Vesuvius India Adjusts Evaluation Amid Flat Financial Performance and Market Sentiment Shift

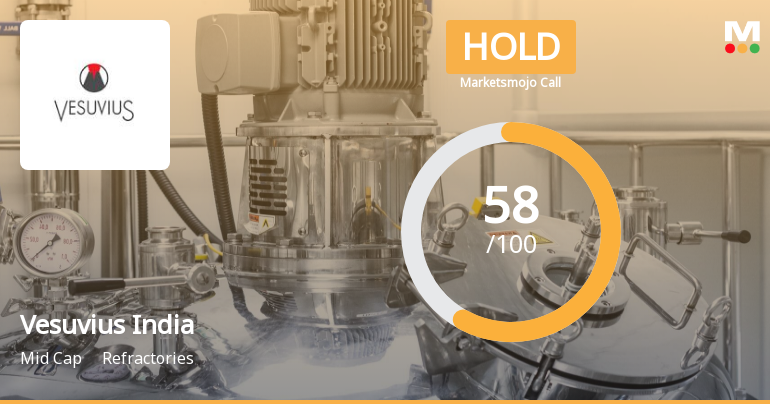

2025-04-02 08:07:12Vesuvius India, a midcap refractories company, has experienced a recent evaluation adjustment reflecting changes in market sentiment. The firm reported flat financial results for December 2024, with a profit after tax of Rs 59.93 crore, while maintaining a strong annual return and low debt-to-equity ratio.

Read MoreVesuvius India Experiences Technical Trend Shifts Amid Strong Long-Term Performance

2025-04-02 08:05:22Vesuvius India, a midcap player in the refractories industry, has recently undergone an evaluation revision reflecting shifts in its technical indicators. The company's current price stands at 4,415.05, down from a previous close of 4,563.90. Over the past year, Vesuvius India has demonstrated a notable stock return of 28.99%, significantly outperforming the Sensex, which recorded a return of 2.72% in the same period. In terms of technical metrics, the MACD indicates a mildly bullish trend on a weekly basis, while the monthly perspective shows a mildly bearish stance. The Bollinger Bands present a bearish outlook weekly, contrasting with a mildly bullish monthly trend. Moving averages suggest a mildly bearish sentiment on a daily basis, while the KST reflects mixed signals across weekly and monthly evaluations. The company's performance over various time frames highlights its resilience, particularly over...

Read MoreVesuvius India Shows Mixed Technical Signals Amid Strong Long-Term Performance

2025-04-01 08:01:53Vesuvius India, a midcap player in the refractories industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 4,563.90, showing a notable increase from the previous close of 4,423.75. Over the past year, Vesuvius India has demonstrated a robust performance, with a return of 37.37%, significantly outpacing the Sensex's return of 5.11% during the same period. In terms of technical indicators, the weekly MACD suggests a mildly bullish sentiment, while the monthly perspective remains mildly bearish. The Bollinger Bands indicate bullish trends on both weekly and monthly charts, and the On-Balance Volume (OBV) also reflects bullish momentum. However, daily moving averages present a mildly bearish outlook, indicating mixed signals in the short term. Vesuvius India's performance over various time frames highlights its resilience, particularly ...

Read MoreVesuvius India Experiences Technical Trend Shifts Amid Strong Long-Term Performance

2025-03-27 08:01:50Vesuvius India, a midcap player in the refractories industry, has recently undergone an evaluation revision reflecting shifts in its technical indicators. The stock is currently priced at 4,437.10, down from a previous close of 4,636.70. Over the past year, Vesuvius India has demonstrated a notable performance, with a return of 30.29%, significantly outperforming the Sensex, which recorded a return of 6.65% in the same period. The technical summary indicates a mixed outlook, with the MACD showing mildly bullish signals on a weekly basis but mildly bearish on a monthly basis. The Bollinger Bands present a bearish trend weekly, while monthly indicators suggest bullish momentum. Additionally, the On-Balance Volume (OBV) remains bullish for both weekly and monthly assessments, indicating strong buying pressure. In terms of stock performance, Vesuvius India has shown resilience over longer periods, with a rema...

