VST Tillers Tractors Faces Mixed Technical Trends Amid Market Evaluation Revision

2025-04-01 08:03:00VST Tillers Tractors, a small-cap player in the automobiles-tractors industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 3,862.50, showing a notable increase from the previous close of 3,749.05. Over the past week, the stock has demonstrated a return of 2.98%, significantly outperforming the Sensex, which returned 0.66% in the same period. In terms of technical indicators, the MACD and KST metrics indicate a bearish sentiment on a weekly basis, while the monthly outlook remains mildly bearish. The Bollinger Bands also reflect a mildly bearish trend, suggesting a cautious market environment. Moving averages on a daily basis align with this sentiment, further emphasizing the current technical landscape. Despite the recent challenges, VST Tillers Tractors has shown resilience over longer periods. The stock has delivered an impressiv...

Read More

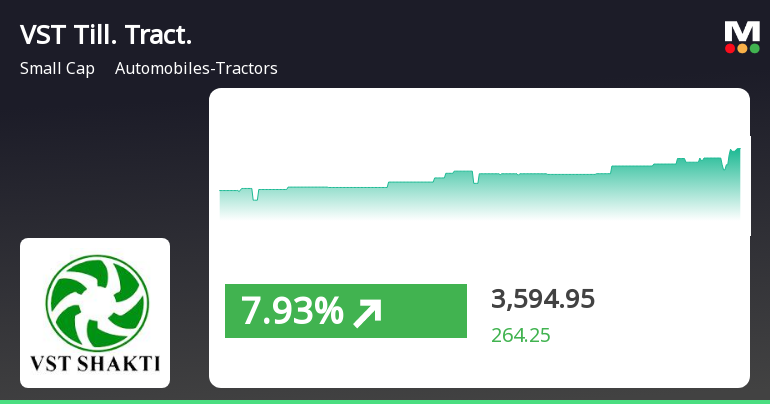

VST Tillers Tractors Shows Strong Short-Term Performance Amid Broader Market Trends

2025-03-19 15:35:27VST Tillers Tractors has shown strong short-term performance, gaining 7.79% on March 19, 2025, and outperforming its sector. The stock has seen consecutive gains over three days, while the broader market, led by mid-cap stocks, also opened higher but remains below key moving averages.

Read More

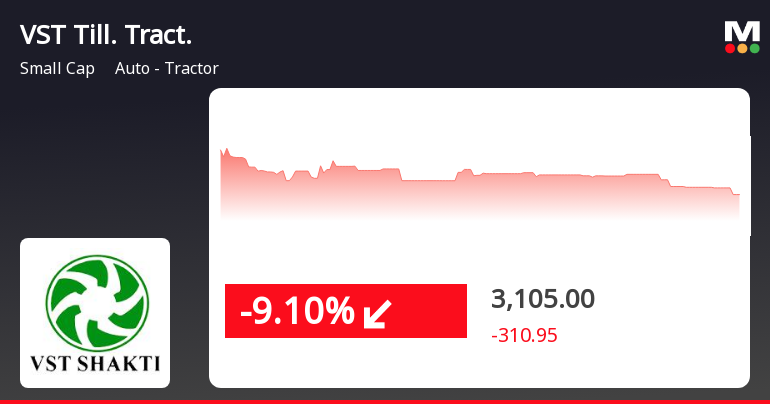

VST Tillers Tractors Experiences Significant Intraday Gains Amidst Mixed Long-Term Trends

2025-03-10 09:35:26VST Tillers Tractors experienced notable trading activity, achieving an intraday high while demonstrating significant volatility. The stock's recent performance has been mixed, with a strong weekly gain contrasted by a monthly decline. Over five years, it has shown substantial growth compared to the broader market index.

Read MoreVST Tillers Tractors Faces Bearish Technical Trends Amid Market Fluctuations

2025-03-07 08:03:13VST Tillers Tractors, a small-cap player in the auto-tractor industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 3344.00, showing a slight increase from the previous close of 3333.25. Over the past year, VST Tillers Tractors has experienced a stock return of 8.00%, outperforming the Sensex, which recorded a return of 0.34% during the same period. However, the company's performance has faced challenges in shorter time frames. Over the last month, VST Tillers Tractors reported a return of -20.71%, while the Sensex returned -4.76%. Year-to-date, the stock has seen a decline of 35.94%, compared to the Sensex's -4.86%. Despite these fluctuations, the company has shown resilience over longer periods, with a remarkable 221.88% return over the past five years, significantly surpassing the Sensex's 97.84%. The technical summary indicates ...

Read MoreVST Tillers Tractors Faces Market Challenges Amid Long-Term Resilience and Performance Metrics

2025-03-06 18:01:07VST Tillers Tractors Ltd, a small-cap player in the auto-tractor industry, has shown notable activity today, reflecting a complex performance landscape. With a market capitalization of Rs 2,916.00 crore, the company currently has a price-to-earnings (P/E) ratio of 27.97, which is below the industry average of 31.97. Over the past year, VST Tillers Tractors has delivered an 8.00% return, significantly outperforming the Sensex, which recorded a modest 0.34%. However, recent trends indicate a decline, with the stock down 35.94% year-to-date compared to the Sensex's drop of 4.86%. In terms of shorter-term performance, the stock has faced challenges, with a 20.71% decrease over the past month and a 33.31% decline over the last three months. Technical indicators suggest a bearish sentiment, with moving averages and Bollinger Bands reflecting negative trends. Despite these fluctuations, VST Tillers Tractors h...

