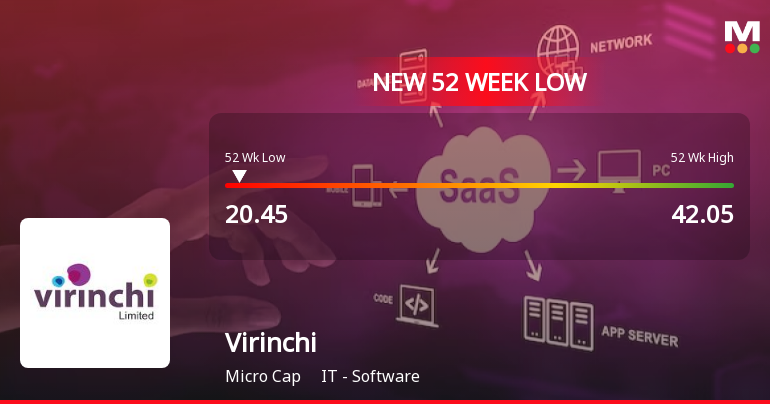

Virinchi Faces Ongoing Challenges Amid Significant Stock Volatility and Weak Fundamentals

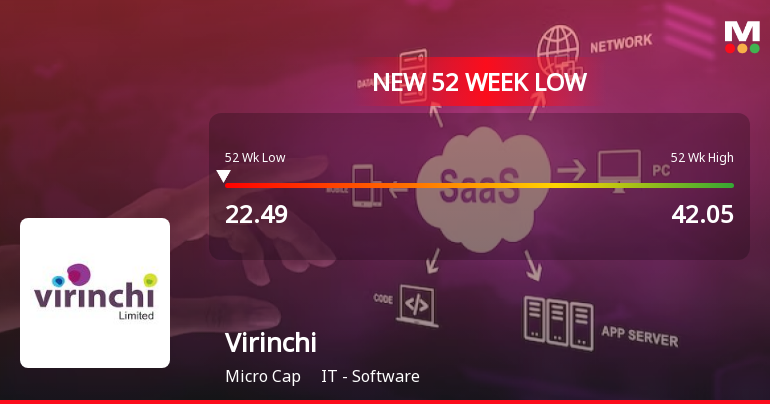

2025-03-27 10:01:29Virinchi, a microcap IT software company, has faced notable volatility, reaching a new 52-week low after a series of losses. Over the past year, it has declined significantly, contrasting with broader market gains. Financial metrics indicate challenges, including weak operating profit growth and high promoter share pledges.

Read More

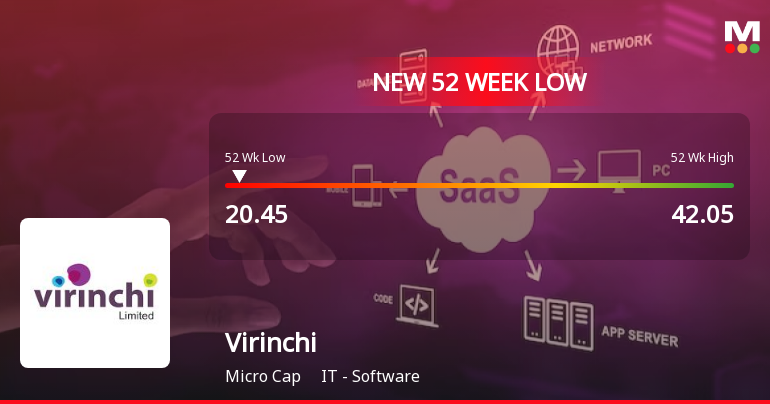

Virinchi Hits 52-Week Low Amid Ongoing Financial Challenges and Market Pressure

2025-03-27 10:01:28Virinchi, a microcap IT software firm, has reached a new 52-week low, reflecting a significant decline over the past year. The company's financial indicators raise concerns, including a low EBIT to interest ratio and dwindling cash reserves, while a substantial portion of promoter shares are pledged, adding to market pressures.

Read More

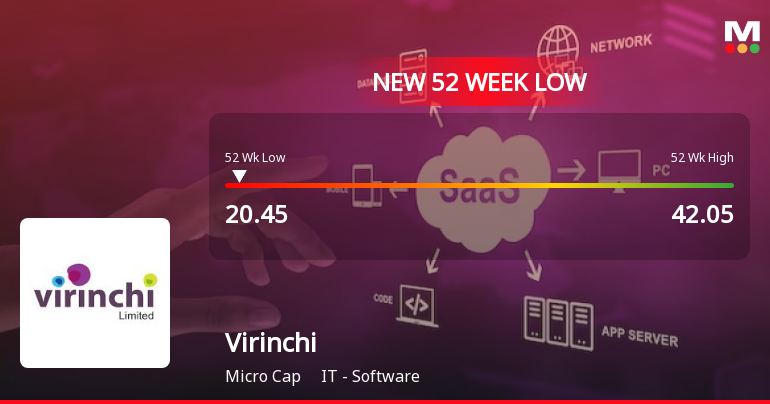

Virinchi Faces Ongoing Challenges Amid Significant Stock Decline and Weak Financial Metrics

2025-03-27 10:01:20Virinchi, a microcap IT software company, has reached a new 52-week low amid a 30.88% annual stock price decline, contrasting with the Sensex's gains. The company faces financial challenges, including a weak EBIT to interest ratio and declining profits, raising concerns about its market position and future prospects.

