Venus Pipes & Tubes Faces Mixed Technical Trends Amid Market Volatility

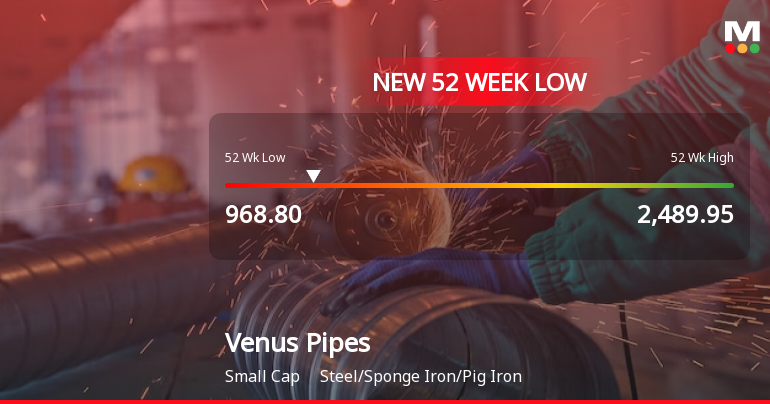

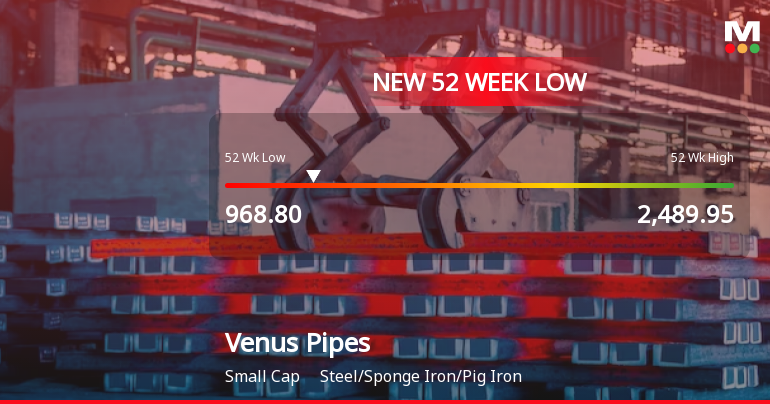

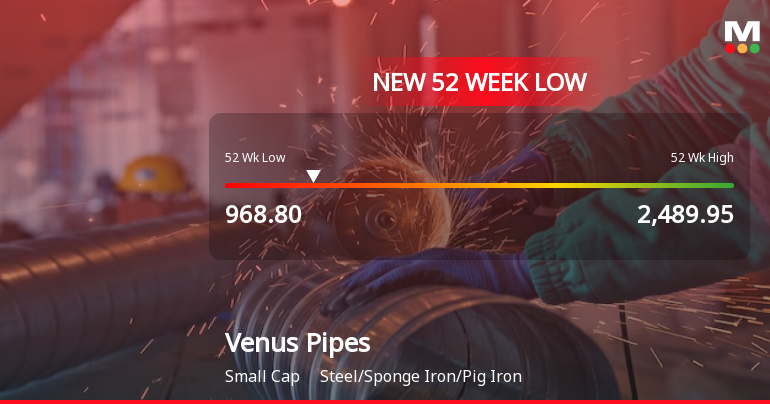

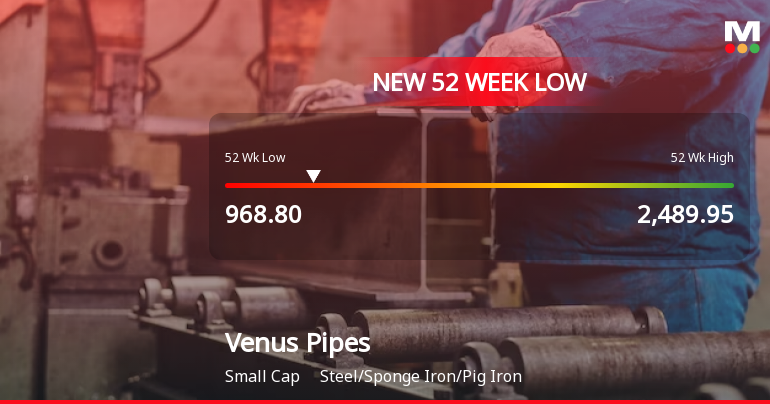

2025-04-02 08:10:08Venus Pipes & Tubes, a small-cap player in the Steel/Sponge Iron/Pig Iron industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1205.00, slightly down from the previous close of 1210.85. Over the past year, Venus Pipes has faced significant challenges, with a return of -34.6%, contrasting sharply with a modest gain of 2.72% in the Sensex during the same period. The technical summary indicates a mixed outlook, with the MACD showing mildly bullish signals on a weekly basis, while the monthly perspective leans mildly bearish. The Bollinger Bands and moving averages present a bearish stance, suggesting caution in the short term. Additionally, the KST and Dow Theory metrics also reflect a mildly bearish trend. In terms of price performance, Venus Pipes reached a 52-week high of 2,489.95 and a low of 968.80, highlighting the volatility e...

Read More

Venus Pipes & Tubes Faces Market Challenges Amid Mixed Financial Signals

2025-04-01 12:02:00Venus Pipes & Tubes, a small-cap entity in the steel industry, faced notable volatility, reaching a 52-week low before a slight recovery. The company has underperformed the market over the past year, showing mixed financial indicators, including a high return on capital but a significant decline in quarterly profits.

Read More

Venus Pipes & Tubes Faces Volatility Amid Declining Performance and Investor Concerns

2025-04-01 12:02:00Venus Pipes & Tubes has faced significant volatility, reaching a new 52-week low amid a five-day losing streak. Despite recent fluctuations and a year-long performance decline, the company shows strong management efficiency and healthy long-term growth, although concerns remain regarding profit and institutional investor participation.

