Windlas Biotech Adjusts Valuation Amid Strong Performance and Competitive Landscape

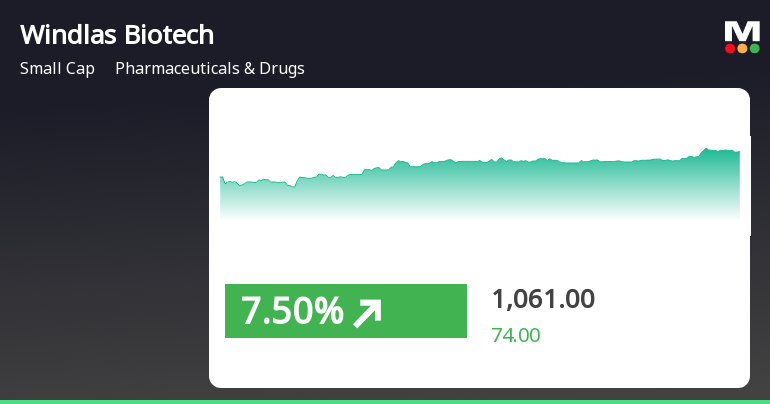

2025-04-03 08:00:52Windlas Biotech, a small-cap player in the Pharmaceuticals & Drugs sector, has recently undergone a valuation adjustment. The company's current price stands at 1,048.30, reflecting a notable performance over the past year with a return of 90.62%, significantly outpacing the Sensex's 3.67% during the same period. Key financial metrics for Windlas Biotech include a PE ratio of 35.50 and an EV to EBITDA ratio of 22.05, which position it within a competitive landscape. The company's return on capital employed (ROCE) is reported at 24.04%, while its return on equity (ROE) is at 12.99%. In comparison to its peers, Windlas Biotech's valuation metrics indicate a relatively strong market position, particularly when juxtaposed with companies like Unichem Labs and RPG LifeScience, which also exhibit high valuation levels. However, some peers, such as Dishman Carbogen, are categorized differently, highlighting the ...

Read MoreWindlas Biotech Shows Mixed Technical Trends Amid Strong Yearly Performance

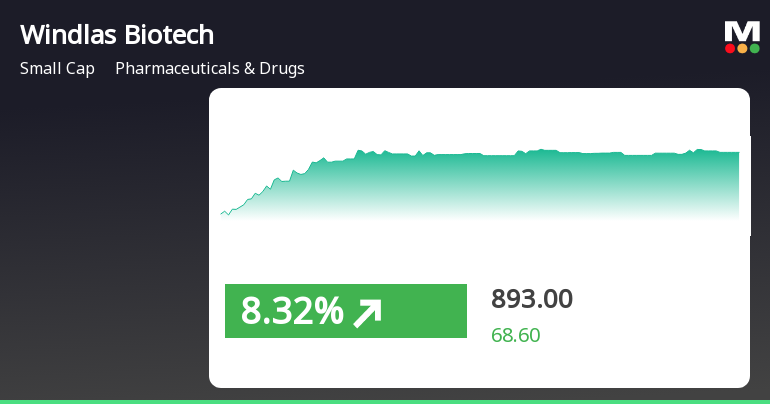

2025-04-02 08:09:54Windlas Biotech, a small-cap player in the Pharmaceuticals & Drugs industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1013.00, having closed at 1036.65 previously. Over the past year, Windlas Biotech has demonstrated significant performance, with a return of 87.07%, notably outperforming the Sensex, which recorded a return of 2.72% during the same period. The technical summary indicates a mixed outlook, with the MACD showing bullish momentum on a weekly basis while leaning mildly bearish on a monthly scale. The Bollinger Bands reflect a mildly bullish trend for both weekly and monthly assessments, suggesting some stability in price movements. Additionally, the daily moving averages are bullish, indicating positive short-term momentum. In terms of market performance, Windlas Biotech has shown resilience, particularly over the las...

Read More

Windlas Biotech Outperforms Market with Significant Stock Gains and Positive Momentum

2025-03-26 12:50:25Windlas Biotech has demonstrated strong performance in the Pharmaceuticals & Drugs sector, achieving consecutive gains over three days and a notable increase today. The stock is trading above multiple moving averages, reflecting a robust upward trend, while the broader market has shown mixed results during the same timeframe.

Read MoreWindlas Biotech Shows Mixed Technical Indicators Amid Strong Performance Trends

