Yatharth Hospital Adjusts Valuation Grade Amid Competitive Healthcare Market Dynamics

2025-04-03 08:00:56Yatharth Hospital & Trauma Care Services has recently undergone a valuation adjustment, reflecting changes in its financial metrics and market position within the Hospital & Healthcare Services industry. The company's current price stands at 435.00, with a notable 52-week range between 345.35 and 692.85. Key financial indicators reveal a PE ratio of 32.20 and an EV to EBITDA ratio of 19.25, which positions Yatharth Hospital in a competitive landscape. The company's return on capital employed (ROCE) is reported at 20.34%, while the return on equity (ROE) is at 13.86%. In comparison to its peers, Yatharth Hospital's valuation metrics show a varied landscape. For instance, Thyrocare Technologies has a higher PE ratio of 43.48, while Artemis Medicare boasts a PE of 49.97, indicating a stronger market position. Other competitors like Indraprastha Medical and Krsnaa Diagnostics also present attractive valuati...

Read MoreYatharth Hospital Adjusts Valuation Grade Amid Competitive Healthcare Sector Dynamics

2025-03-24 08:01:16Yatharth Hospital & Trauma Care Services has recently undergone a valuation adjustment, reflecting a shift in its financial assessment. The company's current price stands at 432.65, with a notable 52-week high of 692.85 and a low of 345.35. In today's trading, the stock reached a high of 440.80 and a low of 416.45. Key financial metrics for Yatharth Hospital include a price-to-earnings (PE) ratio of 32.03 and an EV to EBITDA ratio of 19.14. The return on capital employed (ROCE) is reported at 20.34%, while the return on equity (ROE) stands at 13.86%. These figures provide insight into the company's operational efficiency and profitability. When compared to its peers in the hospital and healthcare services sector, Yatharth's valuation metrics indicate a competitive position. For instance, Thyrocare Technologies has a higher PE ratio of 43.89, while Indraprastha Medical's EV to EBITDA ratio is significantly...

Read MoreYatharth Hospital Faces Mixed Technical Trends Amidst Market Challenges

2025-03-11 08:05:45Yatharth Hospital & Trauma Care Services, a small-cap player in the Hospital & Healthcare Services sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 367.20, down from a previous close of 390.55, with a 52-week high of 692.85 and a low of 345.35. Today's trading saw a high of 395.00 and a low of 363.10. The technical summary indicates a mixed performance across various indicators. The MACD shows a bearish trend on a weekly basis, while the Relative Strength Index (RSI) is bullish weekly but shows no signal monthly. Bollinger Bands reflect a bearish trend weekly, with a sideways movement monthly. Daily moving averages are bearish, and the KST is bearish weekly. Dow Theory indicates no trend weekly, while it is mildly bearish monthly. In terms of returns, Yatharth Hospital has shown a 2.03% increase over the past week, outperforming...

Read MoreYatharth Hospital Opens Strong with 6.21% Gain Amid Market Trends

2025-03-06 11:30:21Yatharth Hospital & Trauma Care Services has shown significant activity in today's trading session, opening with a notable gain of 6.21%. The stock has outperformed its sector by 1.58%, reflecting a positive trend amid broader market conditions. Over the past three days, Yatharth Hospital has experienced a consecutive gain, accumulating a total return of 5.5%. During today's trading, the stock reached an intraday high of Rs 394.95. However, it is important to note that while the stock is currently above its 5-day moving averages, it remains below the 20-day, 50-day, 100-day, and 200-day moving averages, indicating mixed performance in the longer term. In terms of relative performance, Yatharth Hospital's one-day return stands at 1.53%, contrasting with the Sensex's slight decline of 0.06%. Over the past month, the stock has faced challenges, showing a decline of 14.87%, compared to the Sensex's decrease o...

Read MoreYatharth Hospital Faces Technical Challenges Amid Market Volatility and Underperformance

2025-03-06 08:03:19Yatharth Hospital & Trauma Care Services, a small-cap player in the Hospital & Healthcare Services industry, has recently undergone an evaluation revision reflecting its current market position. The stock is currently priced at 371.85, showing a slight increase from the previous close of 365.45. Over the past year, the stock has experienced a high of 692.85 and a low of 345.35, indicating significant volatility. In terms of technical indicators, the weekly MACD is bearish, while the daily moving averages also reflect a bearish sentiment. The Bollinger Bands indicate a mildly bearish trend on a weekly basis, while the monthly outlook remains sideways. The KST and Dow Theory metrics are also aligned with a bearish sentiment, suggesting a cautious market environment for the stock. When comparing the company's performance to the Sensex, Yatharth Hospital has faced challenges. Over the past week, the stock ret...

