Wonderla Holidays Faces Bearish Technical Trends Amid Market Volatility

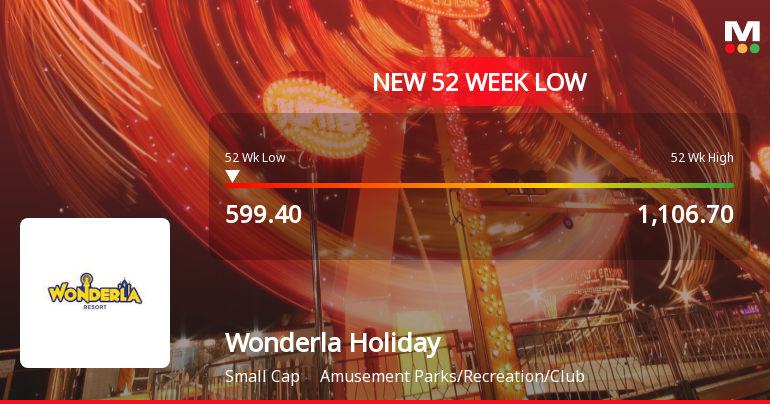

2025-03-13 08:01:33Wonderla Holidays, a small-cap player in the amusement parks and recreation industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 638.10, down from a previous close of 644.65, with a 52-week high of 1,106.70 and a low of 599.40. Today's trading saw a high of 654.00 and a low of 634.75. The technical summary indicates a bearish sentiment across various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) presents a bullish signal weekly, but no clear signal monthly. Bollinger Bands and moving averages both reflect bearish trends, suggesting a cautious market environment. In terms of performance, Wonderla Holidays has faced challenges compared to the Sensex. Over the past week, the stock has returned -0.93%, while the Sensex gained 0.41%. In the ...

Read MoreWonderla Holidays Faces Bearish Technical Trends Amid Market Volatility

2025-03-13 08:01:33Wonderla Holidays, a small-cap player in the amusement parks and recreation industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 638.10, down from a previous close of 644.65, with a 52-week high of 1,106.70 and a low of 599.40. Today's trading saw a high of 654.00 and a low of 634.75. The technical summary indicates a bearish sentiment across various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) presents a bullish signal weekly, but no clear signal monthly. Bollinger Bands and moving averages both reflect bearish trends, suggesting a cautious market environment. In terms of performance, Wonderla Holidays has faced challenges compared to the Sensex. Over the past week, the stock has returned -0.93%, while the Sensex gained 0.41%. In the ...

Read MoreWonderla Holidays Faces Mixed Technical Trends Amid Market Fluctuations

2025-03-12 08:01:53Wonderla Holidays, a small-cap player in the amusement parks and recreation industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 644.65, showing a slight increase from the previous close of 639.00. Over the past year, Wonderla has experienced a significant decline of 29.97%, contrasting with a modest gain of 0.82% in the Sensex during the same period. In terms of technical indicators, the company exhibits a mixed performance. The MACD and Bollinger Bands suggest a bearish sentiment on a weekly basis, while the monthly outlook is mildly bearish. Conversely, the Relative Strength Index (RSI) indicates bullish momentum on both weekly and monthly scales. Moving averages and KST also reflect bearish trends, highlighting a complex technical landscape. Despite the recent challenges, Wonderla has shown resilience over longer periods, with...

Read MoreWonderla Holidays Shows Mixed Technical Trends Amid Market Challenges and Long-Term Resilience

2025-03-07 08:02:35Wonderla Holidays, a small-cap player in the amusement parks and recreation industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 664.35, showing a notable increase from the previous close of 644.10. Over the past year, Wonderla has experienced a significant decline of 29.34%, contrasting with a slight gain of 0.34% in the Sensex during the same period. In terms of technical indicators, the weekly MACD and KST are both in bearish territory, while the monthly RSI indicates a bullish stance. The Bollinger Bands and moving averages also reflect a mildly bearish sentiment on a weekly basis. Despite these trends, the stock has shown resilience in the longer term, with a remarkable 225.58% return over the past five years, significantly outperforming the Sensex's 97.84% return in the same timeframe. The recent performance highlights the ...

