Varroc Engineering Shows Signs of Recovery Amidst Recent Declines in Stock Performance

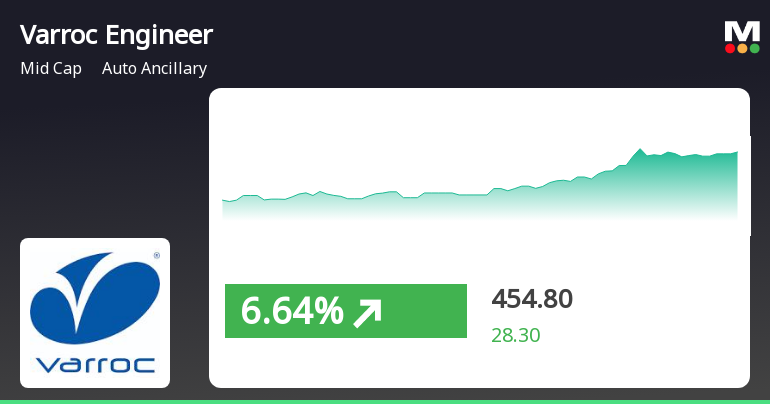

2025-03-27 15:05:31Varroc Engineering, an auto ancillary midcap, experienced a notable performance on March 27, 2025, reversing a two-day decline. The stock reached an intraday high of Rs 460.35. While it has shown short-term volatility, it has demonstrated significant long-term growth over three and five years.

Read MoreVarroc Engineering Faces Mixed Technical Trends Amid Market Challenges

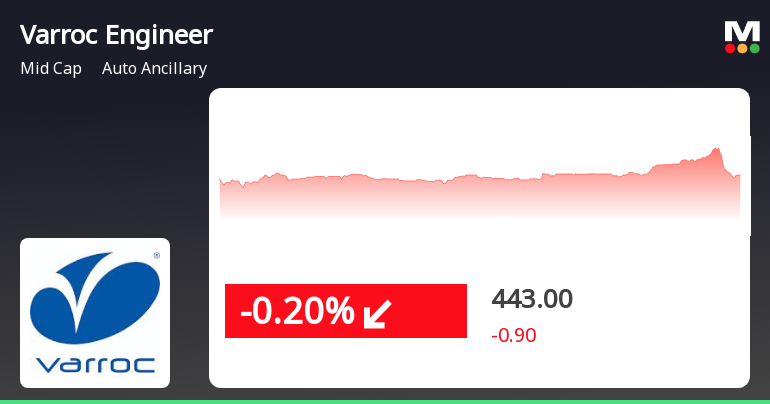

2025-03-27 08:03:54Varroc Engineering, a midcap player in the auto ancillary sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 443.90, slightly down from its previous close of 451.50. Over the past year, Varroc has faced challenges, with a return of -12.16%, contrasting with a 6.65% gain in the Sensex during the same period. In terms of technical indicators, the weekly MACD and KST are both bearish, while the monthly readings show a mildly bearish trend. The moving averages indicate a bearish stance on a daily basis. Interestingly, the On-Balance Volume (OBV) remains bullish on both weekly and monthly scales, suggesting some underlying strength despite the overall bearish sentiment. Varroc's performance over various time frames reveals a mixed picture. While it has shown a notable return of 194.07% over the past five years, its year-to-date perfor...

Read MoreVarroc Engineering Faces Technical Trend Shifts Amid Market Volatility

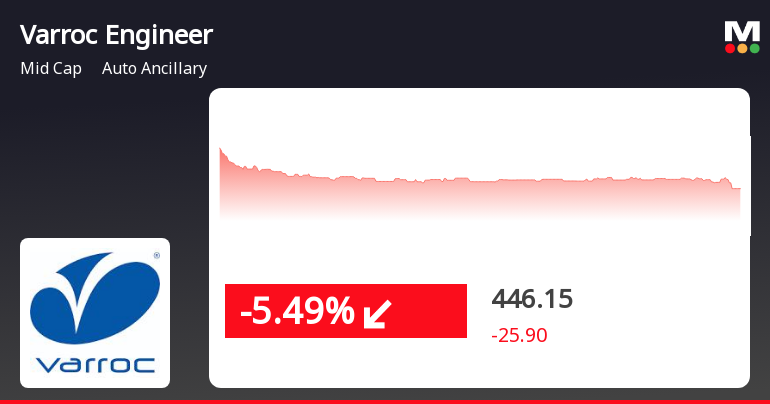

2025-03-26 08:04:42Varroc Engineering, a midcap player in the auto ancillary sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 451.50, down from a previous close of 472.05, with a notable 52-week high of 717.00 and a low of 398.90. Today's trading saw a high of 478.95 and a low of 446.15, indicating some volatility. In terms of technical indicators, the MACD shows a bearish trend on a weekly basis, while the monthly perspective is mildly bearish. The Relative Strength Index (RSI) currently presents no signal for both weekly and monthly evaluations. Bollinger Bands indicate a mildly bearish trend weekly, with a sideways movement monthly. Moving averages reflect a bearish stance on a daily basis, while the KST shows a bearish trend weekly and mildly bearish monthly. Interestingly, the On-Balance Volume (OBV) remains bullish on both weekly and monthly ...

