Yuken India Shows Mixed Performance Amid Broader Market Decline and Small-Cap Gains

2025-04-01 10:15:34Yuken India, a small-cap engineering firm, has experienced notable trading activity, currently above its short-term moving averages but below longer-term ones. While it has shown resilience over the past month, its year-to-date performance reflects a decline, contrasting with the broader market trends.

Read More

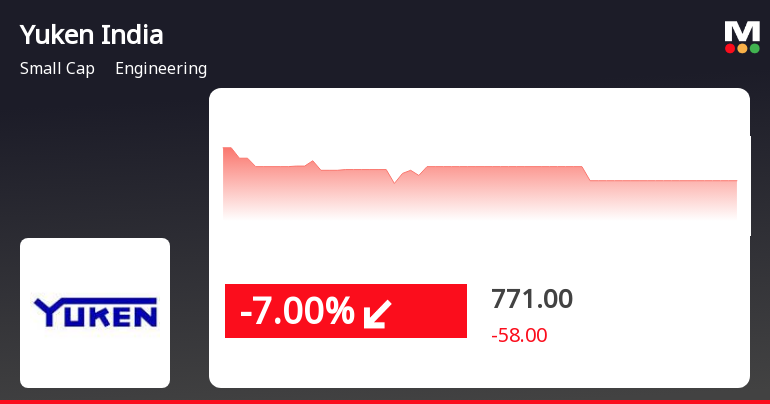

Yuken India Faces Significant Decline Amid Broader Market Weakness and Bearish Trends

2025-03-11 09:50:15Yuken India, a small-cap engineering firm, saw a notable decline on March 11, 2025, underperforming its sector. The broader market, represented by the Sensex, also opened lower and is approaching its 52-week low. Despite recent challenges, Yuken India has shown substantial long-term growth over the past decade.

Read MoreYuken India Faces Significant Volatility Amidst Broader Market Challenges

2025-03-11 09:35:07Yuken India, a small-cap player in the engineering sector, has experienced significant volatility today, opening with a loss of 5.91%. The stock's performance has notably underperformed its sector, trailing by 4.79%. Throughout the trading session, Yuken India reached an intraday low of Rs 772.2, marking a decline of 6.85%. In terms of moving averages, Yuken India is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a consistent downward trend. Over the past day, the stock has declined by 6.34%, while the broader Sensex index has only seen a minor decrease of 0.53%. Looking at a broader timeframe, Yuken India's performance over the past month shows a decline of 8.65%, compared to the Sensex's drop of 3.37%. These metrics highlight the challenges Yuken India is facing in the current market environment, reflecting a period of underperformance relative to bo...

Read MoreYuken India Adjusts Valuation Grade Amidst Competitive Engineering Sector Landscape

2025-03-11 08:00:31Yuken India, a small-cap player in the engineering sector, has recently undergone a valuation adjustment, reflecting its current financial standing. The company's price-to-earnings (PE) ratio stands at 43.58, while its price-to-book value is recorded at 3.72. Other key metrics include an enterprise value to EBITDA ratio of 21.77 and a return on capital employed (ROCE) of 10.10%. The dividend yield is relatively low at 0.18%, and the return on equity (ROE) is noted at 8.89%. In comparison to its peers, Yuken India presents a competitive valuation landscape. For instance, Kennametal India and Unimech Aerospace exhibit higher PE ratios of 46.32 and 80.84, respectively, indicating a more expensive valuation relative to Yuken. Meanwhile, companies like Pitti Engineering and Sanghvi Movers are positioned more favorably in terms of valuation metrics, suggesting a diverse range of financial health within the secto...

