Vinati Organics Faces Mixed Technical Trends Amidst Market Evaluation Revision

2025-03-25 08:01:24Vinati Organics, a midcap player in the chemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1,597.00, slightly down from the previous close of 1,607.45. Over the past year, Vinati Organics has experienced a stock return of 0.77%, which contrasts with the Sensex's return of 7.07% during the same period. The company's performance metrics reveal a mixed technical landscape. The MACD indicators for both weekly and monthly assessments are bearish, while the Bollinger Bands show a bearish trend on a weekly basis and a mildly bearish stance monthly. The daily moving averages also reflect a bearish sentiment. Notably, the KST presents a bullish outlook on a monthly basis, indicating some divergence in short-term and long-term trends. In terms of stock performance relative to the Sensex, Vinati Organics has shown a year-to-date...

Read MoreVinati Organics Shows Divergent Technical Trends Amidst Market Fluctuations

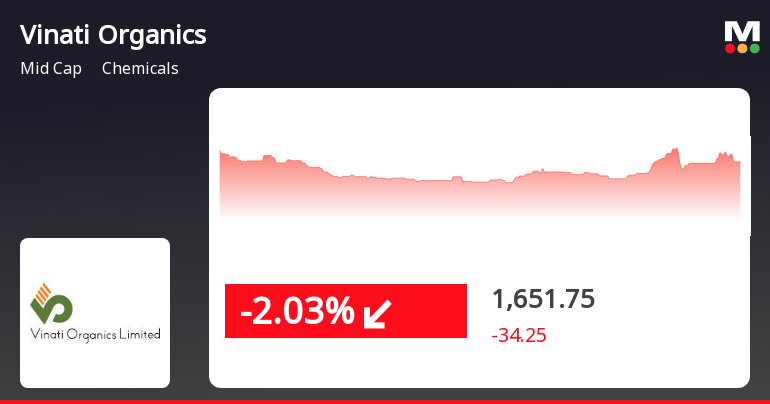

2025-03-19 08:00:59Vinati Organics, a midcap player in the chemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1569.15, showing a slight increase from the previous close of 1528.80. Over the past year, Vinati Organics has experienced a stock return of -3.99%, contrasting with a positive return of 3.51% from the Sensex, indicating a divergence in performance relative to the broader market. In terms of technical indicators, the weekly MACD and moving averages suggest a bearish sentiment, while the monthly KST presents a bullish outlook. The Bollinger Bands indicate a mildly bearish trend on both weekly and monthly scales. The On-Balance Volume (OBV) shows a mildly bullish trend on a weekly basis, but no significant trend is observed monthly. Looking at the company's performance over various time frames, it has faced challenges, particularly...

Read MoreVinati Organics Faces Market Challenges Amid Significant Trading Volatility

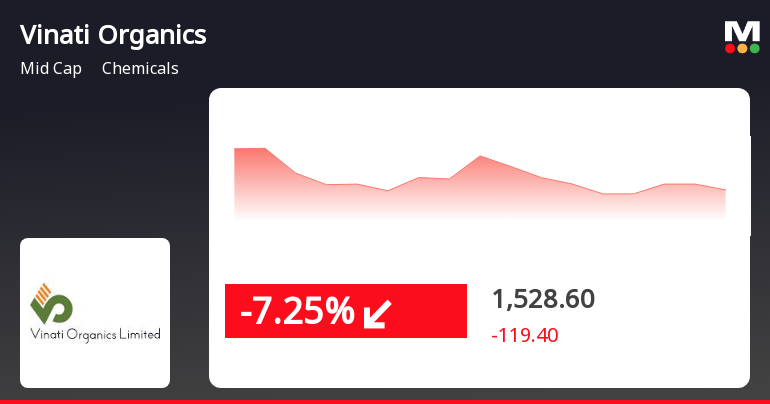

2025-02-28 09:35:07Vinati Organics, a midcap player in the chemicals industry, has experienced significant volatility in today's trading session. The stock opened with a notable loss of 5.64%, reflecting a broader trend of underperformance, as it fell 7.95% compared to the Sensex's decline of just 1.14%. This downturn marks a reversal after two consecutive days of gains. Currently, Vinati Organics is trading close to its 52-week low, just 4.08% above the low of Rs 1462.7. The stock reached an intraday low of Rs 1524.95, representing a decline of 7.47% at its lowest point today. In terms of technical indicators, Vinati Organics is trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, suggesting a bearish trend in the short to medium term. Over the past month, the stock has decreased by 4.83%, while the Sensex has only seen a 2.81% decline. These performance metrics highlight the challenges Vinati Or...

