Vimta Labs Outperforms Sector Amid Broader Market Volatility and Small-Cap Gains

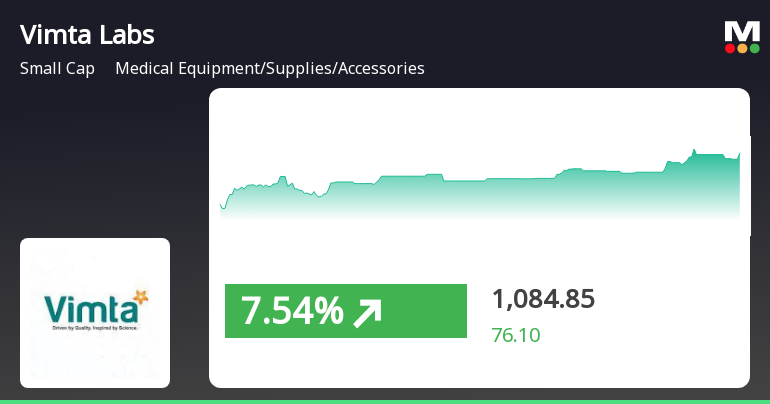

2025-04-03 12:45:20Vimta Labs, a small-cap company in the Medical Equipment sector, experienced notable gains on April 3, 2025, outperforming the sector average. The stock has shown a strong upward trend, trading above key moving averages and achieving a substantial return over the past year, significantly exceeding broader market performance.

Read MoreVimta Labs Shows Mixed Technical Trends Amid Strong Long-Term Performance

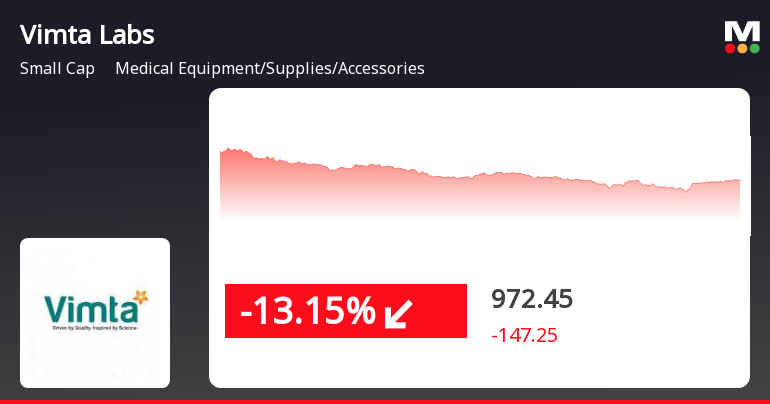

2025-04-02 08:00:57Vimta Labs, a small-cap player in the Medical Equipment/Supplies/Accessories industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 958.85, down from a previous close of 1000.10, with a notable 52-week high of 1,183.00 and a low of 420.00. Today's trading saw a high of 998.00 and a low of 941.20. In terms of technical indicators, the MACD shows a mixed picture with a mildly bearish signal on the weekly chart and a bullish signal on the monthly chart. The Bollinger Bands indicate a mildly bullish trend on both weekly and monthly bases, while moving averages on a daily basis also reflect a mildly bullish sentiment. However, the KST presents a mildly bearish outlook weekly, contrasting with its monthly bullish stance. When comparing Vimta Labs' performance to the Sensex, the company has shown significant returns over various periods. O...