Read MoreYatharth Hospital Faces Technical Trend Challenges Amid Market Volatility

2025-03-05 08:03:45Yatharth Hospital & Trauma Care Services, a small-cap player in the Hospital & Healthcare Services industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 365.45, showing a slight increase from the previous close of 359.90. Over the past year, the stock has experienced significant volatility, with a 52-week high of 692.85 and a low of 345.35. In terms of technical indicators, the weekly MACD remains bearish, while the Relative Strength Index (RSI) indicates bullish momentum on a weekly basis, with no signal on the monthly chart. The Bollinger Bands suggest a mildly bearish trend on the weekly scale, while moving averages indicate a bearish stance on a daily basis. The KST and Dow Theory metrics also reflect a mildly bearish outlook. When comparing the stock's performance to the Sensex, Yatharth Hospital has faced challenges, with a y...

Read More

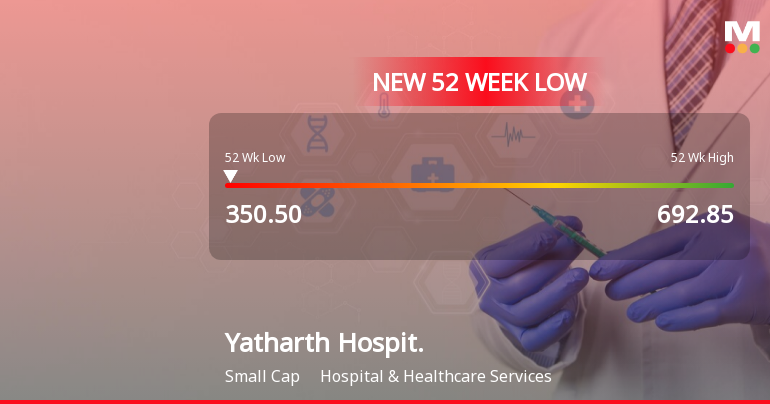

Yatharth Hospital Stock Hits 52-Week Low Amid Ongoing Performance Challenges

2025-03-03 09:37:59Yatharth Hospital & Trauma Care Services has reached a new 52-week low, continuing a downward trend with a 6.74% decline over the past three days. The stock has underperformed its sector and is below key moving averages, reflecting ongoing challenges in the healthcare industry.

Read More

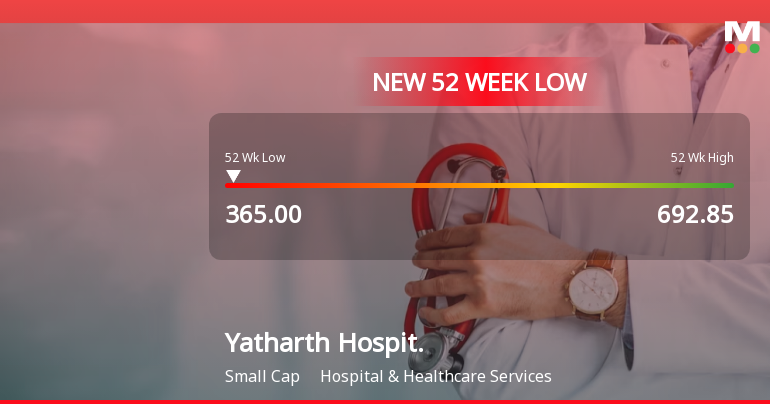

Yatharth Hospital Hits 52-Week Low Amid Ongoing Healthcare Sector Pressures

2025-02-28 09:39:33Yatharth Hospital & Trauma Care Services has reached a new 52-week low, experiencing consecutive losses over the past two days. The stock has underperformed its sector and is trading below key moving averages, reflecting a bearish trend. Over the past year, the company has seen a significant decline compared to the Sensex.

Read More

Yatharth Hospital Reports Record Quarterly Sales Amid Mixed Financial Trends for December 2024

2025-01-27 14:32:00Yatharth Hospital & Trauma Care Services announced its financial results for the quarter ending December 2024, reporting record net sales of Rs 219.16 crore and an operating profit of Rs 54.92 crore. However, profit before tax and earnings per share showed declines, indicating mixed financial performance.

Read MoreDisclosures under Reg. 31(1) and 31(2) of SEBI (SAST) Regulations 2011.

01-Apr-2025 | Source : BSEThe Exchange has received Disclosure under Regulation 31(1) and 31(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 on March 29 2025 for Dr. Kapil Kumar

Resignation Of Mr. Deepak Kumar Tyagi

31-Mar-2025 | Source : BSEResignation of Mr. Deepak Kumar Tyagi -Senior Management Personnel

Closure of Trading Window

29-Mar-2025 | Source : BSEIntimation of Closure of Trading Window

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available