Read More

Vinati Organics Faces Significant Volatility Amid Broader Market Trends in Chemicals Sector

2025-02-28 09:30:20Vinati Organics, a midcap chemicals company, faced notable volatility with a significant stock price decline today. The stock is trading near its 52-week low and has reversed its recent gains, indicating a shift in market sentiment. It has underperformed compared to the broader market over the past month.

Read MoreVinati Organics Experiences Technical Trend Shift Amid Mixed Market Indicators

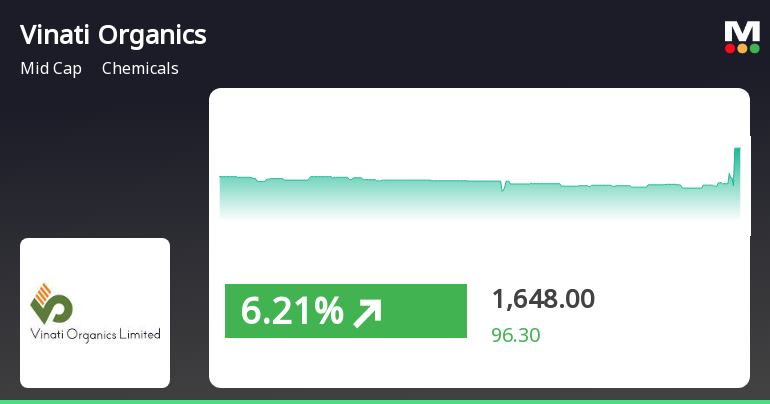

2025-02-28 08:00:27Vinati Organics, a midcap player in the chemicals industry, has recently undergone a technical trend adjustment. The company's current price stands at 1648.00, reflecting a notable shift from its previous close of 1551.70. Over the past year, Vinati Organics has experienced fluctuations, with a 52-week high of 2,331.05 and a low of 1,462.70. In terms of technical indicators, the MACD readings indicate a bearish sentiment on both weekly and monthly charts. The Bollinger Bands also reflect a bearish trend on a monthly basis, while the daily moving averages suggest a bearish outlook. The KST shows a mixed picture, being bearish weekly but bullish monthly. Meanwhile, the On-Balance Volume (OBV) indicates no trend on a weekly basis but is bullish monthly. When comparing the company's performance to the Sensex, Vinati Organics has shown varied returns. Over the past week, it recorded a stock return of 2.36%, co...

Read More

Vinati Organics Shows Strong Performance Amidst Sector Volatility and Market Trends

2025-02-27 15:45:16Vinati Organics has experienced notable trading activity, gaining 6.21% on February 27, 2025, and outperforming its sector. The stock reached an intraday high of Rs 1648, with significant volatility. Currently, it is above its 5-day moving average but below longer-term averages, reflecting a slight decline over the past month.

Read MoreVinati Organics Faces Mixed Technical Trends Amid Market Evaluation Adjustments

2025-02-25 10:28:21Vinati Organics, a midcap player in the chemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1546.25, showing a slight increase from the previous close of 1535.85. Over the past year, the stock has experienced a high of 2,331.05 and a low of 1,462.70, indicating notable volatility. The technical summary reveals a mixed picture, with various indicators suggesting differing trends. The MACD and Bollinger Bands are bearish on both weekly and monthly scales, while the RSI shows bullish momentum on a weekly basis. The KST presents a contrasting view, being bearish weekly but bullish monthly. Additionally, the moving averages indicate a bearish trend on a daily basis, while the On-Balance Volume (OBV) shows no clear trend weekly but is bullish monthly. In terms of performance, Vinati Organics has faced challenges compared to t...

Read More

Vinati Organics Faces Continued Stock Decline Amid Broader Market Trends

2025-01-27 12:15:15Vinati Organics has faced a significant decline in stock performance, marking its fourth consecutive day of losses. The company's stock has underperformed compared to its sector and the broader market, with notable declines over the past month. It is currently trading below multiple moving averages, indicating a sustained downward trend.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSEPlease refer attached

Intimation Under Regulation 30 Of The SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015 Regarding Additional Investment In Veeral Organics Pvt. Ltd. Wholly Owned Subsidiary Company

02-Apr-2025 | Source : BSEPlease refer attached

Closure of Trading Window

26-Mar-2025 | Source : BSEIntimation of Closure of Trading Window

Corporate Actions

No Upcoming Board Meetings

Vinati Organics Ltd has declared 700% dividend, ex-date: 03 Sep 24

Vinati Organics Ltd has announced 1:2 stock split, ex-date: 05 Feb 20

Vinati Organics Ltd has announced 1:2 bonus issue, ex-date: 22 Nov 07

No Rights history available