Read More

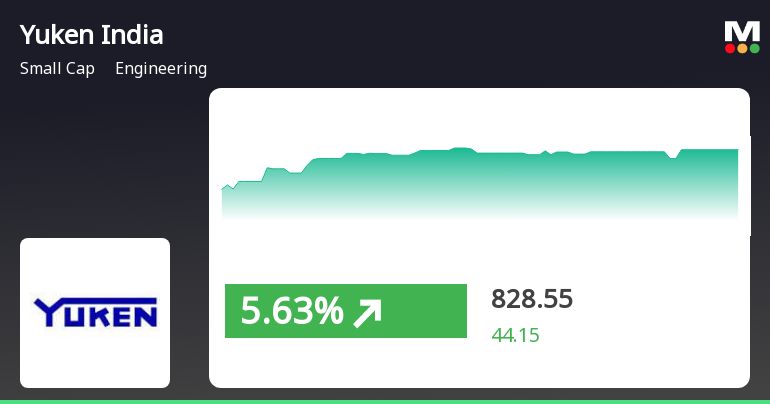

Yuken India Experiences Notable Stock Surge Amid Mixed Long-Term Performance Trends

2025-03-06 15:35:18Yuken India, a small-cap engineering firm, experienced notable activity on March 6, 2025, with a significant intraday gain. Over the past three days, the stock has shown a strong upward trend, outperforming its sector. However, its performance over the past month and three months indicates declines.

Read More

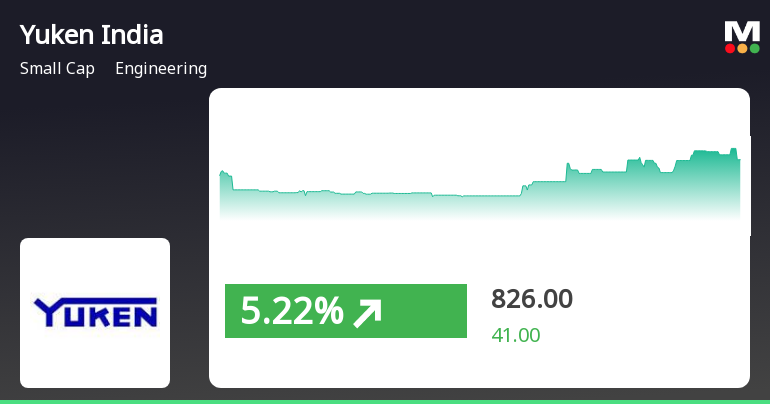

Yuken India's Recent Gains Highlight Volatility Amid Broader Market Trends

2025-02-19 10:35:17Yuken India, a small-cap engineering firm, experienced significant trading activity on February 19, 2025, with a notable gain. The stock reached an intraday high, reflecting strong momentum, while its recent performance indicates volatility compared to broader market trends, including the Sensex.

Read More

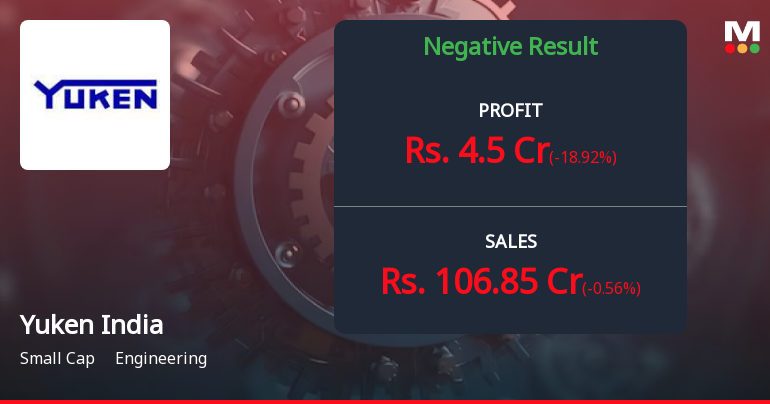

Yuken India Reports December 2024 Results Amidst Financial Challenges and Efficiency Gains

2025-02-13 17:28:48Yuken India has announced its financial results for the quarter ending December 2024, revealing challenges for the smallcap engineering firm. While the company improved its Debtors Turnover Ratio, key metrics such as Profit Before Tax and Profit After Tax have declined, alongside the lowest net sales in five quarters.