Read More

Vimta Labs Faces Intraday Volatility Amid Strong Long-Term Performance Trends

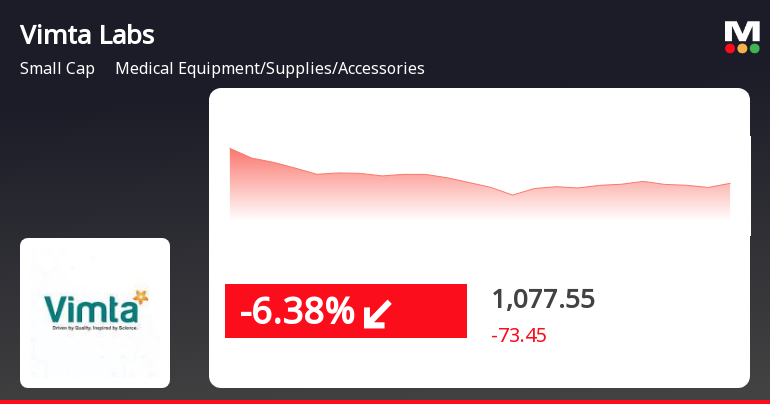

2025-03-24 09:30:19Vimta Labs, a small-cap medical equipment company, faced significant volatility on March 24, 2025, with an intraday high of Rs 1,174.05 and a low of Rs 1,091.40. Despite today's decline, the stock has outperformed the Sensex over the past year, reflecting a generally positive long-term trend.

Read More

Vimta Labs Exhibits Strong Stock Performance Amid Broader Market Gains

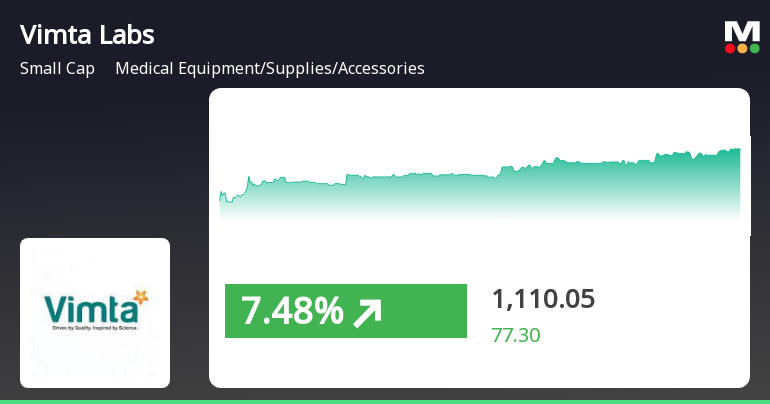

2025-03-18 15:30:51Vimta Labs, a small-cap medical equipment company, experienced notable stock activity on March 18, 2025, with a significant gain following a brief dip. The stock has shown strong performance metrics, trading above key moving averages and outperforming both its sector and the broader market over various time frames.

Read MoreVimta Labs Shows Mixed Technical Trends Amid Strong Long-Term Growth Performance

2025-03-10 08:00:17Vimta Labs, a small-cap player in the Medical Equipment/Supplies/Accessories industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 943.00, showing a notable increase from the previous close of 909.30. Over the past year, Vimta Labs has demonstrated impressive performance, with a return of 94.79%, significantly outpacing the Sensex, which recorded a mere 0.29% during the same period. In terms of technical indicators, the stock exhibits a mixed picture. The Moving Averages signal a bullish trend on a daily basis, while the Bollinger Bands indicate bullish momentum on both weekly and monthly scales. However, the MACD and KST present a more cautious outlook on the weekly timeframe, suggesting some volatility in the short term. Vimta Labs has shown remarkable long-term growth, with a staggering 960.74% return over the past five years, c...

