Venkys Adjusts Valuation Grade Amid Strong Financial Metrics and Competitive Positioning

2025-04-02 08:00:36Venkys (India), a small-cap player in the FMCG sector, has recently undergone a valuation adjustment, reflecting its strong financial metrics and market position. The company's price-to-earnings ratio stands at 17.21, while its price-to-book value is recorded at 1.63. Additionally, Venkys showcases a robust EV to EBITDA ratio of 11.65 and an EV to sales ratio of 0.68, indicating efficient capital utilization. The company also boasts a PEG ratio of 0.18, suggesting favorable growth prospects relative to its earnings. With a dividend yield of 0.42%, Venkys provides a modest return to shareholders. Its latest return on capital employed (ROCE) is 9.08%, and return on equity (ROE) is 9.48%, highlighting effective management of resources. In comparison to its peers, Venkys maintains a competitive edge with a lower PE ratio than some of its counterparts, such as Heritage Foods and Vadilal Industries, which have ...

Read MoreVenkys Faces Technical Trend Shift Amid Diverging Market Performance Metrics

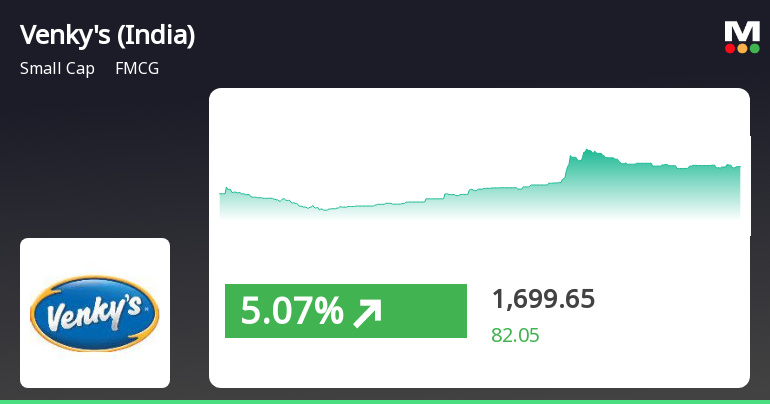

2025-03-27 08:00:39Venkys (India), a small-cap player in the FMCG sector, has recently undergone a technical trend adjustment, reflecting shifts in its market performance metrics. The company's current stock price stands at 1,613.00, down from a previous close of 1,696.15. Over the past year, Venkys has experienced a stock return of 2.38%, contrasting with a 6.65% return from the Sensex, indicating a divergence in performance relative to the broader market. The technical summary reveals a bearish sentiment across various indicators. The MACD shows bearish trends on both weekly and monthly scales, while Bollinger Bands also reflect a bearish outlook. Moving averages indicate a consistent bearish trend, and the On-Balance Volume (OBV) suggests a mildly bearish stance in the weekly and monthly assessments. Despite these challenges, Venkys has demonstrated resilience over longer periods, with a notable 112.14% return over the ...

Read MoreVenkys (India) Shows Mixed Technical Trends Amid Market Dynamics Shift

2025-03-25 08:01:21Venkys (India), a small-cap player in the FMCG sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1722.00, showing a notable increase from the previous close of 1688.00. Over the past year, Venkys has demonstrated a stock return of 7.49%, slightly outperforming the Sensex, which recorded a return of 7.07% in the same period. In terms of technical indicators, the weekly MACD suggests a mildly bullish trend, while the monthly perspective indicates a bearish stance. The Relative Strength Index (RSI) shows no significant signals for both weekly and monthly evaluations. Bollinger Bands reflect a sideways trend on a weekly basis, with a mildly bearish outlook for the monthly assessment. Daily moving averages also indicate a mildly bearish trend, while the KST presents a mixed view with a mildly bullish weekly trend contrasted by a bearis...

Read More

Venkys Faces Market Challenges Amid Declining Sales and Investor Participation

2025-03-18 09:41:36Venkys (India), a small-cap FMCG company, reached a new 52-week low amid five days of declining prices, though it showed some recovery today. Over the past year, the company has faced challenges, including a slight decline in net sales and reduced institutional investor participation, while maintaining a low debt-to-equity ratio.

Read More

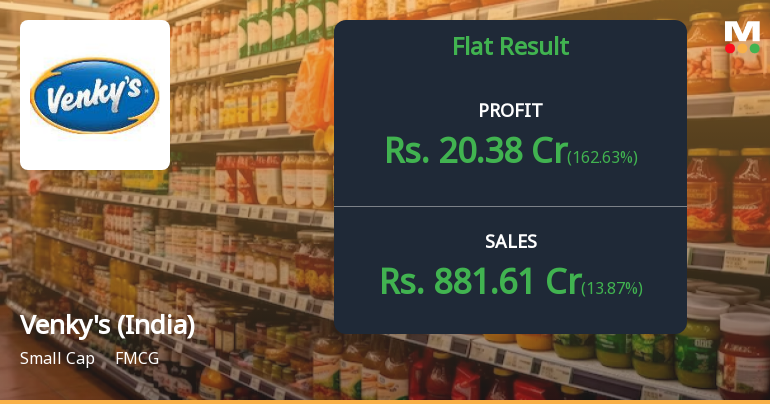

Venkys (India) Reports Stable Q3 FY24-25 Results Amid Score Adjustment

2025-02-07 15:47:42Venkys (India) has announced its financial results for the quarter ending February 2025, showing stable performance for Q3 FY24-25. The company's stock evaluation has adjusted, reflecting recent trends and events that may influence its market standing as it navigates the FMCG sector.

Read More

Venkys (India) Faces Stock Volatility Amid Trend Reversal in FMCG Sector

2025-02-07 15:00:20Venkys (India) has faced notable stock volatility today, experiencing a significant decline after two days of gains. The stock reached an intraday high before dropping to a low, with recorded intraday volatility of 5.84%. It currently sits above some moving averages but below others, underperforming its sector.

Read More

Venkys (India) Shows Strong Recovery Amid Market Volatility and Sector Challenges

2025-01-28 14:00:18Venkys (India), a small-cap FMCG company, saw significant trading activity on January 28, 2025, rebounding after two days of decline. The stock reached an intraday high of Rs 1764.5 amid high volatility, outperforming its sector and demonstrating relative resilience despite a slight decline over the past month.

Read MoreIntegrated Filing (Financial)

11-Feb-2025 | Source : BSEIntegrated Filing Financials for the quarter ended 31 December 2024

Announcement under Regulation 30 (LODR)-Press Release / Media Release

07-Feb-2025 | Source : BSEThe Press Release For the Financial Results Quarter Ended 31 December 2024.

Audited Financial Results Of Venkys India Limited For The Quarter Ended 31 December 2024.

07-Feb-2025 | Source : BSEAudited Financial Results of Venkys India Limited For the Quarter Ended 31 December 2024.

Corporate Actions

No Upcoming Board Meetings

Venkys (India) Ltd has declared 70% dividend, ex-date: 23 Aug 24

No Splits history available

Venkys (India) Ltd has announced 1:2 bonus issue, ex-date: 21 Dec 15

No Rights history available