Read More

Varroc Engineering Faces Volatility Amid Mixed Signals and Recent Gains

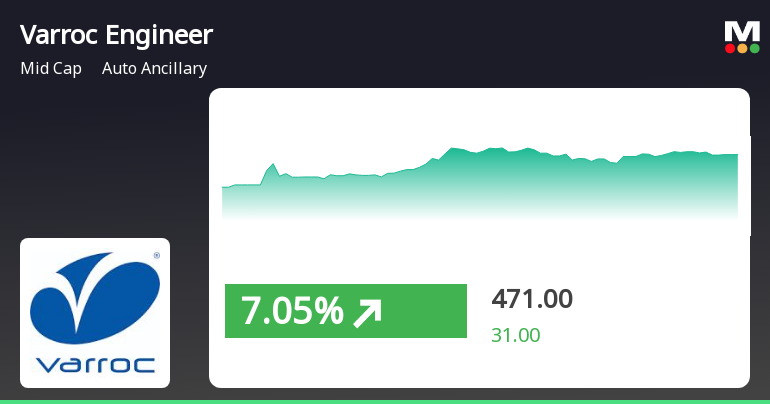

2025-03-25 15:50:25Varroc Engineering, a midcap auto ancillary firm, saw a notable decline on March 25, 2025, following a five-day gain streak. The stock's performance lagged behind the broader market, with high volatility observed intraday. While it has outperformed the Sensex recently, longer-term trends indicate significant challenges.

Read More

Varroc Engineering Shows Strong Short-Term Gains Amid Mixed Long-Term Performance

2025-03-24 10:05:32Varroc Engineering, a midcap auto ancillary firm, experienced notable activity on March 24, 2025, with a significant daily gain. The stock has shown a strong upward trend over the past week, although its longer-term performance remains mixed compared to broader market indices.

Read More

Varroc Engineering Shows Signs of Trend Reversal Amidst Mixed Market Performance

2025-03-18 10:01:05Varroc Engineering, a midcap auto ancillary firm, experienced a notable uptick after three days of decline, outperforming its sector today. Despite this positive movement, the stock remains below key moving averages, reflecting a mixed performance over various time frames amid broader market trends.

Read More

Varroc Engineering Faces Continued Volatility Amid Declining Profitability and Weak Fundamentals

2025-03-17 10:39:52Varroc Engineering, a midcap auto ancillary firm, has faced notable volatility, reaching a new 52-week low. The company has struggled with a significant decline in profit after tax and a negative one-year return, alongside weak long-term fundamentals and high debt levels, indicating ongoing challenges in its market performance.

Read More

Varroc Engineering Shows Resilience Amid Mixed Market Conditions and Gains Momentum

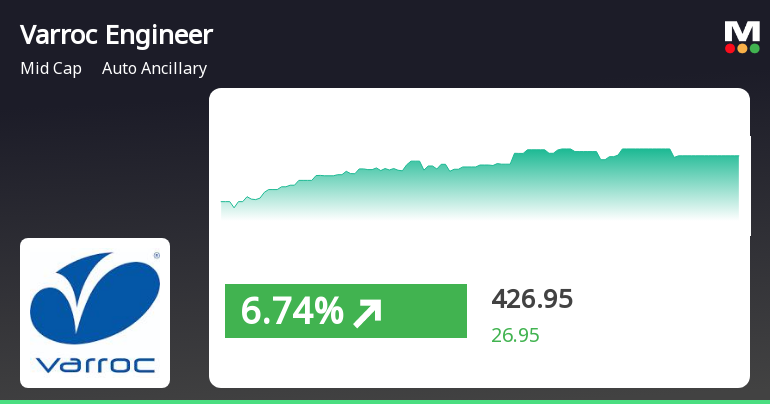

2025-03-06 10:20:30Varroc Engineering has demonstrated strong performance in the auto ancillary sector, achieving notable gains over three consecutive days. The stock has outperformed its sector and reached a significant intraday high. Despite mixed signals from moving averages, the company's resilience is evident amid broader market fluctuations.

Read More

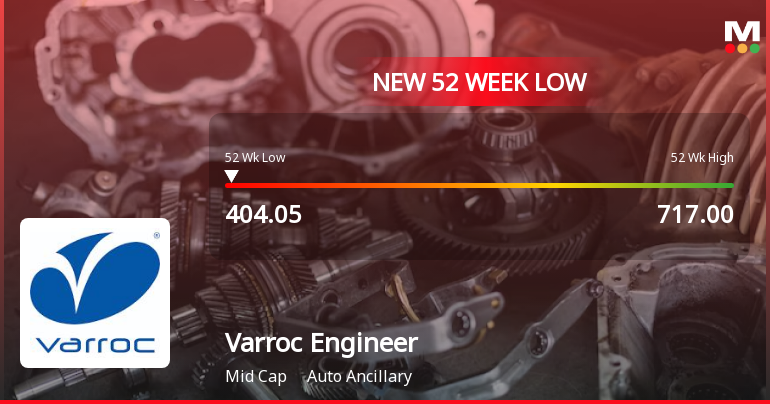

Varroc Engineering Hits 52-Week Low Amid Broader Sector Challenges

2025-03-03 09:37:44Varroc Engineering, a midcap auto ancillary firm, has hit a new 52-week low, marking its sixth consecutive day of losses and an 8.77% decline over this period. The stock's one-year performance is down 18.42%, significantly underperforming the Sensex, which has seen minimal decline.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

03-Apr-2025 | Source : BSENil Certification

Compliance-57 (5) : intimation after the end of quarter

01-Apr-2025 | Source : BSEConfirmation of Payment of interest/Principal obligations for Q-4 FY 2024-25

Compliances-Half Yearly Communication - Debt Instruments

01-Apr-2025 | Source : BSEHalf Yearly Communication-Debentures as per Chapter VIII of SEBI Master Circular dated August 10 2021

Corporate Actions

No Upcoming Board Meetings

Varroc Engineering Ltd has declared 300% dividend, ex-date: 25 Feb 20

No Splits history available

No Bonus history available

No Rights history available