Read More

Vimta Labs Shows Resilience Amid Broader Market Decline and Sector Gains

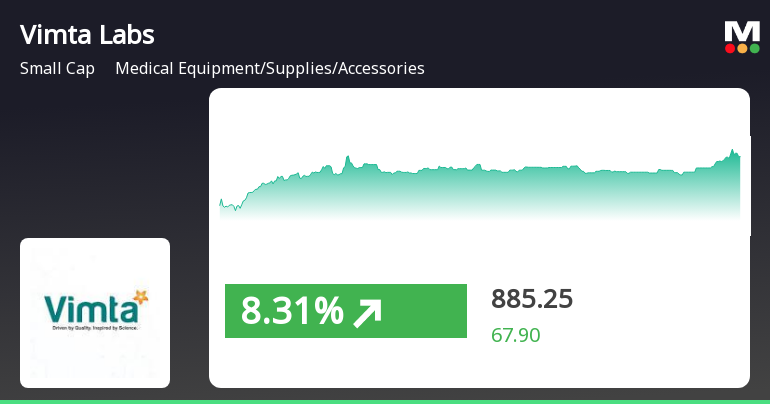

2025-03-04 14:45:17Vimta Labs, a small-cap company in the Medical Equipment sector, experienced a notable performance today, reversing a three-day decline. The stock outperformed its sector and demonstrated resilience over the past year, achieving significant gains despite a generally bearish market environment. Its moving averages reflect volatility and potential recovery.

Read MoreVimta Labs Experiences Valuation Grade Change Amid Strong Financial Performance and Competitive Positioning

2025-03-01 08:00:29Vimta Labs, a small-cap player in the Medical Equipment/Supplies/Accessories sector, has recently undergone a valuation adjustment. The company currently exhibits a price-to-earnings (PE) ratio of 31.91 and a price-to-book value of 5.69. Its enterprise value to EBITDA stands at 17.05, while the EV to EBIT is recorded at 24.42. The PEG ratio is noted at 0.86, indicating a favorable growth perspective relative to its earnings. In terms of financial performance, Vimta Labs has demonstrated a return on capital employed (ROCE) of 21.85% and a return on equity (ROE) of 15.84%. The company's dividend yield is relatively modest at 0.23%. When compared to its peers, Vimta Labs shows a more attractive valuation profile, particularly against Laxmi Dental, which has a significantly higher PE ratio of 70.49 and an EV to EBITDA of 80.13. Over the past year, Vimta Labs has outperformed the Sensex, with a stock return o...

Read MoreVimta Labs Shows Mixed Technical Trends Amidst Strong Long-Term Performance

2025-02-25 10:26:49Vimta Labs, a small-cap player in the Medical Equipment/Supplies/Accessories sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 950.85, showing a notable increase from the previous close of 933.60. Over the past year, Vimta Labs has demonstrated impressive performance, with a return of 93.83%, significantly outpacing the Sensex's return of 2.05% during the same period. The technical summary indicates a mixed outlook, with various indicators showing differing trends. The MACD reflects a mildly bearish stance on a weekly basis while remaining bullish on a monthly scale. The Bollinger Bands suggest a mildly bullish trend weekly and bullish monthly, indicating some volatility but overall positive momentum. Additionally, the moving averages and KST present a mildly bullish trend on a daily and weekly basis, respectively. In terms of re...

Read More

Vimta Labs Faces Volatility Amid Broader Sector Declines and Market Trends

2025-02-17 10:30:17Vimta Labs, a small-cap company in the Medical Equipment sector, saw a significant decline on February 17, 2025, despite earlier gains during the trading day. The stock's recent performance has been volatile, showing resilience over the past month while contrasting sharply with broader market trends.

Read MoreClosure of Trading Window

26-Mar-2025 | Source : BSEIntimation for Closure of Trading Window for the fourth quarter and year ended 31st March 2025.

Announcement under Regulation 30 (LODR)-Allotment of ESOP / ESPS

20-Mar-2025 | Source : BSEAllotment of Employee Stock Options under Vimta Labs Employee Stock Option Plan 2021- The ESOP Allotment Committee of the Board of Directors of the Company at their meeting held on 20th March2025 has allotted 11726 equity shares of face value of Rs.2.

Announcement under Regulation 30 (LODR)-Change in Management

05-Mar-2025 | Source : BSEChange in date of joining or appointment of Chief Financial Officer. The new date of joining is 6th March 2025.

Corporate Actions

No Upcoming Board Meetings

Vimta Labs Ltd has declared 100% dividend, ex-date: 11 Jul 24

Vimta Labs Ltd has announced 2:10 stock split, ex-date: 24 Feb 06

No Bonus history available

No Rights history available