Read MoreWonderla Holidays Shows Mixed Technical Trends Amidst Market Challenges and Resilience

2025-03-06 08:01:42Wonderla Holidays, a small-cap player in the amusement parks and recreation industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 644.10, showing a slight increase from the previous close of 635.80. Over the past year, Wonderla has faced challenges, with a notable decline of 34.33% compared to a marginal gain of 0.07% in the Sensex. In terms of technical indicators, the MACD shows a bearish trend on a weekly basis while indicating a mildly bearish stance monthly. The Relative Strength Index (RSI) presents no signal weekly but is bullish on a monthly scale. Bollinger Bands and KST both reflect mildly bearish trends monthly, while the On-Balance Volume (OBV) indicates a mildly bullish position weekly. Despite recent fluctuations, Wonderla has demonstrated resilience over longer periods, with a remarkable 185.32% return over three yea...

Read More

Wonderla Holidays Faces Continued Volatility Amidst Declining Stock Performance

2025-02-28 09:37:48Wonderla Holidays, a small-cap amusement park operator, has hit a new 52-week low amid ongoing volatility, reflecting a challenging year with a 35.25% decline. The stock is underperforming its sector and trading below key moving averages, prompting scrutiny of its operational strategies and financial health.

Read More

Wonderla Holidays Hits 52-Week Low Amid Broader Sector Decline and Operational Challenges

2025-02-27 12:35:23Wonderla Holidays has reached a new 52-week low, reflecting a challenging year with a 35.70% decline, contrasting with the Sensex's modest gain. The stock is trading below multiple moving averages, highlighting a sustained downward trend as the company navigates competitive market conditions.

Read More

Wonderla Holidays Faces Volatility Amid Sector Resilience and 52-Week Low Proximity

2025-02-19 11:05:30Wonderla Holidays, a small-cap amusement park operator, is nearing its 52-week low, trading at Rs 605.05. After two days of decline, the stock showed signs of recovery today, outperforming its sector. However, it has faced a significant performance decline over the past year compared to broader market trends.

Read More

Wonderla Holidays Hits New Low Amid Broader Sector Challenges and Declining Performance

2025-02-18 11:55:14Wonderla Holidays, a small-cap amusement park operator, has reached a new 52-week low, continuing a downward trend with a notable decline over the past two days. The stock is trading below multiple moving averages, reflecting ongoing challenges in the sector, as it has dropped significantly over the past year.

Read MoreFormat of the Initial Disclosure to be made by an entity identified as a Large Corporate : Annexure A

07-Apr-2025 | Source : BSEFormat of Initial Disclosure to be made by an entity identified as a Large Corporate.

| Sr. No. | Particulars | Details |

| 1 | Name of Company | Wonderla Holidays Ltd |

| 2 | CIN NO. | L55101KA2002PLC031224 |

| 3 | Outstanding borrowing of company as on 31st March / 31st December as applicable (in Rs cr) | 0.30 |

| 4 | Highest Credit Rating during the previous FY | CAREAA- |

| 4a | Name of the Credit Rating Agency issuing the Credit Rating mentioned in (4) | CARE RATINGS LIMITED |

| 5 | Name of Stock Exchange# in which the fine shall be paid in case of shortfall in the required borrowing under the framework | BSE |

Designation: COMPANY SECRETARY

EmailId: cs@wonderla.com

Designation: CHIEF FINANCIAL OFFICER

EmailId: saji.l@wonderla.com

Date: 07/04/2025

Note: In terms para of 3.2(ii) of the circular beginning F.Y 2022 in the event of shortfall in the mandatory borrowing through debt securities a fine of 0.2% of the shortfall shall be levied by Stock Exchanges at the end of the two-year block period. Therefore an entity identified as LC shall provide in its initial disclosure for a financial year the name of Stock Exchange to which it would pay the fine in case of shortfall in the mandatory borrowing through debt markets.

Update- Appointment Of SMP

07-Apr-2025 | Source : BSEUpdate- Appointment of SMP

Compliances- Compliance Certificate For The Period Ended March 31 2025.

03-Apr-2025 | Source : BSECompliance Certificate for the period ended March 31 2025.

Corporate Actions

No Upcoming Board Meetings

Wonderla Holidays Ltd has declared 25% dividend, ex-date: 09 Aug 24

No Splits history available

No Bonus history available

No Rights history available