Read More

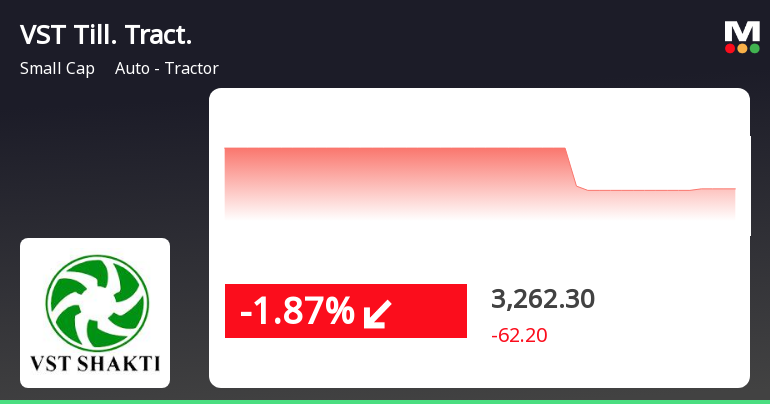

VST Tillers Tractors Faces Significant Stock Volatility Amid Market Challenges

2025-03-03 10:16:02VST Tillers Tractors has faced notable volatility, with its stock price declining significantly today, contrasting with the broader market's performance. The stock has also experienced a substantial decline over the past month and is trading below its moving averages, indicating ongoing challenges in its market position.

Read More

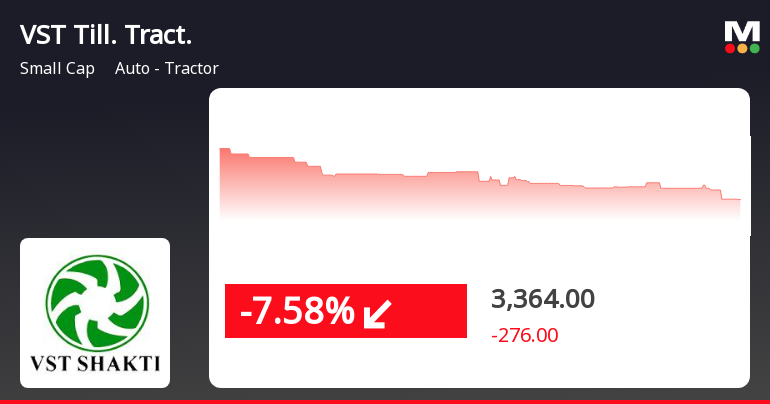

VST Tillers Tractors Faces Sustained Stock Decline Amid Market Challenges

2025-02-18 15:35:25VST Tillers Tractors has faced notable stock volatility, declining for three consecutive days and accumulating a significant drop. The stock is trading below multiple moving averages and has experienced a steep decline over the past month, contrasting sharply with the broader market performance.

Read More

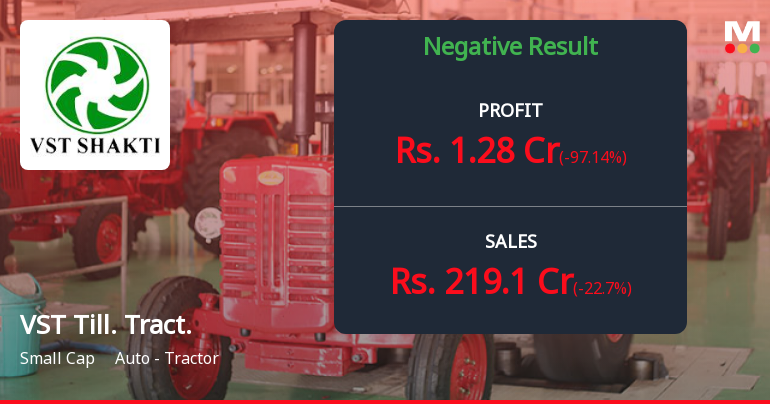

VST Tillers Tractors Reports Significant Q3 Profit Decline Amidst Conservative Financial Structure

2025-02-11 19:12:37VST Tillers Tractors has recently experienced a change in evaluation, reflecting a challenging financial landscape. The company reported significant declines in profit before and after tax for the third quarter of FY24-25, while maintaining a low debt-to-equity ratio and a return on equity of 12.2.

Read More

VST Tillers Tractors Reports Q3 FY24-25 Results Amid Financial Challenges

2025-02-10 18:52:11VST Tillers Tractors has announced its financial results for the quarter ending February 2025, highlighting challenges faced during Q3 FY24-25. The company's stock score has seen a significant adjustment, indicating a transformation in its financial metrics. Stakeholders are encouraged to monitor the evolving performance landscape.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSERTA Certificate

Announcement under Regulation 30 (LODR)-Monthly Business Updates

01-Apr-2025 | Source : BSEMonthly Business Updates

Closure of Trading Window

27-Mar-2025 | Source : BSEClosure of Trading Window

Corporate Actions

No Upcoming Board Meetings

VST Tillers Tractors Ltd has declared 200% dividend, ex-date: 12 Sep 24

No Splits history available

VST Tillers Tractors Ltd has announced 1:2 bonus issue, ex-date: 08 Feb 10

No Rights history available