Read More

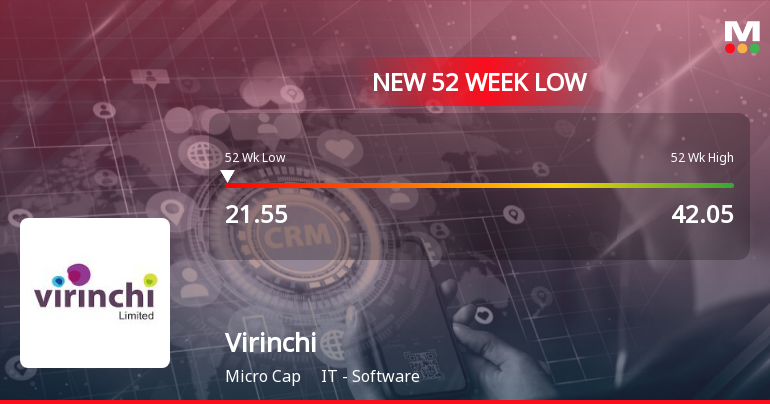

Virinchi Hits 52-Week Low Amid Weak Fundamentals and Increased Pledged Shares

2025-03-27 10:01:17Virinchi, a microcap IT software firm, has reached a new 52-week low, reflecting a significant decline over the past year. The company shows weak long-term fundamentals, including negative operating profit growth and low return on equity, alongside increasing pledged promoter shares, raising concerns about its financial stability.

Read More

Virinchi Faces Continued Volatility Amid Weak Fundamentals and Pledged Shares

2025-03-26 09:50:35Virinchi, a microcap IT software firm, has hit a new 52-week low, continuing a downward trend with significant underperformance compared to its sector. The company's long-term fundamentals are weak, showing negative growth in operating profits and a low return on equity, raising concerns about its financial stability.

Read More

Virinchi Faces Continued Volatility Amid Weak Fundamentals and Market Performance Concerns

2025-03-26 09:50:27Virinchi, an IT software microcap, has hit a new 52-week low amid ongoing volatility, underperforming its sector and the benchmark BSE 500. The company faces challenges with weak long-term fundamentals, high debt management concerns, and a modest return on equity, alongside a significant portion of pledged promoter shares.

Read More

Virinchi Faces Significant Volatility Amid Weak Fundamentals and Bearish Trends

2025-03-26 09:50:23Virinchi, a microcap IT software firm, has faced notable volatility, reaching a new 52-week low. The stock has underperformed its sector and is trading below key moving averages. Financially, it shows weak fundamentals, with declining operating profits and low profitability metrics, alongside increasing pledged promoter shares.

Read More

Virinchi Faces Financial Struggles Amid Significant Stock Volatility and Declining Performance

2025-03-26 09:50:21Virinchi, a microcap IT software company, has faced notable volatility, reaching a new 52-week low. The stock has underperformed its sector and shows a bearish technical outlook. Over the past year, it has declined significantly, raising concerns about its financial health and market position amid ongoing challenges.

Read More

Virinchi Faces Significant Financial Challenges Amidst Ongoing Stock Volatility

2025-03-25 10:40:21Virinchi, a microcap IT software firm, has faced notable volatility, reaching a new 52-week low. The company has underperformed its sector and reported a significant decline in profit after tax. Additionally, its financial metrics indicate weak profitability and debt servicing capabilities, with a substantial portion of promoter shares pledged.

Read MoreDisclosures under Reg. 31(1) and 31(2) of SEBI (SAST) Regulations 2011.

01-Apr-2025 | Source : BSEThe Exchange has received Disclosure under Regulation 31(1) and 31(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 on April 01 2025 for P.K.I. Solutions Pvt Ltd

Disclosures under Reg. 29(2) of SEBI (SAST) Regulations 2011

01-Apr-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 29(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for P K I Solutions Pvt Ltd

Disclosures of reasons for encumbrance by promoter of listed companies under Reg. 31(1) read with Regulation 28(3) of SEBI (SAST) Regulations 2011.

01-Apr-2025 | Source : BSEThe Exchange has received the Disclosures of reasons for encumbrance by promoter of listed companies under Reg. 31(1) read with Regulation 28(3) of SEBI (SAST) Regulations 2011 on April 01 2025 for P.K.I. Solutions Pvt Ltd

Corporate Actions

No Upcoming Board Meetings

Virinchi Ltd has declared 5% dividend, ex-date: 17 Sep 12

No Splits history available

Virinchi Ltd has announced 1:1 bonus issue, ex-date: 21 Mar 22

No Rights history available