WPIL Adjusts Valuation Grade, Highlighting Competitive Edge in Compressors Sector

2025-04-02 08:01:54WPIL, a small-cap player in the compressors and pumps industry, has recently undergone a valuation adjustment, reflecting a shift in its financial standing. The company currently boasts a price-to-earnings (P/E) ratio of 19.83 and a price-to-book value of 2.94, indicating a solid valuation relative to its earnings and assets. Additionally, WPIL's enterprise value to EBITDA stands at 12.04, while its PEG ratio is notably low at 0.51, suggesting a favorable growth outlook compared to its earnings. In terms of performance, WPIL has shown resilience over various time frames. Over the past year, the stock has returned 14.51%, significantly outperforming the Sensex, which returned 2.72%. Over a three-year period, WPIL's return of 370.69% further highlights its strong market position. However, the year-to-date performance shows a decline of 44.64%, contrasting with the Sensex's modest drop of 2.71%. When compare...

Read More

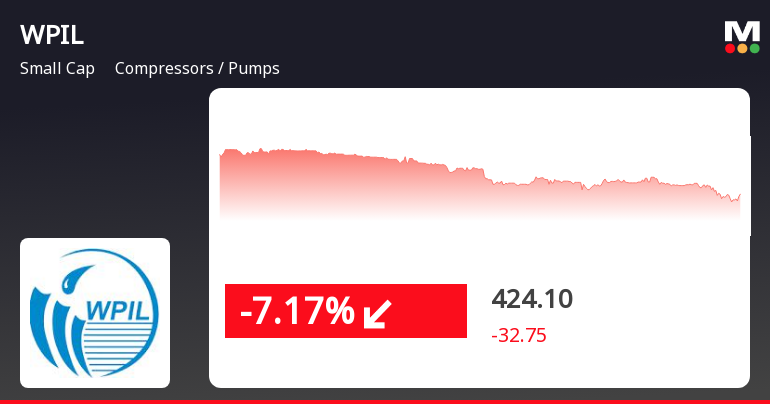

WPIL Faces Volatility Amid Mixed Long-Term Performance Trends in Market

2025-03-25 15:20:21WPIL, a small-cap company in the compressors and pumps sector, has faced notable volatility, experiencing a decline today and marking its second consecutive day of losses. Despite recent downturns, the stock has shown resilience over the past week and month, although its three-month performance indicates a significant decline.

Read More

WPIL Adjusts Valuation Grade Amid Strong Historical Performance and Market Challenges

2025-03-25 08:14:10WPIL, a small-cap company in the Compressors and Pumps industry, has recently adjusted its evaluation score, reflecting changes in financial metrics and market position. Key indicators show effective management efficiency, while the company maintains strong historical performance and debt servicing capabilities despite a shift in the technical landscape.

Read MoreTechnical Indicators Signal Bearish Sentiment Amidst WPIL's Market Volatility

2025-03-25 08:04:26WPIL, a small-cap player in the compressors and pumps industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 456.85, down from a previous close of 470.25, with a notable 52-week high of 768.00 and a low of 318.40. Today's trading saw a high of 495.00 and a low of 455.00, indicating some volatility. The technical summary reveals a bearish sentiment in several indicators, including the MACD and moving averages, while the Bollinger Bands present a mixed picture with a bearish weekly outlook and a bullish monthly perspective. The KST and Dow Theory also reflect a predominantly bearish trend, suggesting caution in the current market environment. In terms of performance, WPIL has shown significant returns over various periods compared to the Sensex. Over the past week, the stock returned 26.69%, while the Sensex returned 5.14%. In the las...

Read MoreWPIL Ltd Experiences Stock Volatility Amidst Strong Long-Term Growth Trends

2025-03-24 18:00:25WPIL Ltd, a small-cap player in the Compressors and Pumps industry, has shown significant fluctuations in its stock performance today. With a market capitalization of Rs 4,736.00 crore, the company has a price-to-earnings (P/E) ratio of 22.32, notably lower than the industry average of 37.90. Over the past year, WPIL has delivered a robust performance of 42.57%, significantly outpacing the Sensex, which recorded a gain of 7.07%. However, today's trading session saw WPIL's stock decline by 2.85%, contrasting with the Sensex's increase of 1.40%. In the short term, WPIL's performance over the past week has been strong, with a 26.69% rise compared to the Sensex's 5.14%. Yet, the three-month outlook reveals a decline of 35.74%, while the year-to-date performance shows a drop of 37.68%. Long-term trends indicate a remarkable growth trajectory, with a staggering 423.61% increase over three years and an impre...

