Vippy Spinpro Adjusts Valuation Grade Amidst Competitive Textile Market Dynamics

2025-04-02 08:01:21Vippy Spinpro, a microcap player in the textile industry, has recently undergone a valuation adjustment, reflecting a notable shift in its financial standing. The company's price-to-earnings ratio stands at 8.24, while its price-to-book value is recorded at 1.19. Additionally, Vippy Spinpro showcases a robust EV to EBITDA ratio of 5.31 and an EV to sales ratio of 0.54, indicating efficient operational performance. In terms of profitability, the company has a return on capital employed (ROCE) of 10.52% and a return on equity (ROE) of 14.43%, which are strong indicators of its financial health. When compared to its peers, Vippy Spinpro's valuation metrics appear favorable. For instance, while Indo Rama Synthetic is currently facing challenges with a loss-making status, other competitors like Mafatlal Industries and Nahar Spinning also present attractive valuations, albeit with varying performance indicators....

Read More

Vippy Spinpro Adjusts Valuation Amid Strong Operational Performance and Market Conditions

2025-03-11 08:11:52Vippy Spinpro, a microcap textile company, has recently adjusted its evaluation, reflecting various financial metrics and market conditions. The firm showcases strong management efficiency with a notable return on capital employed and a low debt-to-EBITDA ratio. Positive operational performance and significant profit growth further characterize the company's current standing.

Read MoreVippy Spinpro Adjusts Valuation Grade Amid Competitive Textile Market Landscape

2025-03-05 08:00:37Vippy Spinpro, a microcap player in the textile industry, has recently undergone a valuation adjustment, reflecting its current market position and financial metrics. The company reports a price-to-earnings (P/E) ratio of 8.26 and an enterprise value to EBITDA ratio of 5.32, indicating a competitive valuation relative to its peers. The price-to-book value stands at 1.19, while the return on capital employed (ROCE) is recorded at 10.52%, and return on equity (ROE) is at 14.43%. In comparison to its industry peers, Vippy Spinpro's valuation metrics show a favorable position against companies like Mafatlal Industries and Ambika Cotton, which also hold attractive valuations. However, it lags behind Sportking India, which has a higher P/E ratio and a slightly elevated EV/EBITDA ratio. The stock has experienced fluctuations, with a current price of 165.00, reflecting a recent high of 165.00 and a low of 150.20...

Read More

Vippy Spinpro Adjusts Evaluation Amid Strong Operational Performance and Market Challenges

2025-03-03 18:44:38Vippy Spinpro, a microcap textile company, has recently adjusted its evaluation based on financial metrics and operational performance. In Q3 FY24-25, it reported a PBDIT of Rs 7.85 crore and a strong return on capital employed, reflecting its market position and operational strengths despite facing some challenges.

Read MoreVippy Spinpro Faces Mixed Technical Trends Amid Market Volatility and Performance Lag

2025-02-25 10:31:25Vippy Spinpro, a microcap player in the textile industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock, which closed at 161.10, has seen fluctuations with a 52-week high of 228.30 and a low of 133.50. Today's trading session recorded a high of 172.95 and a low of 161.10, indicating some volatility. The technical summary reveals a predominantly mildly bearish sentiment across various indicators. The MACD and KST metrics both reflect a mildly bearish trend on both weekly and monthly bases. Additionally, the Bollinger Bands show a bearish stance on the weekly chart while remaining sideways on the monthly. Moving averages present a mildly bullish outlook on a daily basis, suggesting mixed signals in the short term. In terms of performance, Vippy Spinpro's returns have lagged behind the Sensex over various periods. Over the past week, the stock returned -5.24%...

Read More

Vippy Spinpro Reports Strong Financial Performance Amidst Bearish Market Trends

2025-02-24 18:26:52Vippy Spinpro, a microcap textile company, has recently adjusted its evaluation amid positive third-quarter financial results for FY24-25. Key metrics, including operating profit and profit before tax, reached notable highs. However, the stock's technical position has shifted to a mildly bearish range, despite strong management efficiency and attractive valuation.

Read More

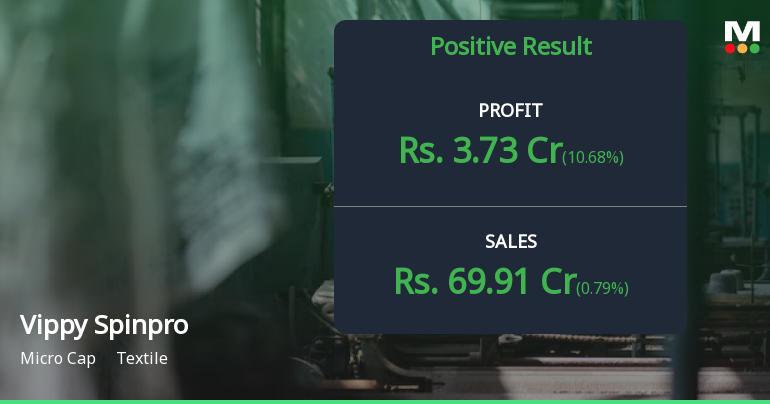

Vippy Spinpro Reports Strong Q3 FY24-25 Results with Record Profitability Metrics

2025-02-07 20:37:25Vippy Spinpro has announced its financial results for Q3 FY24-25, showcasing significant improvements across key metrics. Operating profit reached Rs 7.85 crore, with an operating profit margin of 11.23%. Profit before tax and profit after tax also peaked, while earnings per share stood at Rs 6.35.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

03-Apr-2025 | Source : BSEIn Compliance with Regulation 74(5) of SEBI (Depositories and Participants Regulations 2018 we are enclosing herewith a copy of Certificate Received from M/s Ankit Consultancy Private Limited Registrar and Share Transfer Agent of the Company for the Quarter ended on 31st March 2025.

Closure of Trading Window

24-Mar-2025 | Source : BSEIntimation for Closure of Trading Window for Quarter and Financial Year Ending 31st March 2025.

DISCLOSURE UNDER REGULATION 30 READ WITH PART A OF SCHEDULE III OF THE SEBI (LODR) REGULATIONS 2015 FOR RESULTANT CAPACITY ADDITION DUE TO EXPANSION PROGRAMME.

22-Mar-2025 | Source : BSEDetails regarding the proposed expansion programme are enclosed as Annexure-1 as per requirement of Regulation 30(4) read with Clause B Part-A of Schedule III of the SEBI (LODR) Regulations 2015.

Corporate Actions

No Upcoming Board Meetings

Vippy Spinpro Ltd has declared 5% dividend, ex-date: 19 Sep 07

No Splits history available

No Bonus history available

No Rights history available