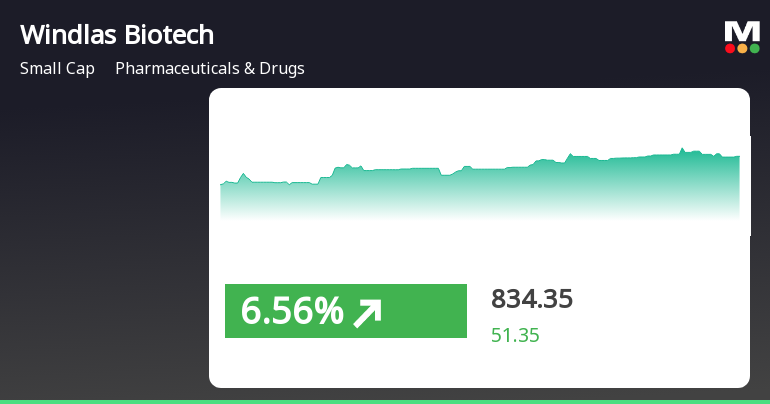

2025-03-26 08:04:58Windlas Biotech, a small-cap player in the Pharmaceuticals & Drugs industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 987.00, showing a notable increase from the previous close of 976.20. Over the past week, Windlas Biotech has demonstrated a strong performance, achieving a return of 9.02%, significantly outpacing the Sensex's return of 3.61% during the same period. In terms of technical indicators, the stock exhibits a mixed picture. While the Bollinger Bands and daily moving averages suggest a positive trend, the MACD and KST indicators present a more cautious outlook on a weekly basis. The stock's 52-week range highlights its volatility, with a high of 1,197.00 and a low of 494.70, indicating substantial price movement over the year. Looking at longer-term performance, Windlas Biotech has delivered an impressive 85.86% return...

Read More

Windlas Biotech Surges Amid Broader Market Weakness, Small-Cap Stocks Shine

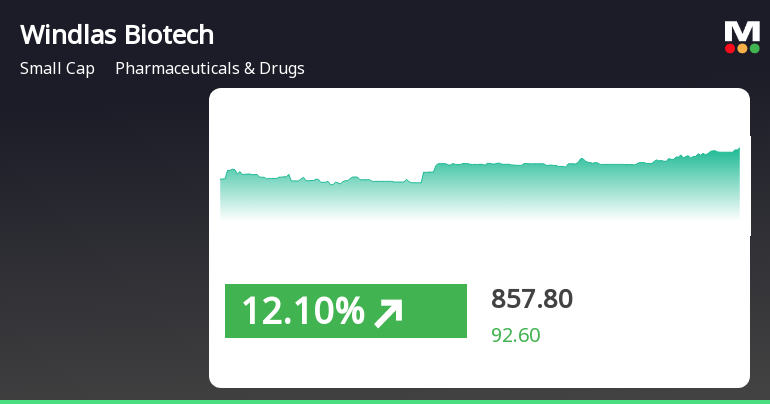

2025-03-04 10:26:17Windlas Biotech has demonstrated notable performance, gaining 7.96% on March 4, 2025, and outperforming its sector. The stock reached an intraday high of Rs 896.9 and has shown consecutive gains over the past two days. Meanwhile, the broader market remains under pressure, with small-cap stocks leading today.

Read More

Windlas Biotech Shows Trend Reversal Amidst Small-Cap Pharmaceutical Volatility

2025-03-03 11:05:30Windlas Biotech has experienced a notable performance shift, gaining 7.42% on March 3, 2025, after two days of decline. The stock reached an intraday high of Rs 823.95 and has outperformed its sector, despite a 13.99% decline over the past month, indicating volatility in the small-cap pharmaceutical market.

Read More

Windlas Biotech Exhibits Volatility Amid Broader Market Decline and Sector Outperformance

2025-02-24 12:05:21Windlas Biotech experienced significant trading activity on February 24, 2025, rebounding from an early decline to reach an intraday high. The stock outperformed its sector while the broader market declined. Despite today's gains, it has seen a notable decline over the past month, indicating volatility in its performance.

Read More

Windlas Biotech Reports Record Sales Amid Stable Financial Structure and Market Outperformance

2025-02-20 18:13:30Windlas Biotech has recently adjusted its evaluation following a strong financial performance in Q3 FY24-25, with net sales and PBDIT reaching record highs. The company maintains a low debt-to-equity ratio and has shown consistent positive results over six quarters, outperforming the broader market significantly.

Read MoreWindlas Biotech Surges 14.43% Amid Strong Buying Activity, Defying Market Trends

2025-02-20 10:18:03Windlas Biotech Ltd is witnessing significant buying activity today, with the stock surging by 14.43%, contrasting sharply with the Sensex, which has declined by 0.36%. This marks a notable trend reversal for Windlas Biotech, as it has gained after five consecutive days of decline. The stock reached an intraday high of Rs 811.2, reflecting strong buyer interest. Over the past week, Windlas Biotech has experienced a slight decrease of 3.30%, while the Sensex fell by 0.63%. In the longer term, the stock has faced challenges, with a 19.82% drop over the past month and a year-to-date decline of 21.51%. However, its one-year performance remains robust, showing a gain of 58.27%, significantly outperforming the Sensex's 3.57% increase. The stock's volatility today has been notable, with an intraday volatility of 6.21%. Currently, Windlas Biotech's price is above its 5-day moving average but below its 20-day, 50-...

Read MoreAnnouncement under Regulation 30 (LODR)-Credit Rating

08-Apr-2025 | Source : BSEReaffirmation of Credit Rating by ICRA Limited

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Apr-2025 | Source : BSECertificate under Regulation 74(5) of the SEBI (Depositories and Participants) Regulation 2018 for the quarter ended 31st March 2025

Closure of Trading Window

31-Mar-2025 | Source : BSEIntimation of closure of Trading Window

Corporate Actions

No Upcoming Board Meetings

Windlas Biotech Ltd has declared 80% dividend, ex-date: 05 Sep 23

No Splits history available

No Bonus history available

No Rights history available