Read More

Venus Pipes & Tubes Faces Volatility Amid Declining Financial Performance and Investor Interest

2025-04-01 12:01:59Venus Pipes & Tubes has faced significant volatility, reaching a new 52-week low amid a notable decline in its stock performance. Recent financial results show a decrease in profit and challenges in covering interest expenses, while institutional investor participation has also declined. Despite these issues, the company exhibits strong management efficiency and healthy long-term growth.

Read More

Venus Pipes & Tubes Faces Market Pressures Amidst Financial Performance Concerns

2025-04-01 12:01:56Venus Pipes & Tubes has faced significant volatility, reaching a new 52-week low amid concerns over its recent financial performance, including a decline in PAT and reduced institutional investor participation. Despite strong management efficiency and healthy long-term growth, the stock shows bearish technical indicators and underperforms the broader market.

Read MoreVenus Pipes & Tubes Faces Technical Trend Shifts Amid Market Volatility

2025-03-27 08:04:03Venus Pipes & Tubes, a small-cap player in the Steel/Sponge Iron/Pig Iron industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1237.75, down from a previous close of 1303.00, with a notable 52-week high of 2489.95 and a low of 1171.55. Today's trading saw a high of 1319.95 and a low of 1230.00, indicating volatility in its price movements. The technical summary reveals mixed signals across various indicators. The MACD shows a mildly bullish trend on a weekly basis but shifts to mildly bearish on a monthly scale. The Relative Strength Index (RSI) remains neutral, with no significant signals detected. Bollinger Bands and moving averages indicate bearish trends, while the On-Balance Volume (OBV) presents a mildly bullish outlook on a weekly basis, contrasting with a mildly bearish monthly perspective. In terms of performance, Venus P...

Read MoreVenus Pipes & Tubes Adjusts Valuation Amid Strong Performance Metrics and Market Position

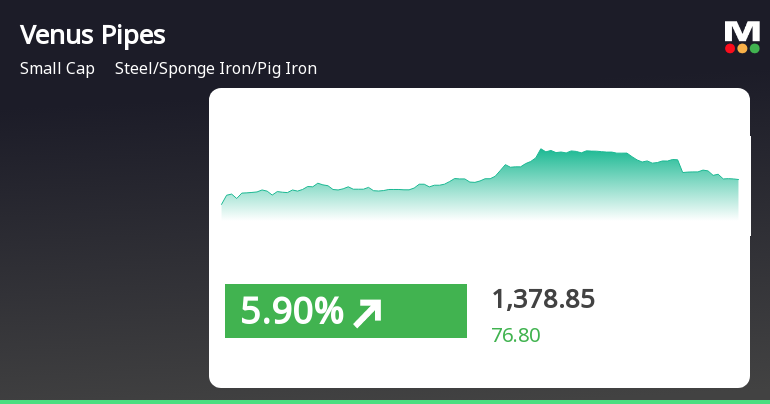

2025-03-20 08:01:07Venus Pipes & Tubes, a small-cap player in the Steel/Sponge Iron/Pig Iron industry, has recently undergone a valuation adjustment. The company's current price stands at 1,391.10, reflecting a notable increase from the previous close of 1,302.05. Over the past week, Venus Pipes has shown a stock return of 4.35%, outperforming the Sensex, which returned 1.92% in the same period. Key financial metrics reveal a PE ratio of 30.16 and an EV to EBITDA of 17.53, indicating a robust market position. The company also boasts a return on capital employed (ROCE) of 24.52% and a return on equity (ROE) of 19.50%, suggesting effective management of its resources. In comparison to its peers, Venus Pipes maintains a higher valuation profile, with its PE ratio exceeding that of Sunflag Iron and Kalyani Steels, while also showcasing a competitive edge in ROCE. This evaluation revision highlights the company's strong perfor...

Read More

Venus Pipes & Tubes Shows Strong Performance Amid Small-Cap Market Rally

2025-03-19 10:20:30Venus Pipes & Tubes has experienced notable stock performance, gaining 7.75% and outperforming its sector. The stock has shown consecutive gains over two days, with a total return of 12.26%. In the broader market, small-cap stocks are leading, while the Sensex has opened higher but remains below its 50-day moving average.

Read MoreVenus Pipes & Tubes Experiences Valuation Grade Change Amid Competitive Industry Landscape

2025-03-12 08:00:53Venus Pipes & Tubes, a small-cap player in the Steel/Sponge Iron/Pig Iron industry, has recently undergone a valuation adjustment. The company's current price stands at 1,359.00, reflecting a notable shift from its previous close of 1,420.25. Over the past year, Venus Pipes has experienced a return of -17.69%, contrasting with a slight gain of 0.82% in the Sensex during the same period. Key financial metrics for Venus Pipes include a PE ratio of 29.47 and an EV to EBITDA ratio of 17.14, indicating its market positioning relative to peers. Notably, the company's return on capital employed (ROCE) is reported at 24.52%, while the return on equity (ROE) stands at 19.50%. In comparison to its peers, Venus Pipes presents a more favorable valuation profile, particularly when juxtaposed with companies like Mishra Dhatu Nig and Kalyani Steels, which are positioned at higher valuation levels. This adjustment refle...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Apr-2025 | Source : BSECertificate under Reg 74(5)

Closure of Trading Window

25-Mar-2025 | Source : BSEClosure of Trading Window

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

27-Feb-2025 | Source : BSEIntimation of Schedule of Analyst/ Institutional Investor meetings

Corporate Actions

No Upcoming Board Meetings

Venus Pipes & Tubes Ltd has declared 5% dividend, ex-date: 29 Nov 24

No Splits history available

No Bonus history available

No Rights history available