Veeram Securities Adjusts Evaluation Amid Mixed Market Signals and Strong Valuation Metrics

2025-03-27 08:09:45Veeram Securities, a player in the Diamond & Gold Jewellery sector, has recently adjusted its evaluation, reflecting changes in financial metrics and market position. This revision highlights the complexities of its current standing, influenced by technical indicators and valuation metrics, amidst a backdrop of mixed market sentiment.

Read MoreVeeram Securities Adjusts Valuation Grade Amid Competitive Industry Landscape

2025-03-24 08:00:59Veeram Securities, a microcap player in the Diamond and Gold Jewellery industry, has recently undergone a valuation adjustment, reflecting a shift in its financial standing. The company's current price is noted at 9.66, with a previous close of 9.88. Over the past year, Veeram Securities has shown a return of 8.66%, outperforming the Sensex, which recorded a return of 5.87% in the same period. Key financial metrics reveal a PE ratio of 21.37 and a PEG ratio of 0.27, indicating a favorable valuation relative to its earnings growth. The company’s EV to EBITDA stands at 19.15, while the EV to Sales ratio is 3.14. Despite a negative ROCE of -16.37%, the ROE is at 14.48%, suggesting effective equity utilization. In comparison to its peers, Veeram Securities maintains a competitive edge with a lower PE ratio than RBZ Jewellers and Uday Jewellery, both of which are rated attractive. Additionally, it outperforms ...

Read More

Veeram Securities Shows Bullish Technical Shift Amid Mixed Financial Performance and Rising Promoter Confidence

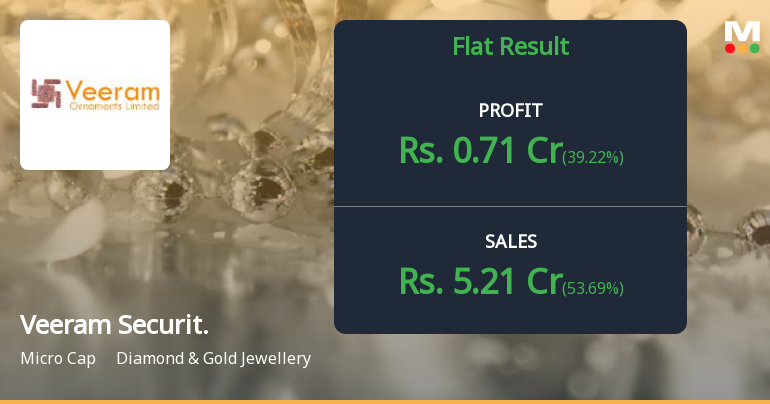

2025-03-21 08:02:52Veeram Securities, a microcap in the Diamond and Gold Jewellery sector, has recently adjusted its evaluation, reflecting a shift in its technical outlook. Despite flat quarterly financial performance, the company has achieved a 14.22% return over the past year and an 80% profit increase, alongside rising promoter confidence.

Read MoreVeeram Securities Adjusts Valuation Amid Mixed Performance in Jewellery Sector

2025-03-05 08:00:59Veeram Securities, a microcap player in the Diamond and Gold Jewellery industry, has recently undergone a valuation adjustment. The company's current price stands at 9.29, reflecting a notable increase from the previous close of 8.55. Over the past year, Veeram has experienced a stock return of -4.33%, which contrasts with a modest gain of -1.19% in the Sensex during the same period. Key financial metrics for Veeram include a PE ratio of 20.55 and an EV to EBITDA ratio of 18.40. The company's PEG ratio is notably low at 0.26, indicating potential growth relative to its earnings. However, the return on capital employed (ROCE) is reported at -16.37%, while the return on equity (ROE) is at 14.48%. In comparison to its peers, Veeram's valuation metrics present a mixed picture. While it maintains an attractive valuation, competitors like Manoj Vaibhav and Ashapuri Gold show stronger performance indicators, par...

Read More

Veeram Securities Faces Growth Challenges Amidst Rising Promoter Confidence and Debt Concerns

2025-02-27 18:53:28Veeram Securities, a microcap in the Diamond and Gold Jewellery sector, has recently adjusted its evaluation amid flat financial performance for the December 2024 quarter. The company faces challenges with declining net sales and debt management, yet maintains a modest profitability level and increased promoter confidence.

Read More

Veeram Securities Shows Stability Amid Mixed Financial Metrics and Rising Promoter Confidence

2025-02-21 18:15:41Veeram Securities, a microcap in the Diamond and Gold Jewellery sector, has recently adjusted its evaluation amid stable financial performance for the quarter ending December 2024. While profits surged by 80% and promoter confidence increased, the company faces challenges with declining net sales and a low EBIT to Interest ratio.

Read More

Veeram Securities Faces Financial Challenges Amidst Promoter Stake Increase and Technical Momentum

2025-02-14 18:34:11Veeram Securities, a microcap in the Diamond & Gold Jewellery sector, has recently experienced an evaluation adjustment reflecting its performance trends. The company reported flat financial results in Q3 FY24-25, with concerns over debt management and profitability, while promoter confidence has increased with a higher stake.

Read More

Veeram Securities Adjusts Valuation Amid Rising Profits and Promoter Confidence

2025-02-10 18:57:26Veeram Securities, a microcap in the Diamond and Gold Jewellery sector, has recently adjusted its evaluation amid flat quarterly performance but an 80% profit increase over the past year. Promoter ownership has risen to 55%, while long-term net sales show an 11.41% CAGR over five years.

Read More

Veeram Securities Reports Flat Q3 Performance Amid 25.75% Year-on-Year Sales Growth

2025-02-07 21:53:08Veeram Securities has announced its financial results for the quarter ending February 2025, reporting flat performance for the third quarter of FY24-25. The company achieved net sales of Rs 17.09 crore for the nine-month period, reflecting a year-on-year growth of 25.75%, indicating resilience in its operations.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSECompliance Certificate under Reg74(5) for the quarter ended 31st March 2025

Corporate Action-Outcome of Right issue

05-Apr-2025 | Source : BSEThe Board of Directors of the Company in their meeting held on today i.e. April 5 2025 has considered and approved Draft Letter of offer to be filled with BSE Limited (Stock Exchange) and Board (SEBI)

Board Meeting Outcome for Outcome Of The Meeting Of The Board Of Directors Of The Company Held On April 5 2025 For The Proposed Rights Issue Of Equity Shares Of Face Value Of Rs. 02.00/- (The Equity Shares) Of Veeram Securities Limited - Fund Raising.

05-Apr-2025 | Source : BSEwe wish to inform you that the Board of Directors of Veeram Securities Limited at its meeting held on today i.e. Saturday April 05 2025 at the Companys Registered Office has inter-alia considered and approved along with other agenda The Draft Letter of Offer in relation to the Rights Issue of the Company to be filed with BSE Limited (the Stock Exchange) for their Prior approval for Issue of the Rights Equity Shares and will also be submitted with the Board (SEBI) for information and dissemination on the Boards website.

Corporate Actions

No Upcoming Board Meetings

Veeram Securities Ltd has declared 2% dividend, ex-date: 21 Feb 25

Veeram Securities Ltd has announced 2:10 stock split, ex-date: 18 Apr 22

Veeram Securities Ltd has announced 1:2 bonus issue, ex-date: 14 Oct 22

No Rights history available