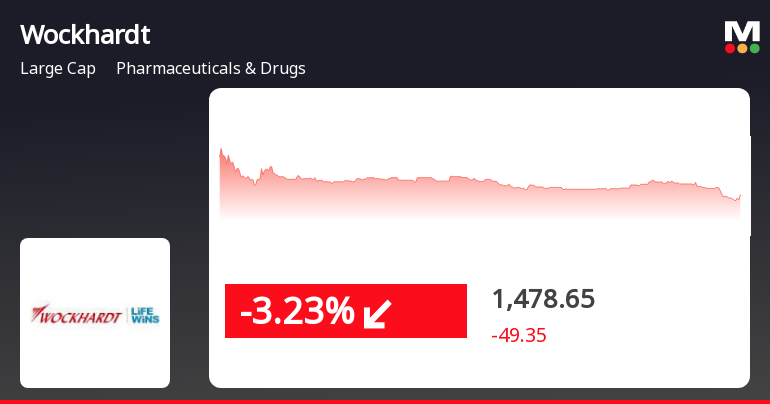

Wockhardt Faces Short-Term Losses Amidst Broader Market Volatility and Sector Gains

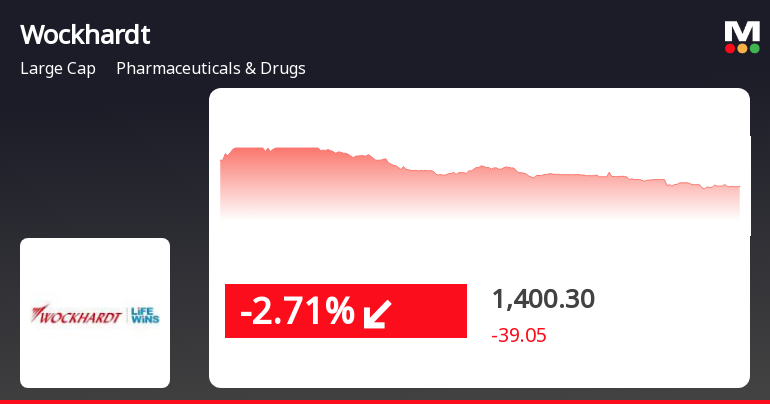

2025-04-03 12:38:28Wockhardt, a key player in the Pharmaceuticals & Drugs sector, faced a decline on April 3, 2025, marking its second consecutive day of losses. Despite recent struggles, the stock has gained 16.32% over the past month, outperforming the Sensex, which has risen by 4.46%.

Read MoreWockhardt Ltd Hits Upper Circuit Limit Amid Mixed Sector Performance and Decreased Investor Participation

