Vidhi Specialty Food Ingredients Faces Technical Trend Shifts Amid Market Fluctuations

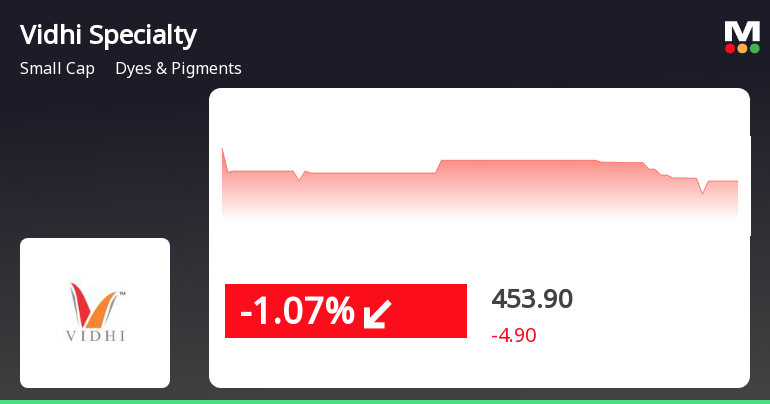

2025-04-03 08:02:01Vidhi Specialty Food Ingredients, a small-cap player in the Dyes & Pigments industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 454.70, slightly down from its previous close of 460.05. Over the past year, Vidhi has experienced fluctuations, with a 52-week high of 571.95 and a low of 387.95. In terms of technical indicators, the weekly MACD and Bollinger Bands suggest a bearish sentiment, while the monthly metrics show a mildly bearish trend. The moving averages also indicate a bearish position, contributing to the overall technical summary. Notably, the stock's performance over various periods reveals a mixed picture. In the past week, Vidhi has outperformed the Sensex with a return of 6.24%, while the Sensex recorded a decline of 0.87%. However, on a year-to-date basis, the stock has seen a decline of 13.88%, contrasting with th...

Read More

Vidhi Specialty Food Ingredients Navigates Mixed Performance Amid Broader Market Trends

2025-04-01 10:15:25Vidhi Specialty Food Ingredients saw an increase on April 1, 2025, despite underperforming its sector. The small-cap company has shown mixed performance, with recent gains over the week and month, but a decline over the past three months. Its moving averages reflect a mixed trend in performance.

Read More

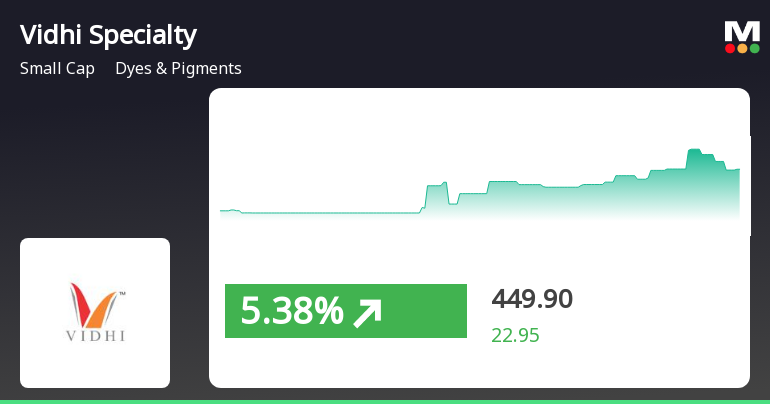

Vidhi Specialty Food Ingredients Shows Resilience Amid Broader Market Fluctuations

2025-03-28 12:35:16Vidhi Specialty Food Ingredients has rebounded after five days of decline, gaining 7.04% on March 28, 2025. The stock outperformed its sector and reached an intraday high of Rs 459. Despite a mixed trend in moving averages, it has shown resilience amid broader market fluctuations.

Read MoreVidhi Specialty Food Ingredients Faces Mixed Technical Trends Amid Market Volatility

2025-03-27 08:01:11Vidhi Specialty Food Ingredients, a small-cap player in the Dyes & Pigments industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 428.00, slightly down from its previous close of 428.70. Over the past year, the stock has experienced a high of 571.95 and a low of 387.95, indicating some volatility in its performance. The technical summary reveals a mixed picture. The MACD indicates bearish trends on both weekly and monthly scales, while the RSI shows bullish momentum on a weekly basis but no signal on a monthly basis. Bollinger Bands and moving averages also reflect bearish tendencies, suggesting caution in the short term. However, the On-Balance Volume (OBV) shows a mildly bullish trend on a weekly basis, indicating some positive trading volume. In terms of returns, Vidhi Specialty has faced challenges compared to the Sensex. Over ...

