Vintage Coffee & Beverages Adjusts Valuation Grade, Signaling Strong Market Position

2025-04-02 08:00:49Vintage Coffee & Beverages, a small-cap player in the tea and coffee industry, has recently undergone a valuation adjustment, reflecting a notable shift in its financial standing. The company's price-to-earnings ratio stands at 40.33, while its price-to-book value is recorded at 4.30. Additionally, key metrics such as EV to EBIT and EV to EBITDA are at 36.30 and 30.54, respectively, indicating a robust operational performance. In terms of returns, Vintage Coffee has shown resilience, particularly over the past year, with a stock return of 68.26%, significantly outperforming the Sensex, which returned 2.72% during the same period. Over three years, the company has also delivered a return of 62.09%, compared to the Sensex's 28.25%. When compared to its peer, Andrew Yule & Co, which is currently facing challenges with a loss-making status, Vintage Coffee's financial metrics highlight its stronger market pos...

Read More

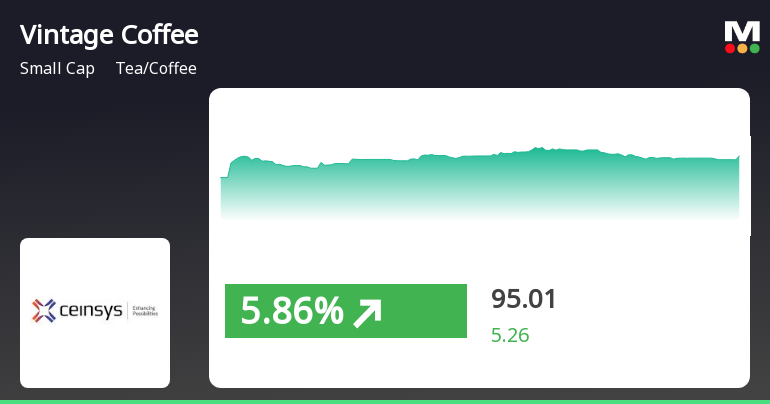

Vintage Coffee & Beverages Shows Strong Performance Amid Favorable Small-Cap Market Trends

2025-03-28 11:00:28Vintage Coffee & Beverages has experienced notable activity, with a recent increase and consecutive gains over two days, resulting in a substantial return. The stock is currently positioned above its short-term moving averages, while the broader market shows positive trends, particularly in small-cap stocks. Over the past year, the company has significantly outperformed the Sensex.

Read More

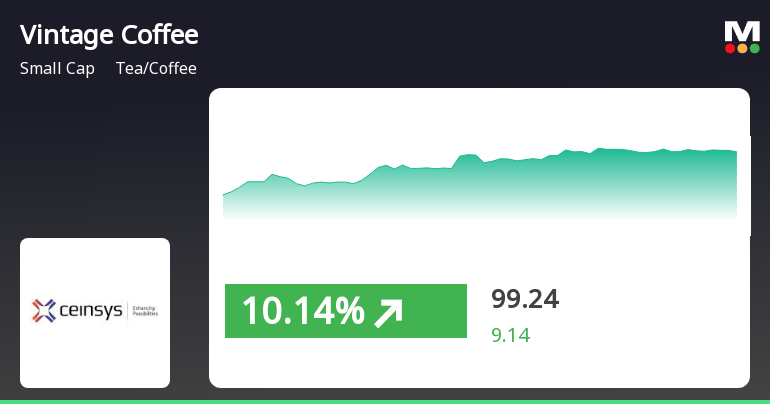

Vintage Coffee & Beverages Shows Strong Performance Amid Broader Market Gains

2025-03-24 09:45:23Vintage Coffee & Beverages has experienced notable stock performance, gaining 7.68% on March 24, 2025, and achieving a 9.11% increase over three days. The stock has outperformed the broader market, with a significant annual return of 69.20%, contrasting with the Sensex's 6.17% over the same period.

Read More

Vintage Coffee & Beverages Faces Technical Shift Amid Strong Financial Performance

2025-03-24 08:09:23Vintage Coffee & Beverages has experienced a change in its evaluation, with technical indicators reflecting a shift in outlook. While the company reports strong financial metrics, including significant growth in net sales and operating profit, it faces challenges such as a high debt-to-EBITDA ratio and low return on capital employed.

