Zensar Technologies Shows Mixed Technical Trends Amid Strong Historical Performance

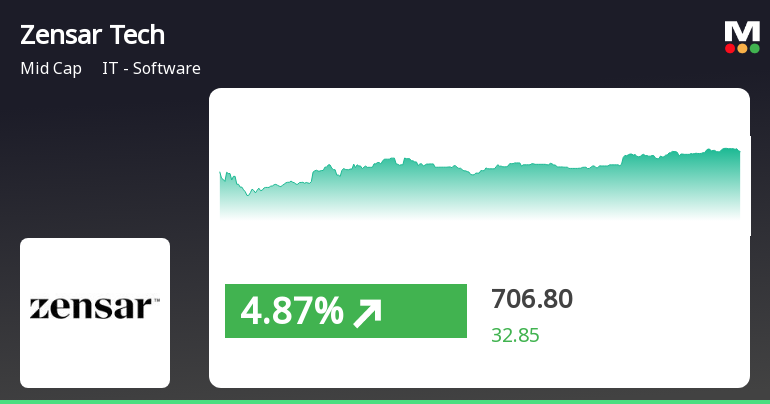

2025-04-03 08:04:15Zensar Technologies, a midcap player in the IT software industry, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock is currently priced at 714.30, showing a notable increase from the previous close of 689.00. Over the past year, Zensar has demonstrated a strong performance with a return of 18.86%, significantly outperforming the Sensex, which recorded a return of 3.67% in the same period. In terms of technical indicators, the weekly MACD is bearish, while the monthly MACD shows a mildly bearish trend. The Bollinger Bands indicate a mildly bearish stance on a weekly basis but shift to bullish on a monthly scale. Daily moving averages suggest a mildly bullish trend, indicating some positive momentum in the short term. Zensar's performance over various time frames highlights its resilience, particularly over the last five years, where it achieved an imp...

Read MoreZensar Technologies Faces Mixed Technical Trends Amid Market Evaluation Revision

2025-04-02 08:06:26Zensar Technologies, a midcap player in the IT software industry, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock is currently priced at 689.00, down from a previous close of 700.15, with a 52-week range between 531.15 and 985.00. Today's trading saw a high of 698.30 and a low of 678.60. The technical summary indicates a mixed performance across various indicators. The MACD shows bearish tendencies on a weekly basis, while the monthly perspective is mildly bearish. The Relative Strength Index (RSI) presents no signals for both weekly and monthly evaluations. Bollinger Bands reflect a bearish trend weekly but are mildly bullish on a monthly basis. Moving averages indicate a mildly bullish stance on a daily basis, while the KST shows a mildly bearish trend for both weekly and monthly assessments. Notably, the Dow Theory and On-Balance Volume (OBV) ind...

Read MoreZensar Technologies Faces Mixed Technical Trends Amid Market Evaluation Revision

2025-03-27 08:02:27Zensar Technologies, a midcap player in the IT software industry, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock is currently priced at 702.45, down from a previous close of 715.10, with a 52-week high of 985.00 and a low of 531.15. Today's trading saw a high of 713.00 and a low of 688.55. In terms of technical indicators, the MACD shows a bearish trend on a weekly basis while being mildly bearish on a monthly scale. The Relative Strength Index (RSI) indicates no significant signals for both weekly and monthly periods. Bollinger Bands present a mildly bearish outlook weekly, contrasting with a mildly bullish stance monthly. Daily moving averages suggest a mildly bullish trend, while the KST remains mildly bearish across both weekly and monthly evaluations. Interestingly, the On-Balance Volume (OBV) reflects a bullish sentiment on both timeframes. ...

Read More

Zensar Technologies Faces Stabilization Amid Slower Growth and Strong Financial Metrics

2025-03-25 08:09:29Zensar Technologies has recently adjusted its evaluation, indicating a shift in its technical trend to a sideways position. The company maintains a low debt-to-equity ratio and a return on equity of 17.5%, while experiencing slower growth in net sales and flat performance in its latest financial results.