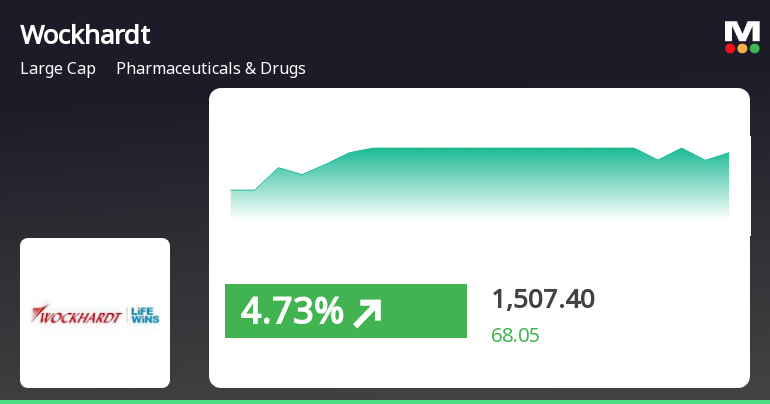

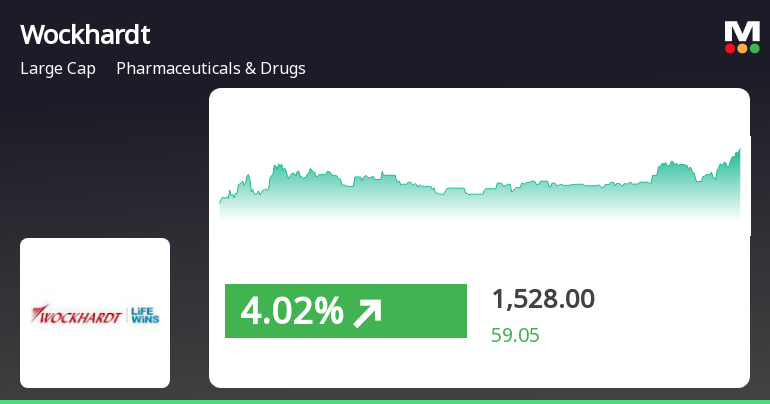

2025-04-03 11:00:06Wockhardt Ltd, a prominent player in the Pharmaceuticals & Drugs sector, has experienced significant trading activity today, hitting its upper circuit limit. The stock reached an intraday high of Rs 1510.25, reflecting a 5% increase from its previous close. This surge comes amid a total traded volume of approximately 7.08 lakh shares, contributing to a turnover of Rs 106.57 crore. Despite the stock's performance today, it has underperformed its sector, which gained 2.56%. Wockhardt's last traded price (LTP) stands at Rs 1489.75, with a notable change of Rs 51.4, or 3.57%. The stock opened with a gap up of 2.9%, indicating positive momentum at the start of the trading session. Wockhardt is currently trading above its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, suggesting a strong position in the market. However, it is worth noting that delivery volume has decreased by 38.99% compared to th...

Read More

Wockhardt Exhibits Strong Stock Performance Amid Broader Market Volatility

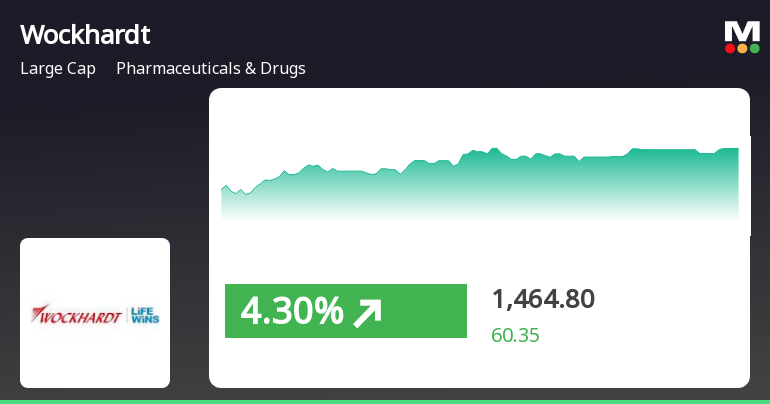

2025-04-03 09:30:17Wockhardt, a key player in the Pharmaceuticals & Drugs sector, experienced notable trading activity, reaching an intraday high and demonstrating significant volatility. The stock has consistently outperformed its moving averages and has shown strong performance over the past week and month, contrasting with broader market challenges.

Read More

Wockhardt's Stock Reversal Highlights Strong Performance Amid Broader Market Challenges

2025-03-28 10:00:17Wockhardt has experienced a notable performance today, reversing a four-day decline with a significant intraday high. The stock has outperformed its sector and shows strong returns over the past month and year, despite mixed short-term momentum and a broader market dip in the Sensex.

Read More

Wockhardt Faces Short-Term Decline Amid Strong Long-Term Performance Metrics

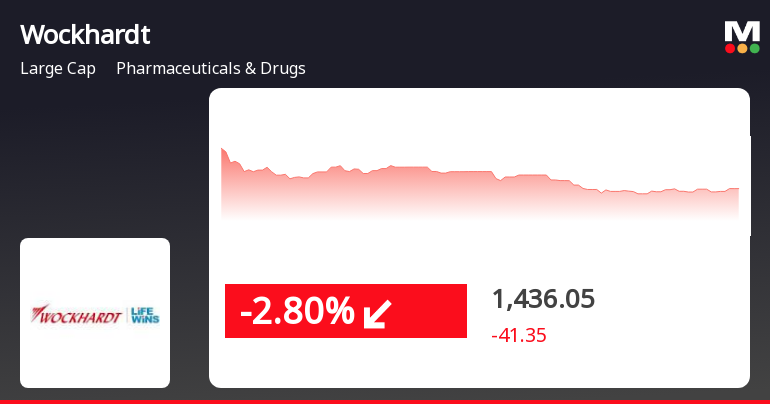

2025-03-25 11:00:18Wockhardt has faced a decline in stock performance, marking its second consecutive day of losses. Despite this, the company remains above several key moving averages and has shown a positive return over the past week. In contrast, the broader market, represented by the Sensex, continues to rise.

