Vedavaag Systems Experiences Valuation Grade Change Amid Competitive Market Landscape

2025-04-01 08:00:14Vedavaag Systems, a microcap player in the IT software industry, has recently undergone a valuation adjustment, reflecting a notable shift in its financial standing. The company's price-to-earnings ratio stands at 9.01, while its price-to-book value is recorded at 0.66. Additionally, Vedavaag's enterprise value to EBITDA ratio is 4.20, and its enterprise value to EBIT is 6.49, indicating a competitive position within its sector. The company also boasts a PEG ratio of 0.22 and a dividend yield of 1.76%. Return on capital employed (ROCE) is reported at 7.85%, with return on equity (ROE) at 5.84%. These metrics suggest a solid operational performance relative to its peers. In comparison to other companies in the industry, Vedavaag Systems presents a more favorable valuation profile. For instance, while NINtec Systems is categorized as very expensive with a PE ratio of 54.07, and Silver Touch and Blue Cloud S...

Read More

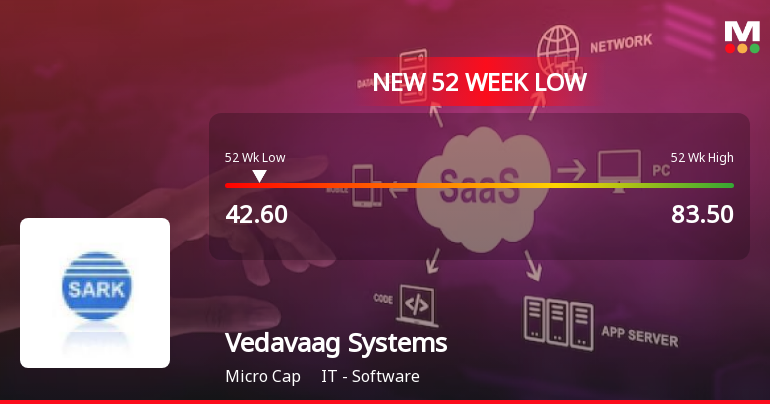

Vedavaag Systems Hits 52-Week Low Amid Broader Market Decline and Small-Cap Resilience

2025-03-28 09:39:54Vedavaag Systems, a microcap IT software firm, has reached a new 52-week low amid a broader market decline. The stock has underperformed its sector and the Sensex over the past year, despite modest growth in net sales and a low debt-to-equity ratio. Technical indicators suggest a bearish outlook.

Read More

Vedavaag Systems Approaches 52-Week Low Amid Broader Market Resilience

2025-03-27 13:05:15Vedavaag Systems, a microcap IT software firm, is nearing a 52-week low, trading just 0.7% above it. Despite modest growth in net sales and operating profit, the company has underperformed its sector and benchmarks, with a 1-year decline of 6.98% amid broader market resilience.

Read MoreVedavaag Systems Adjusts Valuation Grade, Highlighting Competitive Edge in IT Sector

2025-03-25 08:00:18Vedavaag Systems, a microcap player in the IT software industry, has recently undergone a valuation adjustment, reflecting its current financial metrics and market position. The company showcases a price-to-earnings (P/E) ratio of 10.20 and a price-to-book value of 0.75, indicating a potentially favorable valuation relative to its assets. Additionally, Vedavaag's enterprise value to EBITDA stands at 4.77, while its enterprise value to EBIT is recorded at 7.37, suggesting efficient operational performance. The company also boasts a PEG ratio of 0.25, which may indicate growth potential relative to its earnings. With a dividend yield of 1.56%, Vedavaag Systems provides a return to shareholders, albeit modest. The latest return on capital employed (ROCE) is 7.85%, and the return on equity (ROE) is 5.84%, reflecting its profitability metrics. In comparison to its peers, Vedavaag Systems presents a more attrac...

Read More

Vedavaag Systems Faces Continued Volatility Amidst Declining Stock Performance and Growth Concerns

2025-03-04 09:40:33Vedavaag Systems, an IT software microcap, has faced notable volatility, reaching a new 52-week low. The stock has declined significantly over the past ten days and underperformed its sector. Despite some positive financial results, long-term growth prospects appear weak, with the company lagging behind market peers.

Read MoreVedavaag Systems Faces Mixed Technical Trends Amid Market Evaluation Revision

2025-02-25 10:29:14Vedavaag Systems, a microcap player in the IT software industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 55.00, showing a slight increase from the previous close of 52.00. Over the past year, Vedavaag Systems has experienced a stock return of -2.40%, contrasting with a positive return of 2.08% from the Sensex during the same period. The technical summary indicates a bearish sentiment in various indicators, including the MACD and Bollinger Bands, which are both signaling bearish trends on a weekly basis. The moving averages also reflect a bearish stance, while the KST shows a mixed picture with a bullish monthly outlook. The Dow Theory presents a mildly bullish trend on a weekly basis, suggesting some underlying strength despite the overall bearish indicators. In terms of performance, Vedavaag Systems has faced challenges, parti...