Read More

WPIL Ltd Shows Strong Short-Term Gains Amid Mixed Long-Term Trends in Small-Cap Sector

2025-03-21 10:20:21WPIL Ltd, a small-cap company in the compressors and pumps sector, has experienced notable gains, marking its fourth consecutive day of increases. The stock has significantly outperformed its sector over the past year, despite a year-to-date decline. The broader market shows small-cap stocks leading amid a recovery in the Sensex.

Read MoreWPIL's Technical Indicators Present Mixed Signals Amid Strong Long-Term Performance

2025-03-21 08:02:17WPIL, a small-cap player in the compressors and pumps industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 453.50, showing a notable increase from the previous close of 415.80. Over the past year, WPIL has demonstrated a strong performance with a return of 42.00%, significantly outpacing the Sensex's return of 5.89% during the same period. In terms of technical indicators, the weekly MACD and KST suggest bearish trends, while the monthly Bollinger Bands indicate a bullish sentiment. The daily moving averages lean towards a mildly bullish outlook, suggesting some positive momentum in the short term. However, the overall technical summary presents a mixed picture, with various indicators reflecting differing sentiments. Notably, WPIL's performance over longer periods has been impressive, with a staggering 1648.60% return over five y...

Read MoreWPIL Experiences Valuation Grade Change Amid Strong Performance Metrics and Market Position

2025-03-21 08:00:37WPIL, a small-cap player in the compressors and pumps industry, has recently undergone a valuation adjustment. The company's current price stands at 453.50, reflecting a notable increase from the previous close of 415.80. Over the past year, WPIL has demonstrated a stock return of 42.00%, significantly outperforming the Sensex, which returned 5.89% during the same period. Key financial metrics for WPIL include a price-to-earnings (PE) ratio of 22.16 and an EV to EBITDA ratio of 13.52. The company also boasts a return on capital employed (ROCE) of 25.91% and a return on equity (ROE) of 14.47%. In comparison to its peers, WPIL's valuation metrics indicate a more favorable position relative to Roto Pumps, which has a considerably higher PE ratio of 42.68 and a much higher EV to EBITDA ratio of 22.83. Despite the recent valuation adjustment, WPIL's performance indicators and market position suggest a competit...

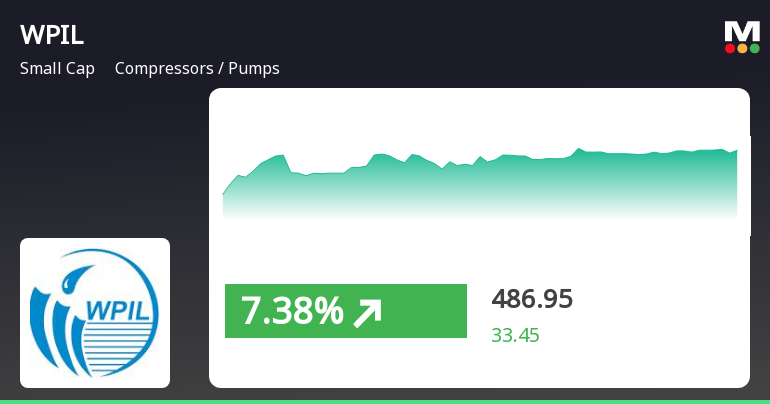

Read MoreWPIL Ltd Experiences Surge with 9.99% Gain Amid Strong Buying Activity

2025-03-20 09:35:38WPIL Ltd, a small-cap player in the compressors and pumps industry, is witnessing significant buying activity, with the stock surging by 9.99% today. This performance starkly contrasts with the Sensex, which only gained 0.70% during the same period. Over the past week, WPIL has shown remarkable strength, climbing 21.43%, while the Sensex rose by just 2.91%. The stock has been on a positive trajectory, marking consecutive gains for the last three days, resulting in a total increase of 26.83%. Today, WPIL opened with a gap up of 3.39% and reached an intraday high of Rs 457.35. Despite a challenging three-month performance, where WPIL declined by 33.91% compared to the Sensex's drop of 2.64%, the stock has demonstrated resilience over the longer term. Over the past year, WPIL has appreciated by 43.21%, significantly outperforming the Sensex's 5.38% increase. The current buying pressure may be attributed ...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSECompliance certificate under Regulation 74(5) of SEBI (DP) Regulation 2018

Announcement under Regulation 30 (LODR)-Credit Rating

01-Apr-2025 | Source : BSECredit Rating of Companys Banking Facilities

Closure of Trading Window

27-Mar-2025 | Source : BSEIntimation for closure of Trading window

Corporate Actions

No Upcoming Board Meetings

WPIL Ltd has declared 200% dividend, ex-date: 02 Aug 24

WPIL Ltd has announced 1:10 stock split, ex-date: 12 Jul 24

No Bonus history available

No Rights history available