Read More

Wockhardt's Recent Decline Signals Potential Volatility in Pharmaceutical Sector Trends

2025-03-24 15:15:15Wockhardt, a key player in the Pharmaceuticals & Drugs sector, saw a decline on March 24, 2025, after a four-day gain streak. Despite this setback, the company has shown strong performance over the past week and month, significantly outperforming the Sensex in both periods.

Read More

Wockhardt Outperforms Sector Amid Broader Market Recovery and Small-Cap Gains

2025-03-21 15:15:17Wockhardt has experienced notable stock performance, gaining 3.36% on March 21, 2025, and outperforming its sector. The stock has shown a strong upward trend over the past four days, with a total return of 16.68%. It has also significantly increased by 177.53% over the past year.

Read MoreWockhardt Adjusts Valuation Grade Amidst Mixed Financial Performance Indicators

2025-03-21 08:00:08Wockhardt, a prominent player in the Pharmaceuticals & Drugs sector, has recently undergone a valuation adjustment, reflecting its current financial standing. The company's price-to-earnings ratio stands at -124.97, indicating challenges in profitability. Additionally, its price-to-book value is reported at 7.03, while the enterprise value to EBITDA ratio is notably high at 114.99. Wockhardt's return on capital employed (ROCE) is at -1.58%, and the return on equity (ROE) is -8.48%, suggesting difficulties in generating returns for shareholders. In comparison to its peers, Wockhardt's valuation metrics are significantly higher, with companies like Sun Pharma and Divi's Lab also classified within the same valuation category, but exhibiting more favorable price-to-earnings and enterprise value ratios. In terms of stock performance, Wockhardt has shown a remarkable return of 169.95% over the past year, sign...

Read MoreWockhardt Ltd Experiences Significant Trading Surge Amid Strong Market Position

2025-03-20 10:00:12Wockhardt Ltd, a prominent player in the Pharmaceuticals & Drugs industry, has shown remarkable activity today, hitting its upper circuit limit. The stock reached an intraday high of Rs 1493, reflecting a 5% increase from its previous trading session. This surge comes as Wockhardt recorded a notable change of Rs 43.05, translating to a 3.03% increase in its price. The stock opened with a gain of 2.11% and has been on a positive trajectory, gaining for three consecutive days and accumulating a total return of 14.9% during this period. With a total traded volume of approximately 5.86 lakh shares and a turnover of Rs 86.92 crore, Wockhardt has demonstrated robust trading activity. In terms of performance metrics, Wockhardt has outperformed its sector by 3.52%, with its current trading price above key moving averages, including the 5-day, 20-day, 50-day, 100-day, and 200-day averages. The stock's liquidity re...

Read MoreIntimation For Incorporation Of A Step-Down Subsidiary Company

08-Apr-2025 | Source : BSEPursuant to Regulation 30 read with Schedule III of the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations 2015 we hereby inform you that Wockhardt Bio AG a subsidiary of the Company has incorporated a new Wholly Owned Subsidiary in Ireland by the name Wockhardt Antibiotics (Ireland) Limited. Consequent to the Incorporation Wockhardt Antibiotics (Ireland) Limited has become a Step- Down Subsidiary of the Company.

Announcement under Regulation 30 (LODR)-Press Release / Media Release

01-Apr-2025 | Source : BSEPursuant to Regulation 30 of SEBI Listing Regulations please find enclosed Press Release - Paediatric US Cancer Patient with Recalcitrant Blood and Liver Infection Successfully Treated with ZaynichTM (Zidebactam/Cefepime WCK 5222)

Closure of Trading Window

27-Mar-2025 | Source : BSEThis is to inform you that pursuant to Companys Code of Conduct for regulating monitoring and reporting trading by designated persons (the Code) the Trading Window for dealing in equity shares of the Company will be closed from 1st April 2025 until 48 hours after the declaration of audited financial results of the Company for the financial year ended 31st March 2025.

Corporate Actions

No Upcoming Board Meetings

Wockhardt Ltd has declared 200% dividend, ex-date: 17 Nov 16

No Splits history available

No Bonus history available

Wockhardt Ltd has announced 3:10 rights issue, ex-date: 08 Mar 22