Valson Industries Faces Significant Volatility Amid Weak Fundamentals and Market Underperformance

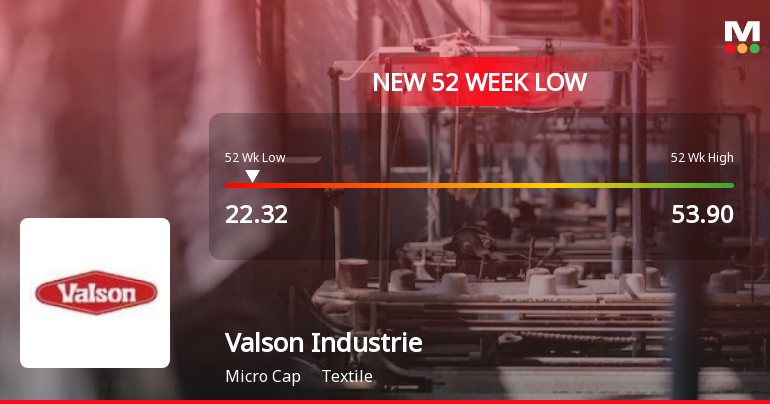

2025-03-25 09:40:17Valson Industries, a microcap textile firm, has faced significant volatility, reaching a new 52-week low. The stock has dropped consecutively over three days, reflecting a bearish trend as it trades below key moving averages. The company's long-term fundamentals show weak growth and high debt levels, contributing to its underperformance.

Read More

Valson Industries Faces Significant Volatility Amid Broader Market Gains and Weak Fundamentals

2025-03-25 09:40:04Valson Industries, a microcap textile firm, has faced notable volatility, reaching a new 52-week low. The stock has declined consecutively over three days, trailing its sector significantly. Long-term fundamentals appear weak, with negative growth in operating profits and a high debt-to-EBITDA ratio, raising profitability concerns.

Read MoreValson Industries Ltd Sees Surge Amid Strong Buying Activity and Market Sentiment Shift

2025-03-17 13:10:07Valson Industries Ltd, a microcap player in the textile industry, is witnessing significant buying activity, with the stock surging by 9.11% today, notably outperforming the Sensex, which rose by just 0.21%. This marks a trend reversal for Valson, as it gained after two consecutive days of decline. The stock opened with a gap up of 9.98%, reaching an intraday high of Rs 26.67. Over the past week, Valson Industries has shown a positive performance of 4.79%, contrasting with a slight decline of 0.18% in the Sensex. However, its performance over the past month reflects a decline of 14.62%, compared to a 2.65% drop in the Sensex. Despite the recent gains, the stock remains below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a longer-term bearish trend. The strong buying pressure could be attributed to various factors, including market sentiment shifts or specific developments wit...

Read More

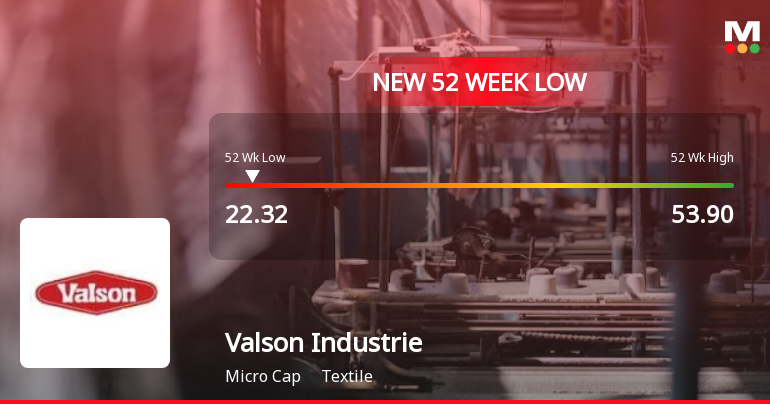

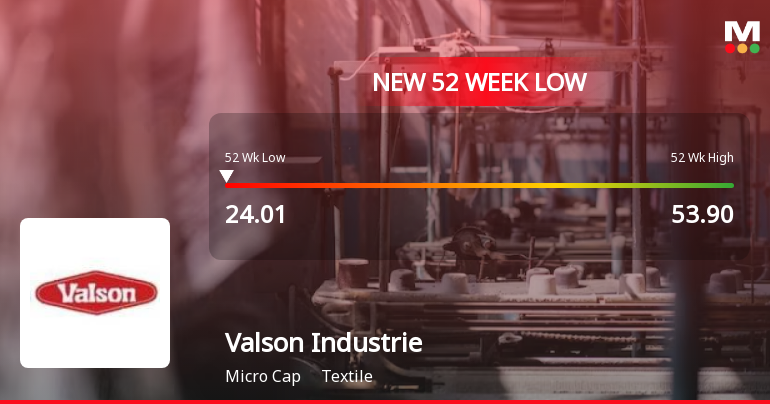

Valson Industries Faces Significant Volatility Amid Broader Market Decline and Weak Fundamentals

