance over three years stands at an impressive 1018.86%, significantly outpacing the Sensex's 29.28% growth. Today's trading saw V2 Retail reach an intraday high of Rs 1803.05. The stock is currently trading above its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a...

Read MoreV2 Retail Hits Upper Circuit Limit Amid Strong Market Performance and Declining Investor Participation

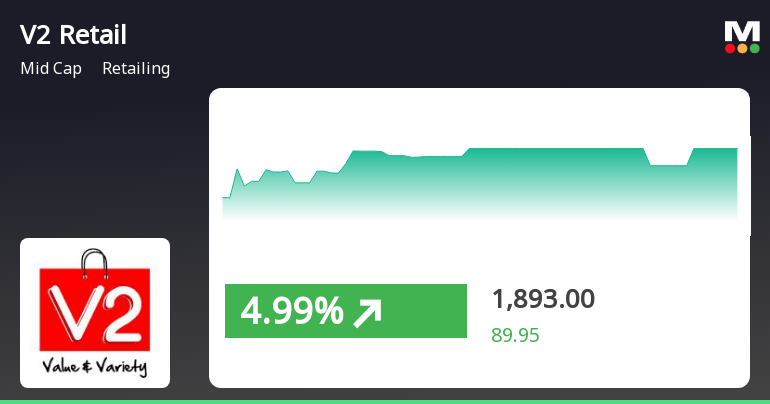

2025-04-02 14:00:05V2 Retail Ltd, a mid-cap player in the retailing industry, has shown remarkable activity today as its stock hit the upper circuit limit. The stock reached an intraday high of Rs 1809.9, reflecting a 5% increase from its previous trading session. The last traded price stood at Rs 1809.85, marking an absolute change of Rs 86.1, or a 4.99% rise. In terms of trading volume, V2 Retail recorded a total traded volume of approximately 2.33 lakh shares, resulting in a turnover of around Rs 41.94 crore. The stock has been on a positive trajectory, gaining for three consecutive days and achieving a total return of 6.87% during this period. Notably, V2 Retail has outperformed its sector, which saw a 1.96% return today, while the broader Sensex index recorded a modest 0.52% increase. The stock is currently trading above its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a strong performance re...

Read More

V2 Retail Adjusts Evaluation Amid Strong Growth and Rising Investor Confidence

2025-04-02 08:15:47V2 Retail has recently adjusted its evaluation, reflecting a shift in technical outlook amid strong financial performance. The company reported significant growth in net sales and operating profit, alongside increased institutional investor participation. However, it faces challenges with a high debt-to-EBITDA ratio, indicating potential debt servicing concerns.

Read MoreV2 Retail Shows Mixed Technical Trends Amidst Notable Market Volatility

2025-03-27 08:02:11V2 Retail, a midcap player in the retailing industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1690.00, down from a previous close of 1747.10, with a notable 52-week high of 2,095.00 and a low of 412.00. Today's trading saw a high of 1799.00 and a low of 1665.00, indicating some volatility. The technical summary reveals mixed signals across various indicators. The MACD shows a mildly bearish trend on a weekly basis while remaining bullish on a monthly scale. The Relative Strength Index (RSI) presents no signals for both weekly and monthly assessments. Bollinger Bands indicate a bullish stance for both time frames, while moving averages suggest a mildly bullish trend daily. The KST reflects a mildly bearish trend weekly but is bullish monthly, and the Dow Theory shows a mildly bullish trend weekly with no trend monthly. The On-Bal...

Read More

V2 Retail Shows Positive Momentum Amid Strong Growth Metrics and Investor Confidence

2025-03-26 08:05:31V2 Retail has recently experienced a change in evaluation, reflecting a shift in its technical outlook. The company reported significant growth in net sales and operating profit, alongside increased institutional investor participation. Despite some challenges, V2 Retail's long-term performance has surpassed broader market indices, indicating a positive trajectory.

Read MoreV2 Retail Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-26 08:02:56V2 Retail, a midcap player in the retailing industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1,747.10, showing a notable increase from the previous close of 1,700.30. Over the past year, V2 Retail has demonstrated impressive performance, with a stock return of 313.47%, significantly outpacing the Sensex return of 7.12% during the same period. In terms of technical indicators, the company exhibits a mixed picture. The MACD shows a mildly bearish trend on a weekly basis but is bullish on a monthly scale. The Bollinger Bands indicate bullish momentum on both weekly and monthly charts, while moving averages on a daily basis also reflect a bullish stance. The KST presents a mildly bearish trend weekly but is bullish monthly, suggesting some volatility in short-term performance. V2 Retail's performance over various time frames highl...

Read More

V2 Retail Exhibits Strong Momentum Amid Broader Market Gains and Positive Trends

2025-03-25 10:05:20V2 Retail has demonstrated strong performance, gaining 5.0% on March 25, 2025, and outperforming its sector. The stock has seen consecutive gains over three days, with a total return of 9.51%. It is trading above key moving averages and has delivered a remarkable 320.07% return over the past year.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSEThe Certificate is attached herewith.

Business Update For Q4 FY25 And FY25 - A Year Of Strong Growth & Strategic Transformation

02-Apr-2025 | Source : BSEThe details are attached herewith

Closure of Trading Window

27-Mar-2025 | Source : BSEThe details are attached herewith.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available