Yasho Industries Faces Bearish Technical Trends Amid Market Volatility

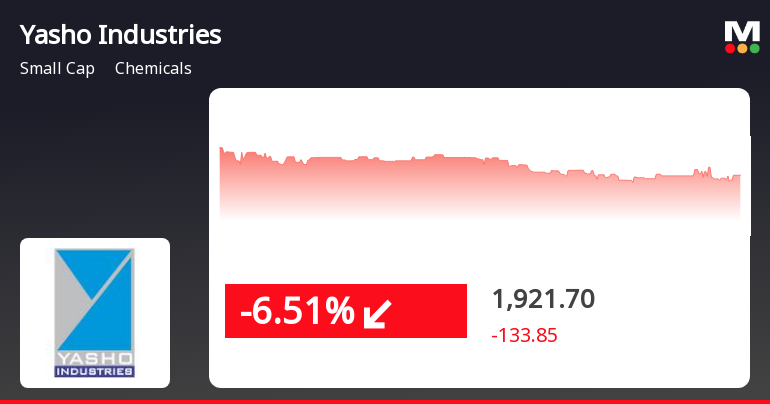

2025-03-24 08:02:49Yasho Industries, a small-cap player in the chemicals sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock, which closed at 1729.45, has seen fluctuations with a 52-week high of 2,330.00 and a low of 1,575.00. Today's trading session recorded a high of 1803.60 and a low of 1724.00, indicating volatility in its price movements. The technical summary reveals a bearish sentiment across various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. Bollinger Bands also reflect a bearish stance for both weekly and monthly periods. Moving averages indicate a bearish trend on a daily basis, and the KST aligns with a mildly bearish view for both weekly and monthly evaluations. In terms of performance, Yasho Industries has faced challenges compared to the Sensex. Over the past week, the stock returned -1.12%, whi...

Read MoreYasho Industries Faces Short-Term Challenges Amid Long-Term Growth Potential

2025-03-21 18:00:36Yasho Industries, a small-cap player in the chemicals sector, has experienced significant fluctuations in its stock performance recently. With a market capitalization of Rs 2,170.00 crore, the company currently holds a price-to-earnings (P/E) ratio of 109.63, notably higher than the industry average of 45.19. Over the past year, Yasho Industries has shown a modest gain of 5.95%, slightly outperforming the Sensex, which recorded a 5.87% increase. However, the stock has faced challenges in the short term, with a 3.92% decline today, contrasting with the Sensex's rise of 0.73%. In the past week, Yasho Industries has decreased by 1.12%, while the Sensex gained 4.17%. The company's performance over the last month has also been negative, down 3.57%, compared to a 2.12% increase in the Sensex. Year-to-date, Yasho Industries is down 11.96%, against the Sensex's decline of 1.58%. Technical indicators suggest a...

Read MoreYasho Industries Faces Technical Trend Shifts Amid Market Evaluation Revision

2025-03-21 08:02:58Yasho Industries, a small-cap player in the chemicals sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1,800.00, down from a previous close of 1,882.95, with a 52-week high of 2,330.00 and a low of 1,575.00. Today's trading saw a high of 1,880.70 and a low of 1,777.35. In terms of technical indicators, the weekly MACD is bearish, while the monthly MACD shows a mildly bearish trend. The Relative Strength Index (RSI) indicates no signal for both weekly and monthly assessments. Bollinger Bands and KST also reflect mildly bearish trends on both timeframes. However, daily moving averages suggest a mildly bullish sentiment, contrasting with the overall monthly indicators. When comparing Yasho Industries' performance to the Sensex, the stock has shown varied returns over different periods. Over the past week, it returned 2.91%, slightl...

Read MoreYasho Industries Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-20 08:03:50Yasho Industries, a small-cap player in the chemicals sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1882.95, showing a notable increase from the previous close of 1807.20. Over the past year, Yasho Industries has demonstrated a return of 14.41%, significantly outperforming the Sensex, which recorded a return of 4.77% during the same period. In terms of technical indicators, the weekly MACD is bearish, while the monthly outlook shows a mildly bearish trend. The Relative Strength Index (RSI) remains neutral on both weekly and monthly scales. Bollinger Bands indicate a mildly bearish trend weekly, contrasting with a bullish monthly perspective. Daily moving averages suggest a mildly bullish sentiment, while the On-Balance Volume (OBV) reflects a similar mildly bullish stance on a daily basis. The company's performance over vario...