Read More

Vidhi Specialty Food Ingredients Faces Bearish Outlook Amidst Growth Concerns and Valuation Issues

2025-03-25 08:05:44Vidhi Specialty Food Ingredients, a small-cap company in the Dyes & Pigments sector, has experienced a recent evaluation adjustment reflecting a shift in its technical outlook. Despite positive quarterly financial results, concerns about long-term growth and high valuation metrics persist, alongside underwhelming market performance over the past year.

Read MoreVidhi Specialty Food Ingredients Shows Mixed Technical Trends Amid Market Volatility

2025-03-25 08:01:54Vidhi Specialty Food Ingredients, a small-cap player in the Dyes & Pigments industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 448.45, slightly down from the previous close of 453.00. Over the past year, the stock has seen a high of 571.95 and a low of 387.95, indicating significant volatility. In terms of technical indicators, the weekly MACD and Bollinger Bands are showing bearish signals, while the monthly metrics present a mildly bearish outlook. The Relative Strength Index (RSI) remains neutral on a weekly basis but indicates bullish sentiment on a monthly scale. The On-Balance Volume (OBV) shows no trend weekly, yet it is bullish monthly, suggesting mixed signals in trading volume. When comparing the company's performance to the Sensex, Vidhi Specialty has faced challenges. Over the past year, the stock has returned -3.74%...

Read MoreVidhi Specialty Food Ingredients Faces Mixed Technical Trends Amid Market Fluctuations

2025-03-19 08:01:47Vidhi Specialty Food Ingredients, a small-cap player in the Dyes & Pigments industry, has recently undergone an evaluation revision reflecting shifts in its technical indicators. The company's current stock price stands at 449.55, slightly above the previous close of 448.70. Over the past year, Vidhi has experienced a stock return of 2.00%, while the Sensex has returned 3.51% in the same period. The technical summary indicates a mixed performance across various metrics. The MACD shows bearish tendencies on both weekly and monthly scales, while the RSI remains bullish for both timeframes. Bollinger Bands suggest a mildly bearish outlook weekly, with a sideways trend monthly. Daily moving averages indicate bearish conditions, and the KST reflects a similar bearish sentiment on a weekly basis, though mildly bearish monthly. In terms of returns, Vidhi Specialty has shown resilience over longer periods, with a...

Read MoreVidhi Specialty Food Ingredients Navigates Mixed Market Trends Amidst Strong Long-Term Growth

2025-03-18 18:00:20Vidhi Specialty Food Ingredients, a small-cap player in the Dyes & Pigments industry, has shown notable activity today, reflecting a complex performance landscape. With a market capitalization of Rs 2,268.00 crore, the company currently has a price-to-earnings (P/E) ratio of 53.48, significantly higher than the industry average of 30.70. Over the past year, Vidhi Specialty Food Ingredients has recorded a modest gain of 2.00%, while the benchmark Sensex has outperformed with a rise of 3.51%. In the short term, the stock has seen a slight increase of 0.19% today, compared to the Sensex's 1.53% gain. However, the stock's performance over the last three months has been challenging, with a decline of 18.18%, contrasting with the Sensex's decrease of 6.09%. Longer-term trends reveal a more favorable picture, with a remarkable 896.78% increase over the past five years, significantly outpacing the Sensex's 160.83...

Read More

Vidhi Specialty Food Ingredients Shows Strong Performance Amid Valuation Concerns and Growth Constraints

2025-03-18 08:04:21Vidhi Specialty Food Ingredients has recently adjusted its evaluation, reflecting its market position and financial performance. The company reported strong third-quarter net sales of Rs 98.52 crore and maintained a solid liquidity position. However, long-term growth appears limited, with modest annual growth rates in sales and operating profit.

Read MoreClosure of Trading Window

25-Mar-2025 | Source : BSEIntimation of closure of trading window for the quarter and year ended March 31 2025 is enclosed.

Announcement under Regulation 30 (LODR)-Resignation of Company Secretary / Compliance Officer

07-Mar-2025 | Source : BSEResignation of CS and Compliance officer and KMP

Announcement under Regulation 30 (LODR)-Newspaper Publication

21-Jan-2025 | Source : BSECopy of newspaper publication dated 21.01.2025 is enclosed herewith.

Corporate Actions

No Upcoming Board Meetings

Vidhi Specialty Food Ingredients Ltd has declared 150% dividend, ex-date: 24 Jan 25

No Splits history available

No Bonus history available

No Rights history available