Welspun Enterprises Shows Strong Resilience Amid Broader Market Gains and Mixed Momentum

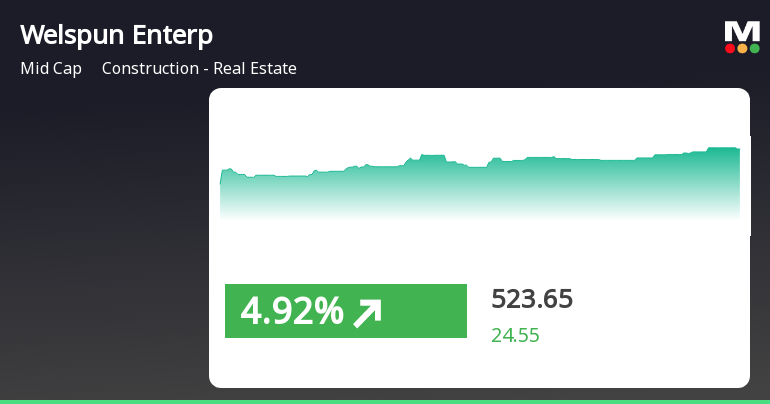

2025-03-24 13:05:26Welspun Enterprises has experienced notable activity, gaining 5.09% on March 24, 2025, and achieving an 18.02% return over the past five days. The stock is currently above its short-term moving averages, while the broader market shows positive momentum, with the BSE Mid Cap index also performing well.

Read MoreWelspun Enterprises Faces Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-20 08:03:21Welspun Enterprises, a midcap player in the construction and real estate sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 474.45, showing a notable increase from the previous close of 459.95. Over the past week, the stock has demonstrated a return of 6.00%, significantly outperforming the Sensex, which returned 1.92% in the same period. In terms of technical indicators, the MACD suggests a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. The Bollinger Bands indicate a mildly bearish stance weekly, contrasting with a bullish monthly perspective. Moving averages also reflect a bearish sentiment on a daily basis. The KST and OBV metrics further support a bearish trend on a weekly basis, with the monthly KST showing a mildly bearish position. Welspun Enterprises has shown impressive long-term performance...

Read MoreWelspun Enterprises Shows Strong Long-Term Growth Amid Market Fluctuations

2025-03-19 18:00:35Welspun Enterprises, a mid-cap player in the construction and real estate sector, has shown significant activity today, with its stock rising by 3.15%. This increase comes amid a broader market context where the Sensex has only gained 0.20%. Over the past year, Welspun Enterprises has outperformed the Sensex, delivering a remarkable 54.52% return compared to the index's 4.77%. Despite a challenging three-month period where the stock has declined by 19.03%, its long-term performance remains impressive. Over the last five years, Welspun Enterprises has achieved a staggering 999.54% increase, significantly outpacing the Sensex's 166.72% growth during the same timeframe. The company's current market capitalization stands at Rs 6,463.00 crore, with a price-to-earnings (P/E) ratio of 20.48, notably lower than the industry average of 62.41. This financial metric indicates a potentially favorable valuation relat...

Read MoreWelspun Enterprises Opens Strong with 8.48% Gain, Outperforming Sector Trends

2025-03-19 12:50:16Welspun Enterprises, a midcap player in the construction and real estate sector, has shown significant activity today, opening with a notable gain of 8.48%. The stock has outperformed its sector by 1.05%, reflecting a strong performance amidst a broader market backdrop. Over the past two days, Welspun Enterprises has recorded a cumulative return of 7.27%, indicating a positive trend. Today, the stock reached an intraday high of Rs 498.95, showcasing high volatility with an intraday fluctuation of 6.72%. In terms of moving averages, the stock is currently above its 5-day and 20-day averages but remains below the 50-day, 100-day, and 200-day averages, suggesting mixed signals in its short to medium-term performance. In comparison to the Sensex, Welspun Enterprises has performed well, with a 1-day return of 3.11% against the Sensex's 0.25% and a 1-month return of 2.51% compared to the Sensex's decline of 0.5...