Read MoreYasho Industries Shows Mixed Technical Trends Amidst Strong Long-Term Performance

2025-03-19 08:04:53Yasho Industries, a small-cap player in the chemicals sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1807.20, showing a notable increase from the previous close of 1710.95. Over the past year, Yasho Industries has demonstrated a return of 6.35%, outperforming the Sensex, which recorded a return of 3.51% in the same period. In terms of technical indicators, the weekly MACD is bearish, while the monthly MACD shows a mildly bearish trend. The Relative Strength Index (RSI) indicates no signal for both weekly and monthly assessments. Bollinger Bands also reflect a mildly bearish stance on a weekly and monthly basis. However, daily moving averages suggest a mildly bullish trend, indicating some positive momentum in the short term. The company's performance over various time frames reveals a mixed picture. While it has faced challeng...

Read MoreYasho Industries Faces Technical Trend Shifts Amid Market Evaluation Revision

2025-03-11 08:05:06Yasho Industries, a small-cap player in the chemicals sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1,760.00, down from a previous close of 1,867.30. Over the past year, Yasho Industries has experienced a slight decline of 0.47%, while the Sensex has remained relatively stable with a minimal change of 0.01%. In terms of technical indicators, the weekly MACD and Bollinger Bands suggest a bearish sentiment, while the monthly indicators show a mildly bearish trend. The KST and On-Balance Volume metrics also align with this assessment, indicating a cautious outlook. Notably, the stock's moving averages present a mildly bullish signal on a daily basis, suggesting some short-term resilience. When comparing the company's performance to the Sensex, Yasho Industries has faced challenges, particularly over the past month and year-to-da...

Read MoreYasho Industries Experiences Technical Trend Adjustments Amid Mixed Market Signals

2025-03-10 08:01:53Yasho Industries, a small-cap player in the chemicals sector, has recently undergone a technical trend adjustment. This revision reflects the company's current market dynamics and performance indicators, which are essential for understanding its position within the industry. The technical summary indicates a mixed performance across various metrics. The MACD shows bearish tendencies on a weekly basis, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) presents no significant signals for both weekly and monthly periods. Bollinger Bands reveal a mildly bearish stance weekly, contrasting with a bullish outlook monthly. Daily moving averages suggest a mildly bullish trend, while the KST indicates a bullish weekly trend but a mildly bearish monthly perspective. The Dow Theory and On-Balance Volume (OBV) metrics both reflect a mildly bearish sentiment. In terms of performance, Yasho ...

Read MoreYasho Industries Faces Mixed Technical Trends Amidst Market Volatility and Historical Resilience

2025-03-05 08:03:18Yasho Industries, a small-cap player in the chemicals sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1715.00, down from a previous close of 1750.65. Over the past year, Yasho Industries has faced challenges, with a return of -17.02%, contrasting sharply with the Sensex's modest decline of -1.19% during the same period. The technical summary indicates a mixed performance across various indicators. The MACD shows bearish trends on both weekly and monthly scales, while the Bollinger Bands also reflect a bearish stance. However, moving averages on a daily basis suggest a mildly bullish outlook. The KST presents a bullish signal weekly but turns mildly bearish monthly, indicating some volatility in market sentiment. In terms of price movement, Yasho Industries has seen a 52-week high of 2,330.00 and a low of 1,514.05, highlighting ...

Read More

Yasho Industries Faces Significant Stock Decline Amid Challenging Market Conditions in February 2025

2025-02-14 14:16:23Yasho Industries, a small-cap chemicals company, saw its stock price decline significantly on February 14, 2025, with a notable intraday low. The company has underperformed its sector and the broader market over the past month, indicating ongoing challenges in the current market environment.

Read MoreClosure of Trading Window

27-Mar-2025 | Source : BSEPlease find attached herewith intimation for closure of trading window

Announcement under Regulation 30 (LODR)-Earnings Call Transcript

20-Feb-2025 | Source : BSEPlease find attached transcripts for Q3FY25

Announcement under Regulation 30 (LODR)-Change in Management

17-Feb-2025 | Source : BSEPlease find attached herewith intimation as per captioned subject matter

Corporate Actions

No Upcoming Board Meetings

Yasho Industries Ltd has declared 5% dividend, ex-date: 26 Jul 24

No Splits history available

No Bonus history available

No Rights history available