2025-03-13 12:35:54Valson Industries, a microcap textile firm, has faced significant volatility, reaching a new 52-week low. The stock has underperformed the market, with a notable decline over the past year. Financial metrics indicate ongoing challenges, including a high Debt to EBITDA ratio and low Return on Equity, reflecting weak fundamentals.

Read MoreValson Industries Faces Intense Selling Pressure Amid Continued Stock Price Declines

2025-02-27 10:22:33Valson Industries Ltd is currently facing significant selling pressure, with the stock showing only sellers today. The company has recorded a notable decline of 7.59% in its stock price, starkly contrasting with the Sensex, which has remained relatively stable with a minimal change of -0.01%. This marks a continuation of a downward trend, as Valson Industries has experienced consecutive days of losses. Over the past week, the stock has gained a mere 0.55%, while the Sensex has declined by 1.51%. However, the longer-term performance reveals a more troubling picture for Valson Industries, with a year-to-date decline of 10.98% compared to the Sensex's -4.54%. In the past year, the stock has dropped 17.57%, while the Sensex has risen by 2.05%. The stock opened with a gap down of 7.25% today and reached an intraday low of Rs 26.7, reflecting a 9.95% decrease. Additionally, Valson Industries is trading below it...

Read More

Valson Industries Faces Operational Challenges Amid Declining Profitability and High Debt Concerns

2025-02-24 18:21:00Valson Industries, a microcap textile company, has recently adjusted its evaluation amid flat financial performance for the quarter ending December 2024. The firm faces challenges with operational efficiency, declining operating profits, and a high Debt to EBITDA ratio, raising concerns about its long-term financial health.

Read More

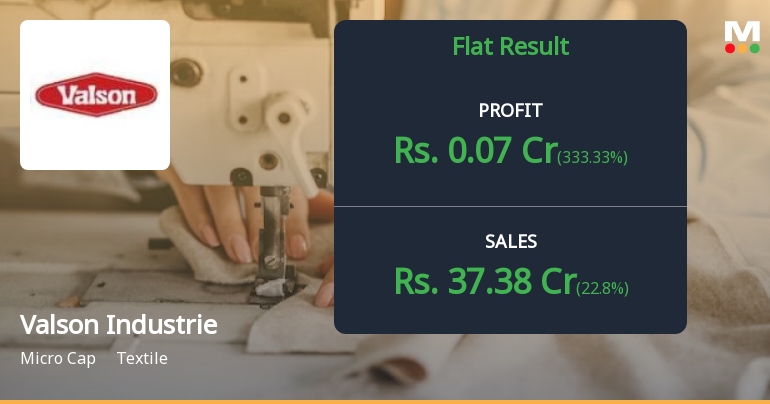

Valson Industries Reports Record Sales Amid Mixed Financial Performance in December 2024

2025-02-12 17:27:51Valson Industries reported its financial results for the quarter ending December 2024, showcasing its highest quarterly net sales in five quarters at Rs 37.59 crore, alongside an operating profit of Rs 0.98 crore. However, the debtors turnover ratio has declined, indicating challenges in debt settlement.

Read MoreClosure of Trading Window

26-Mar-2025 | Source : BSEEnclosed is an intimation of closure of Trading Window

Integrated Filing (Financial)

12-Feb-2025 | Source : BSEEnclosed is Integrated Filing (Financial) for the quarter ended 31-Dec-2024

Un-Audited Financial Results For 31-Dec-2024

12-Feb-2025 | Source : BSEEnclosed are the un-audited financial results for the quarter and nine months ended 31-Dec-2024

Corporate Actions

No Upcoming Board Meetings

Valson Industries Ltd has declared 10% dividend, ex-date: 20 Sep 19

No Splits history available

Valson Industries Ltd has announced 1:1 bonus issue, ex-date: 07 Dec 09

No Rights history available