Vishal Fabrics Faces Mixed Technical Trends Amid Strong Recent Financial Performance

2025-03-24 08:09:46Vishal Fabrics, a microcap textile company, has experienced a recent evaluation adjustment influenced by its technical trends. While the company reported strong Q3 FY24-25 financial performance, challenges remain regarding long-term fundamentals and high debt levels. The stock has outperformed the market, but institutional investment appears cautious.

Read MoreVishal Fabrics Faces Mixed Technical Signals Amidst Strong Yearly Performance

2025-03-24 08:02:12Vishal Fabrics, a microcap player in the textile industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 29.47, showing a notable increase from the previous close of 24.56. Over the past year, Vishal Fabrics has demonstrated a significant return of 53.09%, outperforming the Sensex, which returned 5.87% in the same period. In terms of technical indicators, the weekly MACD and KST are showing bearish signals, while the monthly indicators present a bullish outlook. The Bollinger Bands indicate a mildly bearish trend on a weekly basis, contrasting with a bullish monthly perspective. The moving averages also reflect a mildly bearish sentiment on a daily basis. Despite the mixed technical signals, the company's performance over various time frames reveals a complex picture. For instance, while the year-to-date return is down by 11.74%, t...

Read MoreVishal Fabrics Ltd Achieves 19.99% Surge Amidst Strong Buying Activity

2025-03-21 14:55:11Vishal Fabrics Ltd, a microcap player in the textile industry, is witnessing significant buying activity, with the stock surging by 19.99% today. This performance starkly contrasts with the Sensex, which has only gained 0.67% during the same period. Over the past week, Vishal Fabrics has achieved a remarkable 24.08% increase, while the Sensex rose by 4.11%. The stock has been on a positive trajectory, marking consecutive gains for the last four days, accumulating a total return of 27.47% in this timeframe. Today, it opened with a gap up of 4.85% and reached an intraday high of Rs 29.47. The stock's volatility has been notable, with an intraday fluctuation of 9.72%. In terms of moving averages, Vishal Fabrics is currently above its 5-day, 20-day, and 50-day averages, although it remains below the 100-day and 200-day averages. This performance indicates a strong short-term momentum, potentially driven by ...

Read More

Vishal Fabrics Adjusts Evaluation Amidst Strong Profit Growth and Debt Concerns

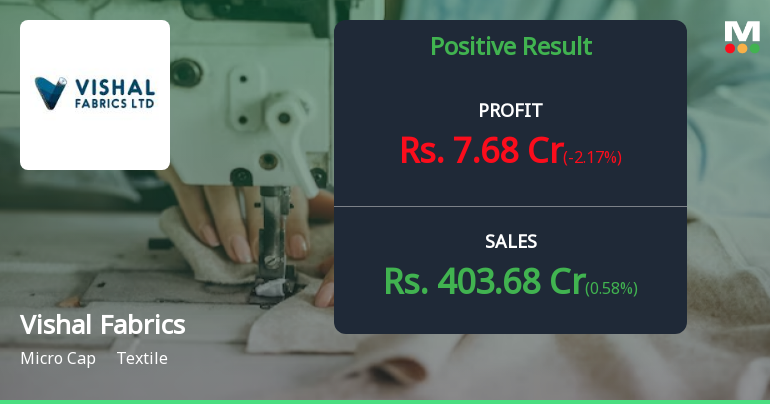

2025-03-18 08:21:42Vishal Fabrics, a microcap textile company, recently experienced a score adjustment reflecting its market dynamics. In Q3 FY24-25, it reported a 29.69% increase in profit after tax, but faces challenges with long-term fundamentals and a high debt to EBITDA ratio. Despite this, it has outperformed the broader market.

Read MoreVishal Fabrics Shows Resilience Amid Broader Market Decline and Industry Challenges

2025-03-12 18:00:30Vishal Fabrics, a microcap player in the textile industry, has shown notable activity today, with its stock price increasing by 0.36%. This performance stands in contrast to the broader market, as the Sensex experienced a slight decline of 0.10%. Over the past week, Vishal Fabrics has outperformed the Sensex, gaining 5.22% compared to the index's 0.41% increase. Despite this recent uptick, the company's year-to-date performance remains challenging, with a decline of 25.16%, while the Sensex has only fallen by 5.26% during the same period. Over the last three years, Vishal Fabrics has faced significant headwinds, with a drop of 36.01%, contrasting sharply with the Sensex's growth of 33.27%. The company's current market capitalization stands at Rs 502.00 crore, with a price-to-earnings (P/E) ratio of 19.38, notably lower than the industry average of 28.62. Technical indicators suggest a bearish trend in the...

Read More

Vishal Fabrics Reports Strong Q3 Profit Growth Amid Long-Term Challenges

2025-03-11 08:19:48Vishal Fabrics, a microcap textile company, recently adjusted its evaluation based on strong third-quarter FY24-25 results, including a significant profit after tax increase and improved operating profit metrics. However, it faces long-term fundamental challenges and a high debt to EBITDA ratio, despite outperforming the broader market.

Read MoreVishal Fabrics Experiences Mixed Technical Signals Amid Market Evaluation Revision

2025-03-11 08:04:14Vishal Fabrics, a microcap player in the textile industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 25.50, showing a slight increase from the previous close of 24.97. Over the past year, Vishal Fabrics has demonstrated a return of 17.73%, contrasting with a negligible change in the Sensex during the same period. The technical summary indicates mixed signals across various indicators. The MACD shows a bearish trend on a weekly basis while being bullish monthly. The Relative Strength Index (RSI) presents no signals for both weekly and monthly assessments. Bollinger Bands reflect a mildly bearish stance weekly, while the monthly outlook remains sideways. Daily moving averages suggest a mildly bullish trend, indicating some positive momentum. In terms of performance, Vishal Fabrics has faced challenges over longer periods, with a ye...

Read More

Vishal Fabrics Reports Strong PAT Growth Amid Long-Term Financial Challenges

2025-02-28 18:32:44Vishal Fabrics, a microcap textile company, recently experienced a score adjustment reflecting its mixed financial trends. The firm reported a 29.69% increase in profit after tax for the third quarter of FY24-25, despite facing long-term challenges such as a high debt to EBITDA ratio and stagnant operating profit growth.

Read More

Vishal Fabrics Reports Strong Q3 Results with Significant Growth in Key Metrics

2025-02-04 21:02:38Vishal Fabrics has announced its financial results for the quarter ending December 2024, highlighting a strong performance in operating metrics. The company reported a Profit After Tax of Rs 18.96 crore for the nine-month period, with significant year-on-year growth, alongside record quarterly operating profit and Profit Before Tax figures.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSESubmission of Certificate under Reg. 74(5) of SEBI (DP) Regulations 2018 for the quarter ended March 31 2025.

Closure of Trading Window

31-Mar-2025 | Source : BSEIntimation for closure of Trading window in pursuant to SEBI (Prohibition of Insider Trading) Regulation 2015.

Announcement under Regulation 30 (LODR)-Acquisition

24-Mar-2025 | Source : BSEIntimation under Reg. 30 of SEBI (Listing Obligation and Disclosure Requirements) Regulations 2015 - Update on Investment.

Corporate Actions

No Upcoming Board Meetings

Vishal Fabrics Ltd has declared 10% dividend, ex-date: 05 Aug 21

Vishal Fabrics Ltd has announced 5:10 stock split, ex-date: 24 Oct 17

Vishal Fabrics Ltd has announced 2:1 bonus issue, ex-date: 10 Mar 22

Vishal Fabrics Ltd has announced 2:3 rights issue, ex-date: 02 Mar 17