Read More

Vesuvius India Shows Strong Growth Potential Amid Positive Market Dynamics

2025-03-26 08:02:52Vesuvius India, a midcap refractories company, has recently seen a change in its evaluation, reflecting a shift in technical trends. The firm has shown a strong annual growth rate of 26.21% in operating profit and maintains a low debt-to-equity ratio, indicating financial stability and institutional support.

Read MoreVesuvius India Shows Mixed Technical Trends Amid Strong Market Performance

2025-03-26 08:02:34Vesuvius India, a midcap player in the refractories industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 4,636.70, showing a slight increase from the previous close of 4,600.05. Over the past year, Vesuvius India has demonstrated significant resilience, achieving a return of 35.07%, compared to the Sensex's 7.12% during the same period. The company's performance metrics indicate a mixed technical landscape. While the MACD shows a mildly bullish trend on a weekly basis, the monthly perspective leans mildly bearish. The Bollinger Bands reflect a bullish stance in both weekly and monthly evaluations, suggesting some volatility in price movements. Additionally, the On-Balance Volume (OBV) indicates bullish sentiment on a weekly basis, further supporting the stock's recent performance. In terms of returns, Vesuvius India has outperfor...

Read MoreVesuvius India Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-25 08:03:01Vesuvius India, a midcap player in the refractories industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 4600.05, showing a notable increase from the previous close of 4547.15. Over the past year, Vesuvius India has demonstrated a robust performance, with a return of 34.00%, significantly outpacing the Sensex's return of 7.07% during the same period. The company's technical indicators present a mixed picture. The MACD shows a mildly bullish trend on a weekly basis, while the monthly outlook leans mildly bearish. Bollinger Bands indicate bullish conditions for both weekly and monthly assessments, suggesting some volatility in price movements. The moving averages, however, reflect a mildly bearish stance on a daily basis, indicating potential short-term challenges. In terms of returns, Vesuvius India has excelled over longer periods...

Read More

Vesuvius India Shows Strong Short-Term Gains Amid Mixed Market Trends

2025-03-10 11:05:15Vesuvius India, a midcap refractories company, experienced notable stock activity, achieving a significant intraday high and strong five-day returns. While currently above several short-term moving averages, it remains below longer-term averages. The broader market, represented by the Sensex, shows a mixed trend, with year-to-date performance for Vesuvius India at a decline.

Read MoreVesuvius India Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-07 08:02:19Vesuvius India, a midcap player in the refractories industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 4,152.00, showing a slight increase from the previous close of 4,034.00. Over the past year, Vesuvius India has demonstrated a notable return of 25.85%, significantly outperforming the Sensex, which recorded a mere 0.34% return in the same period. In terms of technical indicators, the weekly MACD and KST are currently bearish, while the monthly readings show a mildly bearish trend. The Bollinger Bands also indicate a mildly bearish stance on both weekly and monthly charts. Moving averages reflect a similar mildly bearish sentiment on a daily basis. Notably, the Dow Theory suggests a mildly bullish trend on a weekly basis, indicating some underlying strength. When comparing the stock's performance to the Sensex, Vesuvius India h...

Read MoreClosure of Trading Window

26-Mar-2025 | Source : BSENotice of Trading Window Closure

Announcement under Regulation 30 (LODR)-Newspaper Publication

28-Feb-2025 | Source : BSECopy of Newspaper Advertisement pertaining to Financial Results for the Financial Year ended on December 31 2024

Integrated Filing (Financial)

27-Feb-2025 | Source : BSEIntegrated Filling (Financial) for the quarter and financial year ended December 31 2024.

Corporate Actions

No Upcoming Board Meetings

Vesuvius India Ltd has declared 145% dividend, ex-date: 30 Apr 25

No Splits history available

No Bonus history available

No Rights history available