W H Brady & Co Experiences Valuation Grade Change Amid Strong Performance Metrics

2025-04-01 08:00:19W H Brady & Co, a microcap player in the trading industry, has recently undergone a valuation adjustment. The company's current price stands at 775.00, reflecting a notable shift from its previous close of 740.20. Over the past year, W H Brady has demonstrated a strong performance with a return of 78.65%, significantly outpacing the Sensex's 5.11% return. Key financial metrics for W H Brady include a PE ratio of 17.37 and an EV to EBITDA ratio of 13.39, indicating its market positioning relative to its peers. The company also boasts a return on capital employed (ROCE) of 18.75% and a return on equity (ROE) of 15.72%, showcasing its operational efficiency. In comparison to its peers, W H Brady's valuation metrics present a mixed picture. For instance, while it holds a competitive PE ratio, other companies in the sector exhibit varying performance indicators, with some showing significantly higher or lower ...

Read MoreW H Brady & Co Experiences Valuation Grade Change Amid Mixed Financial Metrics

2025-03-26 08:00:22W H Brady & Co, a microcap player in the trading industry, has recently undergone a valuation adjustment, reflecting its current financial standing. The company's price-to-earnings (PE) ratio stands at 17.32, while its price-to-book value is recorded at 2.87. Other key metrics include an enterprise value to EBIT ratio of 15.22 and an enterprise value to EBITDA ratio of 13.35. The PEG ratio is notably low at 0.39, indicating a potentially favorable growth outlook relative to its earnings. In terms of return performance, W H Brady has shown a significant increase over the long term, with a 5-year return of 871.46%, compared to a 173.40% return of the Sensex. However, in the shorter term, the stock has faced challenges, with a year-to-date return of -14.47%, contrasting with a slight decline in the Sensex. When compared to its peers, W H Brady's valuation metrics present a mixed picture. While it maintains a...

Read More

W H Brady & Co Experiences Shift in Technical Outlook Amid Strong Performance Metrics

2025-03-25 08:15:48W H Brady & Co has recently experienced a shift in its technical outlook, reflecting a change in market sentiment. Despite positive performance in profits and net sales, the company's long-term growth appears less robust, with high valuation metrics and bearish technical indicators indicating a cautious market perspective.

Read MoreW H Brady & Co Shows Resilience with Strong Long-Term Growth Amid Short-Term Challenges

2025-03-20 18:00:29W H Brady & Co, a microcap player in the trading industry, has shown significant activity today, reflecting its dynamic market presence. With a market capitalization of Rs 203.00 crore, the company has a price-to-earnings (P/E) ratio of 18.10, notably lower than the industry average of 44.84, indicating a potentially attractive valuation relative to its peers. Over the past year, W H Brady & Co has delivered an impressive performance, gaining 79.19%, significantly outpacing the Sensex, which rose by 5.89% during the same period. In the short term, the stock has seen a daily increase of 0.99%, although it has lagged slightly behind the Sensex's 1.19% gain. Weekly performance remains strong at 7.56%, compared to the Sensex's 3.41%. However, the stock's performance over the last three months has been challenging, with a decline of 14.24%, contrasting with the Sensex's smaller drop of 2.17%. Despite this, W H...

Read More

W H Brady & Co Reports Strong Half-Year Growth Amid Cautious Long-Term Outlook

2025-03-19 08:07:21W H Brady & Co has recently adjusted its evaluation, reflecting strong financial performance in Q3 FY24-25. The company reported a profit after tax of Rs 5.92 crore and net sales of Rs 50.43 crore, indicating significant growth. Its liquidity position remains robust, supported by a low debt-to-equity ratio.