Read MoreZensar Technologies Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-25 08:03:45Zensar Technologies, a midcap player in the IT software industry, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock price is currently at 697.55, showing a notable increase from the previous close of 673.95. Over the past year, Zensar has demonstrated a strong performance with a return of 18.21%, significantly outpacing the Sensex, which returned 7.07% in the same period. In terms of technical indicators, the weekly MACD suggests a bearish trend, while the monthly perspective indicates a mildly bearish stance. The Relative Strength Index (RSI) shows no signals for both weekly and monthly assessments. Bollinger Bands present a mixed view, with a mildly bearish outlook weekly and a mildly bullish one monthly. Daily moving averages indicate a mildly bullish trend, while the KST and Dow Theory metrics lean towards a mildly bearish interpretation. Zensar'...

Read More

Zensar Technologies Shows Strong Short-Term Gains Amid Broader Market Rally

2025-03-24 14:20:18Zensar Technologies has experienced significant activity, outperforming its sector and showing a consistent upward trend over three days. The stock reached an intraday high, with its current price above the 5-day moving average but below longer-term averages. The broader market, including the Sensex, has also seen notable gains.

Read MoreZensar Technologies Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-19 08:03:03Zensar Technologies, a midcap player in the IT software industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 669.00, showing a notable increase from the previous close of 641.90. Over the past year, Zensar has demonstrated a return of 14.57%, significantly outperforming the Sensex, which recorded a return of 3.51% in the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook shows a mildly bearish trend. The Relative Strength Index (RSI) indicates no signals for both weekly and monthly assessments. Bollinger Bands present a mixed picture, with a mildly bearish stance weekly and a mildly bullish outlook monthly. Daily moving averages suggest a mildly bullish trend, while the On-Balance Volume (OBV) indicates bullish momentum on a monthly basis. Zensar's performance over various tim...

Read More

Zensar Technologies Adjusts Evaluation Amidst Growth Concerns and Strong Institutional Support

2025-03-18 08:07:42Zensar Technologies has recently adjusted its evaluation, reflecting various performance indicators and trends. The company reported a cash position of Rs 573.00 crore and maintains a low debt-to-equity ratio. Despite facing challenges, it has outperformed the broader market over the past year, generating a return of 15.82%.

Read MoreZensar Technologies Faces Technical Trend Shift Amid Mixed Market Signals

2025-03-18 08:02:29Zensar Technologies, a midcap player in the IT software industry, has recently undergone a technical trend adjustment. The company's current price stands at 641.90, reflecting a decline from the previous close of 654.55. Over the past year, Zensar has experienced a stock return of 15.82%, outperforming the Sensex, which recorded a return of 2.10%. However, in the shorter term, the stock has faced challenges, with a notable decline of 21.69% over the past month, while the Sensex saw a decrease of only 2.40%. The technical summary indicates a bearish sentiment in various indicators. The MACD shows a bearish trend on a weekly basis and a mildly bearish trend monthly. Bollinger Bands and KST also reflect bearish tendencies, while moving averages present a mildly bullish outlook on a daily basis. The On-Balance Volume (OBV) shows no trend weekly but is bullish monthly, suggesting mixed signals in trading activi...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSEPlease find enclosed herewith certificate issued by the Registrar and Transfer Agent of the Company KFin Technologies Limited confirming compliance of Regulation 74(5) of the SEBI (Depositories and Participants) Regulations 2018 for the quarter ended March 31 2025

Zensar To Transform Tesco Insurance And Money Services With Cloud-First Strategy

27-Mar-2025 | Source : BSEThe press release is enclosed herewith.

Closure of Trading Window

25-Mar-2025 | Source : BSEIntimation of Trading window closure pursuant to SEBI (Prohibition of Insider Trading) Regulations 2015

Corporate Actions

No Upcoming Board Meetings

Zensar Technologies Ltd has declared 100% dividend, ex-date: 28 Jan 25

Zensar Technologies Ltd has announced 2:10 stock split, ex-date: 07 Sep 18

Zensar Technologies Ltd has announced 1:1 bonus issue, ex-date: 21 Jul 10

No Rights history available