Voith Paper Fabrics India Adjusts Valuation Amid Mixed Competitive Landscape in Textiles

2025-04-02 08:01:36Voith Paper Fabrics India, a microcap player in the textile industry, has recently undergone a valuation adjustment, reflecting its current market standing. The company's price-to-earnings ratio stands at 18.32, while its price-to-book value is recorded at 1.89. Other key metrics include an EV to EBIT of 14.87 and an EV to EBITDA of 10.70, indicating its operational efficiency relative to its enterprise value. In terms of returns, Voith Paper has experienced a decline of 29.74% year-to-date, contrasting with a modest drop of 2.71% in the Sensex during the same period. Over a longer horizon, the company has shown a significant return of 237.91% over the past decade, outperforming the Sensex's 169.02% gain. When compared to its peers, Voith Paper's valuation metrics present a mixed picture. While it is positioned as very expensive, competitors like Mafatlal Industries and Nahar Spinning are noted for their ...

Read More

Voith Paper Fabrics India Faces Market Challenges Amid Declining Financial Performance

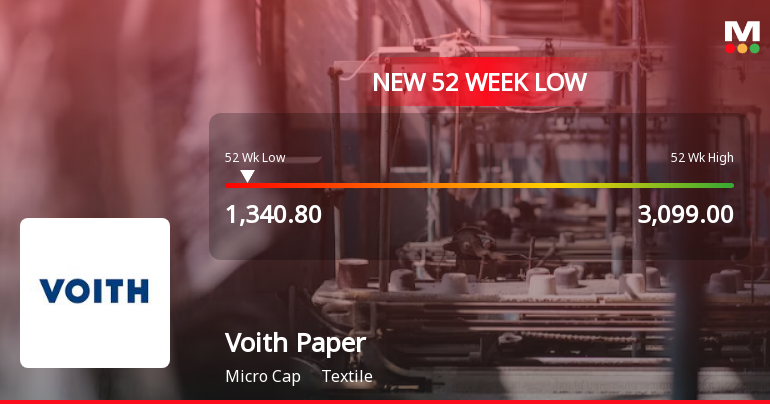

2025-03-05 09:47:48Voith Paper Fabrics India reached a new 52-week low today, despite a brief intraday recovery. The stock has declined significantly over the past year and continues to trade below key moving averages. Recent financial results show a drop in quarterly profit and low growth rates in sales and operating profit.

Read More

Voith Paper Fabrics Hits 52-Week Low Amidst Broader Market Underperformance

2025-03-05 09:47:31Voith Paper Fabrics India has reached a new 52-week low, reflecting a significant decline in its stock performance over the past year. Despite a slight recovery today, the company's financial metrics indicate slow growth and recent quarterly results show a decrease in profit, suggesting challenging long-term prospects.

Read More

Voith Paper Fabrics India Hits 52-Week Low Amidst Declining Financial Performance

2025-03-05 09:47:29Voith Paper Fabrics India has reached a new 52-week low, reflecting a significant decline over the past year. Despite a slight recovery during the trading day, the stock remains below key moving averages. The company reported disappointing financial results, including a decline in profit after tax and limited long-term growth prospects.

Read More

Voith Paper Fabrics India Hits 52-Week Low Amidst Declining Financial Performance

2025-03-04 10:13:14Voith Paper Fabrics India reached a new 52-week low today, following a brief recovery. The company reported its lowest net sales in recent quarters and a decline in profit after tax. Its performance has lagged behind the broader market, raising concerns about its financial health and valuation.

Read MoreVoith Paper Fabrics India Adjusts Valuation Amid Competitive Textile Industry Landscape

2025-03-04 08:00:36Voith Paper Fabrics India has recently undergone a valuation adjustment, reflecting its current financial metrics and market position within the textile industry. The company's price-to-earnings ratio stands at 16.86, while its price-to-book value is recorded at 1.74. Voith Paper's enterprise value to EBITDA ratio is 9.53, and its enterprise value to EBIT is noted at 13.24. The company also shows a dividend yield of 0.58%, with a return on capital employed (ROCE) of 18.16% and a return on equity (ROE) of 10.32%. In comparison to its peers, Voith Paper's valuation metrics indicate a relatively higher position, particularly when looking at the price-to-earnings ratio. Competitors such as Sportking India and Mafatlal Industries exhibit lower PE ratios, suggesting a different valuation landscape within the sector. Additionally, while Voith Paper has faced challenges in stock performance over various time frame...

Read More

Voith Paper Fabrics India Hits 52-Week Low Amid Sustained Market Challenges

2025-03-03 10:36:26Voith Paper Fabrics India has reached a new 52-week low, reflecting a significant decline in its stock performance. Over the past year, the company has faced challenges, with a notable drop compared to the broader market. The stock is currently trading below multiple moving averages, indicating ongoing difficulties.

Read More

Voith Paper Fabrics India Faces Significant Challenges Amid Sustained Market Volatility

2025-02-28 09:38:07Voith Paper Fabrics India has reached a new 52-week low, reflecting a notable downturn in its stock performance. The company has underperformed its sector and is trading below multiple moving averages, indicating a sustained downward trend. Over the past year, it has experienced a significant decline compared to the broader market.

Read More

Voith Paper Fabrics India Hits 52-Week Low Amid Ongoing Market Challenges

2025-02-27 13:05:20Voith Paper Fabrics India has reached a new 52-week low, reflecting ongoing challenges for the microcap textile company. Despite a brief intraday increase, the stock has underperformed its sector and recorded a significant annual decline, highlighting the need for a review of its operational and financial strategies.

Read MoreClosure of Trading Window

25-Mar-2025 | Source : BSEIntimation about Trading Window Closure for Designated Persons.

Announcement under Regulation 30 (LODR)-Newspaper Publication

12-Mar-2025 | Source : BSENotice of intimation about Postal Ballot exercise as published in newspapers.

Shareholder Meeting / Postal Ballot-Notice of Postal Ballot

11-Mar-2025 | Source : BSENotice of Postal Ballot seeking approval of shareholders for appointment of Dr. Ram Sewak Sharma as an Independent Director of the Company.

Corporate Actions

No Upcoming Board Meetings

Voith Paper Fabrics India Ltd has declared 80% dividend, ex-date: 26 Jul 24

No Splits history available

No Bonus history available

No Rights history available