Read MoreW H Brady & Co Experiences Valuation Grade Change Amid Strong Yearly Performance

2025-03-05 08:00:25W H Brady & Co, a microcap player in the trading industry, has recently undergone a valuation adjustment. The company's current price stands at 695.00, reflecting a notable decline from its previous close of 710.00. Over the past year, W H Brady has shown a return of 23.78%, significantly outperforming the Sensex, which recorded a mere 1.19% return during the same period. Key financial metrics for W H Brady include a PE ratio of 15.57 and an EV to EBITDA ratio of 11.97, indicating a competitive position within its sector. The company's PEG ratio is notably low at 0.35, suggesting potential for growth relative to its earnings. Additionally, W H Brady boasts a return on capital employed (ROCE) of 18.75% and a return on equity (ROE) of 15.72%, highlighting its efficiency in generating profits from its capital. In comparison to its peers, W H Brady's valuation metrics present a more favorable outlook, partic...

Read More

W H Brady & Co Reports Growth Amid Shifting Stock Trends and Valuation Concerns

2025-03-03 18:47:54W H Brady & Co has recently experienced a change in evaluation, reflecting a nuanced view of its financial health. The company reported positive third-quarter results for FY24-25, with notable growth in net sales and operating profit, despite a shift in its stock's technical trend indicating a challenging outlook.

Read MoreW H Brady & Co Adjusts Valuation Grade Amid Competitive Trading Sector Landscape

2025-02-25 10:23:04W H Brady & Co, a microcap player in the trading industry, has recently undergone a valuation adjustment, reflecting its current financial standing. The company reports a PE ratio of 17.46 and an EV to EBITDA of 13.46, indicating a competitive position in its sector. Its PEG ratio stands at 0.40, suggesting a favorable growth outlook relative to its earnings. In terms of profitability, W H Brady boasts a return on capital employed (ROCE) of 18.75% and a return on equity (ROE) of 15.72%, highlighting its efficiency in generating returns for shareholders. The company's price to book value is recorded at 2.89, while its EV to sales ratio is 1.84, further illustrating its market valuation metrics. When compared to its peers, W H Brady's valuation metrics are notably distinct. For instance, while some competitors like Fratelli Vineyard are loss-making, others such as Kamdhenu and Sreeleathers maintain expensiv...

Read More

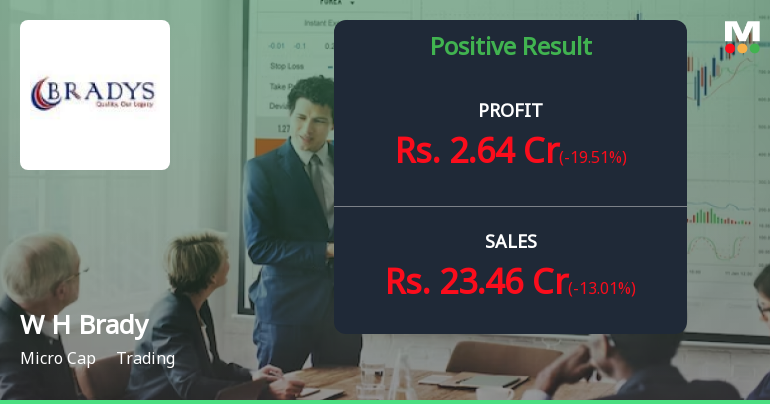

W H Brady & Co Reports Mixed Financial Results Amidst Growth and Sales Decline

2025-02-06 17:23:09W H Brady & Co has reported mixed financial results for the quarter ending December 2024. While Profit After Tax increased significantly and cash reserves reached a six-period high, quarterly net sales declined, raising concerns about sustainability. The Debtors Turnover Ratio improved, indicating better receivables management.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSEDisclosure under Regulation 74(5) of SEBI (DP) Regulations 2018

Closure of Trading Window

27-Mar-2025 | Source : BSEIntimation of Closure of Trading Window

Disclosure Under Regulation 30 (Listing Obligations And Disclosure Requirements) Regulations 2015

20-Mar-2025 | Source : BSEGiving of Guarantees or Indemnity or becoming a Surety by whatever name called for any third party.

Corporate Actions

No Upcoming Board Meetings

W H Brady & Co Ltd has declared 7% dividend, ex-date: 05 Aug 16

No Splits history available

W H Brady & Co Ltd has announced 1:2 bonus issue, ex-date: 03 Jan 08

No Rights history available