Voltas Faces Technical Trend Shifts Amidst Market Evaluation Adjustments

2025-04-03 08:00:48Voltas, a prominent player in the air conditioning industry, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock is currently priced at 1344.70, slightly down from the previous close of 1351.75. Over the past year, Voltas has shown a return of 13.02%, outperforming the Sensex, which recorded a return of 3.67% in the same period. In terms of technical indicators, the weekly MACD and KST are showing bearish signals, while the monthly indicators reflect a mildly bearish stance. The Bollinger Bands indicate a mixed outlook, with weekly readings suggesting bearish conditions and monthly readings leaning mildly bullish. The moving averages also present a bearish trend on a daily basis. Voltas has experienced fluctuations in its stock performance, with a 52-week high of 1,946.20 and a low of 1,103.00. Notably, the company's year-to-date return stands at -24.8...

Read MoreSurge in Open Interest Signals Increased Trading Activity for Voltas Ltd.

2025-04-02 10:00:05Voltas Ltd., a prominent player in the air conditioning industry, has experienced a significant increase in open interest today, reflecting heightened trading activity. The latest open interest stands at 79,461 contracts, a notable rise from the previous open interest of 54,126 contracts, marking a change of 25,335 contracts or an increase of 46.81%. The trading volume for the day reached 120,514 contracts, indicating robust market engagement. In terms of price performance, Voltas has underperformed its sector by 0.92%, with a 1D return of -1.36%. The stock has faced consecutive declines over the past two days, accumulating a total drop of 8.52% during this period. Currently, Voltas is trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, suggesting a challenging market position. Despite these challenges, there has been a notable rise in delivery volume, which reached 14.72 lakh s...

Read MoreVoltas Faces Technical Trend Shifts Amid Market Evaluation Revision

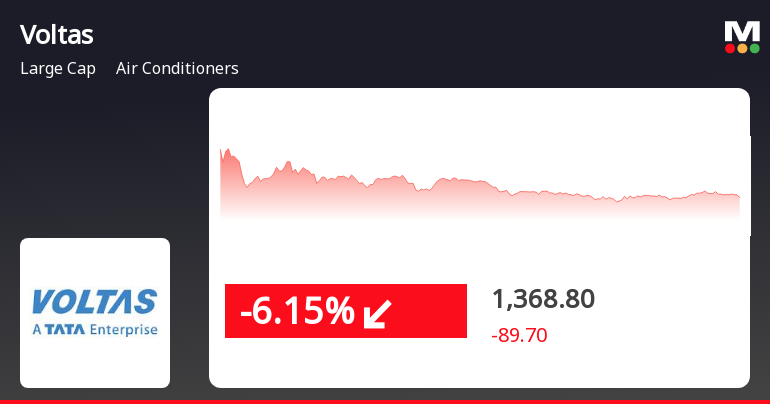

2025-04-02 08:01:36Voltas, a prominent player in the air conditioning industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1,351.75, a notable decline from its previous close of 1,458.50. Over the past year, Voltas has experienced a stock return of 17.19%, significantly outperforming the Sensex, which recorded a return of 2.72% in the same period. In terms of technical indicators, the weekly MACD and KST are both signaling bearish trends, while the monthly indicators show a mildly bearish stance. The Bollinger Bands indicate a bearish trend on a weekly basis, contrasting with a mildly bullish outlook on a monthly basis. The daily moving averages also reflect a bearish sentiment. Voltas has shown varied performance over different time frames. While it has faced challenges year-to-date with a return of -24.47%, it has demonstrated resilience over the ...

Read More

Voltas Ltd. Faces Significant Stock Decline Amid Broader Market Challenges

2025-04-01 11:40:19Voltas Ltd., a key player in the air conditioning sector, saw a notable decline on April 1, 2025, amid a broader market downturn. The stock is currently trading below several moving averages, reflecting a bearish trend, while its performance over the past year remains strong compared to the Sensex.

Read MoreVoltas Ltd. has emerged as one of the most active stock calls today amid significant trading activity.

2025-04-01 11:00:04Voltas Ltd., a prominent player in the air conditioning industry, has emerged as one of the most active stocks today, reflecting significant trading activity in its options market. The company, with a market capitalization of Rs 45,791.14 crore, saw notable movements in its call options, particularly for expiry on April 24, 2025. The call option with a strike price of Rs 1,400 recorded 5,164 contracts traded, generating a turnover of Rs 699.24 lakh and an open interest of 1,559 contracts. Meanwhile, the Rs 1,500 strike price option saw 5,264 contracts traded, with a turnover of Rs 259.06 lakh and an open interest of 3,375 contracts. The underlying value of Voltas is currently at Rs 1,461.00. Despite this activity, Voltas has underperformed its sector by 2.53%, with the stock hitting an intraday low of Rs 1,372, reflecting a decline of 5.94%. The weighted average price indicates that more volume was traded...