Read More

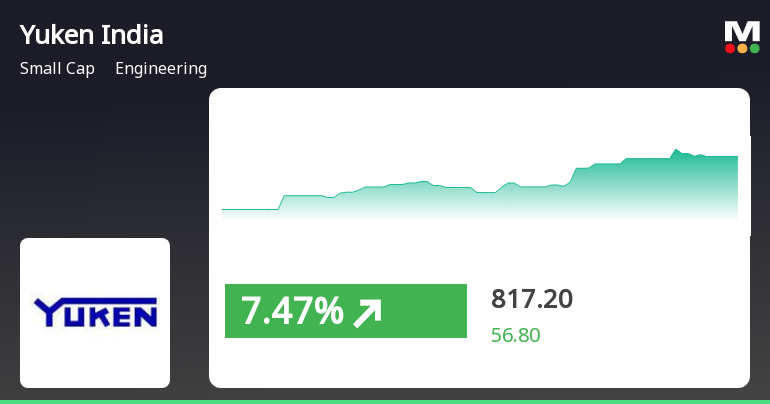

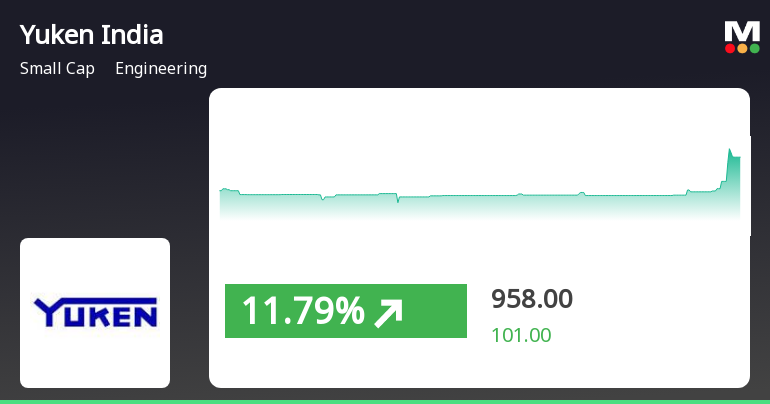

Yuken India Experiences Significant Stock Surge Amidst Sector Volatility and Mixed Trends

2025-01-31 15:35:14Yuken India, a small-cap engineering firm, saw significant stock activity on January 31, 2025, with notable intraday fluctuations. Despite a recent monthly decline, today's performance allowed it to outperform its sector. The stock's moving averages indicate mixed trends in the short to medium term.

Read More

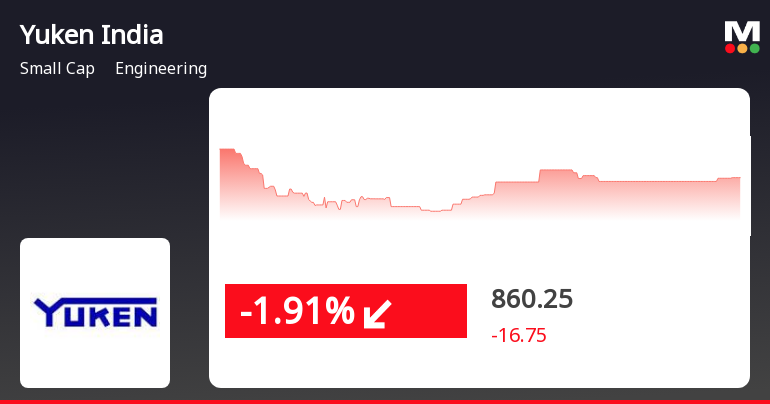

Yuken India Faces Significant Stock Volatility Amid Broader Market Declines

2025-01-28 11:50:15Yuken India has faced notable stock volatility on January 28, 2025, with a significant decline following a brief intraday gain. The stock has dropped 18.93% over the past nine days and is trading below all key moving averages, indicating ongoing challenges in the current market environment.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

02-Apr-2025 | Source : BSEDear Sir/madam Compliances certificate under reg 74(5) of SEBI (DP) Regulations 2018 for the fourth quarter and year ended 31st March 2025.

Compliance Certificate For The Year Ended 31St March 2025

02-Apr-2025 | Source : BSECompliance certificate for the year ended 31st March 2025

Closure of Trading Window

31-Mar-2025 | Source : BSEDear Sir/madam Closure of the trading window for the fourth quarter ending 31st March 2025.

Corporate Actions

No Upcoming Board Meetings

Yuken India Ltd has declared 15% dividend, ex-date: 28 Aug 24

No Splits history available

Yuken India Ltd has announced 3:1 bonus issue, ex-date: 12 Sep 18

No Rights history available