Vadilal Enterprises Achieves All-Time High Amidst Broader Market Challenges

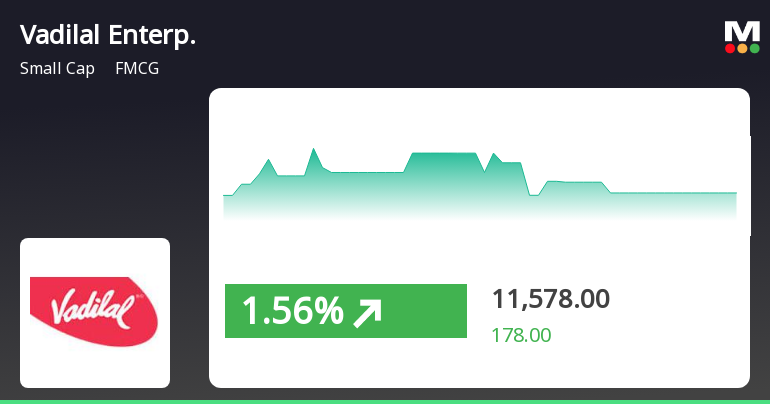

2025-04-03 09:50:28Vadilal Enterprises, a small-cap FMCG company, achieved a significant milestone by reaching a new all-time high of Rs. 12,497.65 on April 3, 2025. The stock has demonstrated strong performance, with a notable 22.76% return over three days, significantly outperforming its sector and the broader market.

Read More

Vadilal Enterprises Achieves 52-Week High Amid Strong Market Performance Trends

2025-04-03 09:39:16Vadilal Enterprises has achieved a new 52-week high in its stock price, following a strong three-day performance that saw significant gains. The company has outperformed its sector and is trading above key moving averages, reflecting a positive trend. Over the past year, it has delivered impressive returns compared to the broader market.

Read More

Vadilal Enterprises Achieves All-Time High Stock Price, Signaling Strong Market Momentum

2025-04-03 09:32:10Vadilal Enterprises has reached an all-time high stock price of Rs. 12,272.35, reflecting a significant milestone for the company. The stock has shown strong performance, outperforming its sector and consistently exceeding key moving averages, with notable gains over various time frames, including a 194.28% return over the past year.

Read More

Vadilal Enterprises Achieves All-Time High Stock Price Amid Strong Market Performance

2025-04-02 09:32:25Vadilal Enterprises has reached an all-time high stock price of Rs. 11,111, marking a significant achievement for the company. The stock has shown strong performance, gaining 9.9% over two days and outperforming its sector. Over the past year, it has surged by 175.69%, significantly exceeding key benchmarks.

Read More

Vadilal Enterprises Faces Mixed Financial Performance Amid Bullish Technical Indicators

2025-04-02 08:34:51Vadilal Enterprises has recently adjusted its evaluation score, reflecting a shift in its stock's technical landscape. While key indicators suggest bullish momentum, the company reported negative financial performance for Q3 FY24-25. Despite this, institutional investor interest has slightly increased, and the company has outperformed broader market indices over the past year.

Read More

Vadilal Enterprises Achieves 52-Week High Amid Broader Market Decline

2025-04-01 11:56:13Vadilal Enterprises has reached a new 52-week high of Rs. 10,990, reflecting strong market activity and a significant performance boost. The company has outperformed its sector and demonstrated resilience amid a broader market decline, with a remarkable one-year performance increase of 181.82%.

Read More

Vadilal Enterprises Achieves All-Time High Stock Price, Signaling Strong Market Confidence

2025-04-01 11:43:07Vadilal Enterprises has reached an all-time high stock price of Rs. 10,990, reflecting strong performance in the FMCG sector. The stock has consistently outperformed the Sensex, with significant gains over various time frames, including a 181.82% increase over the past year and a remarkable 993.86% rise over five years.

Read More

Vadilal Enterprises Faces Mixed Technical Trends Amid Declining Financial Performance

2025-03-25 08:23:05Vadilal Enterprises has experienced a recent evaluation adjustment, reflecting mixed technical trends in its stock performance. The company reported a decline in financial metrics for the quarter ending December 2024, following two positive quarters. Despite challenges, a low Debt to Equity ratio and increased institutional interest suggest a complex market position.

Read MoreVadilal Enterprises Shows Mixed Technical Trends Amid Strong Market Performance

2025-03-25 08:05:19Vadilal Enterprises, a microcap player in the FMCG sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company’s stock price is currently at 10,430.00, down from a previous close of 10,644.00, with a 52-week high of 10,882.90 and a low of 3,201.50. In terms of technical indicators, the weekly MACD remains bullish, while the monthly MACD also reflects a bullish stance. However, the Relative Strength Index (RSI) shows bearish trends on both weekly and monthly scales. The Bollinger Bands indicate a mildly bullish trend weekly and bullish monthly, while the daily moving averages are bullish. The KST presents a mildly bearish outlook weekly but remains bullish monthly. Notably, Dow Theory shows no discernible trend in both weekly and monthly assessments. When comparing the company's performance to the Sensex, Vadilal Enterprises has demonstrated significant return...

Read MoreIntimation Under Regulation 30 Of The SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015 -Postal Ballot Notice.

09-Apr-2025 | Source : BSEIntimation under Regulation 30 of SEBI (LODR) Regulations2015- Postal Ballot Notice.

Announcement Under Reg 30

31-Mar-2025 | Source : BSEAnnouncement under Reg 30

Closure of Trading Window

31-Mar-2025 | Source : BSEIntimation of Trading Window Closure as per SEBI (Prohibition of Insider Trading) Regulations 2015.

Corporate Actions

No Upcoming Board Meetings

Vadilal Enterprises Ltd has declared 15% dividend, ex-date: 19 Sep 24

No Splits history available

No Bonus history available

No Rights history available