Read MoreWelspun Enterprises Opens Strong with 6.18% Gain, Outperforming Sector Trends

2025-03-18 14:50:16Welspun Enterprises, a midcap player in the construction and real estate sector, has shown significant activity today, opening with a gain of 6.18%. The stock reached an intraday high of Rs 469.4, outperforming its sector by 1.4%. In terms of performance metrics, Welspun Enterprises recorded a 1-day increase of 3.57%, compared to the Sensex's rise of 1.34%. Over the past month, the stock has gained 1.40%, while the Sensex has declined by 1.06%. From a technical perspective, the stock's moving averages indicate a mixed trend; it is currently above the 5-day and 20-day moving averages but below the 50-day, 100-day, and 200-day averages. The MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. The Bollinger Bands reflect a bearish stance weekly but are bullish monthly. With a beta of 1.27, Welspun Enterprises is classified as a high beta stock, suggesting it tends to expe...

Read MoreWelspun Enterprises Faces Mixed Technical Trends Amid Market Volatility

2025-03-18 08:03:39Welspun Enterprises, a midcap player in the construction and real estate sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 442.10, down from a previous close of 451.95, with a notable 52-week high of 664.10 and a low of 297.00. Today's trading saw a high of 457.95 and a low of 441.85, indicating some volatility. The technical summary reveals a mixed picture. The MACD indicates bearish trends on both weekly and monthly scales, while the Bollinger Bands show a bearish stance weekly but a bullish outlook monthly. Moving averages suggest a mildly bullish sentiment on a daily basis, contrasting with the bearish signals from the KST and the lack of definitive trends in the Dow Theory and OBV metrics. In terms of performance, Welspun Enterprises has shown a strong return over the long term, particularly over three and five years, with r...

Read MoreWelspun Enterprises Shows Mixed Technical Trends Amid Strong Yearly Performance

2025-03-17 08:01:15Welspun Enterprises, a midcap player in the construction and real estate sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 451.95, showing a slight increase from the previous close of 447.60. Over the past year, Welspun has demonstrated significant resilience, with a remarkable return of 56.55%, significantly outperforming the Sensex, which recorded a modest gain of 1.47% during the same period. In terms of technical indicators, the company presents a mixed picture. The Moving Averages indicate a mildly bullish sentiment on a daily basis, while the MACD and KST metrics suggest a bearish to mildly bearish outlook on weekly and monthly timelines. The Bollinger Bands reflect a bullish trend on a monthly basis, contrasting with a mildly bearish stance on the weekly chart. Welspun's performance over various time frames highlights its ...

Read MoreWelspun Enterprises Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-13 08:02:15Welspun Enterprises, a midcap player in the construction and real estate sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 447.60, showing a notable increase from the previous close of 424.50. Over the past year, Welspun has demonstrated a strong performance with a return of 45.16%, significantly outpacing the Sensex, which recorded a mere 0.49% during the same period. In terms of technical indicators, the company exhibits a mixed outlook. The MACD signals a bearish trend on a weekly basis, while the monthly perspective leans mildly bearish. The Bollinger Bands present a contrasting view, indicating a bullish stance on a monthly basis. Daily moving averages suggest a mildly bullish trend, although the KST and OBV metrics reflect a mildly bearish sentiment on a weekly basis. Welspun's performance over various time frames highlight...

Read MoreWelspun Enterprises Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-13 08:02:15Welspun Enterprises, a midcap player in the construction and real estate sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 447.60, showing a notable increase from the previous close of 424.50. Over the past year, Welspun has demonstrated a strong performance with a return of 45.16%, significantly outpacing the Sensex, which recorded a mere 0.49% during the same period. In terms of technical indicators, the company exhibits a mixed outlook. The MACD signals a bearish trend on a weekly basis, while the monthly perspective leans mildly bearish. The Bollinger Bands present a contrasting view, indicating a bullish stance on a monthly basis. Daily moving averages suggest a mildly bullish trend, although the KST and OBV metrics reflect a mildly bearish sentiment on a weekly basis. Welspun's performance over various time frames highlight...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSEPlease find attached Certificate under Regulation 74(5) of the SEBI (Depositories and Participants) Regulations 2018 for the quarter ended March 31 2025

Closure of Trading Window

31-Mar-2025 | Source : BSEClosure of Trading Window for dealing in securities of the Company in terms of SEBI (Prohibition of Insider Trading) Regulations 2015 as amended for the quarter ending March 31 2025

Board Meeting Outcome for Intimation Regarding Sale Of Entire Stake Held In Non-Operative Wholly Owned Subsidiaries Of The Company

27-Mar-2025 | Source : BSEIntimation regarding sale of entire stake held in non-operative Wholly Owned Subsidiaries of the Company

Corporate Actions

No Upcoming Board Meetings

Welspun Enterprises Ltd has declared 30% dividend, ex-date: 05 Jul 24

No Splits history available

No Bonus history available

No Rights history available