Read More

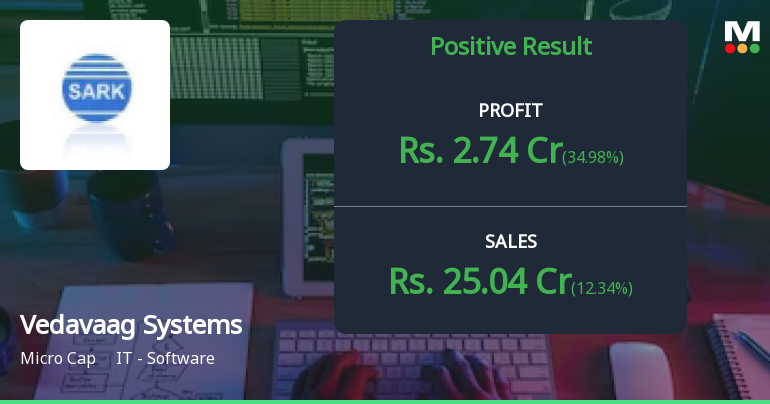

Vedavaag Systems Reports Strong Quarterly Results Amid Long-Term Growth Concerns

2025-02-24 18:14:33Vedavaag Systems, a microcap IT software firm, has recently experienced a change in evaluation. The company reported strong quarterly financial results, including a profit before tax of Rs 4.26 crore. However, long-term growth appears limited, with modest annual sales growth and challenges in market sentiment reflected in its stock performance.

Read MoreVedavaag Systems Faces Mixed Performance Amid Broader Market Trends and Challenges

2025-02-20 11:57:04Vedavaag Systems Ltd., a microcap player in the IT software industry, has shown mixed performance metrics in recent trading sessions. With a market capitalization of Rs 168.00 crore, the company currently has a price-to-earnings (P/E) ratio of 16.81, significantly lower than the industry average of 33.52. Over the past year, Vedavaag Systems has experienced a decline of 6.22%, contrasting with the Sensex's gain of 3.64%. In the short term, the stock has seen a slight decrease of 0.13% today, while the Sensex fell by 0.29%. However, the stock has shown some resilience over the past week, rising by 2.31% compared to a 0.55% drop in the Sensex. Longer-term performance reveals a more challenging landscape for Vedavaag Systems, with a year-to-date decline of 15.52% and a three-year performance drop of 17.37%. In contrast, the stock has outperformed the Sensex over the five-year and ten-year periods, with gain...

Read More

Vedavaag Systems Reports Strong Financial Growth and Improved Profitability in December 2024 Results

2025-02-17 10:48:08Vedavaag Systems has announced its financial results for the quarter ending December 2024, highlighting significant achievements. The company reported its highest Profit Before Tax at Rs 4.26 crore and net sales of Rs 29.49 crore, reflecting a strong growth trend. Operating profit and margins also showed improvement, indicating enhanced efficiency.

Read MoreClosure of Trading Window

27-Mar-2025 | Source : BSEIntimation of closure of trading window

Board Meeting Outcome for Intimation Of Conversion Of Warrants Into Equity Shares Under The Securities And Exchange Board Of India (Listing Obligations And Disclosure Requirements) Regulations 2015 (SEBI Listing Regulations)

20-Mar-2025 | Source : BSEAllotment of 293700 equity shares on conversion of warrants

Board Meeting Intimation for Notice Of Board Meeting To Be Held On March 20 2025 To Consider And Approve The Conversion Of Warrants Into Equity Shares Of The Company.

17-Mar-2025 | Source : BSEVEDAVAAG Systems Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 20/03/2025 inter alia to consider and approve Pursuant to Regulation 30 of SEBI (Listing Obligations & Disclosure Requirements) Regulations 2015 we wish to inform you that a Meeting of the Board of Directors of the Company will be held on Thursday March 20 2025 at registered office of the Company situated at 1-89/G/113 NR 3rd Floor Park View Gafoor Nagar Madhapur Hyderabad Shaikpet Telangana India 500081 to consider and approve the conversion of Warrants into Equity Shares of the Company.

Corporate Actions

No Upcoming Board Meetings

Vedavaag Systems Ltd. has declared 7% dividend, ex-date: 23 Sep 24

No Splits history available

No Bonus history available

No Rights history available