Read MoreVintage Coffee Experiences Technical Trend Shift Amid Mixed Market Signals

2025-03-24 08:00:43Vintage Coffee & Beverages, a small-cap player in the tea and coffee industry, has recently undergone a technical trend adjustment. This revision reflects a shift in the company's performance indicators, which are essential for understanding its market position. Currently, the stock is priced at 90.10, slightly above its previous close of 90.07. Over the past year, Vintage Coffee has shown a notable return of 57.57%, significantly outperforming the Sensex, which recorded a return of 5.87% in the same period. However, the year-to-date performance indicates a decline of 23.58%, contrasting with the Sensex's slight drop of 1.58%. In terms of technical metrics, the MACD shows a bearish signal on a weekly basis while remaining bullish monthly. The Bollinger Bands indicate a mildly bearish trend weekly, with a bullish outlook monthly. The moving averages reflect a bearish sentiment on a daily basis, while the...

Read MoreVintage Coffee & Beverages Shows Mixed Performance Amidst Strong Long-Term Gains

2025-03-21 18:00:24Vintage Coffee & Beverages Ltd, a small-cap player in the tea and coffee industry, has shown notable activity today. With a market capitalization of Rs 1,112.00 crore, the company has a price-to-earnings (P/E) ratio of 38.42, significantly lower than the industry average of 76.09. Over the past year, Vintage Coffee & Beverages has delivered a robust performance, gaining 57.57%, in stark contrast to the Sensex, which rose by only 5.87%. However, recent trends indicate a mixed performance. Today, the stock saw a slight increase of 0.03%, while the Sensex rose by 0.73%. In the past week, the stock has gained 3.60%, although it has faced challenges over the past month, declining by 5.11%. Year-to-date, Vintage Coffee & Beverages has experienced a downturn of 23.58%, compared to the Sensex's decline of 1.58%. Despite these fluctuations, the company has shown resilience over a three-year period, with a total ...

Read More

Vintage Coffee & Beverages Reports Strong Growth Amid Market Challenges and Operational Stability

2025-03-11 08:18:35Vintage Coffee & Beverages has recently adjusted its evaluation, reflecting strong Q3 FY24-25 performance with a 101.57% increase in net sales and a 418.34% rise in operating profit. The company has shown consistent growth over ten quarters, highlighting its operational stability and effective financial management despite some challenges.

Read MoreVintage Coffee & Beverages Shows Mixed Technical Trends Amid Market Volatility

2025-03-11 08:01:27Vintage Coffee & Beverages, a small-cap player in the tea and coffee industry, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock price is currently at 89.36, down from a previous close of 93.20, with a notable 52-week high of 143.30 and a low of 51.10. Today's trading saw a high of 94.91 and a low of 88.18, indicating some volatility. In terms of technical indicators, the MACD shows a mixed picture with a bearish signal on the weekly chart and a bullish signal on the monthly chart. The Bollinger Bands also reflect this divergence, being bearish weekly while bullish monthly. Moving averages indicate a mildly bullish trend on a daily basis, suggesting some short-term positive momentum. When comparing the company's performance to the Sensex, Vintage Coffee has shown a strong return over the past year, with a 35.7% increase, while the Sensex remained nea...

Read More

Vintage Coffee & Beverages Reports Strong Growth Amidst Market Challenges and Debt Concerns

2025-03-06 08:10:39Vintage Coffee & Beverages has adjusted its evaluation following strong third-quarter FY24-25 results, including a 101.57% growth in net sales and a 418.34% increase in operating profit. The company has shown consistent positive performance over ten quarters, though it faces challenges related to debt and management efficiency.

Read MoreCompliance Certificate Under Regulation 7(3) Of SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015 For The Year Ended 31.03.2025

05-Apr-2025 | Source : BSEWith reference to the subject cited please find enclosed the the Compliance Certificate pursuant to Regulation 7(3) of the SEBI (LODR) Regulations 2015 for the year ended 31.03.2025.

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

05-Apr-2025 | Source : BSEIntimation of Analyst / Institutional Investor Meeting under Regulation 30 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

02-Apr-2025 | Source : BSECertificate under Regulation 74 (5) of the SEBI (Depositories and Participants) Regulations 2018 for the quarter ended 31.03.2025.

Corporate Actions

No Upcoming Board Meetings

No Splits history available

No Bonus history available

Vintage Coffee & Beverages Ltd has announced 1:2 rights issue, ex-date: 19 Jun 23