Read MoreVoltas Ltd. Sees Significant Open Interest Surge Amidst Market Challenges

2025-04-01 11:00:03Voltas Ltd., a prominent player in the air conditioning industry, has experienced a significant increase in open interest today, signaling heightened activity in its futures market. The latest open interest stands at 68,060 contracts, up from the previous 54,126, marking a change of 13,934 contracts or a 25.74% increase. The trading volume for the day reached 64,159 contracts, contributing to a total futures value of approximately Rs 54,701.82 lakhs. Despite this surge in open interest, Voltas has underperformed its sector, with a decline of 2.53% compared to the air conditioning industry's overall drop of 3.32%. The stock touched an intraday low of Rs 1,372, reflecting a decrease of 5.94% from the previous close. Additionally, Voltas is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a bearish trend in the short to medium term. On a positive note, the d...

Read MoreVoltas Ltd. has emerged as one of the most active stock puts today amid market challenges.

2025-04-01 11:00:03Voltas Ltd., a prominent player in the air conditioning industry, has emerged as one of the most active stocks in the options market today, particularly with its put options. The company, which holds a market capitalization of Rs 45,791.14 crore, has seen significant trading activity in its put options set to expire on April 24, 2025. Notably, the put option with a strike price of Rs 1,300 recorded 2,180 contracts traded, generating a turnover of Rs 153.73 lakh, while the Rs 1,400 strike price option saw 2,501 contracts traded with a turnover of Rs 483.33 lakh. The open interest for these options stands at 870 and 1,042 contracts, respectively, indicating a robust interest among traders. In terms of stock performance, Voltas has underperformed its sector by 2.53%, with a one-day return of -5.13%. The stock reached an intraday low of Rs 1,372, reflecting a decline of 5.94%. Additionally, Voltas is current...

Read MoreVoltas Ltd. Sees Significant Open Interest Surge Amidst Market Activity Shift

2025-03-21 15:00:05Voltas Ltd., a prominent player in the air conditioning industry, has experienced a significant increase in open interest today. The latest open interest stands at 85,083 contracts, reflecting a rise of 12,878 contracts or 17.84% from the previous open interest of 72,205. This uptick in open interest comes alongside a trading volume of 124,095 contracts, indicating heightened activity in the stock. In terms of price performance, Voltas has underperformed its sector by 1.46%, with the stock recording a decline of 3.34% on the day. Over the past two days, the stock has seen a consecutive fall, totaling a decrease of 4.93%. The intraday low reached was Rs 1,412, marking a drop of 3.94% from the previous close. Notably, the weighted average price suggests that more volume was traded closer to this low price. Despite the recent downturn, Voltas maintains a market capitalization of Rs 47,012.10 crore, categoriz...

Read MoreVoltas Ltd. Sees Significant Open Interest Surge Amid Increased Trading Activity

2025-03-21 14:00:05Voltas Ltd., a prominent player in the air conditioning industry, has experienced a significant increase in open interest today. The latest open interest stands at 82,322 contracts, marking a rise of 10,117 contracts or 14.01% from the previous open interest of 72,205. This uptick in open interest coincides with a trading volume of 98,954 contracts, indicating heightened activity in the stock. In terms of price performance, Voltas has underperformed its sector by 1.05%, with the stock experiencing a consecutive decline over the past two days, resulting in a total drop of 4.57%. Today, the stock reached an intraday low of Rs 1,423.35, reflecting a decrease of 3.17%. The weighted average price suggests that more volume was traded closer to this low price point. Despite these challenges, Voltas maintains a market capitalization of Rs 47,051.81 crore, categorizing it as a large-cap stock. The stock's liquidit...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Apr-2025 | Source : BSEPlease find enclosed herewith the Certificate received from Registrar and Share Transfer Agent certifying compliance with Regulation 74(5) of the SEBI (Depositories and Participants) Regulations 2018 for quarter ended 31st March 2025.

Intimation Under Regulation 30 Of SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015 (SEBI Listing Regulations)

02-Apr-2025 | Source : BSEResignation Letter - Senior Management

Intimation Under Regulation 30 Of SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015

01-Apr-2025 | Source : BSEChange in Senior Management Team.

Corporate Actions

No Upcoming Board Meetings

Voltas Ltd. has declared 550% dividend, ex-date: 25 Jun 24

Voltas Ltd. has announced 1:10 stock split, ex-date: 22 Sep 06

No Bonus history available

No Rights history available